EXHIBIT 99.2

Published on October 30, 2019

Exhibit 99.2

FORTIVE CORPORATION AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

AND OTHER INFORMATION

Adjusted Net Earnings from Continuing Operations, Adjusted Diluted Net Earnings per Share from Continuing Operations, Adjusted Revenue, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Gross Profit, Adjusted Gross Profit Margin and Adjusted Effective Tax Rate

We disclose the non-GAAP measures of historical adjusted net earnings from continuing operations, historical and forecasted adjusted diluted net earnings per share from continuing operations and historical adjusted estimated effective tax rate, which to the extent applicable, make the following adjustments to GAAP net earnings, GAAP diluted net earnings per share and GAAP estimated effective tax rate:

• |

Excluding on a pretax basis amortization of acquisition-related intangible assets; |

• |

Excluding on a pretax basis acquisition and other costs deemed significant (“Transaction Costs”); |

• |

Excluding on a pretax basis the effect of deferred revenue and inventory fair value adjustments related to significant acquisitions; |

• |

Excluding on a pretax basis the effect of earnings from our equity method investments; |

• |

Excluding on a pretax basis the non-cash interest expense associated with our 0.875% convertible senior notes; |

• |

Excluding on a pretax basis the non-recurring gain on the disposition of assets; |

• |

With respect to adjusted net earnings from continuing operations and adjusted diluted net earnings per share from continuing operations, excluding on a pretax basis restructuring charges; |

• |

Excluding the tax effect of the adjustments noted above. The tax effect of such adjustments was calculated by applying our overall estimated effective tax rate to the pretax amount of each adjustment (unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment). We expect to apply our overall estimated effective tax rate to each adjustment going forward, and, as such, we are applying the estimated effective tax rate to each adjustment for the forecasted periods to facilitate comparisons in future periods; |

• |

Excluding the 2017 provisional amount estimated in connection with the Tax Cut and Jobs Act and subsequent adjustments to the provisional estimates (the “TCJA Adjustments”); and |

• |

Including the impact of the assumed conversion of our Mandatory Convertible Preferred Stock. |

We also disclose non-GAAP measures of historical adjusted revenue, historical adjusted gross profit, historical adjusted gross profit margins, historical adjusted operating profit, and historical adjusted operating profit margins, which make the following adjustments to GAAP revenue, GAAP gross profit, GAAP operating profit, GAAP gross profit margin, and GAAP operating profit margin:

• |

Excluding the effect of deferred revenue fair value adjustments related to significant acquisitions; |

• |

With respect to adjusted gross profit, adjusted gross profit margins, adjusted operating profit, and adjusted operating profit margins, excluding the effect of inventory fair value adjustments related to significant acquisitions; |

• |

With respect to adjusted operating profit and adjusted operating profit margins, excluding acquisition and other costs deemed significant; and |

• |

With respect to adjusted operating profit and adjusted operating profit margins, excluding amortization of acquisition-related intangible assets. |

While we have a history of acquisition activity, we do not acquire businesses on a predictable cycle, and the amount of an acquisition’s purchase price allocated to intangible assets and related amortization term and the deferred revenue and inventory fair value adjustments are unique to each acquisition and can vary significantly from acquisition to acquisition. In addition, the Transaction Costs are unique to each transaction, are impacted from period to period depending on the number of acquisitions

1

or divestitures evaluated, pending or completed during such period, and the complexity of such transactions. We adjust for, and identify as significant, Transaction Costs, acquisition-related fair value adjustments to deferred revenue and inventory, and corresponding restructuring charges primarily related to acquisitions, in each case, incurred in a given period, if we determine that such costs and adjustments exceed the range of our typical transaction costs and adjustments, respectively, in a given period. We believe, however, that it is important for investors to understand that such intangible assets contribute to revenue generation and that intangible assets and deferred revenue and inventory fair value adjustments related to past acquisitions will recur in future periods until such intangible assets and deferred revenue and inventory fair value adjustments, as applicable, have been fully amortized.

Furthermore, we adjust for the effect of earnings from our equity method investments over which we do not exercise control over the operations or the resulting earnings. We believe that this adjustment provides our investors with additional insight into our operational performance. However, it should be noted that earnings from our equity method investments will recur in future periods while we maintain such investments.

We exclude costs incurred pursuant to discrete restructuring plans that are fundamentally different (in terms of the size, strategic nature and planning requirements, as well as the inconsistent frequency, of such plans) from the ongoing productivity improvements. Because these restructuring plans are incremental to activities that arise in the ordinary course of our business and because the costs associated with such restructuring plans are not indicative of Fortive’s ongoing operating costs in a given period, we exclude these costs from the calculation of Adjusted Net Earnings from Continuing Operations and Adjusted Diluted Net Earnings Per Share from Continuing Operations to facilitate a more consistent comparison of operating results over time.

In June 2018, we issued $1.38 billion in aggregate liquidation preference of shares of our 5.00% Mandatory Convertible Preferred Stock (“MCPS”). Dividends on the MCPS are payable on a cumulative basis at an annual rate of 5.00% on the liquidation preference of $1,000 per share. Unless earlier converted, each share of the MCPS will automatically convert on July 1, 2021 into between, after giving effect to the prior anti-dilution adjustment, 10.9041 and 13.3575 shares of our common stock, subject to further anti-dilution adjustments. The number of shares of our common stock issuable on conversion of the Mandatory Convertible Preferred Stock will be determined based on the average volume weighted average price (“VWAP”) per share of our common stock over the 20 consecutive trading day period beginning on and including the 22nd scheduled trading day immediately preceding July 1, 2021. For the purposes of calculating adjusted earnings and adjusted earnings per share, we have excluded the MCPS dividend and, for the purposes of adjusted earnings per share, assumed the “if-converted” method of share dilution (the incremental shares of common stock deemed outstanding applying the “if-converted” method of share dilution, the “MCPS Converted Shares”). We believe that using the “if-converted” method provides additional insight to investors on the potential impact of the MCPS once they are converted into common stock no later than July 1, 2021.

On February 22, 2019, we issued $1.4 billion in aggregate principal amount of our 0.875% Convertible Senior Notes due 2022 (the “Convertible Notes”), including $187.5 million in aggregate principal amount resulting from an exercise in full of an over-allotment option. The Convertible Notes bear interest at a rate of 0.875% per year, payable semiannually in arrears on February 15 and August 15 of each year, beginning on August 15, 2019. The Notes mature on February 15, 2022, unless earlier repurchased or converted in accordance with their terms prior to such date.

Of the proceeds received from the issuance of the Convertible Notes, $1.3 billion was classified as debt and $102.2 million was classified as equity, using an assumed effective interest rate of 3.38%. We recognize interest expense using the 3.38% assumed rate, and pay interest to holders of the notes at a coupon rate of 0.875%. We believe that adjusting for the non-cash imputed interest expense between the assumed rate and coupon rate provides additional insight into our cash interest expense.

The TCJA Adjustments identified above have been excluded from the GAAP measures identified above because items of this nature and/or size occur with inconsistent frequency or occur for reasons that may be unrelated to our commercial performance during the period and/or because we believe the corresponding adjustments are useful in assessing our potential ongoing operating costs or gains in a given period.

The forecasted adjusted diluted net earnings per share from continuing operations does not reflect certain adjustments that are inherently difficult to predict or estimate due to their unknown timing, effect and/or significance.

Management believes that these non-GAAP financial measures provide useful information to investors by reflecting additional ways of viewing aspects of our operations that, when reconciled to the corresponding GAAP measure, help our investors to understand the long-term profitability trends of our business, and facilitate comparisons of our operational performance and profitability to prior and future periods and to our peers.

These non-GAAP measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measures, and may not be comparable to similarly titled measures reported by other companies.

2

Core Financial Measures

We use the term “core” in the context of a revenue measure or an operating profit measure when referring to a corresponding GAAP measure excluding (1) the impact from acquired businesses and (2) with respect to core revenue measures, the impact of currency translation. References to sales or operating profit attributable to acquisitions or acquired businesses refer to GAAP sales or operating profit, as applicable, from acquired businesses recorded prior to the first anniversary of the acquisition less the amount of sales or operating profit, as applicable, attributable to certain divested businesses or product lines not considered discontinued operations prior to the first anniversary of the divestiture. The portion of sales attributable to the impact of currency translation is calculated as the difference between (a) the period-to-period change in sales (excluding sales impact from acquired businesses) and (b) the period-to-period change in sales (excluding sales impact from acquired businesses) after applying the current period foreign exchange rates to the prior year period. These non-GAAP measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measures, and may not be comparable to similarly titled measures reported by other companies.

Management believes that these non-GAAP measures provide useful information to investors by helping identify underlying growth trends in our business and facilitating comparisons of our operational performance with prior and future periods and to our peers. We exclude the effect of acquisition and divestiture-related items because the nature, size and number of such transactions can vary dramatically from period to period and between us and our peers. We exclude the effect of currency translation from sales measures because currency translation is not under management’s control and is subject to volatility. We believe that such exclusions, when presented with the corresponding GAAP measures, may assist in assessing the business trends and making comparisons of long-term performance.

Free Cash Flow from Continuing Operations, Free Cash Flow from Continuing Operations Conversion Ratio, and Adjusted Free Cash Flow from Continuing Operations Conversion Ratio

We use the term “free cash flow” when referring to cash provided by operating activities from continuing operations calculated according to GAAP less payments for additions to property, plant and equipment from continuing operations. In addition, we use the term “free cash flow conversion ratio” when we refer to the ratio of such non-GAAP free cash flow measure to net earnings from continuing operations calculated according to GAAP less, if applicable, any TCJA Adjustments. We also use the term “adjusted free cash flow conversion ratio” when we refer to the ratio of such non-GAAP free cash flow measure to adjusted net earnings from continuing operations. We also present free cash flow, free cash flow conversion ratios, and adjusted free cash flow conversion ratios on a trailing twelve month basis, which represents the ratio of non-GAAP free cash flow measures to earnings from continuing operations and adjusted earnings from continuing operations on a trailing twelve month basis.

Management believes that such non-GAAP measures provide useful information to investors in assessing our ability to generate cash without external financing, fund acquisitions and other investments and, in the absence of refinancing, repay our debt obligations. However, it should be noted that free cash flow as a liquidity measure has material limitations because it excludes certain expenditures that are required or that we have committed to, such as debt service requirements and other non-discretionary expenditures. Such non-GAAP measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measures, and may not be comparable to similarly titled measures reported by other companies.

Geographic Information

We are a global business with operations in both developed markets and high-growth markets. We define high-growth markets as Eastern Europe, the Middle East, Africa, Latin America and Asia with the exception of Japan and Australia. We define developed markets as all jurisdictions in which we operate other than the high-growth markets.

3

SECTION 1

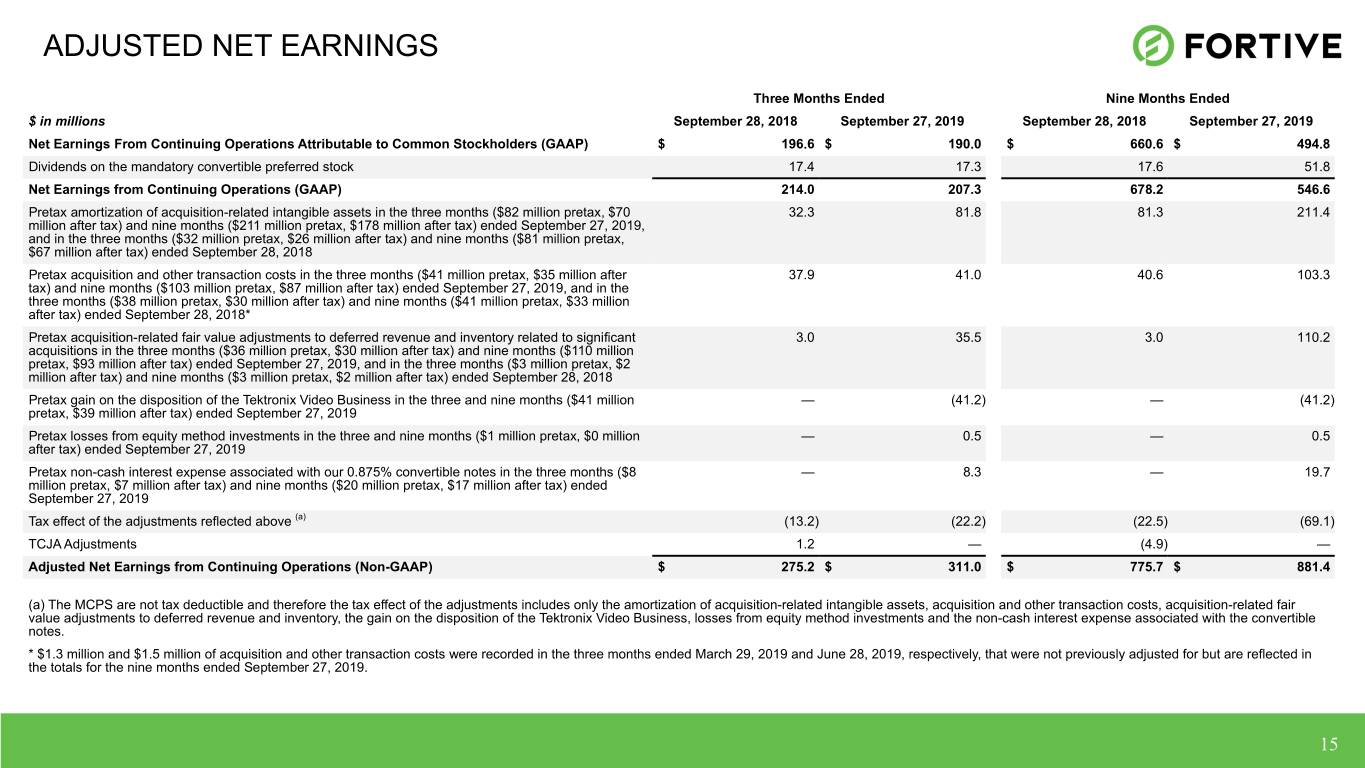

Adjusted Net Earnings from Continuing Operations

Three Months Ended |

Nine Months Ended |

||||||||||||||

($ in millions) |

September 27, 2019 |

September 28, 2018 |

September 27, 2019 |

September 28, 2018 |

|||||||||||

Net Earnings From Continuing Operations Attributable to Common Stockholders (GAAP) |

$ |

190.0 |

$ |

196.6 |

$ |

494.8 |

$ |

660.6 |

|||||||

Dividends on the mandatory convertible preferred stock |

17.3 |

17.4 |

51.8 |

17.6 |

|||||||||||

Net Earnings from Continuing Operations (GAAP) |

207.3 |

214.0 |

546.6 |

678.2 |

|||||||||||

Pretax amortization of acquisition-related intangible assets in the three months ($82 million pretax, $70 million after tax) and nine months ($211 million pretax, $178 million after tax) ended September 27, 2019, and in the three months ($32 million pretax, $26 million after tax) and nine months ($81 million pretax, $67 million after tax) ended September 28, 2018 |

81.8 |

32.3 |

211.4 |

81.3 |

|||||||||||

Pretax acquisition and other transaction costs in the three months ($41 million pretax, $35 million after tax) and nine months ($103 million pretax, $87 million after tax) ended September 27, 2019, and in the three months ($38 million pretax, $30 million after tax) and nine months ($41 million pretax, $33 million after tax) ended September 28, 2018* |

41.0 |

37.9 |

103.3 |

40.6 |

|||||||||||

Pretax acquisition-related fair value adjustments to deferred revenue and inventory related to significant acquisitions in the three months ($36 million pretax, $30 million after tax) and nine months ($110 million pretax, $93 million after tax) ended September 27, 2019, and in the three months ($3 million pretax, $2 million after tax) and nine months ($3 million pretax, $2 million after tax) ended September 28, 2018 |

35.5 |

3.0 |

110.2 |

3.0 |

|||||||||||

Pretax losses from equity method investments in the three and nine months ($1 million pretax, $0 million after tax) ended September 27, 2019 |

0.5 |

— |

0.5 |

— |

|||||||||||

Pretax gain on the disposition of the Tektronix Video Business in the three and nine months ($41 million pretax, $39 million after tax) ended September 27, 2019 |

(41.2 |

) |

— |

(41.2 |

) |

— |

|||||||||

Pretax non-cash interest expense associated with our 0.875% convertible notes in the three months ($8 million pretax, $7 million after tax) and nine months ($20 million pretax, $17 million after tax) ended September 27, 2019 |

8.3 |

— |

19.7 |

— |

|||||||||||

Tax effect of the adjustments reflected above (a)

|

(22.2 |

) |

(13.2 |

) |

(69.1 |

) |

(22.5 |

) |

|||||||

TCJA Adjustments |

— |

1.2 |

— |

(4.9 |

) |

||||||||||

Adjusted Net Earnings from Continuing Operations (Non-GAAP) |

$ |

311.0 |

$ |

275.2 |

$ |

881.4 |

$ |

775.7 |

|||||||

(a) The MCPS are not tax deductible and therefore the tax effect of the adjustments includes only the amortization of acquisition-related intangible assets, acquisition and other transaction costs, acquisition-related fair value adjustments to deferred revenue and inventory, the gain on the disposition of the Tektronix Video Business, losses from equity method investments and the non-cash interest expense associated with the convertible notes. | |||||||||||||||

* $1.3 million and $1.5 million of acquisition and other transaction costs were recorded in the three months ended March 29, 2019 and June 28, 2019, respectively, that were not previously adjusted for but are reflected in the totals for the nine months ended September 27, 2019. | |||||||||||||||

4

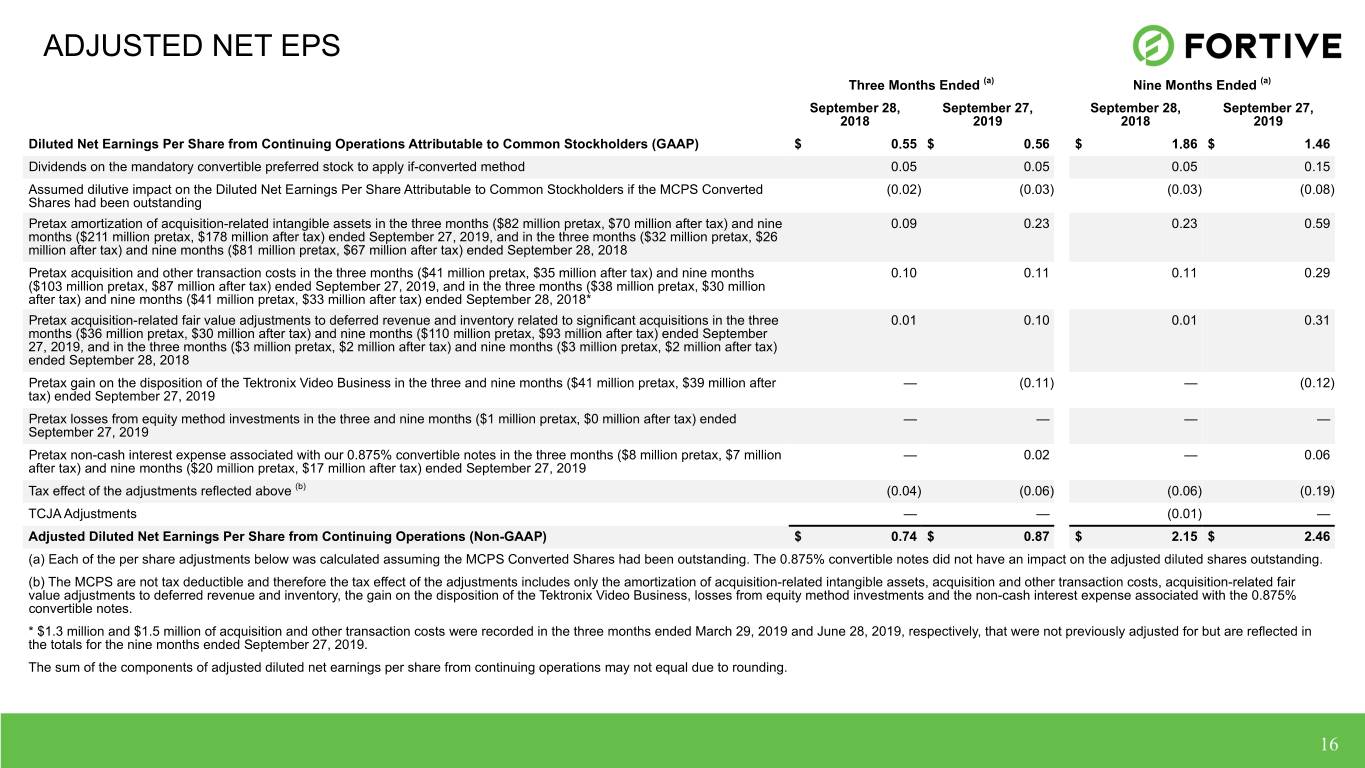

Adjusted Diluted Net Earnings Per Share from Continuing Operations

Three Months Ended (a)

|

Nine Months Ended (a)

|

||||||||||||||

September 27, 2019 |

September 28, 2018 |

September 27, 2019 |

September 28, 2018 |

||||||||||||

Diluted Net Earnings Per Share from Continuing Operations Attributable to Common Stockholders (GAAP) |

$ |

0.56 |

$ |

0.55 |

$ |

1.46 |

$ |

1.86 |

|||||||

Dividends on the mandatory convertible preferred stock to apply if-converted method |

0.05 |

0.05 |

0.15 |

0.05 |

|||||||||||

Assumed dilutive impact on the Diluted Net Earnings Per Share Attributable to Common Stockholders if the MCPS Converted Shares had been outstanding |

(0.03 |

) |

(0.02 |

) |

(0.08 |

) |

(0.03 |

) |

|||||||

Pretax amortization of acquisition-related intangible assets in the three months ($82 million pretax, $70 million after tax) and nine months ($211 million pretax, $178 million after tax) ended September 27, 2019, and in the three months ($32 million pretax, $26 million after tax) and nine months ($81 million pretax, $67 million after tax) ended September 28, 2018 |

0.23 |

0.09 |

0.59 |

0.23 |

|||||||||||

Pretax acquisition and other transaction costs in the three months ($41 million pretax, $35 million after tax) and nine months ($103 million pretax, $87 million after tax) ended September 27, 2019, and in the three months ($38 million pretax, $30 million after tax) and nine months ($41 million pretax, $33 million after tax) ended September 28, 2018* |

0.11 |

0.10 |

0.29 |

0.11 |

|||||||||||

Pretax acquisition-related fair value adjustments to deferred revenue and inventory related to significant acquisitions in the three months ($36 million pretax, $30 million after tax) and nine months ($110 million pretax, $93 million after tax) ended September 27, 2019, and in the three months ($3 million pretax, $2 million after tax) and nine months ($3 million pretax, $2 million after tax) ended September 28, 2018 |

0.10 |

0.01 |

0.31 |

0.01 |

|||||||||||

Pretax losses from equity method investments in the three and nine months ($1 million pretax, $0 million after tax) ended September 27, 2019 |

— |

— |

— |

— |

|||||||||||

Pretax gain on the disposition of the Tektronix Video Business in the three and nine months ($41 million pretax, $39 million after tax) ended September 27, 2019 |

(0.11 |

) |

— |

(0.12 |

) |

— |

|||||||||

Pretax non-cash interest expense associated with our 0.875% convertible notes in the three months ($8 million pretax, $7 million after tax) and nine months ($20 million pretax, $17 million after tax) ended September 27, 2019 |

0.02 |

— |

0.06 |

— |

|||||||||||

Tax effect of the adjustments reflected above (b)

|

(0.06 |

) |

(0.04 |

) |

(0.19 |

) |

(0.06 |

) |

|||||||

TCJA Adjustments |

— |

— |

— |

(0.01 |

) |

||||||||||

Adjusted Diluted Net Earnings Per Share from Continuing Operations (Non-GAAP) |

$ |

0.87 |

$ |

0.74 |

$ |

2.46 |

$ |

2.15 |

|||||||

(a) Each of the per share adjustments below was calculated assuming the MCPS Converted Shares had been outstanding. The 0.875% convertible notes did not have an impact on the adjusted diluted shares outstanding. | |||||||||||||||

(b) The MCPS are not tax deductible and therefore the tax effect of the adjustments includes only the amortization of acquisition-related intangible assets, acquisition and other transaction costs, acquisition-related fair value adjustments to deferred revenue and inventory, the gain on the disposition of the Tektronix Video Business, losses from equity method investments and the non-cash interest expense associated with the 0.875% convertible notes. | |||||||||||||||

* $1.3 million and $1.5 million of acquisition and other transaction costs were recorded in the three months ended March 29, 2019 and June 28, 2019, respectively, that were not previously adjusted for but are reflected in the totals for the nine months ended September 27, 2019. | |||||||||||||||

The sum of the components of adjusted diluted net earnings per share from continuing operations may not equal due to rounding. | |||||||||||||||

5

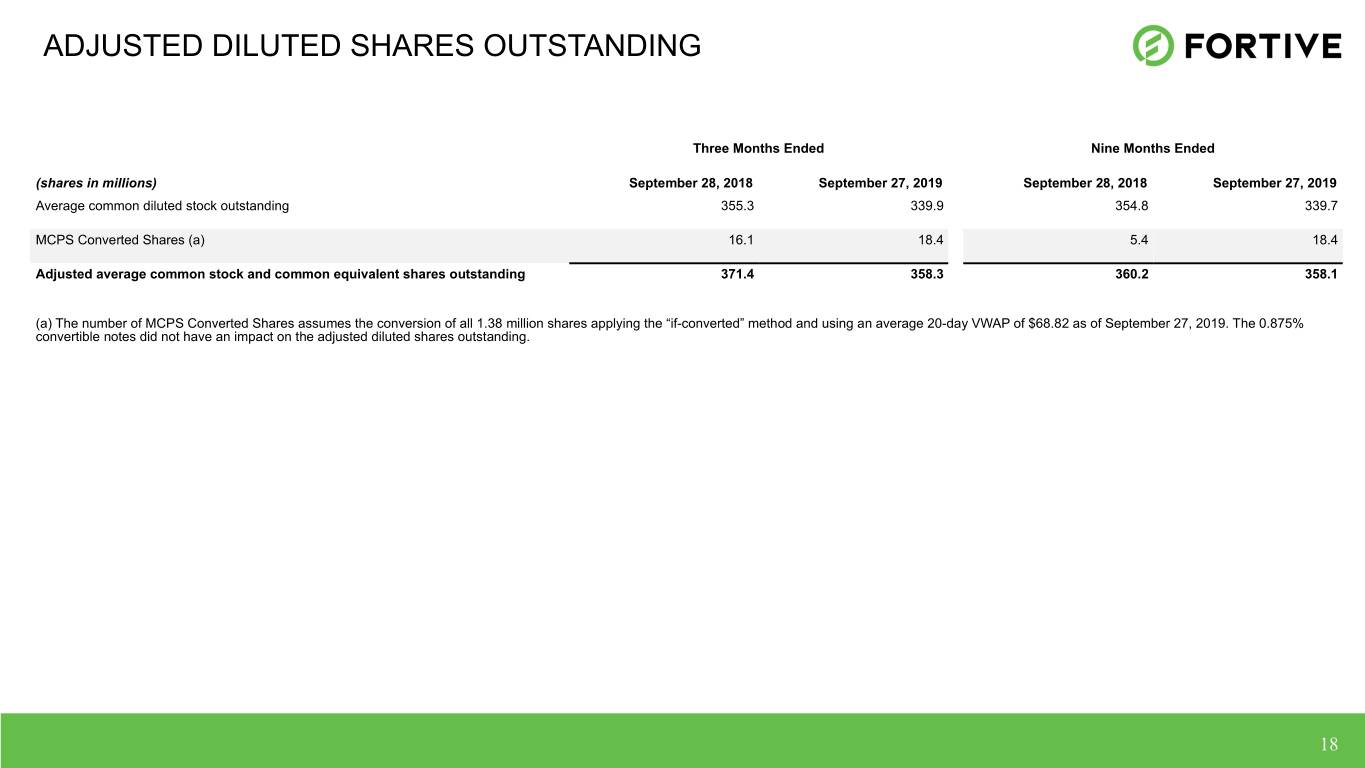

Adjusted Diluted Shares Outstanding

Three Months Ended |

Nine Months Ended |

||||||||||

(shares in millions) |

September 27, 2019 |

September 28, 2018 |

September 27, 2019 |

September 28, 2018 |

|||||||

Average common diluted stock outstanding |

339.9 |

355.3 |

339.7 |

354.8 |

|||||||

MCPS Converted Shares (a)

|

18.4 |

16.1 |

18.4 |

5.4 |

|||||||

Adjusted average common stock and common equivalent shares outstanding |

358.3 |

371.4 |

358.1 |

360.2 |

|||||||

(a) The number of MCPS Converted Shares assumes the conversion of all 1.38 million shares applying the “if-converted” method and using an average 20-day VWAP of $68.82 as of September 27, 2019. The 0.875% convertible notes did not have an impact on the adjusted diluted shares outstanding. | |||||||||||

6

SECTION 2

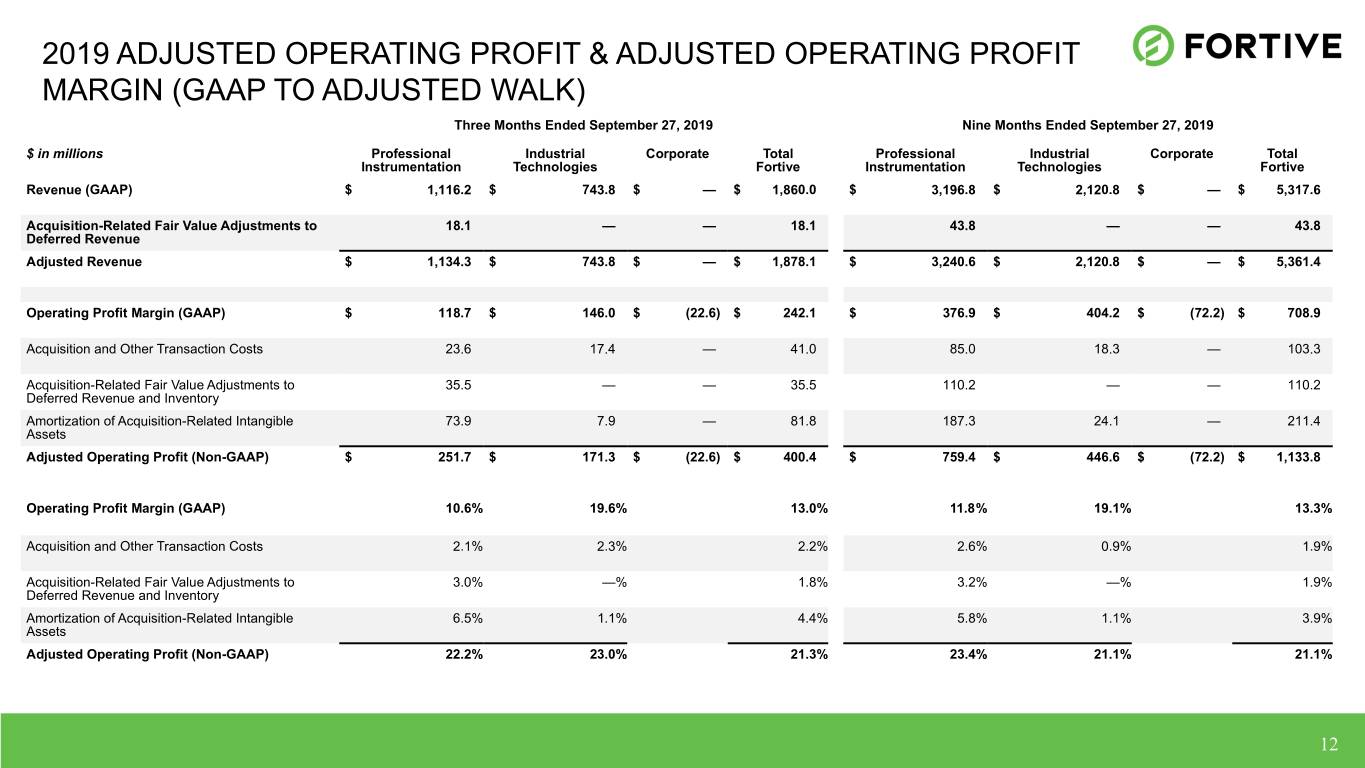

Adjusted Operating Profit

Three Months Ended September 27, 2019 |

|||||||||||||||

($ in millions) |

Professional Instrumentation |

Industrial Technologies |

Corporate |

Total Fortive |

|||||||||||

Adjusted Revenue |

|||||||||||||||

Revenue (GAAP) |

$ |

1,116.2 |

$ |

743.8 |

$ |

— |

$ |

1,860.0 |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

18.1 |

— |

— |

18.1 |

|||||||||||

Adjusted Revenue (Non-GAAP) |

$ |

1,134.3 |

$ |

743.8 |

$ |

— |

$ |

1,878.1 |

|||||||

Adjusted Operating Profit |

|||||||||||||||

Operating Profit (GAAP) |

$ |

118.7 |

$ |

146.0 |

$ |

(22.6 |

) |

$ |

242.1 |

||||||

Acquisition and Other Transaction Costs |

23.6 |

17.4 |

— |

41.0 |

|||||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue and Inventory |

35.5 |

— |

— |

35.5 |

|||||||||||

Amortization of Acquisition-Related Intangible Assets |

73.9 |

7.9 |

— |

81.8 |

|||||||||||

Adjusted Operating Profit (Non-GAAP) |

$ |

251.7 |

$ |

171.3 |

$ |

(22.6 |

) |

$ |

400.4 |

||||||

Adjusted Operating Profit Margin |

|||||||||||||||

Operating Profit (GAAP) Margin |

10.6 |

% |

19.6 |

% |

13.0 |

% |

|||||||||

Acquisition and Other Transaction Costs |

2.1 |

% |

2.3 |

% |

2.2 |

% |

|||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue and Inventory |

3.0 |

% |

— |

% |

1.8 |

% |

|||||||||

Amortization of Acquisition-Related Intangible Assets |

6.5 |

% |

1.1 |

% |

4.4 |

% |

|||||||||

Adjusted Operating Profit Margin (Non-GAAP) |

22.2 |

% |

23.0 |

% |

21.3 |

% |

|||||||||

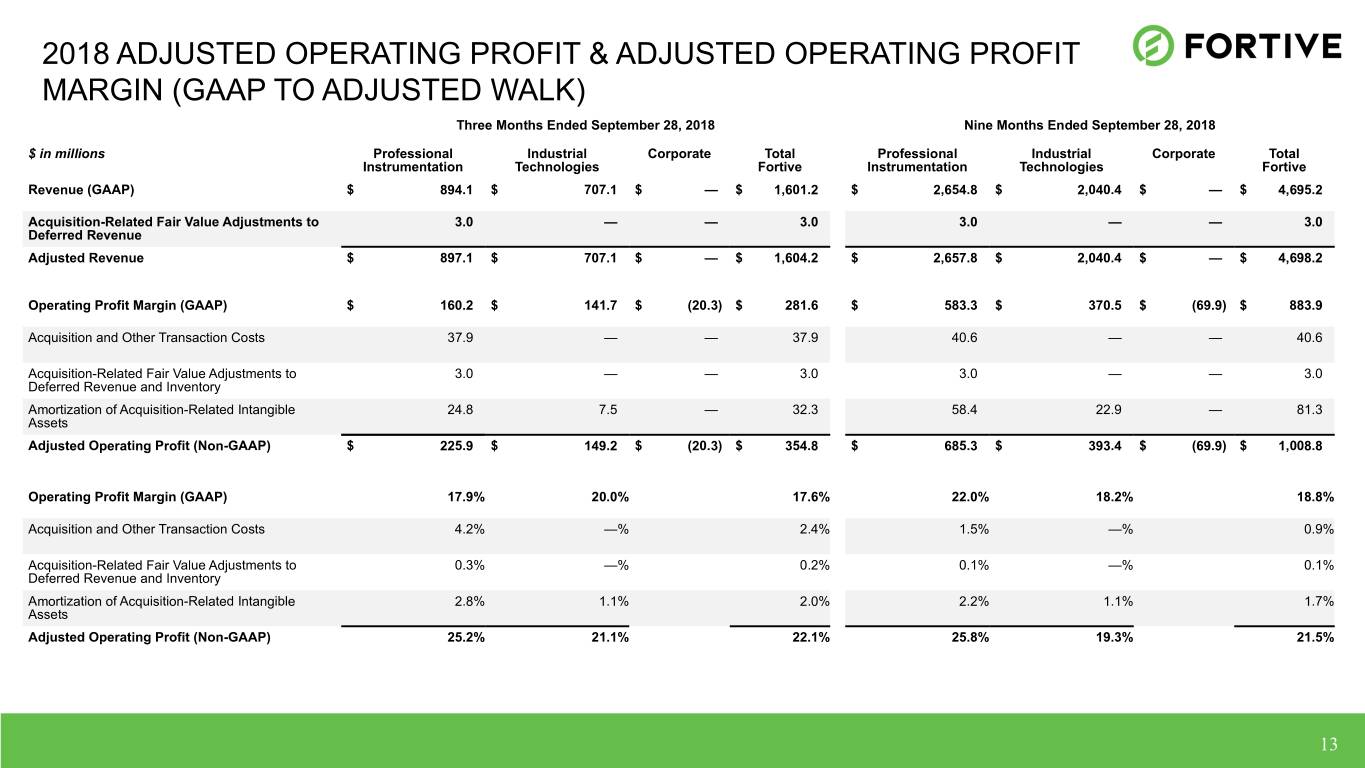

Three Months Ended September 28, 2018 |

|||||||||||||||

($ in millions) |

Professional Instrumentation |

Industrial Technologies |

Corporate |

Total Fortive |

|||||||||||

Adjusted Revenue |

|||||||||||||||

Revenue (GAAP) |

$ |

894.1 |

$ |

707.1 |

$ |

— |

$ |

1,601.2 |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

3.0 |

— |

— |

3.0 |

|||||||||||

Adjusted Revenue (Non-GAAP) |

$ |

897.1 |

$ |

707.1 |

$ |

— |

$ |

1,604.2 |

|||||||

Adjusted Operating Profit |

|||||||||||||||

Operating Profit (GAAP) |

$ |

160.2 |

$ |

141.7 |

$ |

(20.3 |

) |

$ |

281.6 |

||||||

Acquisition and Other Transaction Costs |

37.9 |

— |

— |

37.9 |

|||||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

3.0 |

— |

— |

3.0 |

|||||||||||

Amortization of Acquisition-Related Intangible Assets |

24.8 |

7.5 |

— |

32.3 |

|||||||||||

Adjusted Operating Profit (Non-GAAP) |

$ |

225.9 |

$ |

149.2 |

$ |

(20.3 |

) |

$ |

354.8 |

||||||

Adjusted Operating Profit Margin |

|||||||||||||||

Operating Profit (GAAP) Margin |

17.9 |

% |

20.0 |

% |

17.6 |

% |

|||||||||

Acquisition and Other Transaction Costs |

4.2 |

% |

— |

% |

2.4 |

% |

|||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

0.3 |

% |

— |

% |

0.2 |

% |

|||||||||

Amortization of Acquisition-Related Intangible Assets |

2.8 |

% |

1.1 |

% |

2.0 |

% |

|||||||||

Adjusted Operating Profit Margin (Non-GAAP) |

25.2 |

% |

21.1 |

% |

22.1 |

% |

|||||||||

7

Nine Months Ended September 27, 2019 |

|||||||||||||||

($ in millions) |

Professional Instrumentation |

Industrial Technologies |

Corporate |

Total Fortive |

|||||||||||

Adjusted Revenue |

|||||||||||||||

Revenue (GAAP) |

$ |

3,196.8 |

$ |

2,120.8 |

$ |

— |

$ |

5,317.6 |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

43.8 |

— |

— |

43.8 |

|||||||||||

Adjusted Revenue (Non-GAAP) |

$ |

3,240.6 |

$ |

2,120.8 |

$ |

— |

$ |

5,361.4 |

|||||||

Adjusted Operating Profit |

|||||||||||||||

Operating Profit (GAAP) |

$ |

376.9 |

$ |

404.2 |

$ |

(72.2 |

) |

$ |

708.9 |

||||||

Acquisition and Other Transaction Costs |

85.0 |

18.3 |

— |

103.3 |

|||||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue and Inventory |

110.2 |

— |

— |

110.2 |

|||||||||||

Amortization of Acquisition-Related Intangible Assets |

187.3 |

24.1 |

— |

211.4 |

|||||||||||

Adjusted Operating Profit (Non-GAAP) |

$ |

759.4 |

$ |

446.6 |

$ |

(72.2 |

) |

$ |

1,133.8 |

||||||

Adjusted Operating Profit Margin |

|||||||||||||||

Operating Profit (GAAP) Margin |

11.8 |

% |

19.1 |

% |

13.3 |

% |

|||||||||

Acquisition and Other Transaction Costs |

2.6 |

% |

0.9 |

% |

1.9 |

% |

|||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

3.2 |

% |

— |

% |

1.9 |

% |

|||||||||

Amortization of Acquisition-Related Intangible Assets |

5.8 |

% |

1.1 |

% |

3.9 |

% |

|||||||||

Adjusted Operating Profit Margin (Non-GAAP) |

23.4 |

% |

21.1 |

% |

21.1 |

% |

|||||||||

Nine Months Ended September 28, 2018 |

|||||||||||||||

($ in millions) |

Professional Instrumentation |

Industrial Technologies |

Corporate |

Total Fortive |

|||||||||||

Adjusted Revenue |

|||||||||||||||

Revenue (GAAP) |

$ |

2,654.8 |

$ |

2,040.4 |

$ |

— |

$ |

4,695.2 |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

3.0 |

— |

— |

3.0 |

|||||||||||

Adjusted Revenue (Non-GAAP) |

$ |

2,657.8 |

$ |

2,040.4 |

$ |

— |

$ |

4,698.2 |

|||||||

Adjusted Operating Profit |

|||||||||||||||

Operating Profit (GAAP) |

$ |

583.3 |

$ |

370.5 |

$ |

(69.9 |

) |

$ |

883.9 |

||||||

Acquisition and Other Transaction Costs |

40.6 |

— |

— |

40.6 |

|||||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

3.0 |

— |

— |

3.0 |

|||||||||||

Amortization of Acquisition-Related Intangible Assets |

58.4 |

22.9 |

— |

81.3 |

|||||||||||

Adjusted Operating Profit (Non-GAAP) |

$ |

685.3 |

$ |

393.4 |

$ |

(69.9 |

) |

$ |

1,008.8 |

||||||

Adjusted Operating Profit Margin |

|||||||||||||||

Operating Profit (GAAP) Margin |

22.0 |

% |

18.2 |

% |

18.8 |

% |

|||||||||

Acquisition and Other Transaction Costs |

1.5 |

% |

— |

% |

0.9 |

% |

|||||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

0.1 |

% |

— |

% |

0.1 |

% |

|||||||||

Amortization of Acquisition-Related Intangible Assets |

2.2 |

% |

1.1 |

% |

1.7 |

% |

|||||||||

Adjusted Operating Profit Margin (Non-GAAP) |

25.8 |

% |

19.3 |

% |

21.5 |

% |

|||||||||

8

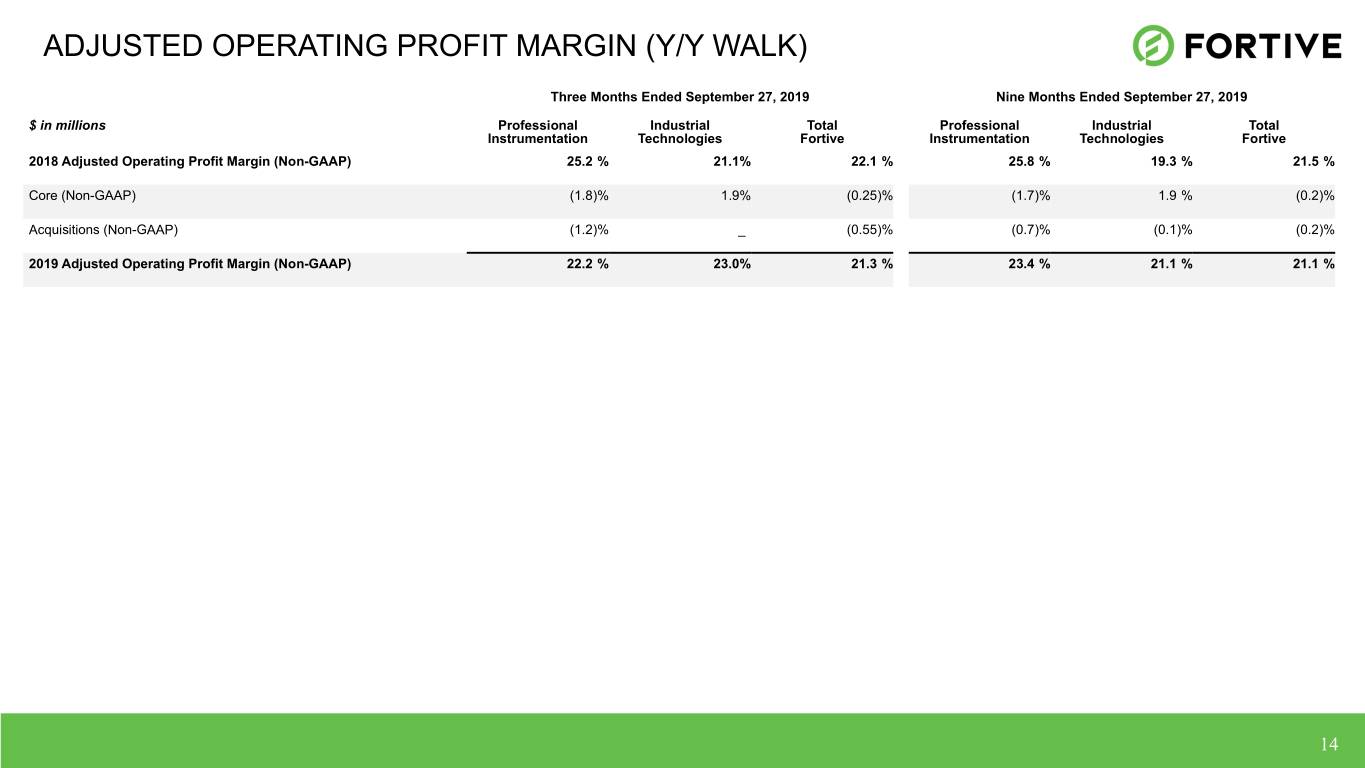

Adjusted Operating Profit Margin (Y/Y Walk)

Three Months Ended September 27, 2019 |

||||||||

Professional Instrumentation |

Industrial Technologies |

Total Fortive |

||||||

2018 Adjusted Operating Profit Margin (Non-GAAP) |

25.2 |

% |

21.1 |

% |

22.1 |

% |

||

Core (Non-GAAP) |

(1.8 |

)% |

1.9 |

% |

(0.25 |

)% |

||

Acquisitions (Non-GAAP) |

(1.2 |

)% |

— |

% |

(0.55 |

)% |

||

2019 Adjusted Operating Profit Margin (Non-GAAP) |

22.2 |

% |

23.0 |

% |

21.3 |

% |

||

Nine Months Ended September 27, 2019 |

||||||||

Professional Instrumentation |

Industrial Technologies |

Total Fortive |

||||||

2018 Adjusted Operating Profit Margin (Non-GAAP) |

25.8 |

% |

19.3 |

% |

21.5 |

% |

||

Core (Non-GAAP) |

(1.7 |

)% |

1.9 |

% |

(0.2 |

)% |

||

Acquisitions (Non-GAAP) |

(0.7 |

)% |

(0.1 |

)% |

(0.2 |

)% |

||

2019 Adjusted Operating Profit Margin (Non-GAAP) |

23.4 |

% |

21.1 |

% |

21.1 |

% |

||

9

SECTION 3

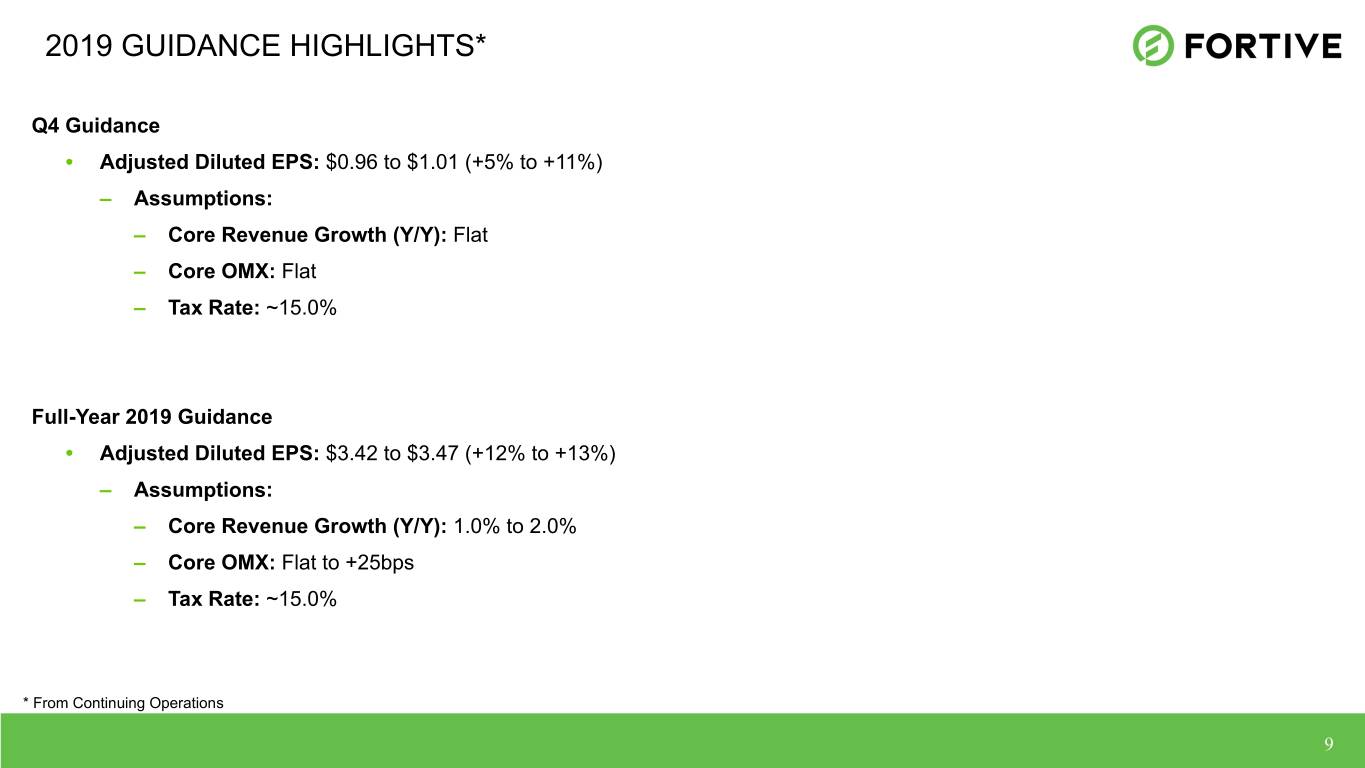

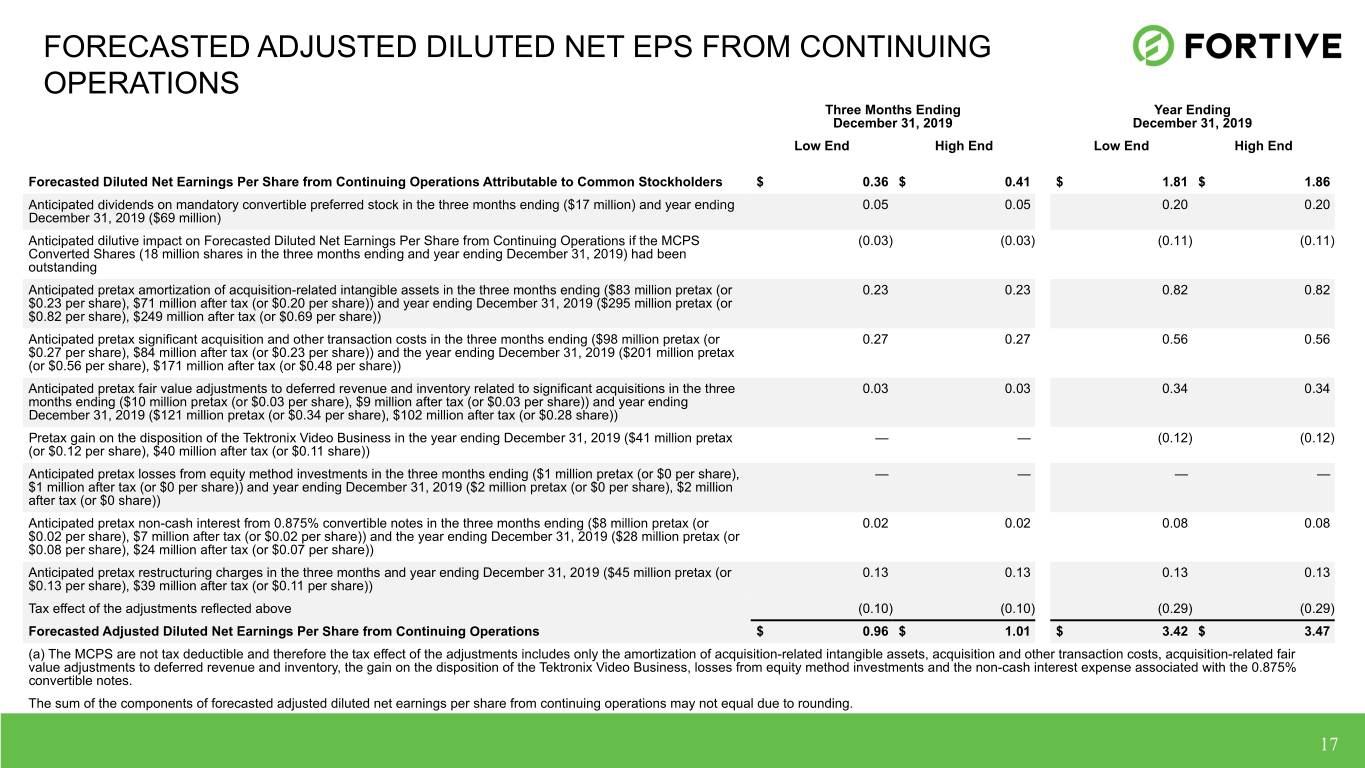

Forecasted Adjusted Diluted Net Earnings Per Share from Continuing Operations

Three Months Ending December 31, 2019 |

Year Ending December 31, 2019 |

||||||||||||||

Low End |

High End |

Low End |

High End |

||||||||||||

Forecasted Diluted Net Earnings Per Share from Continuing Operations Attributable to Common Stockholders |

$ |

0.36 |

$ |

0.41 |

$ |

1.81 |

$ |

1.86 |

|||||||

Anticipated dividends on mandatory convertible preferred stock in the three months ending ($17 million) and year ending December 31, 2019 ($69 million) |

0.05 |

0.05 |

0.20 |

0.20 |

|||||||||||

Anticipated dilutive impact on Forecasted Diluted Net Earnings Per Share from Continuing Operations if the MCPS Converted Shares (18 million shares in the three months ending and year ending December 31, 2019) had been outstanding |

(0.03 |

) |

(0.03 |

) |

(0.11 |

) |

(0.11 |

) |

|||||||

Anticipated pretax amortization of acquisition-related intangible assets in the three months ending ($83 million pretax (or $0.23 per share), $71 million after tax (or $0.20 per share)) and year ending December 31, 2019 ($295 million pretax (or $0.82 per share), $249 million after tax (or $0.69 per share)) |

0.23 |

0.23 |

0.82 |

0.82 |

|||||||||||

Anticipated pretax significant acquisition and other transaction costs in the three months ending ($98 million pretax (or $0.27 per share), $84 million after tax (or $0.23 per share)) and the year ending December 31, 2019 ($201 million pretax (or $0.56 per share), $171 million after tax (or $0.48 per share)) |

0.27 |

0.27 |

0.56 |

0.56 |

|||||||||||

Anticipated pretax fair value adjustments to deferred revenue and inventory related to significant acquisitions in the three months ending ($10 million pretax (or $0.03 per share), $9 million after tax (or $0.03 per share)) and year ending December 31, 2019 ($121 million pretax (or $0.34 per share), $102 million after tax (or $0.28 share)) |

0.03 |

0.03 |

0.34 |

0.34 |

|||||||||||

Pretax gain on the disposition of the Tektronix Video Business in the year ending December 31, 2019 ($41 million pretax (or $0.12 per share), $40 million after tax (or $0.11 share)) |

— |

— |

(0.12 |

) |

(0.12 |

) |

|||||||||

Anticipated pretax losses from equity method investments in the three months ending ($1 million pretax (or $0 per share), $1 million after tax (or $0 per share)) and year ending December 31, 2019 ($2 million pretax (or $0 per share), $2 million after tax (or $0 share)) |

— |

— |

— |

— |

|||||||||||

Anticipated pretax non-cash interest from 0.875% convertible notes in the three months ending ($8 million pretax (or $0.02 per share), $7 million after tax (or $0.02 per share)) and the year ending December 31, 2019 ($28 million pretax (or $0.08 per share), $24 million after tax (or $0.07 per share)) |

0.02 |

0.02 |

0.08 |

0.08 |

|||||||||||

Anticipated pretax restructuring charges in the three months and year ending December 31, 2019 ($45 million pretax (or $0.13 per share), $39 million after tax (or $0.11 per share)) |

0.13 |

0.13 |

0.13 |

0.13 |

|||||||||||

Tax effect of the adjustments reflected above (a)

|

(0.10 |

) |

(0.10 |

) |

(0.29 |

) |

(0.29 |

) |

|||||||

Forecasted Adjusted Diluted Net Earnings Per Share from Continuing Operations |

$ |

0.96 |

$ |

1.01 |

$ |

3.42 |

$ |

3.47 |

|||||||

(a) The MCPS are not tax deductible and therefore the tax effect of the adjustments includes only the amortization of acquisition-related intangible assets, acquisition and divestiture-related transaction costs, acquisition and divestiture-related fair value adjustments to deferred revenue and inventory, losses from equity method investments, and non-cash interest from 0.875% convertible notes. | |||||||||||||||

The sum of the components of forecasted adjusted diluted net earnings per share from continuing operations may not equal due to rounding. | |||||||||||||||

10

SECTION 4

Core Revenue Growth

|

Components of Revenue Growth

Total Fortive

|

% Change Three Months Ended September 27, 2019 vs. Comparable 2018 Period |

% Change Nine Months Ended September 27, 2019 vs. Comparable 2018 Period |

|||

Total Revenue Growth (GAAP) |

16.2 |

% |

13.3 |

% |

|

Core (Non-GAAP) |

2.1 |

% |

2.6 |

% |

|

Acquisitions (Non-GAAP) |

15.3 |

% |

12.7 |

% |

|

Impact of currency translation (Non-GAAP) |

(1.2 |

)% |

(2.0 |

)% |

|

Professional Instrumentation |

|||||

Total Revenue Growth (GAAP) |

24.8 |

% |

20.4 |

% |

|

Core (Non-GAAP) |

(1.3 |

)% |

0.2 |

% |

|

Acquisitions (Non-GAAP) |

27.2 |

% |

22.1 |

% |

|

Impact of currency translation (Non-GAAP) |

(1.1 |

)% |

(1.9 |

)% |

|

Industrial Technologies |

|||||

Total Revenue Growth (GAAP) |

5.2 |

% |

3.9 |

% |

|

Core (Non-GAAP) |

6.5 |

% |

5.7 |

% |

|

Acquisitions (Non-GAAP) |

0.1 |

% |

0.5 |

% |

|

Impact of currency translation (Non-GAAP) |

(1.4 |

)% |

(2.3 |

)% |

|

11

SECTION 5

Year-over-Year Operating Profit Margins

Segments |

||||||||

Total Fortive |

Professional Instrumentation |

Industrial Technologies |

||||||

Three Month Period ended September 28, 2018 Operating Profit Margin (GAAP) |

17.6 |

% |

17.9 |

% |

20.0 |

% |

||

Third quarter 2019 impact from operating profit margin of businesses that have been owned for less than one year (Non-GAAP) |

(4.15 |

)% |

(7.0 |

)% |

— |

% |

||

Third quarter 2019 acquisition and divestiture-related transaction costs (Non-GAAP) |

(0.20 |

)% |

1.5 |

% |

(2.3 |

)% |

||

Year-over-year core operating margin changes for the third quarter 2019 (defined as all year-over-year operating margin changes other than the changes identified in the line items above) (Non-GAAP) |

(0.25 |

)% |

(1.8 |

)% |

1.9 |

% |

||

Three Month Period ended September 27, 2019 Operating Profit Margin (GAAP) |

13.0 |

% |

10.6 |

% |

19.6 |

% |

||

Nine Month Period ended September 28, 2018 Operating Profit Margin (GAAP) |

18.8 |

% |

22.0 |

% |

18.2 |

% |

||

Nine months ended September 27, 2019 impact from operating profit margin of businesses that have been owned for less than one year (Non-GAAP) |

(4.0 |

)% |

(6.8 |

)% |

(0.1 |

)% |

||

Nine months ended September 27, 2019 year-over-year acquisition-related transaction costs (Non-GAAP) |

(1.3 |

)% |

(1.7 |

)% |

(0.9 |

)% |

||

Year-over-year core operating margin changes for the nine months ended September 27, 2019 (defined as all year-over-year operating margin changes other than the changes identified in the line item above) (Non-GAAP) |

(0.2 |

)% |

(1.7 |

)% |

1.9 |

% |

||

Nine Month Period ended September 27, 2019 Operating Profit Margin (GAAP) |

13.3 |

% |

11.8 |

% |

19.1 |

% |

||

The sum of the components of operating profit margin may not equal due to rounding. | ||||||||

12

SECTION 6

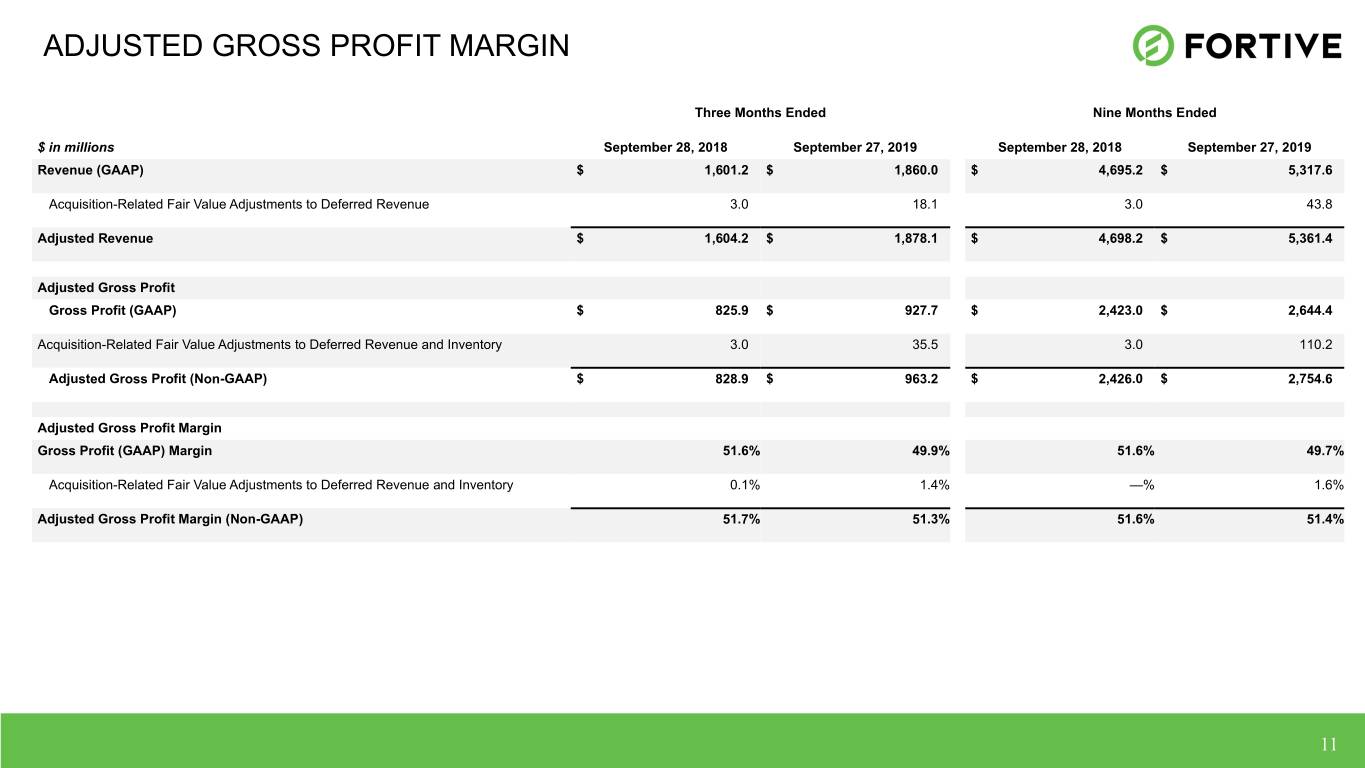

Adjusted Gross Profit Margin

Three Months Ended |

Nine Months Ended |

||||||||||||||

($ in millions) |

September 27, 2019 |

September 28, 2018 |

September 27, 2019 |

September 28, 2018 |

|||||||||||

Adjusted Revenue |

|||||||||||||||

Revenue (GAAP) |

$ |

1,860.0 |

$ |

1,601.2 |

$ |

5,317.6 |

$ |

4,695.2 |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue |

18.1 |

3.0 |

43.8 |

3.0 |

|||||||||||

Adjusted Revenue (Non-GAAP) |

$ |

1,878.1 |

$ |

1,604.2 |

$ |

5,361.4 |

$ |

4,698.2 |

|||||||

Adjusted Gross Profit |

|||||||||||||||

Gross Profit (GAAP) |

$ |

927.7 |

$ |

825.9 |

$ |

2,644.4 |

$ |

2,423.0 |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue and Inventory |

35.5 |

3.0 |

110.2 |

3.0 |

|||||||||||

Adjusted Gross Profit (Non-GAAP) |

$ |

963.2 |

$ |

828.9 |

$ |

2,754.6 |

$ |

2,426.0 |

|||||||

Adjusted Gross Profit Margin |

|||||||||||||||

Gross Profit (GAAP) Margin |

49.9 |

% |

51.6 |

% |

49.7 |

% |

51.6 |

% |

|||||||

Acquisition-Related Fair Value Adjustments to Deferred Revenue and Inventory |

1.4 |

% |

0.1 |

% |

1.6 |

% |

— |

% |

|||||||

Adjusted Gross Profit Margin (Non-GAAP) |

51.3 |

% |

51.7 |

% |

51.4 |

% |

51.6 |

% |

|||||||

SECTION 7

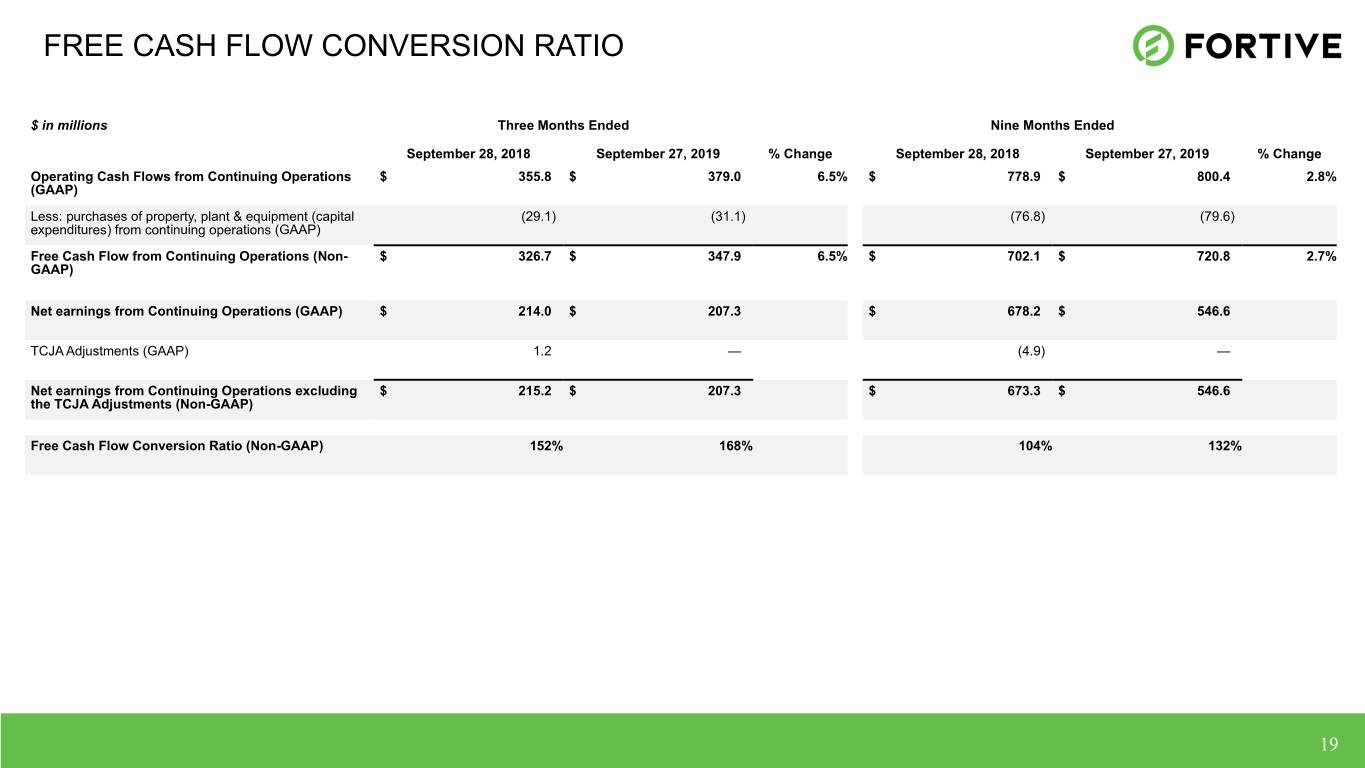

Free Cash Flow from Continuing Operations Conversion Ratio

Three Months Ended |

Nine Months Ended |

||||||||||||||

($ in millions) |

September 27, 2019 |

September 28, 2018 |

September 27, 2019 |

September 28, 2018 |

|||||||||||

Free Cash Flow from Continuing Operations: |

|||||||||||||||

Operating Cash Flows from Continuing Operations (GAAP) |

$ |

379.0 |

$ |

355.8 |

$ |

800.4 |

$ |

778.9 |

|||||||

Less: purchases of property, plant & equipment (capital expenditures) from continuing operations (GAAP) |

(31.1 |

) |

(29.1 |

) |

(79.6 |

) |

(76.8 |

) |

|||||||

Free Cash Flow from Continuing Operations (Non-GAAP) |

$ |

347.9 |

$ |

326.7 |

$ |

720.8 |

$ |

702.1 |

|||||||

Free Cash Flow from Continuing Operations Conversion Ratio: |

|||||||||||||||

Net Earnings from Continuing Operations (GAAP) |

$ |

207.3 |

$ |

214.0 |

$ |

546.6 |

$ |

678.2 |

|||||||

TCJA Adjustments (GAAP) |

— |

1.2 |

— |

(4.9 |

) |

||||||||||

Net Earnings from Continuing Operations excluding the TCJA Adjustments (Non-GAAP) |

$ |

207.3 |

$ |

215.2 |

$ |

546.6 |

$ |

673.3 |

|||||||

Free Cash Flow from Continuing Operations Conversion Ratio (Non-GAAP) |

168 |

% |

152 |

% |

132 |

% |

104 |

% |

|||||||

13

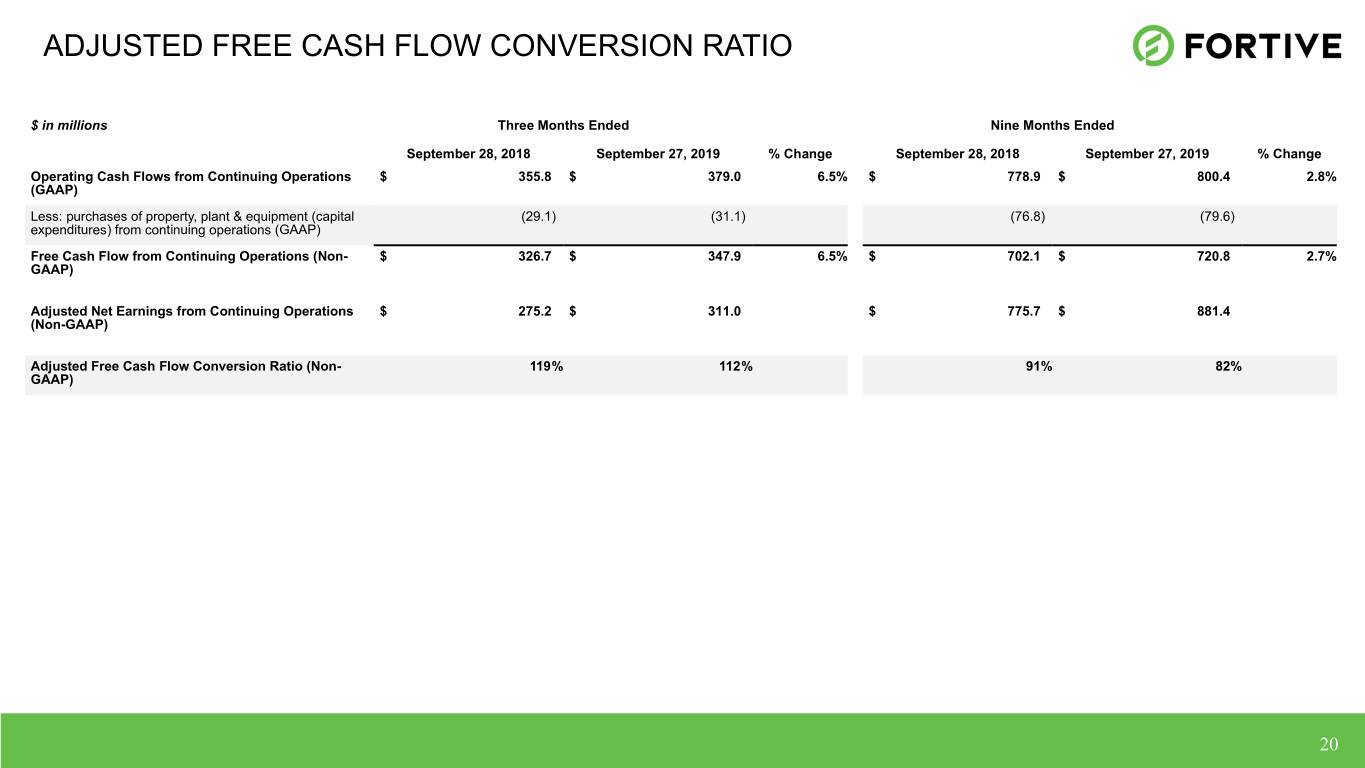

Adjusted Free Cash Flow from Continuing Operations Conversion Ratio

Three Months Ended |

% Change |

|||||||||

($ in millions) |

September 28, 2018 |

September 27, 2019 |

||||||||

Operating Cash Flows from Continuing Operations (GAAP) |

$ |

355.8 |

$ |

379.0 |

6.5 |

% |

||||

Less: purchases of property, plant & equipment (capital expenditures) from continuing operations (GAAP) |

(29.1 |

) |

(31.1 |

) |

||||||

Free Cash Flow from Continuing Operations (Non-GAAP) |

$ |

326.7 |

$ |

347.9 |

6.5 |

% |

||||

Adjusted Net Earnings from Continuing Operations (Non-GAAP) |

$ |

275.2 |

$ |

311.0 |

||||||

Adjusted Free Cash Flow from Continuing Operations Conversion Ratio - (Non-GAAP) |

119 |

% |

112 |

% |

||||||

Nine Months Ended |

% Change |

|||||||||

($ in millions) |

September 28, 2018 |

September 27, 2019 |

||||||||

Operating Cash Flows from Continuing Operations (GAAP) |

$ |

778.9 |

$ |

800.4 |

2.8 |

% |

||||

Less: purchases of property, plant & equipment (capital expenditures) from continuing operations (GAAP) |

(76.8 |

) |

(79.6 |

) |

||||||

Free Cash Flow from Continuing Operations (Non-GAAP) |

$ |

702.1 |

$ |

720.8 |

2.7 |

% |

||||

Adjusted Net Earnings from Continuing Operations (Non-GAAP) |

$ |

775.7 |

$ |

881.4 |

||||||

Adjusted Free Cash Flow from Continuing Operations Conversion Ratio - (Non-GAAP) |

91 |

% |

82 |

% |

||||||

14

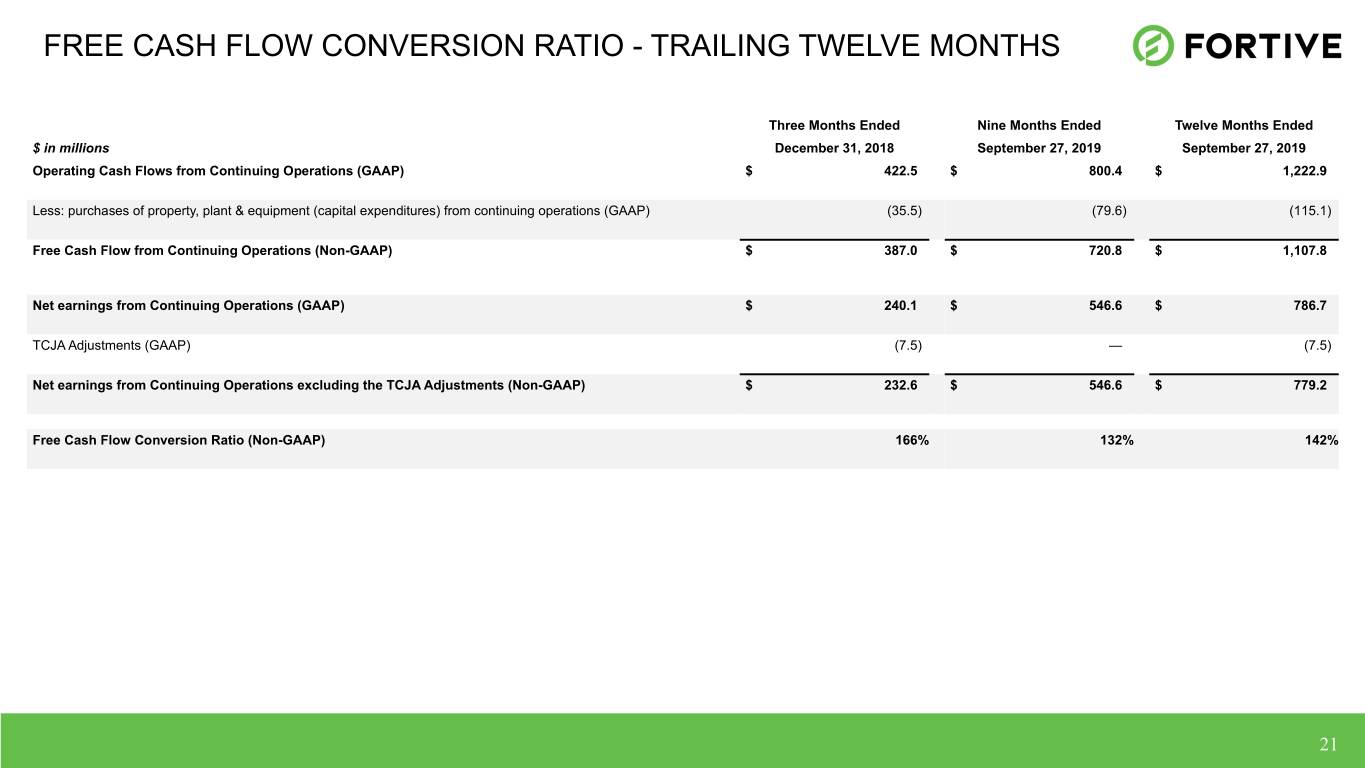

Free Cash Flow from Continuing Operations Conversion Ratio - Trailing Twelve Months

Three Months Ended |

Nine Months Ended |

Twelve Months Ended |

|||||||||

($ in millions) |

December 31, 2018 |

September 27, 2019 |

September 27, 2019 |

||||||||

Operating Cash Flows from Continuing Operations (GAAP) |

$ |

422.5 |

$ |

800.4 |

$ |

1,222.9 |

|||||

Less: purchases of property, plant & equipment (capital expenditures) from continuing operations (GAAP) |

(35.5 |

) |

(79.6 |

) |

(115.1 |

) |

|||||

Free Cash Flow from Continuing Operations (Non-GAAP) |

$ |

387.0 |

$ |

720.8 |

$ |

1,107.8 |

|||||

Net Earnings from Continuing Operations (GAAP) |

$ |

240.1 |

$ |

546.6 |

$ |

786.7 |

|||||

TCJA Adjustments (GAAP) |

(7.5 |

) |

— |

(7.5 |

) |

||||||

Net Earnings from Continuing Operations excluding the TCJA Adjustments (Non-GAAP) |

$ |

232.6 |

$ |

546.6 |

$ |

779.2 |

|||||

Free Cash Flow Conversion Ratio (Non-GAAP) |

166 |

% |

132 |

% |

142 |

% |

|||||

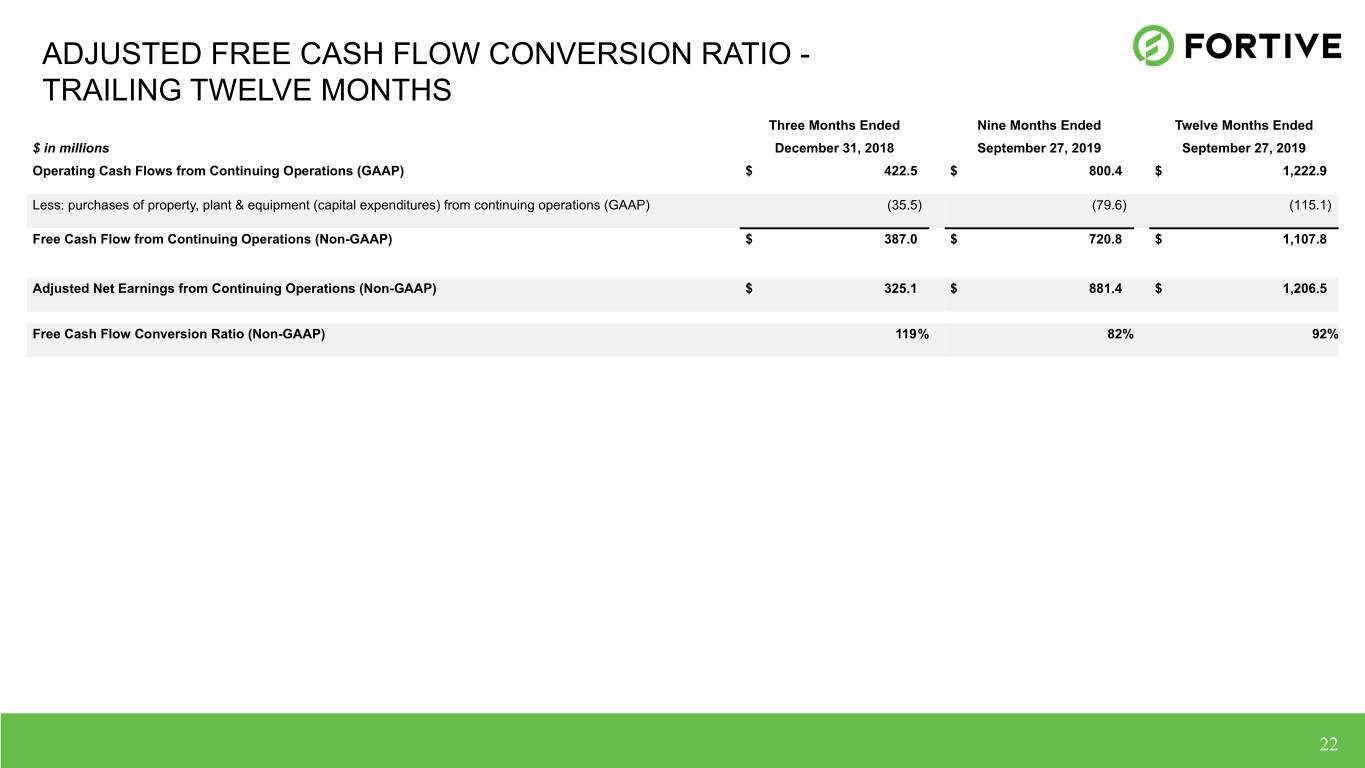

Adjusted Free Cash Flow from Continuing Operations Conversion Ratio - Trailing Twelve Months

Three Months Ended |

Nine Months Ended |

Twelve Months Ended |

|||||||||

($ in millions) |

December 31, 2018 |

September 27, 2019 |

September 27, 2019 |

||||||||

Operating Cash Flows from Continuing Operations (GAAP) |

$ |

422.5 |

$ |

800.4 |

$ |

1,222.9 |

|||||

Less: purchases of property, plant & equipment (capital expenditures) from continuing operations (GAAP) |

(35.5 |

) |

(79.6 |

) |

(115.1 |

) |

|||||

Free Cash Flow from Continuing Operations (Non-GAAP) |

$ |

387.0 |

$ |

720.8 |

$ |

1,107.8 |

|||||

Adjusted Net Earnings from Continuing Operations (Non-GAAP) |

$ |

325.1 |

$ |

881.4 |

$ |

1,206.5 |

|||||

Free Cash Flow Conversion Ratio (Non-GAAP) |

119 |

% |

82 |

% |

92 |

% |

|||||

15

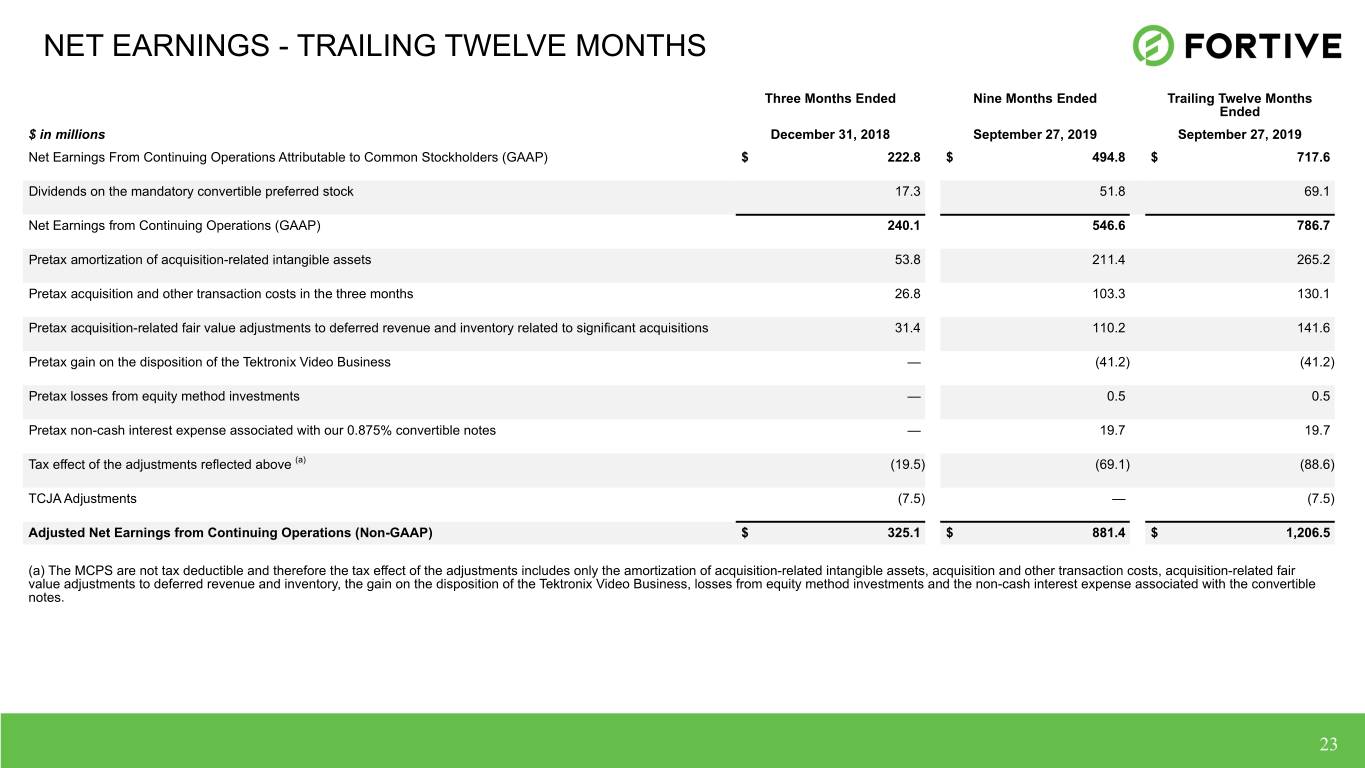

Adjusted Net Earnings from Continuing Operations - Trailing Twelve Months

Three Months Ended |

Nine Months Ended |

Twelve Months Ended |

|||||||||

($ in millions) |

December 31, 2018 |

September 27, 2019 |

September 27, 2019 |

||||||||

Net Earnings from Continuing Operations Attributable to Common Stockholders (GAAP) |

$ |

222.8 |

$ |

494.8 |

$ |

717.6 |

|||||

Dividends on the mandatory convertible preferred stock |

17.3 |

51.8 |

69.1 |

||||||||

Net Earnings from Continuing Operations |

240.1 |

546.6 |

786.7 |

||||||||

Pretax amortization of acquisition-related intangible assets |

53.8 |

211.4 |

265.2 |

||||||||

Pretax acquisition and other transaction costs* |

26.8 |

103.3 |

130.1 |

||||||||

Pretax acquisition-related fair value adjustments to deferred revenue and inventory related to significant acquisitions |

31.4 |

110.2 |

141.6 |

||||||||

Pretax gain on the disposition of the Tektronix Video Business |

— |

(41.2 |

) |

(41.2 |

) |

||||||

Pretax losses from equity method investments |

— |

0.5 |

0.5 |

||||||||

Pretax non-cash interest expense associated with our 0.875% convertible notes |

— |

19.7 |

19.7 |

||||||||

Tax effect of the adjustments reflected above(a)

|

(19.5 |

) |

(69.1 |

) |

(88.6 |

) |

|||||

TCJA Adjustments |

(7.5 |

) |

— |

(7.5 |

) |

||||||

Adjusted Net Earnings from Continuing Operations (Non-GAAP) |

$ |

325.1 |

$ |

881.4 |

$ |

1,206.5 |

|||||

(a) The MCPS are not tax deductible and therefore the tax effect of the adjustments includes only the amortization of acquisition-related intangible assets, acquisition and other transaction costs, acquisition-related fair value adjustments to deferred revenue and inventory, the gain on the disposition of the Tektronix Video Business, losses from equity method investments and the non-cash interest expense associated with the convertible notes. | |||||||||||

* $1.3 million and $1.5 million of acquisition and other transaction costs were recorded in the three months ended March 29, 2019 and June 28, 2019, respectively, that were not previously adjusted for but are reflected in the totals for the nine months ended September 27, 2019. | |||||||||||

16

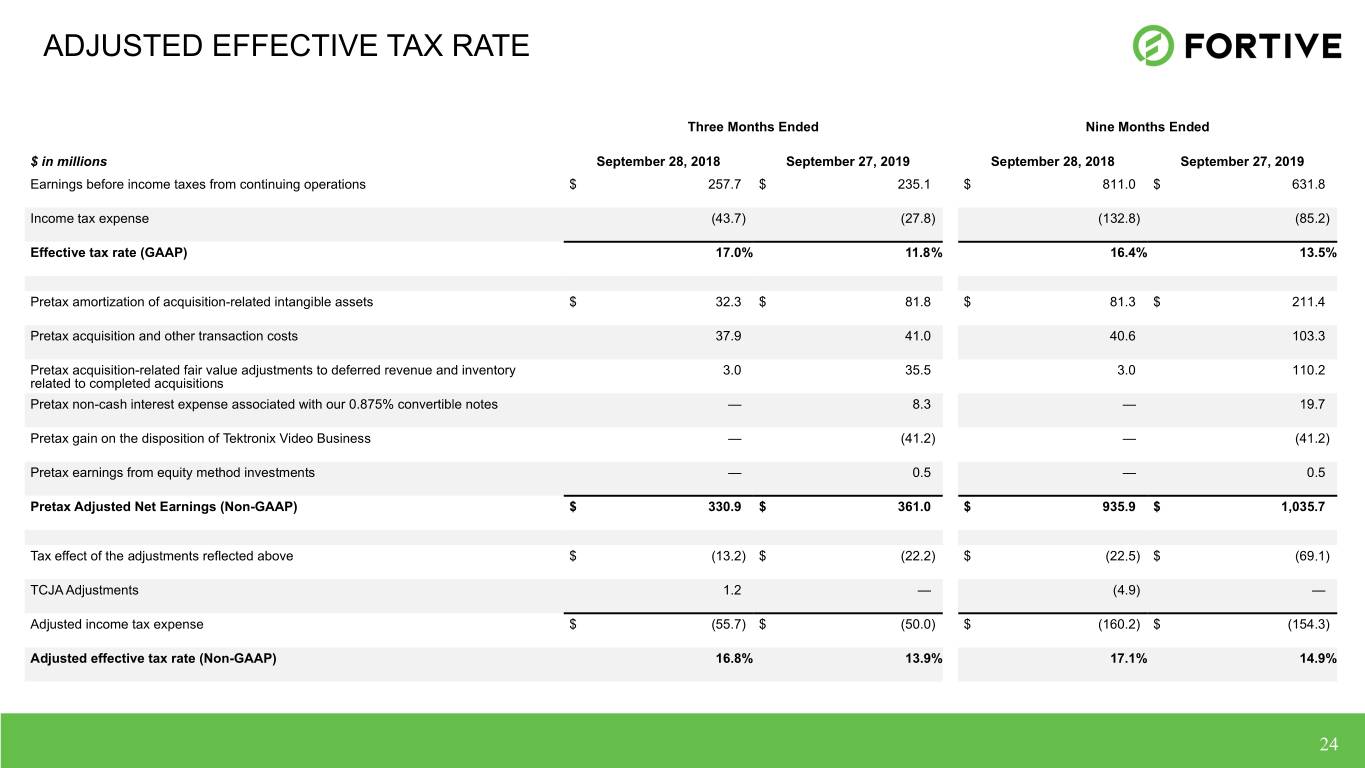

SECTION 8

Adjusted Effective Tax Rate

Three Months Ended |

Nine Months Ended |

||||||||||||||

($ in millions) |

September 27, 2019 |

September 28, 2018 |

September 27, 2019 |

September 28, 2018 |

|||||||||||

Earnings before income taxes from continuing operations |

$ |

235.1 |

$ |

257.7 |

$ |

631.8 |

$ |

811.0 |

|||||||

Income tax expense |

(27.8 |

) |

(43.7 |

) |

(85.2 |

) |

(132.8 |

) |

|||||||

Effective tax rate (GAAP) |

11.8 |

% |

17.0 |

% |

13.5 |

% |

16.4 |

% |

|||||||

Pretax amortization of acquisition-related intangible assets |

$ |

81.8 |

$ |

32.3 |

$ |

211.4 |

$ |

81.3 |

|||||||

Pretax acquisition and divestiture-related transaction costs |

41.0 |

37.9 |

103.3 |

40.6 |

|||||||||||

Pretax acquisition-related fair value adjustments to deferred revenue and inventory related to completed acquisitions |

35.5 |

3.0 |

110.2 |

3.0 |

|||||||||||

Pretax non-cash interest expense associated with our 0.875% convertible notes |

8.3 |

— |

19.7 |

— |

|||||||||||

Pretax gain on disposition |

(41.2 |

) |

— |

(41.2 |

) |

— |

|||||||||

Pretax losses from equity method investments |

0.5 |

— |

0.5 |

— |

|||||||||||

Pretax Adjusted Net Earnings (Non-GAAP) |

$ |

361.0 |

$ |

330.9 |

$ |

1,035.7 |

$ |

935.9 |

|||||||

Tax effect of the adjustments reflected above |

$ |

(22.2 |

) |

$ |

(13.2 |

) |

$ |

(69.1 |

) |

$ |

(22.5 |

) |

|||

TCJA Adjustments |

— |

1.2 |

— |

(4.9 |

) |

||||||||||

Adjusted income tax expense |

$ |

(50.0 |

) |

$ |

(55.7 |

) |

$ |

(154.3 |

) |

$ |

(160.2 |

) |

|||

Adjusted effective tax rate (Non-GAAP) |

13.9 |

% |

16.8 |

% |

14.9 |

% |

17.1 |

% |

|||||||

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

Q3 2019 Earnings Conference Call Transcript

Operator:

My name is Philip, and I will be your conference facilitator this afternoon. At this time, I would like to welcome everyone to Fortive Corporation's third quarter 2019 earnings results conference call. All lines have been placed on mute to prevent any background noise. After the speaker's remarks there will be a question-and-answer session.

I would now like to turn the call over to Mr. Griffin Whitney, Vice President of Investor Relations. Mr. Whitney, you may begin your conference.

Griffin Whitney, Vice President-Investor Relations, Fortive Corporation:

Thank you, Philip. Good afternoon everyone and thank you for joining us on the call. With us today are Jim Lico, our President and Chief Executive Officer, and Chuck McLaughlin, our Senior Vice President and Chief Financial Officer.

We present certain non-GAAP financial measures on today's call. Information required by SEC Regulation G relating to these non-GAAP financial measures are available on the Investors Section of our website, www.fortive.com, under the heading Financial Information.

We completed the divestiture of the Automation & Specialty Business on October 1, 2018, and accordingly have included the results of the A&S Business as discontinued operations for current and historical periods. The results presented on this call are based on continuing operations.

During the presentation, we will describe certain of the more significant factors that impacted year-over-year performance. All references to period-to-period increases or decreases and financial metrics are year over year on a continuing operations basis.

During the call, we will make forward-looking statements within the meaning of the federal securities laws including statements regarding events or developments that we expect or anticipate will or may occur in the future. These forward-looking statements are subject to a number of risks and uncertainties and actual results might differ materially from any forward-looking statements that we make today. Information regarding these factors that may cause actual results to differ materially from these forward-looking statements is available in our SEC filings, including our Annual Report on Form 10-K for the year ended December 31, 2018. These forward-looking statements speak only as of the date that they are made, and we do not assume any obligation to update any forward-looking statements.

With that, I'd like to turn the call over to Jim.

James A. Lico, President, Chief Executive Officer & Director, Fortive Corporation:

Thanks, Griffin, and good afternoon, everyone.

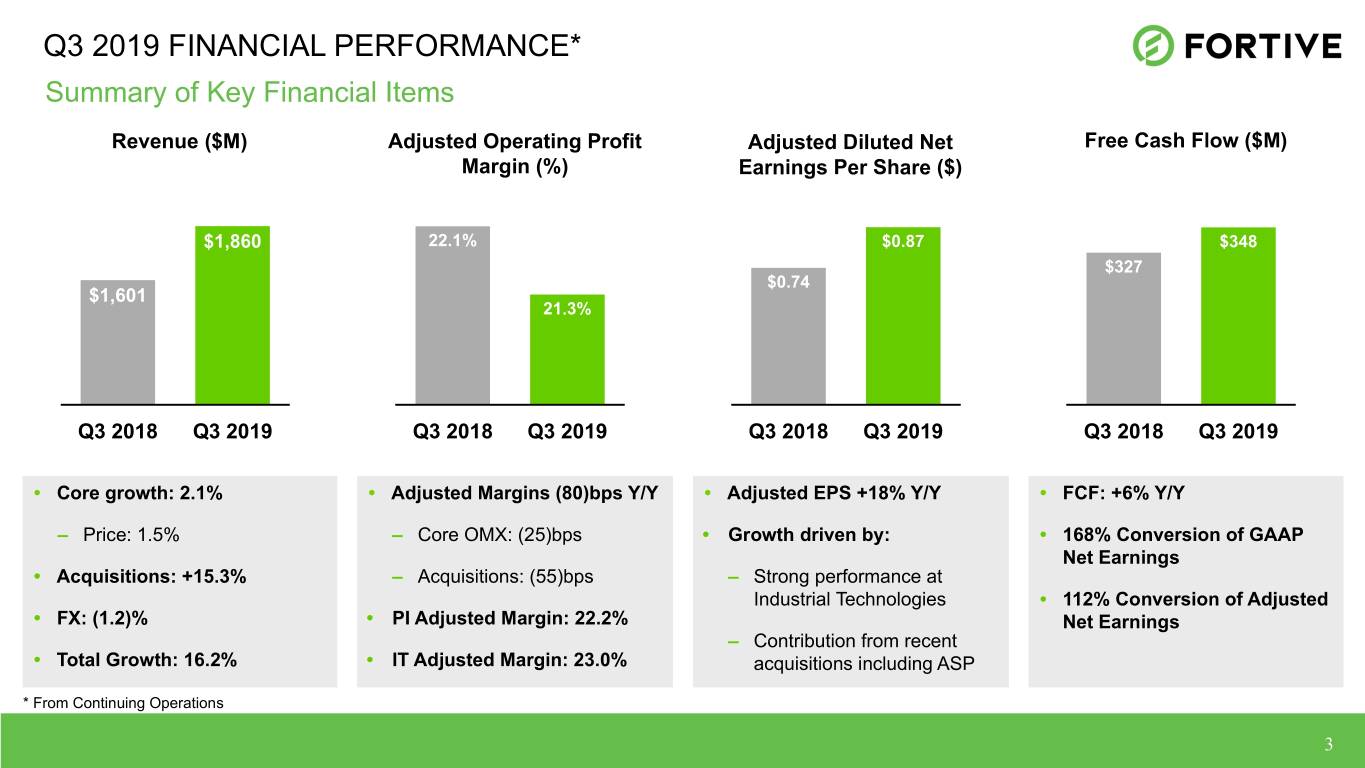

Today, we reported adjusted diluted earnings per share of $0.87 for the third quarter of 2019, representing an increase of 18% year over year despite short cycle slowing that intensified over the course of the quarter. While these challenges impacted growth in certain parts of our Professional Instrumentation segment, a double-digit increase in earnings and strong cash flow performance demonstrated both a contribution from our recent acquisitions and the strength of Fortive Business System to provide resilience to our portfolio.

As we navigate the slowing in the short-term, we continue to invest in our businesses to drive organic innovation, fuel further compounding and execute our capital allocation strategy to strength our long-term competitive advantage across the portfolio.

We've completed a significant amount of deal activity over the past three years and the execution of our capital allocation strategy continues. We have owned Advanced Sterilization Products for a little more than two quarters and we are pleased with its performance thus far and continue to make substantial progress with this integration.

In the coming weeks, we will close on China representing a significant step forward as we bring the remainder of ASP's geographies under our direct control. As we roll off the transition services agreement and install key elements of the Fortive Business System in the coming quarters, we will lay the groundwork for accelerated innovation and growth in the years ahead.

43

We also continue to make progress with respect to the intended separation of NewCo, which we announced on September 4th. Utilizing FBS, we have taken substantial steps forward with respect to our preparations, and we remain on track toward completing the transaction in the second half of 2020. We look forward to providing additional details on the transaction and updates on further milestones for NewCo in the coming weeks and months.

With that, I'd like to turn to the details of the quarter. Adjusted net earnings were $311 million, up 13% over the prior year, and adjusted diluted net earnings per share were $0.87.

Sales grew 16.2% to $1.9 billion, reflecting a core revenue increase of 2.1%, and the contribution from recent acquisitions. Core revenue growth was highlighted by strong performance at Gilbarco Veeder-Root and PacSci EMC, which was partially offset by declines in the short-cycle businesses within Professional Instrumentation, including Fluke, Tektronix and some parts of Sensing Technologies. Unfavorable foreign currency exchange rates reduced growth by 120 basis points.

Geographically, developed markets core revenue grew low single digits, reflecting the slowing macro conditions across both North America and Western Europe. Core revenue growth in North America was low single digits, led by GVR, EMC and Industrial Scientific, while Western Europe grew slightly.

High-grow markets core revenue decreased low single digits due to the loss of Huawei-related revenue at Tektronix and weaker market conditions in the Middle East.

China posted slightly positive growth as strong performance at Fluke and Qualitrol was largely offset by a decline in Tektronix, due to the Huawei impact, and flat performance of GVR. India was flat as growth at Fluke and Qualitrol was offset by timing delays for certain large project rollouts at GVR, which are now expected to start in the fourth quarter.

Adjusted operating profit margin was 21.3%, representing a year-over-year decrease of 80 basis points, including 55 basis points of dilutive operating margin associated with acquisitions.

Core operating margins decreased 25 basis points as the continued slowing within Professional Instrumentation more than offsets strength at GVR and another solid quarter of operating margin expansion in Matco.

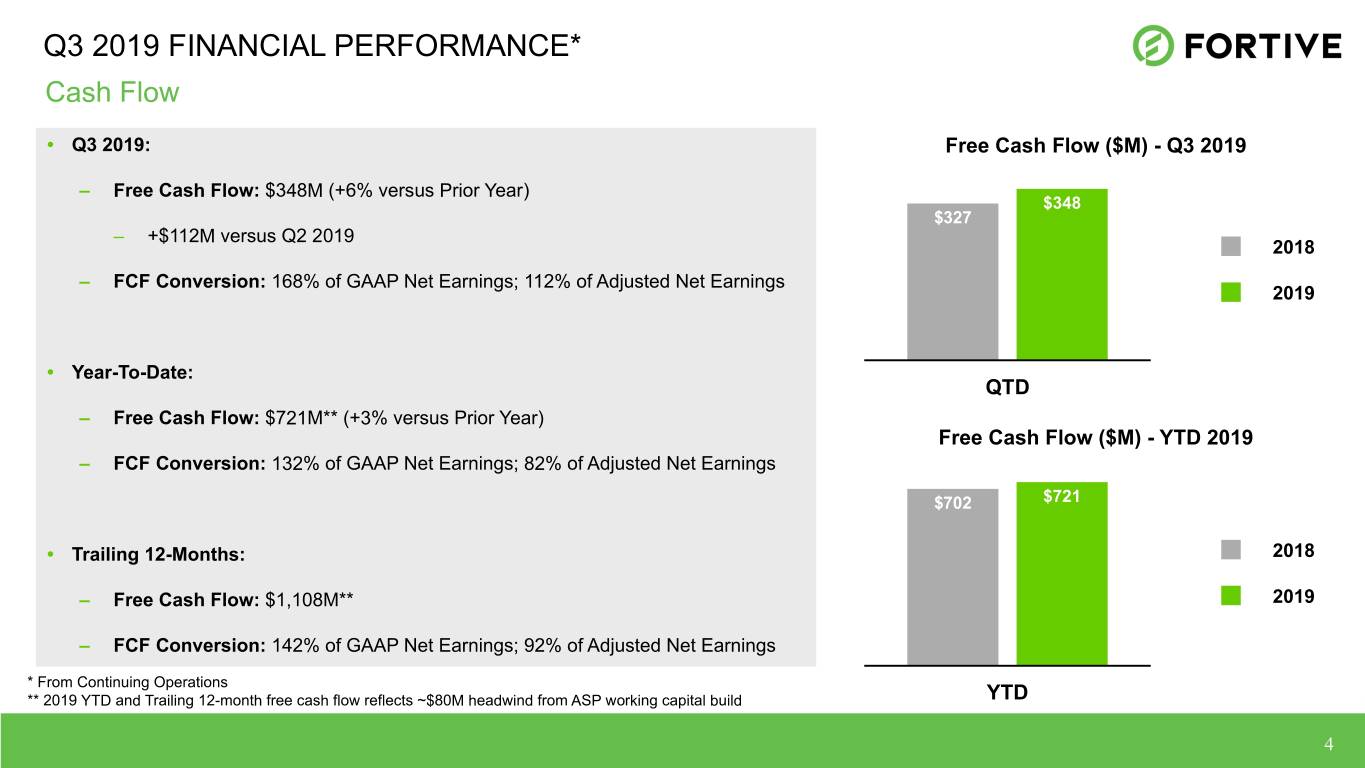

During the third quarter, we generated $348 million of free cash flow or a sequential increase of $111 million from the second quarter. This free cash flow performance represented a conversion ratio of 168%.

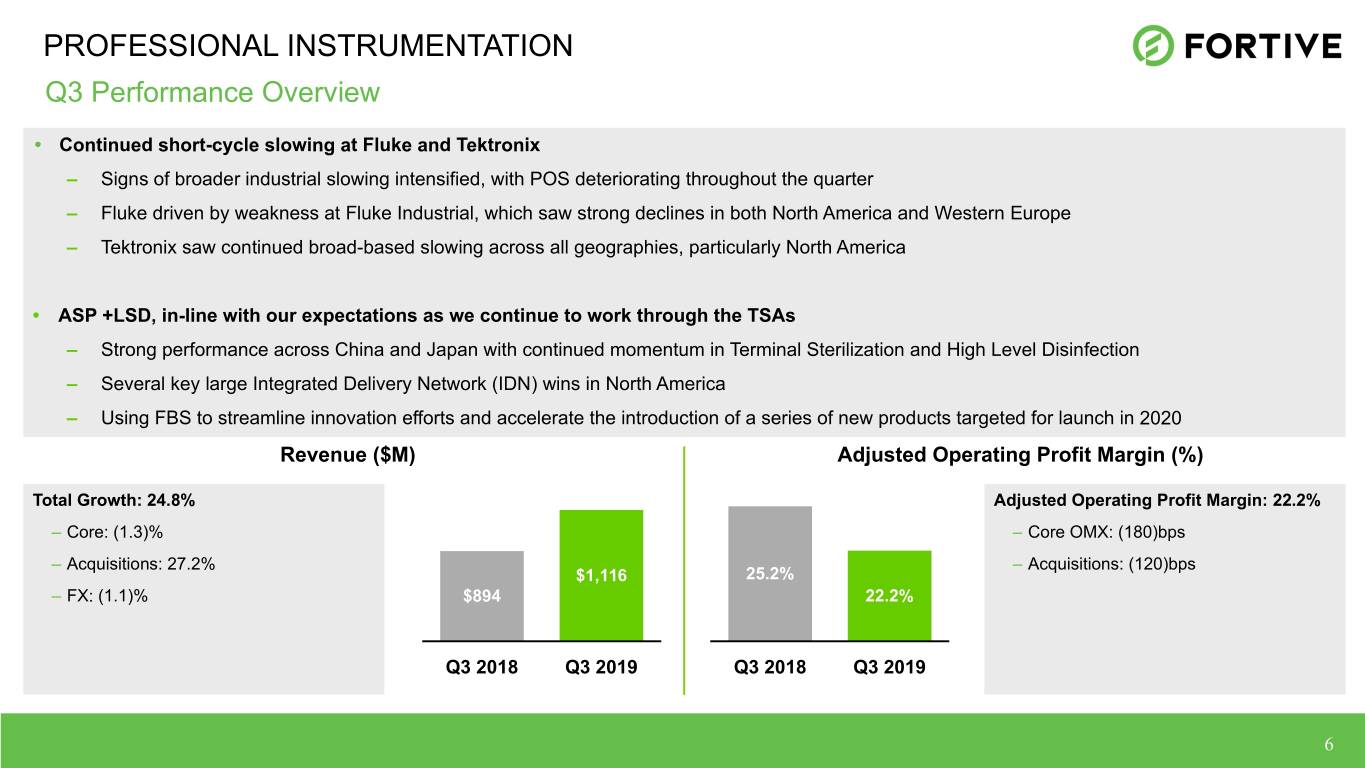

Turning to our segments, Professional Instrumentation posted sales growth of 24.8% despite a low single-digit decrease in core revenue. The significant contribution of recent acquisitions, most notably ASP, continued to drive overall growth within Professional Instrumentation. Unfavorable foreign currency exchange rates reduced growth by 110 basis points.

Segment level adjusted operating margin was 22.2%, representing a year-over-year decrease of 300 basis points, including 120 basis points of dilutive operating margin associated with acquisitions.

Core operating margins decreased 180 basis points, reflecting a combination of slower revenue performance, the impact of tariffs and unfavorable foreign currency exchange.

Advanced Instrumentation & Solutions core revenue decreased low single digits as strong performance at EMC was more than offset by continued slowing across Fluke and Tektronix.

Field solutions core revenue decreased low single digits, including a low single-digit decline in developed markets driven primarily by slowing at Fluke in North America.

High-growth markets increased low single digits, driven by growth at Fluke and strong performance from Qualitrol in China.

Fluke's core revenue declined mid-single digits due to a high single-digit decrease at Fluke Industrial. Fluke Digital Systems grew greater than 20%, led by strong growth at eMaint, which generated a 10% increase in net new customers and a greater-than-20% increase in annual recurring revenue.

From a geographic perspective, the slowing that emerged at the end of the second quarter became more pronounced in the third quarter, particularly in North America, which saw a high single-digit decrease in revenue with slowing point-of-sale trends.

44

Fluke generated mid-single-digit growth in China, driven by strong performance across Fluke Industrial, Process Instruments, and Fluke Networks. Fluke Health won a multi-million-dollar order for RadWatch, a product developed in collaboration with the US Army, to monitor and measure radiation dosage.

The acquisition of PRUFTECHNIK closed at the beginning of the quarter and has gotten off to a solid start. We are excited about the integration of PRUFTECHNIK enhances Fluke's offering and capabilities with respect to asset reliability and condition monitoring.

ISC delivered low single-digit core growth as decreases in Western Europe and China partially offset stronger performance in North America. ISC's lower core growth in the quarter reflected a decline in instrument sales, which tend to be more sensitive to broader macro slowing.

ISC's iNet offering had another strong quarter, generating mid-teens growth as ISC continues to increase its share of subscription-based recurring revenue. ISC also recently launched the WiFi-enabled Ventis Pro5 multi-gas monitor, ISC's first direct-to-cloud product and a key step forward for ISC's emerging “connected worker” safety initiative.

The integrations of both Intelex and Safer Systems are progressing well, positioning ISC to significantly advance its safety-as-a-service strategy to provide real-time solutions for its customers’ environmental, health and safety-related workflows.

Qualitrol's core revenue declined low single digits as the continued challenges in North America, Western Europe and the Middle East were partially offset by greater than 20% growth in China, and greater than 30% growth in Latin America.

Qualitrol saw mid-teens growth in their basic sensors product line driven by share gains and is starting to see early signs of more positive bookings momentum heading into the fourth quarter.

Our facilities and asset management businesses, Gordian and Accruent both rolled core during the third quarter, but had a relatively small effect on the core performance of Professional Instrumentation, given the partial period. These businesses continue to perform well, generating high single-digit core growth.

Gordian's procurement platform in particular continues to drive strong growth, paced by increased construction volume with large enterprise customers, including the New York City Department of Education. Gordian also recently closed its largest facility planning deal to date, with CommonSpirit Health Systems to complete a facility condition assessment across its entire network.

Accruent saw slower growth in the quarter due to softer licensing revenue as it transitions customers away from certain legacy products towards its higher growth SaaS offerings. The company continues to generate strong SaaS bookings, with its sales team increasingly driving enterprise customers towards longer-term subscription-based contracts with higher total contract value.

Accruent added more than 70 customers in the third quarter, while significantly expanding its existing contract with Cushman & Wakefield to cover a broader range of offerings across Accruent's software platform.

Product realization core revenue decreased slightly, as strong growth at both EMC and Invetech was offset by continued weakness at Tektronix. EMC generated another quarter of broad-based double-digit sales growth across both its core defense product lines and its commercial satellite offering. EMC continues to maintain a very strong backlog with large recent customer wins and increasing momentum among commercial satellite operators, providing the company with excellent revenue visibility into next year.

Tektronix registered a high single-digit decrease in core revenue. Tektronix continued to be negatively impacted by slowing at Keithley, broad-based weakness in Western Europe, and the loss of its Huawei business due to the US Government imposed trade restrictions earlier this year.

While Tektronix registered strong growth from its high-performance oscilloscopes, driven by the 5G buildout in China, it also saw further slowing in North America, including a low double-digit decline for its core mid-range scopes.

Negative point-of-sale trends present an ongoing challenge heading into the fourth quarter. Despite the macro challenges, which we expect to persist into next year, Tektronix continues to focus on business execution, driving gains in its strategic growth segments, including key data center and automotive wins during the quarter.

45

Core revenue for Sensing Technologies decreased low single digits, as growth in North America and China was more than offset by weakness in Western Europe. Anderson-Negele had a strong quarter using FBS commercial tools to drive continued share gains in adjacent segments of the food and beverage end-market.

Building on the momentum in its environmental monitoring offering, Setra recently launched its Setra Lite product line, providing a simple, cost-effective, and highly visible solution to address pressure monitoring requirements in hospital rooms, which has been very well received by the market.

Turning to Advanced Sterilization Products, the company grew low single digits, in line with our expectations, as we continue to work our way through the completion of the transition services agreements. ASP's growth was led by strong performance in China and Japan, which saw continued momentum in Terminal Sterilization as well as strong growth in high-level disinfection tied to the recent launch of its new automatic endoscope reprocessor product line for the Japanese market.

ASP also landed some key wins in North America, expanding its footprint and overall portfolio in strategic integrated delivery networks in both Texas and Illinois. The ASP team has begun to apply the Fortive Business System to streamline its innovation efforts and accelerate the introduction of a series of new products targeted for launch in 2020.

Consistent with our strategy to build strong positions and connected workflows, we recently signed an agreement to acquire Censis, a leading provider of instrument tracking software, as a key addition to our sterilization offering. Censis provides central sterilization departments with front-line error prevention tools and analytics, which help improve efficiency and productivity in sterilization workflows, optimize compliance reporting, and reduce the risk of hospital-acquired infections. We expect the acquisition to close before the end of the year.

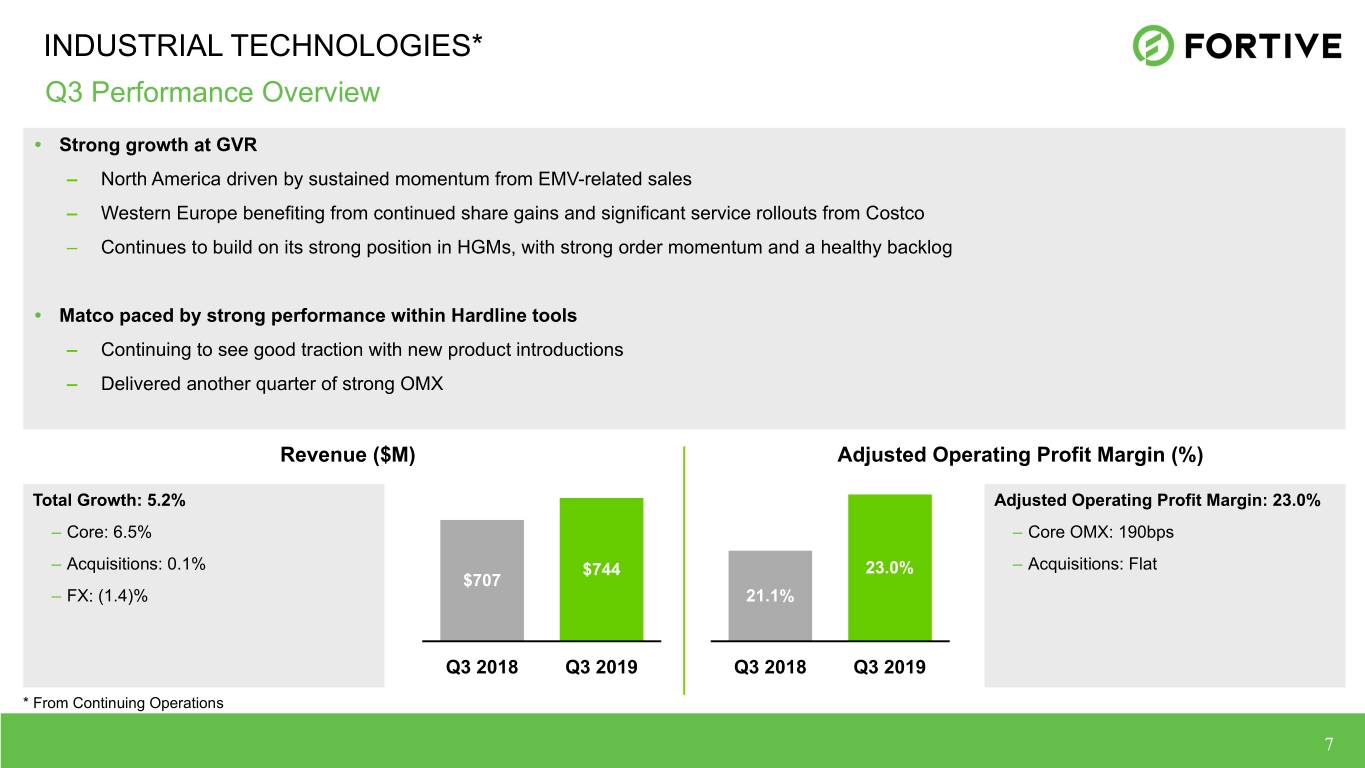

Moving to Industrial Technologies, revenue grew 5.2%, including core revenue growth of 6.5%. Acquisitions contributed 10 basis points of growth, while unfavorable foreign exchange rates reduced growth by 140 basis points. Segment level adjusted operating margin was 23.0%, including a core operating margin increase of 190 basis points, driven by the continued strong volume at GVR and solid performance at Matco.

Our transportation technologies platform core revenue grew high single digits, led by mid-teens growth in North America. GVR delivered low double-digit core revenue growth, highlighted by a mid-teens increase in developed markets. GVR's performance in North America was paced by sustained momentum from EMV-related sales, while growth in Western Europe reflected a combination of continued share gains and significant service rollouts with Costco during the quarter.

GVR posted flat growth across high-growth markets, and strong performance in Latin America was offset by continued delays from automation project rollouts in India, as well as a large dispenser tender, for which expected delivery has been shifted into the fourth quarter.

Despite these short-term dynamics, GVR continues to build on its strong position within high-growth markets and India in particular, as strong order momentum and a healthy backlog provide good visibility into the region's sustained growth in the coming quarters.

GVR recently launched Passport Express Lane, adding a self-checkout system optimized for convenience stores to its Passport suite of solutions. GVR also launched a new family of products for Insite360 called HALO, which provide a significant upgrade to the system's field fuel logistics functionality.

During the third quarter, we made a follow-on investment in Tritium, as we continue to support the company's rapid growth. GVR also recently announced the integration of a credit card reader into Tritium's high-speed EV charging stations, enhancing payment functionality to include credit card, debit card, and contactless payment methods.

Teletrac Navman performed in line with expectations, generating a low teens core revenue decrease in the third quarter, as continued strong growth across Asia-Pacific was more than offset by the company's performance across North America and Western Europe. The key priority for the Teletrac Navman team remains the stabilization of its business in North America as it addresses the high level of customer churn over the past 12 months and returns the company to a sustainable growth trajectory. We continue to see improvements in our customer-related metrics, including the level of customer churn.

Moving to franchise distribution, the platform's core revenue grew low single digits during the third quarter, as low single-digit growth at Matco was partially offset by a low single digit decline at Hennessy. Matco was led by another strong quarter of growth in hardline tools, offset by some slowing in tool storage.

46

Matco continues to see good traction with new product introductions, highlighted by the recent launch of a new half-inch air impact wrench with a market-leading combination of power and control and a lightweight design that makes it significantly easier for the technician to handle.

Before turning to the guide, as we look ahead to 2020, we are mindful of the challenging macroeconomic environment and are, therefore, planning to increase our spending on a range of strategic productivity initiatives by approximately $45 million in the fourth quarter.

These initiatives will better position us to deliver sustained earnings growth, while maintaining investments to drive future growth and innovation.

We are updating our full year 2019 adjusted diluted net EPS guidance to $3.42 to $3.47, representing year-over-year growth of 12% to 13% on a continuing operations basis. The revised annual guide reflects the headwinds faced by our Professional Instrumentation segment due to the short-cycle slowing dynamics that became more pronounced in the third quarter, and which we expect to persist through the end of the year. The revised guidance assumes 1% to 2% core revenue growth and an effective tax rate of approximately 15%.

We are also initiating our fourth quarter adjusted diluted net EPS guidance of $0.96 to $1.01 representing year-over-year growth of 5% to 11%. This includes assumptions of flat core revenue growth, flat core OMX and an effective tax rate of approximately 15%.

To wrap up, during the third quarter we delivered high teens earnings growth with strong free cash flow, even as the macroeconomic backdrop became more challenging. The quarter demonstrated the powerful earnings contribution from the acquisitions we have added over the past few years, which are also increasing the resilience of our portfolio as they compound and become a larger share of our total revenue.

Despite short-cycle slowing and the headwinds we expect to persist into next year, we continue to execute our capital allocation strategy to drive further portfolio transformation, build a better, stronger Fortive and create greater long-term value for employees, customers and shareholders.

With that, I would like to turn it over to Griffin.

Griffin Whitney, Vice President-Investor Relations, Fortive Corporation:

Thanks, Jim. That concludes our formal comments. Philip, we're now ready for questions.

Operator:

Your first question is from the line of Steve Tusa with JPMorgan.

C. Stephen Tusa, Analyst, JPMorgan Securities LLC:

Hey, guys. Good afternoon.

James A. Lico, President, Chief Executive Officer & Director, Fortive Corporation:

Hi, Steve. How are you?

C. Stephen Tusa, Analyst, JPMorgan Securities LLC:

I'm doing all right. So, can you just help us a little bit with parsing out the acquisitions? How much of an impact on margin and then maybe easier just like what was the negative earnings impact from stuff that ran through from the deal that you closed in the third quarter, if there was any?

James A. Lico, President, Chief Executive Officer & Director, Fortive Corporation:

In the third quarter, the deal expenses, on our adjusted earnings, there's nothing in there that ran through there, and there really wasn't any headwinds related to the acquisitions. The headwinds we faced were largely about the slowing of the topline, as we progressed through the quarter.

47

C. Stephen Tusa, Analyst, JPMorgan Securities LLC:

Okay. And then when it comes to the deal that you were planning to contribute this year like, Gordian and Accruent, I think ASP is kind of a bit of a standout, that seems to be on track. Just remind us what you said they were going to contribute at the beginning of the year? And is that still the case here that they're going to contribute the same amount? Or is the Accruent comment that you made – I think it was Accruent you made a comment around, is that slowing, having an impact on what those are ultimately going to contribute?

James A. Lico, President, Chief Executive Officer & Director, Fortive Corporation:

So, I think that the ASP continues to be right on track on that $0.20. And I think what we said for Gordian and Accruent, I have to go back and look, but $0.24 to $0.28 for the year, and I think when we get there, they're largely intact. Keep in mind that probably a third of the OP from those things are in the fourth quarter, so I think that we continue to be in that range.

Operator:

Your next question is from the line of Deane Dray with RBC Capital Markets.