PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 8, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☑ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Fortive Corporation

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| 1 |

2022 PROXY STATEMENT

| 2 |

FORTIVE CORPORATION

6920 Seaway Blvd

Everett, WA98203

Notice of 2022 Annual Meeting of Shareholders

ITEMS OF BUSINESS:

|

Board Recommendation |

Page | |||||

| 1. | To elect the eight director nominees named in the Proxy Statement, each for a one-year term expiring at the 2023 annual meeting and until his or her respective successor is duly elected and qualified. |  |

FOR | 17 | ||

| 2. | To approve on an advisory basis Fortive’s named executive officer compensation. |  |

FOR | 82 | ||

| 3. | To ratify the selection of Ernst & Young LLP as Fortive’s independent registered public accounting firm for the year ending December 31, 2022. |  |

FOR | 83 | ||

| 4. | To approve amendments to Fortive’s Restated Certificate of Incorporation to eliminate the supermajority voting requirements. |  |

FOR | 86 | ||

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most shareholders have a choice of voting in advance over the Internet, by telephone or by using a traditional proxy card or voting instruction form. You may also vote during the annual meeting by following the instructions available on the meeting website during the meeting. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

The rules and procedures applicable to the 2022 Annual Meeting, together with a list of shareholders of record for inspection for any legally valid purpose, will be available at the 2022 Annual Meeting for shareholders of record at www.virtualshareholdermeeting. com/FTV2022. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically, and submit questions and receive technical support during the virtual meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 7, 2022:

The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com.

By Order of the Board of Directors,

Secretary

April 25, 2022

|

|

When: June 7, 2022 at 3:00 p.m., PDT. |

|

|

Items of Business: 4 proposals as listed here |

|

Date of Mailing: The date of mailing of this Proxy Statement is on or about April 25, 2022. |

|

|

Who Can Vote: Shareholders of Fortive’s common stock at the close of business on April 11, 2022. |

|

|

Virtual-Only Meeting: As part of our precautions regarding the COVID-19 pandemic, the 2022 Annual Meeting of Shareholders will be held in a virtual-only meeting format. |

|

Where: www.virtualshareholder meeting.com/FTV2022 |

| 3 |

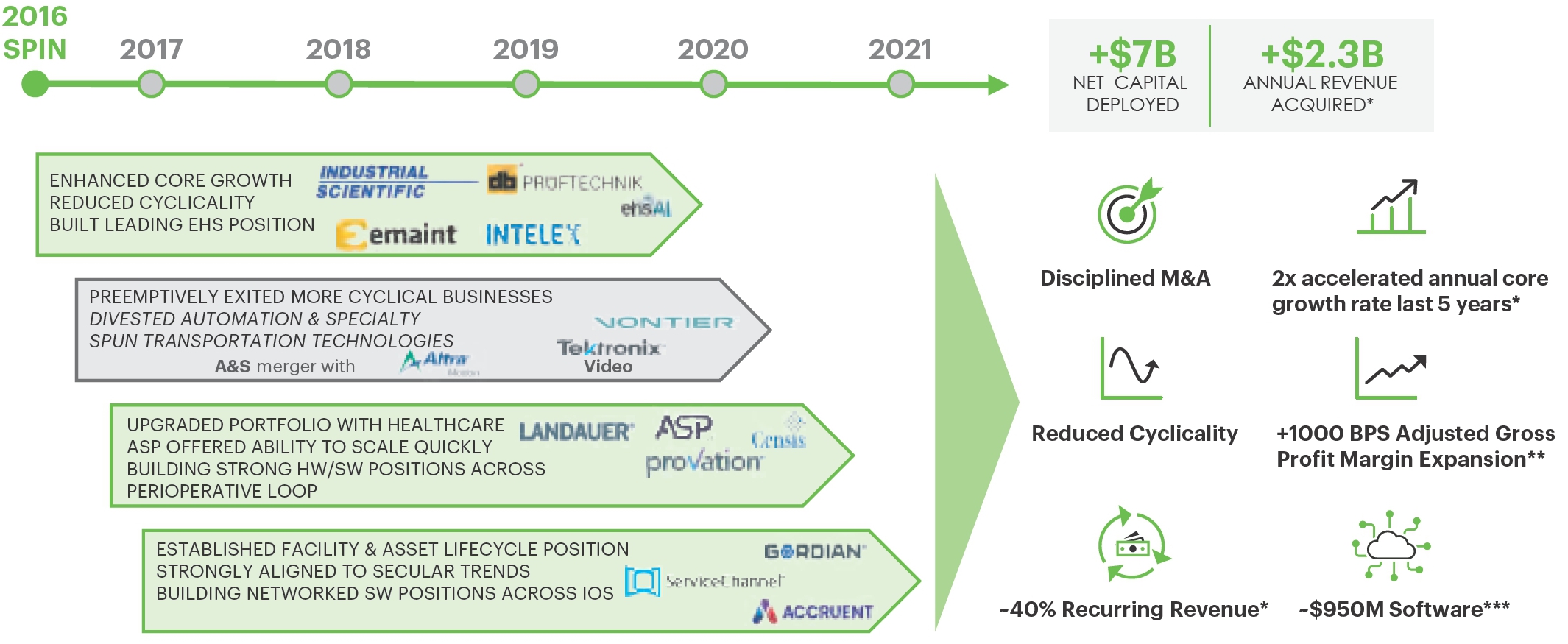

Our Company

Fortive Corporation is a provider of essential technologies for connected workflow solutions across a range of attractive industrial technology end-markets. Our strategic segments - Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions - include well-known brands with leading positions in their markets. Our businesses design, develop, manufacture, and service professional and engineered products, software, and services, building upon leading brand names, innovative technologies, and significant market positions.

We are guided by our shared purpose to deliver essential technology for the people who accelerate progress in buildings, factories, and hospitals, and we are united by our culture of continuous improvement and bias for action that embody the Fortive Business System (“FBS”). Through rigorous application of the proprietary set of growth, lean, and leadership tools and processes that comprise FBS, we continuously improve business performance in the critical areas of innovation, product development and commercialization, global supply chain, sales and marketing, and leadership development. Our commitment to FBS enables us to drive higher customer satisfaction and profitability, and generate significant improvements in innovation, growth, and core operating margins. Additionally, our FBS tools enable us to execute a disciplined acquisition strategy and expand our portfolio into new and attractive markets, evolving to further our goal of creating long-term shareholder value.

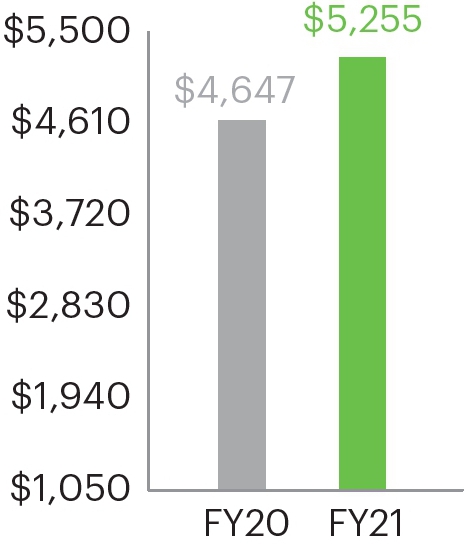

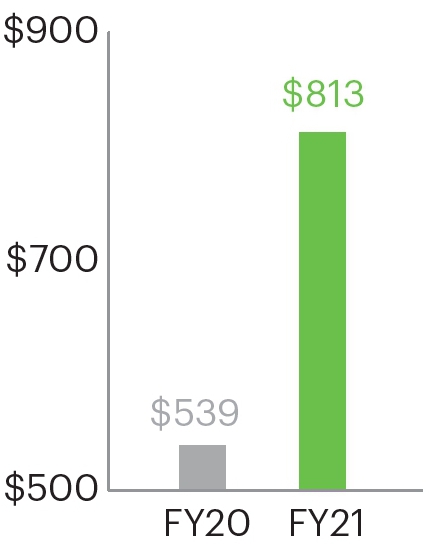

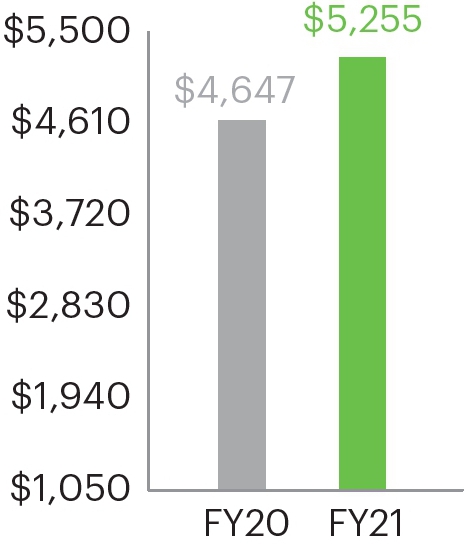

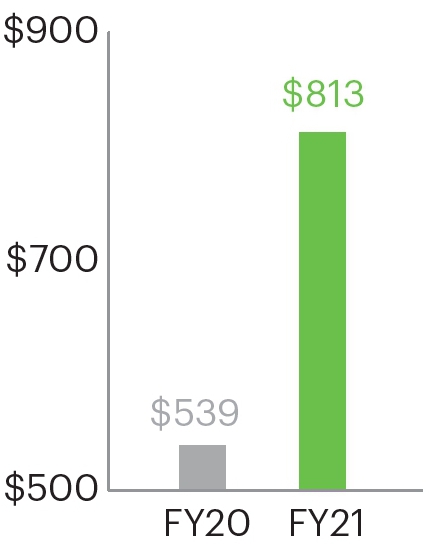

2021 Financial Highlights*

| Revenue | Operating Profit | Adjusted Operating Profit |

Free Cash Flow |

| in millions | in millions | in millions | in millions |

|

|

|

|

| Core Revenue Growth of 9.5% | 390 bps of Operating Profit Margin Expansion with 2021 EPS of $1.65 | 210 bps of Adjusted Operating Profit Margin Expansion with 2021 Adjusted EPS of $2.75, representing 32% Adjusted EPS Growth |

| * | Core Revenue Growth, Adjusted Operating Profit, Adjusted Operating Profit Margin Expansion, Adjusted EPS, Adjusted EPS Growth, and Free Cash Flow are non-GAAP financial measures. For the definition of these non-GAAP financial measures and the reconciliation of such measures to the corresponding GAAP measures, please refer to “Non-GAAP Financial Measures” in Appendix B to this proxy statement. |

2022 PROXY STATEMENT

| 4 | About Fortive |

Sustainability Strategic Pillars

|

|

|

|

|

||||

|

Empower Inclusive & Diverse Teams Advance an inclusive culture that enables everyone to do their best work. |

Invest in Our Create and advocate for positive impacts in the communities in which we work, live and serve. |

Protect Protect the environment and resources across the value chain. |

Work & Source Responsibly Raise and reinforce expectations to ensure people, safety and quality are priority #1. |

Operate with Establish and enforce boundaries to protect critical assets. |

Inclusion and Diversity

| Strategic Pillars | |

|

Inclusion and Diversity (I&D) Matters: |

|

►Build a diverse Fortive through hiring, developing, and retaining a strong and diverse team

|

|

|

Everyone Owns Inclusion: |

|

►Invest in development of our teams to build a Fortive where you can be yourself and do your best work

|

|

|

I&D in Our DNA: |

|

►Build a culture of equity that enables greater innovation and performance for customers and the world

|

|

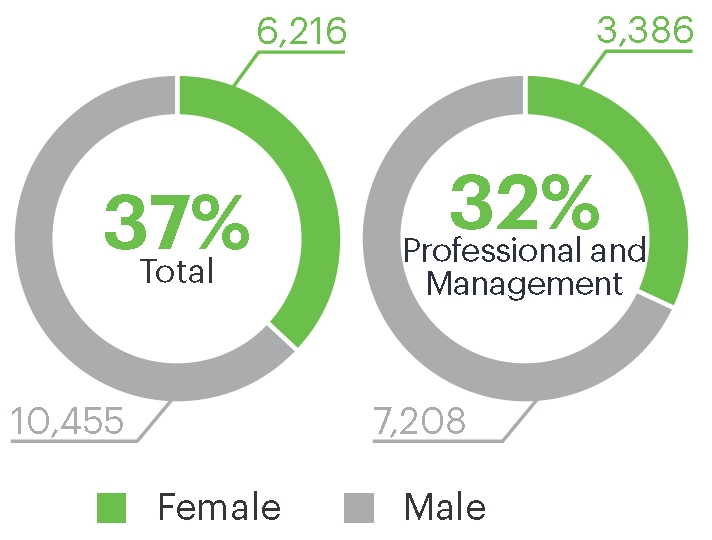

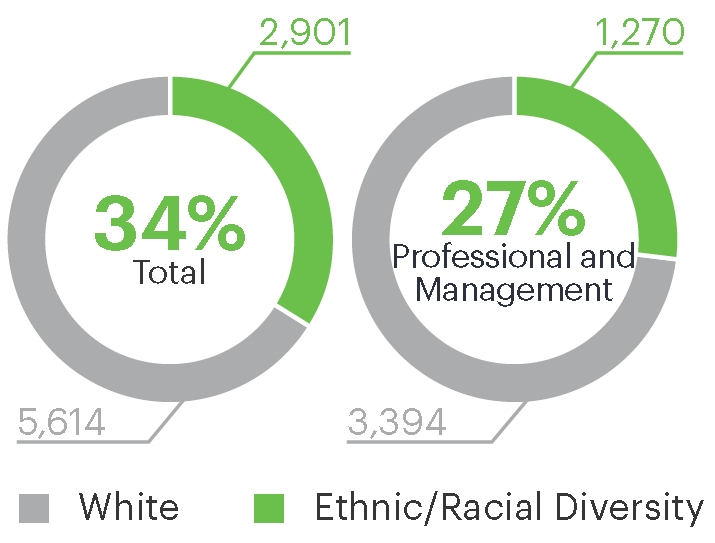

In 2021, we continued to strengthen our culture of Inclusion and Diversity by developing inclusive leaders, learning, expanding employee resource communities, and reinforcing equitable talent processes.

Aspirational Goals

| Our 2025 Goals |

|

| Gender Representation | 50% |

| BIPOC Representation | 37% |

| Senior Leader Diversity | 50% |

| Inclusion & Belonging Score in Employee Experience Survey | 85% |

Enhanced Transparency

We will publish our 2021 EEO-1 report on our website by April 30, 2022.

| 5 |

|

Proposal 1 (page 17) › |

Election of Directors |

Overview of Director Nominees

Our eight director nominees are comprised of current directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of the Company. Additional details on board membership criteria are set forth on page 27 under “Corporate Governance – Director Nomination Process.”

| Director Nominee | Daniel Comas |

Sharmistha Dubey |

Rejji Hayes |

Wright Lassiter |

James Lico |

Kate Mitchell |

Jeannine Sargent |

Alan Spoon |

| Skills and Attributes | ||||||||

| Global Experience |

|

|

|

|

|

|

|

|

| Senior Executive Leadership Experience |

|

|

|

|

|

|

|

|

| Relevant Industry Experience |

|

|

|

|

|

|

|

|

| Sustainability (ESG) Experience |

|

|

|

|

|

|

|

|

| Technology Management Experience |

|

|

|

|

|

|

|

|

| Cybersecurity Experience |

|

|

|

|

|

|

|

|

| Financial Literacy or Public Accounting Experience |

|

|

|

|

|

|

|

|

| Human Capital Management Experience |

|

|

|

|

|

|

|

|

| Mergers and Acquisition Experience |

|

|

|

|

|

|

|

|

| Public Company Board Experience |

|

|

|

|

|

|

|

|

| Legal and Corporate Governance Experience |

|

|

|

|

|

|

|

|

| Capital Markets and Corporate Finance Experience |

|

|

|

|

|

|

|

|

| Operational and Risk Management Experience |

|

|

|

|

|

|

|

|

| Demographic Information | ||||||||

| Tenure* | 1 | 2 | 1 | 0 | 6 | 6 | 3 | 6 |

| Gender | M | F | M | M | M | F | F | M |

| Race/Ethnicity | ||||||||

| African American or Black |

|

|

||||||

| Asian |

|

|||||||

| White |

|

|

|

|

|

|||

| * | Calculated as of the date of this Proxy Statement |

|

Indicates Expertise |

|

Indicates Experienced |

|

The Board of Directors recommends that shareholders vote “FOR” the election of each of the Director Nominees to the Board. |

2022 PROXY STATEMENT

| 6 | Proxy Voting Roadmap |

|

Proposal 2 (page 82) › |

Advisory Vote on Executive Compensation |

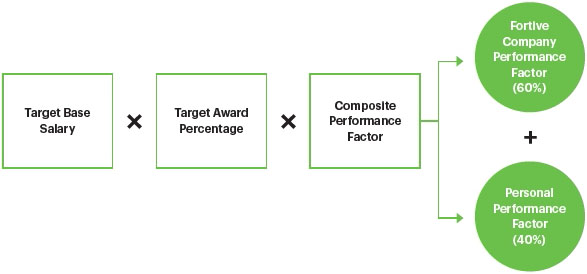

Elements of Executive Compensation

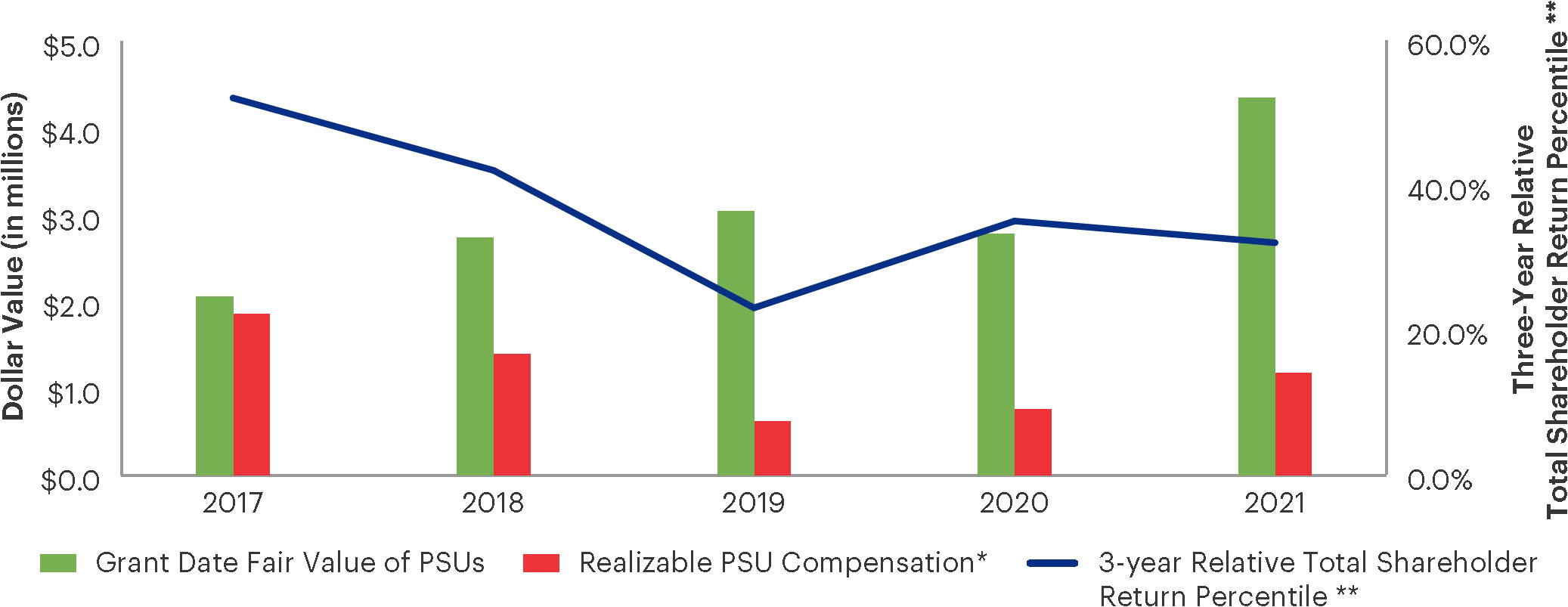

Consistent with our executive compensation philosophy, the 2021 executive compensation program emphasized equity-based compensation with long-term vesting requirements and was dependent on long-term company performance.

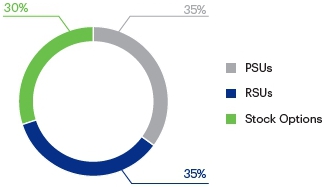

| Base Salary | Annual Incentive Compensation |

Stock Options | Restricted Stock Units (“RSUs”) |

Performance Stock Units (“PSUs”) |

|

| Form of Compensation |

Cash Near-Term Emphasis |

Cash Near-Term Emphasis |

Equity Long-Term Emphasis |

||

| Compensation Period |

1 year | Annual Performance |

4 years | 4 years | 3 years with an additional 1 year holding period |

| Key Performance Measures |

N/A | Company Financial Results and Performance Relative to Individual Goals |

Stock Price Appreciation |

Financial Performance and Stock Price Appreciation |

Three-Year Relative Total Shareholder Return |

| Determination of Performance- Based Payouts |

N/A | Formulaic + Discretion |

N/A | Formulaic | Formulaic |

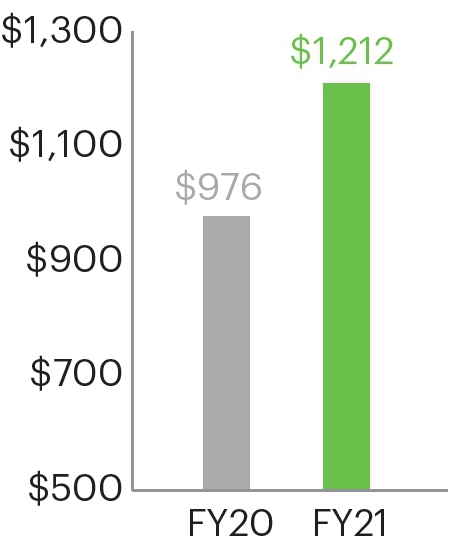

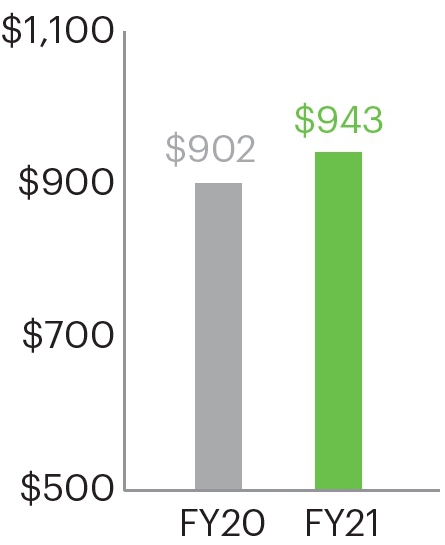

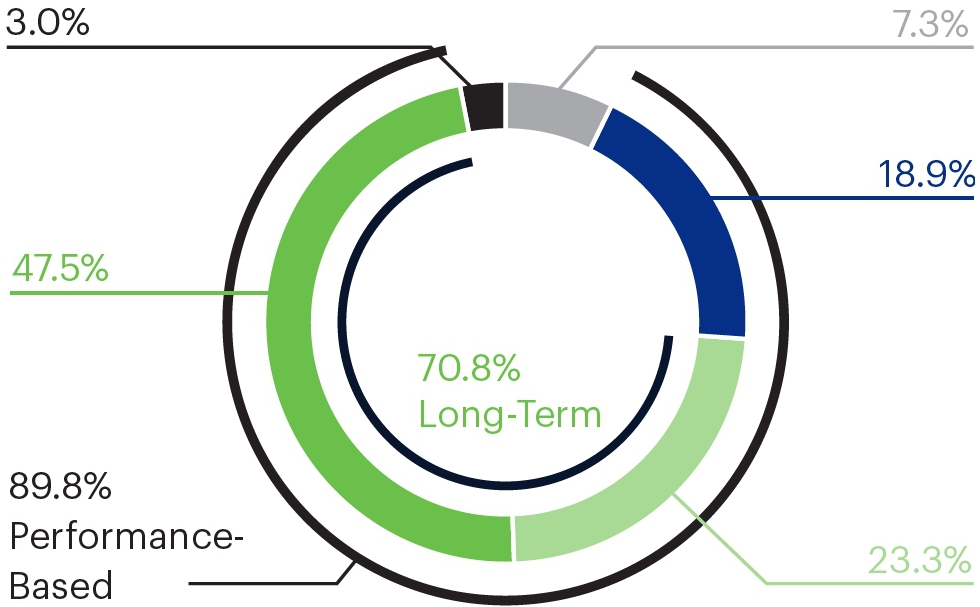

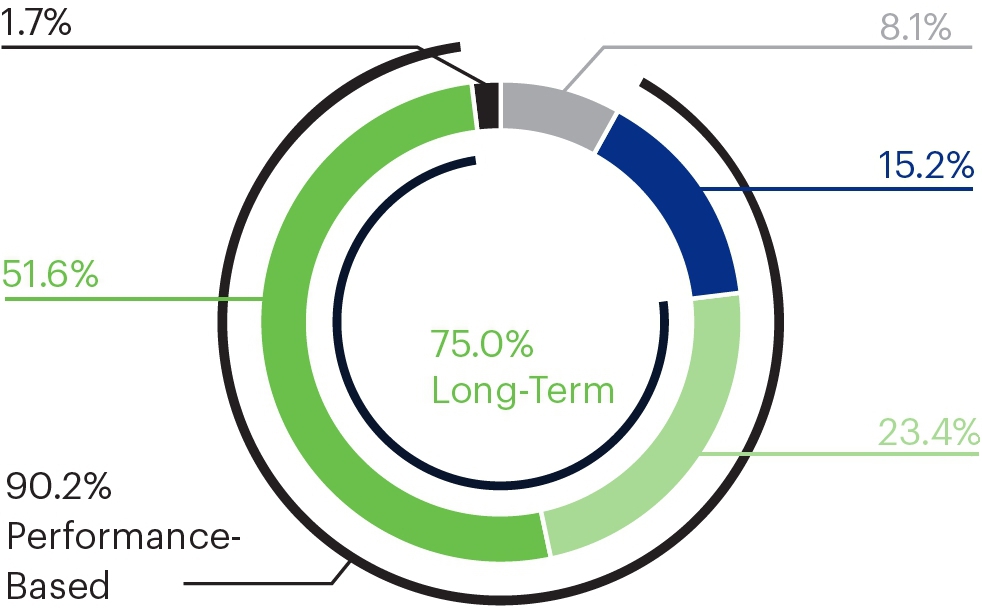

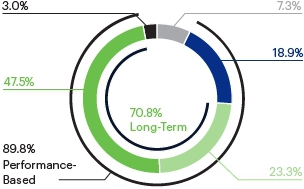

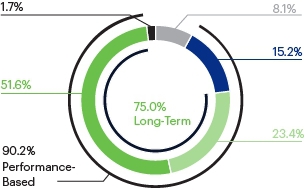

2021 Pay Mix

Our 2021 executive compensation program aligned compensation with the creation of long-term value for our shareholders. As shown below, the significant majority of our 2021 executive compensation was performance-based (including compensation that was dependent on performance of our stock price).

| CEO Pay | All Other NEO Pay* |

|

|

| Salary | Annual Incentive Compensation | Stock Options | PSUs/RSUs | All Other |

| * | Includes one-time sign-on equity awards. |

|

The Board of Directors recommends that shareholders vote “FOR” the resolution set forth in Proposal 2. |

| Proxy Voting Roadmap | 7 |

|

Proposal 3 (page 83) › |

Ratification of Independent Registered Public Accounting Firm |

After consideration of the independence and performance of the Company’s independent registered public accounting firm, the Audit Committee believes that the continued retention of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm is in the best interests of the Company and its shareholders. Consequently, the Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for 2022.

|

The Board of Directors recommends that shareholders vote “FOR” the ratification of the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for 2022. |

|

Proposal 4 (page 86) › |

Proposal to Eliminate Supermajority Voting Requirements |

|

The Board of Directors recommends that shareholders vote “FOR” the approval of the amendments to Fortive’s Restated Certificate of Incorporation to eliminate the supermajority voting requirements. |

2022 PROXY STATEMENT

| 8 |

Directors and Executive Officers

The following table sets forth as of April 1, 2022 (unless otherwise indicated) the number of shares and percentage of Common Stock beneficially owned by each of Fortive’s directors, nominees for director and each of the executive officers named in the Summary Compensation Table, and all executive officers and directors of Fortive as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of April 1, 2022. Except as indicated, the address of each director and executive officer shown in the table below is c/o Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203.

| Name |

Number of Shares Beneficially Owned(1) |

Percent of Class(1) |

|||||

| Daniel L. Comas | 39,420 | (2) | * | ||||

| Sharmistha Dubey | 8,340 | (3) | * | ||||

| Rejji P. Hayes | 1,900 | (4) | * | ||||

| Wright Lassiter III | 1,860 | (5) | * | ||||

| James A. Lico | 1,591,377 | (6) | * | ||||

| Kate D. Mitchell | 27,811 | (7) | * | ||||

| Jeannine Sargent | 9,429 | (8) | * | ||||

| Alan G. Spoon | 103,797 | (9) | * | ||||

| Barbara B. Hulit | 372,238 | (10) | * | ||||

| Charles E. McLaughlin | 321,810 | (11) | * | ||||

| Edward R. Simmons | 840 | (12) | * | ||||

| Olumide Soroye | 502 | (13) | * | ||||

| All current executive officers and directors as a group (16 persons) | 2,821,284 | (14) | * | ||||

| (1) | Balances credited to each executive officer’s account under the Fortive Executive Deferred Incentive Plan (the “EDIP”) which are vested or are scheduled to vest within 60 days of April 1, 2022 are included in the table. See “Employee Benefit Plans—Fortive Executive Deferred Incentive Plan” for a description of our EDIP. The incremental number of notional phantom shares of Common Stock credited to a person’s EDIP account is based on the incremental amount of contribution to the person’s EDIP balance divided by the closing price of Common Stock as reported on the NYSE on the date of the contribution. In addition, for purposes of the table, the number of shares attributable to each executive officer’s 401(k) Plan account is equal to (a) the officer’s balance, as of March 31, 2022 in the Fortive stock fund included in the executive officer’s 401(k) Plan account (the “401(k) Fortive Stock Fund”), divided by (b) the closing price of Common Stock as reported on the NYSE on March 31, 2022. The 401(k) Fortive Stock Fund consists of a unitized pool of Common Stock and cash. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of April 1, 2022 or upon vesting of Restricted Stock Units (“RSUs”) that vest within 60 days of April 1, 2022. The table also includes unvested restricted shares that are subject only to time-vesting requirements. In addition, RSUs granted to a non-executive director for which shares are not delivered until the earlier of the director’s death or, at the earliest, the first day of the seventh month following the director’s resignation from the board are not included in the table. |

| (2) | Includes options to acquire 960 shares, 75 shares held in an irrevocable trusts and 1,721 shares beneficially owned by Mr. Comas’ spouse. Mr. Comas disclaims beneficial ownership of the shares held by the trusts and by his spouse. |

| (3) | Includes options to acquire 8,340 shares. |

| (4) | Includes options to acquire 1,900 shares. |

| (5) | Includes options to acquire 1,860 shares. |

| (6) | Includes options to acquire 1,249,094 shares, 31,386 shares attributable to Mr. Lico’s 401(k) Fortive Stock Fund and 129,825 notional phantom shares attributable to Mr. Lico’s EDIP account. |

| (7) | Includes options to acquire 27,811 shares. |

| (8) | Includes options to acquire 9,429 shares. |

| (9) | Includes options to acquire 43,124 shares. |

| (10) | Includes options to acquire 301,822 shares, and 33,825 notional phantom shares attributable to Ms. Hulit’s EDIP account. Ms. Hulit retired from her executive officer role on December 31, 2021 and was not an executive officer as April 1, 2022. |

| Ownership of Our Stock | 9 |

| (11) | Includes options to acquire 279,313 shares, and 21,060 notional phantom shares attributable to Mr. McLaughlin’s EDIP account. |

| (12) | Includes 840 notional phantom shares attributable to Mr. Simmons’ EDIP account. |

| (13) | Includes 502 notional phantom shares attributable to Mr. Soroye’s EDIP account. |

| (14) | Includes options to acquire 2,234,571 shares, 1,177 RSUs, 31,386 shares attributable to 401(k) accounts and 179,155 notional phantom shares attributable to executive officers’ EDIP accounts. |

| * | Represents less than 1% of the outstanding Common Stock. |

Principal Shareholders

The following table sets forth the number of shares and percentage of Common Stock beneficially owned by each person who owns of record or is known to Fortive to beneficially own more than five percent of Common Stock.

| Name and Address |

Number of Shares Beneficially Owned |

Percentage of Class |

|||||

| The Vanguard Group | 36,567,233 | (1) | 10.2% | ||||

| 100 Vanguard Blvd., Malvern, PA 19355 | |||||||

| BlackRock, Inc. | 33,420,429 | (2) | 9.3% | ||||

| 55 East 52nd Street, New York, NY 10055 | |||||||

| Wellington Management Group LLP | 22,204,547 | (3) | 6.2% | ||||

| c/o Wellington Management Group LLP 280 Congress Street, Boston, MA 02210 |

|||||||

| T. Rowe Price Associates, Inc. | 19,758,392 | (4) | 5.5% | ||||

| 100 E. Pratt Street, Baltimore, MD 21202 | |||||||

| (1) | The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 2022 by The Vanguard Group, which sets forth their respective beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, The Vanguard Group has shared voting power over 532,180 shares, sole dispositive power over 35,202,980 shares and shared dispositive power over 1,364,253 shares. |

| (2) | The amount shown and the following information is derived from a Schedule 13G/A filed February 3, 2022 by BlackRock, Inc. which sets forth BlackRock, Inc.’s beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, BlackRock, Inc. has sole voting power over 30,071,671 shares and sole dispositive power over 33,420,429 shares. |

| (3) | The amount shown and the following information is derived from a Schedule 13G filed February 4, 2022 jointly by Wellington Management Group LLP, Wellington Group Holdings LLP, Wellington Investment Advisors Holding LLP, and Wellington Management Company LLP (collectively, the “Wellington Reporting Entities”), which sets forth their respective beneficial ownership as of December 31, 2021. According to the Schedule 13G, the Wellington Reporting Entities have shared voting power over 19,596,109 shares and shared dispositive power over 22,204,507 shares. The shares are owned of record by clients of one or more investment advisers directly or indirectly owned by Wellington Management Group LLP. Those clients have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such shares. No such client is known to have such right or power with respect to more than five percent of the Company’s common stock. |

| (4) | The amount shown and the following information is derived from a Schedule 13G/A filed February 14, 2022 by T. Rowe Price Associates, Inc. (“Price Associates”), which sets forth Price Associates’ beneficial ownership as of December 31, 2021. According to the Schedule 13G/A, Price Associates has sole voting power over 8,647,418 shares and sole dispositive power over 19,758,392 shares. Price Associates does not serve as custodian of the assets of any of its clients; accordingly, in each instance only the client or the client’s custodian or trustee bank has the right to receive dividends paid with respect to, and proceeds from the sale of, such securities. The ultimate power to direct the receipt of dividends paid with respect to, and the proceeds from the sale of, such securities, is vested in the individual and institutional clients which Price Associates serves as investment adviser. Any and all discretionary authority which has been delegated to Price Associates may be revoked in whole or in part at any time. |

2022 PROXY STATEMENT

| 10 |

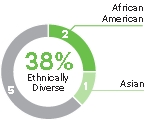

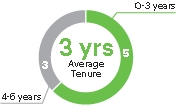

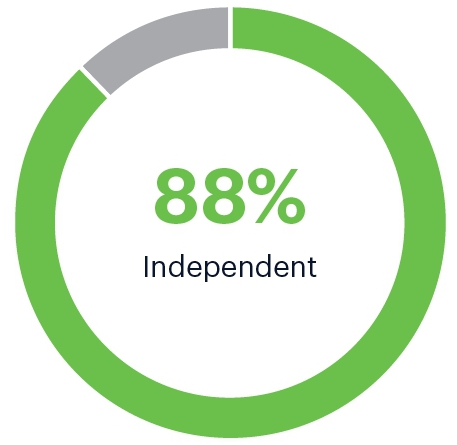

Our eight director nominees are comprised of current directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of the Company. Additional details on board membership criteria are set forth on page 27 under “Corporate Governance – Director Nomination Process.”

|

|

Gender |

|

Ethnicity/Race |

|

Independence |

|

Tenure |

||||

|

63% Diversity |

|

|

|

|

|||||||

| * | Calculated as of the date of this Proxy Statement |

|

Indicates Expertise |

|

Indicates Experienced |

| Directors | 11 |

We have included information as of April 11, 2022 relating to each nominee for election as director, including his or her age, the year in which he or she became a director, his or her principal occupation, any board memberships at other public companies (to the extent required under Item 401(e)(2) of Regulation S-K) during the past five years, and the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Fortive. Please see “Corporate Governance – Director Nomination Process” for a further discussion of the Board’s process for nominating Board candidates. In the event a nominee declines or is unable to serve, the proxies may be voted at the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

Daniel L. Comas Age: 58 Director Since: 2021 Independent |

Background |

|||

|

►Had served as Executive Vice President of Danaher Corporation, a global science and technology company, from April 2005 through December 2020, including as Chief Financial Officer through December 2018

►Had also served in various other roles at Danaher, including in roles with responsibilities over corporate development, treasury, finance and risk management after joining Danaher in 1991

►Currently serves as an advisor to Danaher and is an adjunct professor at Georgetown University

►Holds a Bachelor’s degree in Economics from Georgetown University and a Master’s degree in Business Administration from Stanford University

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

2022 PROXY STATEMENT

| 12 | Directors |

Sharmistha Dubey Age: 51 Director Since: 2020 Independent |

Background |

|||

|

►Currently serves as the Chief Executive Officer and Director of Match Group, Inc., a publicly-traded provider of global dating products, overseeing growth for the portfolio of brands including Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime

►Had also served in various other senior leadership positions at Match Group, Inc., including as Match Group’s President, Chief Operating Officer of Tinder, President of Match Group Americas, Chief Product Officer of Match, and Chief Product Officer and EVP of The Princeton Review after joining Match Group in 2016

►Currently serves as a director of Naspers Limited, a technology investment company, and Prosus N.V., a global consumer internet group that is majority-owned by Naspers

►Holds an undergraduate degree in Engineering from the Indian Institute of Technology and a master’s degree in Engineering from Ohio State University

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

Rejji P. Hayes Age: 47 Director Since: 2020 Independent |

Background |

|||

|

►Currently serves as Executive Vice President and Chief Financial Officer of CMS Energy Corporation, a publicly-traded electric and natural gas company since 2017, overseeing all treasury, tax, investor relations, accounting, financial planning and analysis, internal audit services, supply chain, facilities, fleet, corporate safety, real estate, and mergers & acquisitions

►Previously served as Chairman of the Board of EnerBank USA®, a nationwide provider of home improvement loans and former CMS Energy subsidiary

►Had served as the Chief Financial Officer of ITC Holdings Corp, a publicly-traded electric transmission company, from 2014 to 2016 and as its Vice President, Finance and Treasurer from 2012 to 2014

►Held strategy and financial leadership roles for Exelon Corporation, Lazard Freres & Co., and Bank of America Securities prior to joining ITC Holdings Corp.

►Holds a bachelor’s degree from Amherst College and a master’s degree in business from Harvard Business School

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

| Directors | 13 |

Wright Age: 58 Director Since: 2022* Independent * Mr. Lassiter, who was appointed by the Board effective January 1, 2022, was recommended by a third-party search firm engaged by the Nominating and Governance Committee. |

Background |

|||

|

►Currently serves as President and CEO of Henry Ford Health System, a $7 billion, private, not-for-profit health system comprised of six hospitals, a health plan and wide range of ambulatory and retail health services since 2014

►Serves as the chair of The American Hospital Association Board of Trustees, a national organization that represents America’s hospitals and health systems to advance health in America

►Serves as a director of Quest Diagnostics, a publicly-traded diagnostic information services company, as well as a member of its Audit and Finance Committee and its Quality and Compliance Committee

►Serves as the lead independent director of DT Midstream, a publicly-traded energy company, as well as the chair of its Corporate Governance Committee, a member of its Environmental, Social and Governance Committee, and a member of its Organization and Compensation Committee

►Had served as the CEO of Alameda Health System in Oakland, California, from 2005 to 2014

►Had served as a Director of the Federal Reserve Bank of Chicago from 2018 to 2021

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

James A. Lico Age: 56 Director Since: 2016 |

Background |

|||

|

►Currently serves as the Chief Executive Officer and President of Fortive since 2016

►Had served in various leadership positions at Danaher Corporation, a global science and technology company, including as Executive Vice President from 2005 to 2016

►Had served as a director of NetScout Systems, Inc., a public company, from 2015 to 2018

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

2022 PROXY STATEMENT

| 14 | Directors |

Kate D. Mitchell Age: 63 Director Since: 2016 Independent |

Background |

|||

|

►Currently serves as a partner and co-founder of Scale Venture Partners, a Silicon Valley-based firm that invests in early-in-revenue technology companies, since 1997

►Had served with Bank of America, a multinational banking and financial services corporation, from 1988 to 1996, most recently as Senior Vice President for Bank of America Interactive Banking

►Serves as director of SVB Financial Group, a publicly-traded financial services, bank holding and financial holding company, as well as a member of its Governance Committee and Risk Committee

►Serves as a director of Silicon Valley Community Foundation and other private company boards on behalf of Scale Venture Partners

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

| Directors | 15 |

Jeannine Age: 58 Director Since: 2019 Independent |

Background |

|||

|

►Currently as an operating partner of Katalyst Ventures, an early-stage technology venture fund, since 2018

►Serves as a senior advisor at Generation Investment Management, LLP since 2017 and as an advisor at Breakthrough Energy Ventures since 2018, each an investment venture focused on sustainable innovation

►Had served as president of Innovation and New Ventures at Flex, a leader in global design and manufacturing, from 2012 until 2017

►Had also served as the chief executive officer at Oerlikon Solar, a thin-film silicon solar photovoltaic module manufacturer and a wholly owned subsidiary of Oerlikon, a publicly-traded Swiss company, and Voyan Technology, an embedded systems software provider

►Serves as a director of Synopsys, Inc., a publicly-traded electronic design automation company, as well as a member of its Audit Committee

►Serves

as the lead independent director of Proterra Inc., a publicly-traded commercial vehicle electrification technology company, as

well as the chair of its Nominating and ESG Committee

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

2022 PROXY STATEMENT

| 16 | Directors |

Alan G. Spoon Age:70 Director Since: 2016 Independent |

Background |

|||

|

►Has served as the Chairman of the Board of Fortive since 2016

►Had served as a Partner of Polaris Partners, a company that invests in private technology and life science firms, from 2000 to 2018, including as Managing General Partner from 2000 to 2010 and as Partner Emeritus from 2015 to 2018

►Had served in senior leadership roles as the Washington Post Company (now known as Graham Holdings Company), including as Chief Operating Officer and a director from 1991 to 2000, as President from 1993 to May 2000, and as President of Newsweek from 1989 to 1991

►Serves as a director of IAC/InterActiveCorp, including as a chair of its Audit Committee

►Serves as a director of Match Group, Inc., including as a chair of its Audit Committee

►Serves as a director of Danaher Corporation, including as the chair of its Compensation Committee

|

||||

|

Other Current Public Company Directorships Director Qualifications |

||||

| Directors | 17 |

| Proposal 1 | Election of Directors |

At the Annual Meeting, shareholders will be asked to elect Daniel L. Comas, Sharmistha Dubey, Rejji P. Hayes, Wright L. Lassiter III, James A. Lico, Kate D. Mitchell, Jeannine Sargent, and Alan G. Spoon (each of whom has been recommended by the Nominating and Governance Committee, has been nominated by the Board and currently serves as a director of Fortive) to serve a one-year term until the 2023 Annual Meeting of Shareholders and until his or her respective successor is duly elected and qualified.

In the event a nominee declines or is unable to serve, the proxies may be voted at the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this would occur.

|

The Board of Directors recommends that shareholders vote “FOR” the election of each of the Director Nominees to the Board. |

2022 PROXY STATEMENT

| 18 |

Governance Highlights

Board Composition

|

We have documented and executed our commitment to Board diversity in our Corporate Governance Guidelines and the Nominating and Governance Committee Charter, with three female directors and three ethnically/racially diverse directors |

|

We have engaged in rigorous refreshment of the Board, with a majority of the Board appointed during or after 2019 |

|

We have fully declassified the Board to provide for the election of all directors for one-year terms |

|

We have adopted proxy access to permit a shareholder, or a group of up to 20 shareholders, owning at least 3% of the outstanding shares continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 20% of the board of directors, as further detailed in our Bylaws |

|

We maintain a majority vote requirement for the election of directors in uncontested elections |

Board Structure

|

We have separated our Chairman and CEO positions, with an independent Chairman |

Board Role and Responsibilities

|

We have implemented a Sustainability (ESG) program, as reported in our annual Sustainability Report, with multi-layered oversight by the Nominating and Governance Committee and the full Board |

|

We have formalized and documented in the Compensation Committee Charter oversight of our human capital management by the Compensation Committee, including matters related to overall employee retention and inclusive and diverse company culture, with annual review by the full Board |

|

We have formalized and documented in the Nominating and Governance Committee Charter oversight of our CEO succession planning by the Nominating and Governance Committee, with annual review by the full Board |

|

We have formalized and documented in the Audit Committee Charter oversight of our cybersecurity by the Audit Committee, with quarterly review by the Audit Committee of our cybersecurity planning, monitoring, risk management, remediation, and controls and annual review by the full Board |

|

We have implemented a robust annual shareholder engagement program |

Other Governance Policies and Practices

|

We have no shareholder rights plan |

|

We have implemented the right of shareholders to call a special meeting |

|

Subject to approval by the shareholders of Proposal 4, we have approved the elimination of the supermajority voting requirements |

|

We have adopted a Political Contribution Policy overseen by the Nominating and Governance Committee |

|

We have an absolute prohibition against pledging of our stock by our director and executive officers |

|

We have implemented stock ownership requirements for non-CEO executive officers at multiple of three times base salary and for CEO and directors at multiple of five times base salary and annual cash retainer respectively |

| Corporate Governance | 19 |

Corporate Governance Guidelines, Committee Charters and Code of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and adopted written charters for each of the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Finance Committee of the Board. The Board of Directors has also adopted our Code of Conduct that includes, among other things, a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Nominating and Governance Committee Charter, and Code of Conduct referenced above are each available in the Investors Corporate Governance section of our website at http://www.fortive.com.

The Board has separated the positions of Chairman and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our shareholders.

The entire Board selects its Chairman, and our Board has selected Alan G. Spoon, an independent director, as its Chairman, in light of Mr. Spoons independence and his deep experience and knowledge with corporate governance, board management, shareholder engagement, risk management and Fortives diverse businesses and industries.

As the independent Chairman of the Board, Mr. Spoon leads the activities of the Board, including:

| ► | Calling, and presiding over, all meetings of the Board; |

| ► | Together with the CEO and the Corporate Secretary, setting the agenda for the Board; |

| ► | Calling, and presiding over, the executive sessions of non-management directors and of the independent directors; |

| ► | Advising the CEO on strategic aspects of the Companys business, including developments and decisions that are to be discussed with, or would be of interest to, the Board; |

| ► | Acting as a liaison, as necessary, between the non-management directors and the management of the Company; and |

| ► | Acting as a liaison, as necessary, between the Board and the committees of the Board. |

In the event that the Chairman of the Board is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select by majority vote an independent director to serve as the Lead Independent Director with the authority to:

| ► | Preside over all meetings of the Board at which the Chair is not present, including the executive sessions; |

| ► | Call meetings of the independent directors; |

| ► | Act as a liaison, as necessary, between the independent directors and the CEO; and |

| ► | Advise with respect to the Boards agenda. |

The Boards non-management directors meet in executive session following the Boards regularly scheduled meetings, with the executive sessions chaired by the independent Chairman. In addition, the independent directors meet as a group in executive session at least once a year.

2022 PROXY STATEMENT

| 20 | Corporate Governance |

The Boards role in risk oversight at the Company is consistent with the Companys leadership structure, with management having day-to-day responsibility for assessing and managing the Companys risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company.

Enterprise Operations

The Board oversees the Companys risk management processes directly and through its committees. In general, the Board oversees the management of risks inherent in the operation of the Companys businesses on a consolidated basis, by each operating segment and by key corporate functions. In addition, the enterprise risk oversight includes review of the risks and opportunities related to the implementation by the Company of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure. Furthermore, through the Audit Committee, the Board oversees the Companys enterprise risk management process and policies. At least on an annual basis or more frequently as deemed appropriate by the Board, the Board reviews in depth with senior leaders of the Company the Companys enterprise risk management, with particular focus on the enterprise risks and opportunities with the greatest impact and highest probability. In addition, the chairs of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee review with each other and with the rest of the Board during executive sessions of Board meetings as appropriate updates to the Companys enterprise risk management discussed during the corresponding committee meetings. Furthermore, at least on an annual basis or more frequently as deemed appropriate by the Board, the Board reviews with the SVP General Counsel our insurance policies, including our D&O insurance policy, general liability policy, and our information security risk insurance policy.

Portfolio and Operating Segment

At each Board meeting, the Board oversees the Companys performance and execution against the strategic goals for the Companys operating segments, overall portfolio, and innovation, including overseeing the corresponding management of risks and opportunities. In addition, on an annual basis, the Board conducts an informal meeting led by senior management and dedicated entirely to deeper review of the acquisition, product development, commercial, innovation, capital allocation, human capital and risk management strategies for each of the operating segments.

Cybersecurity and Product Security

The Board has delegated to the Audit Committee the responsibility of exercising oversight with respect to the Companys cybersecurity risk management and risk controls. Consistent with such delegation, our Chief Information Officer provides a report to the Audit Committee on quarterly basis, and to the Board on an annual basis, regarding the Companys cybersecurity program, including the Companys compliance program, monthly training program, monitoring, auditing, implementation and communication processes, controls, and procedures. In addition, the Chief Information Officer reviews with the Audit Committee the results of the audit conducted by BitSight Technologies as well as the annual assessment by an independent auditing firm of our security program's alignment with the NIST Cyber Security framework. Although, as of the date of this proxy statement, there have been no cybersecurity breaches nor cybersecurity incidents that have had a material financial impact, the Chief Information Officer reviews with the Audit Committee the results of any notable incidents or attempted breaches on a quarterly basis.

Sustainability (ESG)

The Board has delegated to the Nominating and Governance Committee the responsibility of exercising oversight with respect to the reporting of the Companys Sustainability disclosure. Consistent with such delegation, our SVP General Counsel provides frequent reports and updates to the Nominating and Governance Committee, and a report to the Board on an annual basis, regarding the Companys Sustainability program and strategies, including the corresponding risks and opportunities, goals, progress, shareholder engagement and disclosure. See Sustainability (ESG) for further discussion on governance structure of our Sustainability program.

Human Capital Management

The Board has delegated to the Compensation Committee the responsibility of exercising oversight of the Companys human capital and compensation, including oversight of overall compensation, retention and inclusion and diversity

| Corporate Governance | 21 |

strategies. Our SVP of Human Resources provides regular reports on compensation and other human capital management risks, trends, best practices, strategies and disclosure to the Compensation Committee. While the Board has delegated these responsibilities to the Compensation Committee, the Board remains actively involved and receives additional reports throughout the year on employee engagement, inclusion and diversity, talent development, company culture and alignment of human capital strategies with the Company’s overall portfolio and operational strategies.

Management Succession

The entire Board oversees the recruitment, development, retention, and succession planning of our executive officer positions, with the responsibilities of oversight of CEO succession planning delegated to the Nominating and Governance Committee, and the responsibilities of ensuring appropriate compensation strategies and programs to align with the retention and recruitment delegated to the Compensation Committee. Our SVP of Human Resources provides regular reports on the CEO succession planning process and strategies to the Nominating and Governance Committee and on compensation strategies and programs to assist in retention and recruitment of future leaders to the Compensation Committee. The SVP of Human Resources also provides additional reports throughout the year to the full Board on short-term and long-term readiness of potential successors, outside recruitment to populate the succession funnel as necessary, and development plans of future leaders. In addition to the formal activities noted below, the Board and its committee members engage and assess our executive officers and high-potential employees during management presentations, our annual multi-day leadership conference, our annual strategy sessions for the Board, regular the visits to our operating companies, and periodic informal meetings and communications.

| ► | January | February | April | August | |||||

| STRATEGY UPDATE AND CEO SUCCESSION PLANNING PROCESS REVIEW |

PERFORMANCE REVIEW AND COMPENSATION AWARDS |

EMPLOYEE ENGAGEMENT UPDATE AND ENTERPRISE RISK ASSESSMENT REPORT |

TALENT, SUCCESSION AND ENGAGEMENT UPDATE |

||||||

|

Nominating and Governance Committee: Review of the scope and process for annual CEO succession planning Compensation Committee: Preliminary review of the performance of the executive officers in connection with compensation analysis |

Compensation Committee: Finalize and approve performance reviews and compensation decisions for the prior year and target compensation for the current year, with deliberation and input from the entire Board |

Board: Update on company culture, leadership effectiveness reflected in employee survey Nominating and Governance Committee: Review status and progress on CEO succession planning, including review of short-term and long-term funnel and readiness |

Board: Review of senior management succession readiness, including short-term and long-term leadership development, diversity, and employee engagement |

2022 PROXY STATEMENT

| 22 | Corporate Governance |

Committees’ Role in Risk Oversight

|

Audit Committee | Nominating and Governance Committee |

|

|||||

The Audit Committee oversees risks related to financial controls, legal and compliance risks and major financial, and business continuity risks. The Audit Committee also assists the Board in overseeing the Company’s risk assessment and risk management policies and oversees our cybersecurity risk management and risk controls as well as our data privacy controls. |

|

The Nominating and Governance Committee oversees risks associated with corporate governance, board management, CEO succession planning, conflict of interest, political contribution, and Sustainability (ESG) reporting. |

||||||

| ► | ◄ | |||||||

| ► | ◄ | |||||||

|

Compensation Committee | Finance Committee |

|

|||||

The Compensation Committee oversees risks associated with the Company’s compensation policies and practices. The Compensation Committee also oversees risks associated with human capital, including retention, recruitment, inclusion and diversity strategies. |

The Finance Committee oversees risks associated with the execution of the Company’s acquisition, investment and divestiture strategies. |

|||||||

Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities.

Internal Risk Committee

The Company’s Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts, and, on at least an annual basis, provides a report to the Board and provides a report of the process to the Audit Committee.

| Corporate Governance | 23 |

|

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the NYSE. The Board has affirmatively determined that seven out of our eight current directors, including Mss. Sharmistha Dubey, Kate D. Mitchell and Jeannine Sargent and Messrs. Daniel L. Comas, Rejji P. Hayes, Wright Lassiter III, and Alan G. Spoon, are independent within the meaning of the listing standards of the NYSE. |

|

Board of Directors and Committees of the Board

Director Attendance

In 2021, the Board met eight times (including a separate session dedicated to portfolio strategy) and acted by unanimous written consent three times. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served during 2021. As a general matter, directors are expected to attend annual meetings of shareholders. Each of our current directors who were serving on the Board at the time attended remotely our virtual 2021 Annual Meeting of Shareholders.

Committee Membership

The membership of each of the Audit, Compensation, Nominating and Governance, and Finance Committees as of April 11, 2022 is set forth below.

| Name of Director | Audit | Compensation | Nominating and Governance |

Finance |

| Daniel L. Comas | Member | Member | ||

| Sharmistha Dubey | Member | Member | ||

| Rejji P. Hayes | Chair | |||

| Wright Lassiter III | Member | |||

| James A. Lico | Member | |||

| Kate D. Mitchell | Member | Chair | Member | |

| Jeannine Sargent | Member | Chair | ||

| Alan G. Spoon | Member | Chair |

2022 PROXY STATEMENT

| 24 | Corporate Governance |

|

Audit Committee |

(Chair)

|

|

| Kate D. Mitchell |

Jeannine Sargent |

Meetings in 2021:

8

The Audit Committee is responsible for: |

|

|

►Assessing the qualifications and independence of Fortive’s independent auditors;

►Appointing, compensating, retaining, and evaluating Fortive’s independent auditors;

►Overseeing the quality and integrity of Fortive’s financial statements and making a recommendation to the Board regarding the inclusion of the audited financial statements in Fortive’s Annual Report on Form 10-K;

►Overseeing Fortive’s internal auditing processes;

►Overseeing management’s assessment of the effectiveness of Fortive’s internal control over financial reporting;

►Overseeing management’s assessment of the effectiveness of Fortive’s disclosure controls and procedures;

►Overseeing risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks;

►Overseeing Fortive’s risk assessment and risk management policies;

►Overseeing Fortive’s compliance with legal and regulatory requirements;

►Overseeing Fortive’s cybersecurity and product security risk management and risk controls;

►Overseeing swap and derivative transactions and related policies and procedures; and

►Preparing a report as required by the SEC to be included in this proxy statement.

|

|

The Board has determined that each member of the Audit Committee is: |

|

|

►Independent for purposes of Rule 10A-3(b)(1) under the Exchange Act and the NYSE listing standards;

►Qualified as an audit committee financial expert as that term is defined in SEC rules; and

►Financially literate within the meaning of the NYSE listing standards.

|

|

Furthermore, as of the date of this proxy statement, no Audit Committee member serves on the audit committee of more than three public companies.

The Audit Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.

The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and the independent auditor in carrying out its oversight responsibilities. Management is responsible for the preparation, presentation, and integrity of Fortive’s financial statements, accounting and financial reporting principles, internal control over financial reporting, and disclosure controls and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of Fortive’s system of internal control over financial reporting. Fortive’s independent auditor, Ernst & Young LLP, is responsible for performing independent audits of Fortive’s financial statements and internal control over financial reporting and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

| Corporate Governance | 25 |

|

Compensation Committee |

(Chair)

|

|

| Daniel L. Comas |

Sharmistha Dubey |

|

|

| Wright Lassiter III |

Meetings in 2021:

6

The Compensation Committee acted by unanimous written consent one time in 2021.

The Compensation Committee is responsible for: |

|

|

►Determining and approving the form and amount of annual compensation of the CEO and our other executive officers, including evaluating the performance of, and approving the compensation paid to, our CEO and other executive officers;

►Reviewing and making recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercising all authority with respect to the administration of such plans;

►Reviewing and making recommendations to the Board with respect to the form and amounts of director compensation;

►Overseeing and monitoring compliance with Fortive’s compensation recoupment policy;

►Overseeing and monitoring compliance by directors and executive officers with Fortive’s stock ownership requirements;

►Overseeing risks associated with Fortive’s compensation policies and practices;

►Overseeing our engagement with shareholders and proxy advisory firms regarding executive compensation matters;

►Assisting the Board in oversight of our human capital management practices, including strategies, risk management, employee retention and inclusive and diverse culture;

►Overseeing the Company’s reporting on the Company’s human capital management practices; and

►Reviewing and discussing with management the Compensation Discussion & Analysis (“CD&A”) in the annual proxy statement and recommending to the Board the inclusion of the CD&A in the proxy statement.

|

|

Each member of the Compensation Committee is: |

|

|

►A non-employee director for purposes of Rule 16b-3 under the Exchange Act; and

►Based on the determination of the Board, independent under NYSE listing standards and under Rule 10C-1 under the Exchange Act.

|

|

The Chair of the Compensation Committee works with our Senior Vice President-Human Resources and our Corporate Secretary to schedule the Compensation Committee’s meetings and set the agenda for each meeting. Our Senior Vice President-Human Resources, Vice President-Total Rewards, Senior Vice President-General Counsel, and Vice President-Associate General Counsel and Secretary generally attend, and from time-to-time our CEO and CFO attend, the Compensation Committee meetings and support the Compensation Committee in preparing meeting materials and taking meeting minutes. In particular, our CEO provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy; participates in the Compensation Committee’s discussions regarding the performance and compensation of the other executive officers; and provides recommendations to the Compensation Committee regarding all significant elements of compensation paid to such other executive officers, their annual personal performance objectives and his evaluation of their performance. The Compensation Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendation at each regularly scheduled Board meeting.

Under the terms of its charter, the Compensation Committee has the authority to engage the services of outside advisors and experts to assist the Compensation Committee. Following the assessment and determination of Pearl Meyer &

2022 PROXY STATEMENT

| 26 | Corporate Governance |

Partners, LLC’s (“Pearl Meyer”) independence from Fortive’s management, the Compensation Committee engaged Pearl Meyer as the Compensation Committee’s independent compensation consultant for 2021. The Compensation Committee had the sole discretion and authority to select, retain and terminate Pearl Meyer as well as to approve any fees, terms and other conditions of its services. Pearl Meyer reported directly to the Compensation Committee and took its direction solely from the Compensation Committee. Pearl Meyer’s primary responsibilities in 2021 were to provide advice and data in connection with the selection of Fortive’s peer group for assessing executive compensation, the structuring of the executive compensation programs in 2021 and 2022, the compensation levels for our executive officers, and the compensation levels for our directors; assess our executive compensation program in the context of market practices and corporate governance best practices; and advise the Compensation Committee regarding our proposed executive compensation public disclosures. In the course of discharging its responsibilities, the Compensation Committee’s independent compensation consultant may, from time to time and with the Compensation Committee’s consent, request from management certain information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of our executive officer responsibilities and other business information. Pearl Meyer did not provide any services to Fortive or its management in 2021, and the Compensation Committee is not aware of any work performed by Pearl Meyer that raises any conflicts of interest.

Compensation Committee Interlocks and Insider Participation

During 2021, none of the members of the Compensation Committee was an officer or employee of Fortive. No executive officer of Fortive served on the compensation committee (or other board committee performing equivalent functions) or on the board of directors of any entity having an executive officer who served on the Compensation Committee.

|

Nominating and Governance Committee |

(Chair)

|

|

| Sharmistha Dubey |

Alan G. Spoon |

Meetings in 2021:

4

The Nominating and Governance Committee acted by unanimous written consent one time in 2021.

The Nominating and Governance Committee is responsible for: |

|

|

►Reviewing and making recommendations to the Board regarding the size, classification and composition of the Board;

►Assisting the Board in identifying individuals qualified to become Board members;

►Assisting the Board in identifying characteristics, skills, and experiences for the Board with the objective of having a Board with diverse backgrounds, experiences, skills, and perspectives;

►Proposing to the Board the director nominees for election by our shareholders at each annual meeting;

►Overseeing and reviewing the process for, and making recommendations to the Board relating to the management of, the Company's CEO succession planning;

►Assisting the Board in determining the independence and qualifications of the Board and Committee members and making recommendations to the Board regarding committee membership;

►Developing and making recommendations to the Board regarding a set of corporate governance guidelines and reviewing such guidelines on an annual basis;

►Overseeing compliance with the corporate governance guidelines;

►Overseeing director education and director orientation process and programs;

►Overseeing Fortive’s Sustainability (ESG) reporting;

►Reviewing and making recommendation to the Board relating to the governance matters set forth in the Company's Certificate of Incorporation and Bylaws;

►Assisting the Board and the Committees in engaging in annual self-assessment of their performance; and

►Administering Fortive’s Related Person Transactions Policy.

|

|

The Board has determined that each member of the Nominating and Governance Committee is independent within the meaning of the NYSE listing standards.

| Corporate Governance | 27 |

The Nominating and Governance Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.

|

Finance Committee |

(Chair)

|

|

| Daniel L. Comas |

James A. Lico |

|

|

| Kate D. Mitchell |

|

The Finance Committee assists the Board in assessing potential acquisition, investment and divestiture opportunities and approving business acquisitions, investments and divestitures up to the levels of authority delegated to it by the Board.

|

The Nominating and Governance Committee recommends to the Board director candidates for nomination and election at the annual meeting of shareholders and, in the event of vacancies between annual meetings of shareholders, for appointment to fill such vacancies.

Board Membership Criteria

In assessing the candidates for recommendation to the Board as director nominees, the Nominating and Governance Committee will evaluate such candidates against the standards and qualifications set out in our Corporate Governance Guidelines, including:

Personal and professional integrity and character Personal and professional integrity and character

Skills, knowledge, diversity of background and experience, and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of our business Skills, knowledge, diversity of background and experience, and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of our business

|

The extent to which the interplay of the candidate’s skills, knowledge, expertise and diversity of background and experience with that of the other Board members will help build a Board that is effective in collectively meeting our strategic needs and serving the long-term interests of the shareholders The extent to which the interplay of the candidate’s skills, knowledge, expertise and diversity of background and experience with that of the other Board members will help build a Board that is effective in collectively meeting our strategic needs and serving the long-term interests of the shareholders

|

Prominence and reputation in the candidate’s profession Prominence and reputation in the candidate’s profession

The capacity and desire to represent the interests of the shareholders as a whole The capacity and desire to represent the interests of the shareholders as a whole

Availability to devote sufficient time to the affairs of Fortive Availability to devote sufficient time to the affairs of Fortive

|

2022 PROXY STATEMENT

| 28 | Corporate Governance |

The Nominating and Governance Committee annually reviews with the Board the skills, knowledge, experience, background and attributes required of Board nominees, considering current Board composition and the Company’s circumstances. In making its recommendations to our Board, the Nominating and Governance Committee considers the criteria noted above, as well as, among others, the following skills, knowledge, experience, background and attributes:

Skills and Attributes

|

Independence |

|

Sustainability (ESG) Experience |

|

Mergers and Acquisition Experience |

||

|

Diversity |

|

Technology |

|

Public Company Board Experience |

||

|

Global Experience and International Exposure |

|

Financial Literacy or Public Accounting Experience |

|

Legal and Corporate Governance Experience |

||

|

Senior Executive Leadership Experience |

|

Cybersecurity Experience |

|

Capital Markets and Corporate Finance Experience |

||

|

Relevant Industry Experience |

|

Human Capital Management and Organizational Development Experience |

|

Operational and Risk Management Experience |

The Nominating and Governance Committee takes into account a candidate’s ability to contribute to the diversity of perspective and analysis of the Board and, as such, believes it is important to consider attributes such as race, ethnicity, gender, age, education, cultural experience, and professional experience in evaluating candidates who may be able to contribute to the diverse perspective and practical insight of the Board as a whole. Although we do not have a formal diversity policy and the Board does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors, the Board’s and the Nominating and Governance Committee’s commitment to diversity as an essential consideration in the director nominee selection process has been documented in both the Corporate Governance Guidelines and the Nominating and Governance Committee’s Charter and has been reflected in the Board’s actions.

Director Evaluation and Board Refreshment Process

On an annual basis, the Nominating and Governance Committee reviews and assesses, with input from the various other committees, the process for the annual self-assessment of the full Board, each of the committees of the Board, and individual directors. The process assessment takes into account the feedback from the directors on the effectiveness of the prior self-assessment process, incremental perspective and expertise a new director may bring, and input from the shareholder engagement process.

For 2021, the Nominating and Governance Committee engaged Boardspan, an independent board governance company with deep expertise in board performance assessment, to assist in conducting a facilitated interview of each director and key management members to conduct an assessment of both the full Board (including each committee) and the individual directors.

| Corporate Governance | 29 |

The following describes the self-assessment process implemented and conducted by the Board and the committees of the Board in 2021.

| 1. Anonymous Online Scoping Survey | |||||

| With the assistance of Boardspan, the Nominating and Governance Committee conducted an online survey of each of the directors to identify the key areas of focus and topics to discuss and evaluate during the confidential, individual interview conducted by Boardspan. | |||||

|

2. Confidential Facilitated Interviews of each Director and each Key Management Member for a Full Board and Peer Assessment | ||||

| Based on the consolidated results of the anonymous online survey, Boardspan interviewed each director and each key management member to conduct an assessment of the full Board, each committee and each individual director to identify key strengths and opportunities for continuous improvement. The areas of focus included strategic alignment, board culture, board efficiency, board meeting structure, interaction with management, committees and individual strength, and potential opportunities for continuous improvements. | |||||

|

3. Full Board Review | ||||

| The Chairman of the Board and the Chair of the Nominating and Governance Committee reviewed the results of the annual self-assessment for potential action and recommendations, with the final results and recommendations reviewed with the full Board for alignment on the assessment and potential actions. | |||||

Shareholder Recommendations on Director Nomination

Shareholders may recommend a director nominee to the Nominating and Governance Committee. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under “—Communications with the Board of Directors” with whatever supporting material the shareholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Nominating and Governance Committee, the Nominating and Governance Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. The Nominating and Governance Committee’s determination of whether to conduct a full evaluation is based primarily on the Nominating and Governance Committee’s view as to whether a new or additional Board member is necessary or appropriate at such time, and the likelihood that the prospective nominee can satisfy the evaluation factors described above under “—Board Membership Criteria” and any such other factors as the Nominating and Governance Committee may deem appropriate. The Nominating and Governance Committee takes into account whatever information is provided to it with the recommendation of the prospective candidate and any additional inquiries the Nominating and Governance Committee may in its discretion conduct or have conducted with respect to such prospective nominee. The Nominating and Governance Committee evaluates director nominees in the same manner whether a shareholder or the Board has recommended the candidate.

2022 PROXY STATEMENT

| 30 | Corporate Governance |

Proxy Access

Pursuant to the proxy access provisions in Section 2.12 of our Amended and Restated Bylaws, a shareholder, or group of up to 20 shareholders, owning 3% or more of Fortives outstanding shares of common stock continuously for at least three years may nominate and include in our proxy materials directors constituting up to 20% of the Board. With respect to the 2023 Annual Meeting of Shareholders, the nomination notice and other materials required by these provisions must be delivered or mailed to and received by Fortives Secretary in writing between November 26, 2022 and December 26, 2022 (or, if the 2023 Annual Meeting of Shareholders is called for a date that is not within 30 calendar days of the anniversary of the date of the Annual Meeting, by the later of the close of business on the date that is 120 days prior to the date of the 2023 Annual Meeting of Shareholders or within 10 days after the public announcement of the date of the 2023 Annual Meeting of Shareholders) at the following address: Fortive Corporation, Attn: Secretary, 6920 Seaway Blvd., Everett, WA 98203. When submitting nominees for inclusion in the proxy materials pursuant to the proxy access provisions, shareholders must follow the notice procedures and provide the information required by our Amended and Restated Bylaws. Our Amended and Restated Bylaws are available at Investor Corporate Governance section of our corporate website, http://www.fortive.com.

Majority Voting for Directors

Our Amended and Restated Bylaws provide for majority voting in uncontested director elections, and our Board has adopted a related director resignation policy. Under the policy, our Board will not appoint or nominate for election to the Board any person who has not tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election and such resignation is accepted by the Board. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the directors resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation.

At any meeting of shareholders for which Fortives Secretary receives a notice that a shareholder has nominated a person for election to the Board in compliance with our Amended and Restated Bylaws and such nomination has not been withdrawn on or before the tenth day before we first mail our notice of meeting to our shareholders, the directors will be elected by a plurality of the votes cast (which means that the nominees who receive the most affirmative votes would be elected to serve as directors).

| Corporate Governance | 31 |

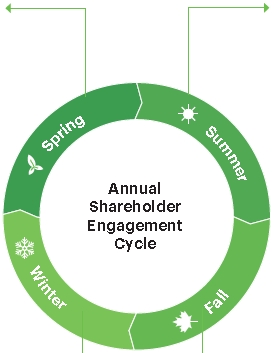

Engagement Cadence Throughout the Year

|

SPRING We publish our proxy statement and our annual report We continue our discussion with our largest shareholders, as warranted |

|

SUMMER We conduct our annual meeting We assess how our shareholders voted on our proposals at our annual meeting We conduct our investor day event |

|

WINTER |

|

FALL |

|

We assess governance best practices We review policy updates from stakeholders We update our annual governance framework and policies |

The Board and the committees approve the self-assessment process, which includes considerations from the shareholder engagement process The Board conducts the annual self-assessment We conduct our annual shareholder outreach |

In addition, throughout the year, senior members of management engage in extensive discussions with our investor community to discuss our strategy, our results, our operations, our product offerings, our end markets, our Sustainability (ESG) efforts, and our outlook through numerous investor conferences, investor calls, investor meetings, investor events, and earnings calls.

2021 Annual Shareholder Outreach

In 2021, as part of our annual shareholder outreach, we invited our top 16 shareholders, representing approximately 60 percent of our outstanding shares, and leading proxy advisory firms to discuss Sustainability, Corporate Governance, Board Composition, Risk Oversight, Human Capital Management and Executive Compensation. With a significant number of our investors accepting our invitation, our senior leaders met with investors holding approximately 30 percent of our outstanding shares.

2022 PROXY STATEMENT

| 32 | Corporate Governance |

Consistent with our prior practice, our management team shared the feedback from our shareholder outreach process with our Board for potential responsive actions. We have identified below feedback we have received from our shareholders in the past years during our annual shareholder outreach and the corresponding actions taken by the Board:

| Shareholder Feedback | Responsive Actions | |

| Increase shareholder rights and board accountability |

►We declassified the Board

►We provided proxy access

►We provided right of shareholders to call a special meeting

►Subject to approval by the shareholders, we approved the elimination of the supermajority voting requirements

►We provided for majority vote requirement for director election

|

|

| Increase the level of independence on the Board |

►We refreshed our Board, with 7 out of our 8 directors independent, with only our CEO representing a non-independent director on the Board

►We maintained an independent Chairman of the Board, with the CEO and the Chairman positions separated

|

|

| Ensure diversity on the Board |

►We updated our governance guidelines to document our commitment to diversity on the Board

►We continued execution on our commitment, with three female directors and three directors representing ethnic or racial diversity

|

|