DEF 14A: Definitive proxy statements

Published on April 24, 2023

Table of Contents

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12

|

|

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

Table of Contents

Table of Contents

| 1 |

TABLE OF CONTENTS

| Notice of 2023 Annual Meeting of Shareholders | 2 | |||

| About Fortive | 3 | |||

| Proxy Voting Roadmap | 5 | |||

| Ownership of Our Stock | 9 | |||

| Directors | 11 | |||

| 11 | ||||

| 13 | ||||

| Proposal 1 Election of Directors | 18 | |||

| Corporate Governance | 19 | |||

| 19 | ||||

| Corporate Governance Guidelines, Committee Charters and Code of Conduct |

20 | |||

| 20 | ||||

| 21 | ||||

| 24 | ||||

| 25 | ||||

| 30 | ||||

| 33 | ||||

| Sustainability | 36 | |||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| Human Capital Management | 41 | |||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| Certain Relationships and Related Transactions | 43 | |||

| Director Compensation | 44 | |||

| Compensation Discussion and Analysis | 46 | |||

| Compensation Committee Report | 73 | |||

| Executive Compensation Tables | 74 | |||

| Pay Ratio Disclosure | 82 | |||

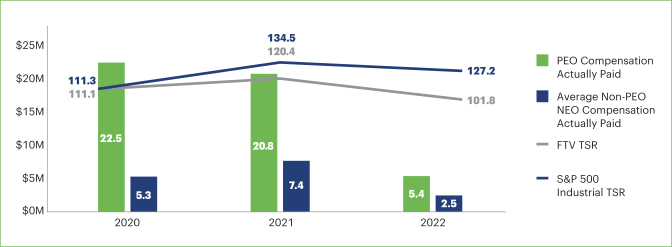

| Pay vs. Performance | 83 | |||

| Equity Compensation Plan Information | 86 | |||

| Proposal 2 Advisory Vote on Executive Compensation | 87 | |||

| Proposal 3 Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation | 88 | |||

| Proposal 4 Ratification of Independent Registered Public Accounting Firm | 89 | |||

| Audit Committee Matters | 90 | |||

| Audit Committee Report | 91 | |||

| Proposal 5 Shareholder Proposal Seeking Shareholder Ratification of Termination Pay | 92 | |||

| Additional Information | 95 | |||

| Other Matters | 100 | |||

| Shareholder Proposals for Next Year’s Annual Meeting | 100 | |||

| Appendix A Non-GAAP Financial Measures | A-1 | |||

| 2023 Proxy Statement |

Table of Contents

| 2 |

FORTIVE CORPORATION

6920 Seaway Blvd

Everett, WA98203

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

ITEMS OF BUSINESS:

| Board Recommendation |

Page | |||||

| 1. |

To elect the nine director nominees named in the Proxy Statement, each for a one-year term expiring at the 2024 annual meeting and until his or her respective successor is duly elected and qualified. |

FOR

FOR |

5 | |||

| 2. |

To approve on an advisory basis Fortive’s named executive officer compensation. |

FOR

FOR |

6 | |||

| 3. |

To hold an advisory vote relating to the frequency of future shareholder advisory votes on Fortive’s named executive officer compensation. |

ONE YEAR

ONE YEAR |

7 | |||

| 4. |

To ratify the appointment of Ernst & Young LLP as Fortive’s independent registered public accounting firm for the year ending December 31, 2023. |

FOR

FOR |

7 | |||

| 5. |

To consider and act upon a shareholder proposal seeking shareholder ratification of termination pay. |

AGAINST

AGAINST |

8 | |||

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most shareholders have a choice of voting in advance over the Internet, by telephone or by using a traditional proxy card or voting instruction form. You may also vote during the annual meeting by following the instructions available on the meeting website during the meeting. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

The rules and procedures applicable to the 2023 Annual Meeting, together with a list of shareholders of record for inspection for any legally valid purpose, will be available at the 2023 Annual Meeting for shareholders of record at www.virtualshareholdermeeting.com/FTV2023. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically, and submit questions and receive technical support during the virtual meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 6, 2023:

The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com.

By Order of the Board of Directors,

Daniel B. Kim

Secretary

April 24, 2023

|

When: June 6, 2023 at 3:00 p.m., PDT.

Items of Business: 5 proposals as listed here

Date of Mailing: The date of mailing of this Proxy Statement is on or about April 24, 2023.

Who Can Vote: Shareholders of Fortive’s common stock at the

Virtual-Only Meeting: The 2023 Annual Meeting of Shareholders will be held in a virtual-only meeting format.

Where: www.virtualshareholder meeting.com/FTV2023

|

|

Table of Contents

| 3 |

ABOUT FORTIVE

Our Company

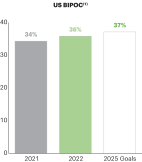

Fortive Corporation is a provider of essential technologies for connected workflow solutions across a range of attractive industrial technology end-markets. Our strategic segments—Intelligent Operating Solutions, Precision Technologies, and Advanced Healthcare Solutions—include well-known brands with leading positions in their markets. Our businesses design, develop, manufacture, and service professional and engineered products, software, and services, building upon leading brand names, innovative technologies, and significant market positions.

Fortive Business System

Our teams across our operating companies are united by our culture of continuous improvement and bias for action that is embodied in the Fortive Business System (“FBS”). Through rigorous application of the proprietary set of growth, lean, and leadership tools and processes that comprise FBS, we continuously improve business performance in the critical areas of innovation, product development and commercialization, global supply chain, sales and marketing, corporate development, human capital management, sustainability efforts, and leadership development. Our commitment to FBS has enabled us to drive customer satisfaction and profitability, and generate significant improvements in innovation, growth, and core operating margins. Additionally, FBS has helped us execute a disciplined acquisition strategy and expand our portfolio into new and attractive markets while creating long-term shareholder value.

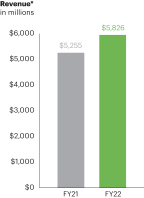

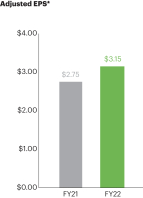

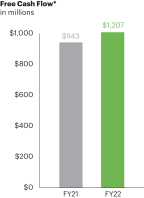

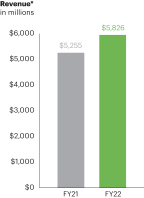

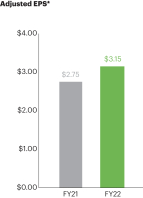

2022 Financial Highlights*

Financial Performance Highlights

|

|

|

|

|||

| Core Revenue Growth of 10.1% in FY22 |

||||||

| * | Core Revenue Growth, Adjusted EPS, and Free Cash Flow are non-GAAP financial measures. For the definition of these non-GAAP financial measures and the reconciliation of such measures to the corresponding GAAP measures, please refer to “Non-GAAP Financial Measures” in Appendix A. |

| 2023 Proxy Statement |

Table of Contents

| 4 |

About Fortive |

Sustainability Strategic Pillars

Inclusion, Diversity, and Equity

| Strategic Pillars |

||

|

|

INCLUSION

u Invest in development of our teams to build a Fortive where you can be yourself and do your best work |

|

|

|

DIVERSITY

u Build a diverse Fortive through hiring, developing, and retaining a strong and diverse team |

|

|

|

EQUITY

u Create a culture of equity that enables greater innovation and performance for customers and the world |

|

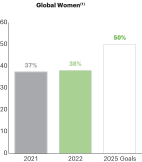

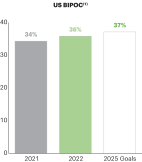

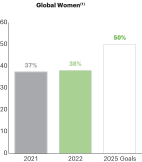

In 2022, we continued to strengthen our culture of Inclusion and Diversity by developing inclusive leaders, learning, expanding employee resource communities, and reinforcing equitable talent processes.

|

Gender & BIPOC Representation

|

||||||

|

|

|

|

|||

| (1) | Based on internal data as of the end of the respective calendar year. |

|

Table of Contents

| 5 |

PROXY VOTING ROADMAP

| Proposal 1

(page 18) › |

Election of Directors |

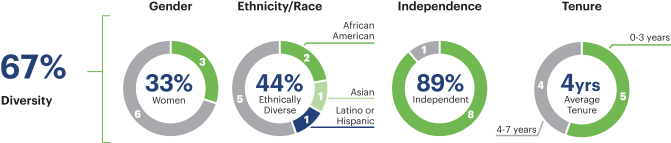

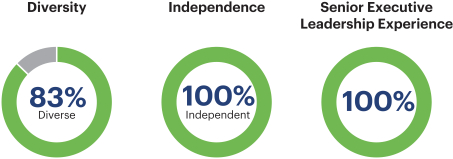

Overview of Director Nominees

Our nine director nominees are comprised of current directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of the Company. Additional details on board membership criteria are set forth on page 30 under “Corporate Governance – Director Nomination Process.”

| Skills and Attributes |

|

|

|

|

|

|

|

|

|

|||||||||

| Global Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Senior Executive Leadership Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Relevant Industry Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Sustainability (ESG) Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Technology Management Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Cybersecurity Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Financial Literacy or Public Accounting Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Human Capital Management Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Mergers and Acquisition Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Public Company Board Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Legal and Corporate Governance Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Capital Markets and Corporate Finance Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Operational and Risk Management Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Demographic Information |

||||||||||||||||||

| Tenure* |

0 | 2 | 3 | 2 | 1 | 7 | 7 | 4 | 7 | |||||||||

| Gender |

M | M | F | M | M | M | F | F | M | |||||||||

| Race/Ethnicity |

||||||||||||||||||

| African American or Black |

|

|

||||||||||||||||

| Asian |

|

|||||||||||||||||

| Hispanic/Latino |

|

|||||||||||||||||

| White |

|

|

|

|

|

|||||||||||||

| * | Calculated as of the date of this Proxy Statement |

|

Indicates Expertise |

|

Indicates Experienced |

|

|

The Board of Directors recommends that shareholders vote “FOR” the election of each of the Director Nominees to the Board.

|

| 2023 Proxy Statement |

Table of Contents

| 6 | Proxy Voting Roadmap |

| Proposal 2

(page 87) › |

Advisory Vote on Executive Compensation |

Elements of Executive Compensation

Consistent with our executive compensation philosophy, the 2022 executive compensation program emphasized equity-based compensation with long-term vesting requirements and was dependent on long-term company performance.

| Base Salary | Annual Incentive Compensation |

Stock Options | Restricted Stock Units (“RSUs”) |

Performance Stock Units (“PSUs”) |

||||||

| Form of Compensation |

Cash Near-Term Emphasis |

Cash Near-Term Emphasis |

Equity Long-Term Emphasis | |||||||

| Compensation Period |

1 year | Annual Performance | 4 years | 4 years | 3 years with an additional 1 year holding period |

|||||

| Key Performance Measures |

N/A | Company Financial Results and Performance Relative to Individual Goals |

Stock Price Appreciation | Financial Performance and Stock Price Appreciation |

Three-Year Relative Total Shareholder Return and Financial Performance |

|||||

| Determination of Performance- Based Payouts |

N/A | Formulaic + Discretion |

N/A | Formulaic | Formulaic | |||||

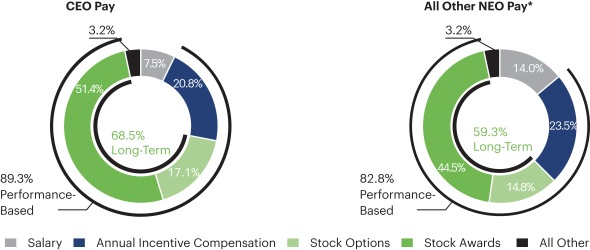

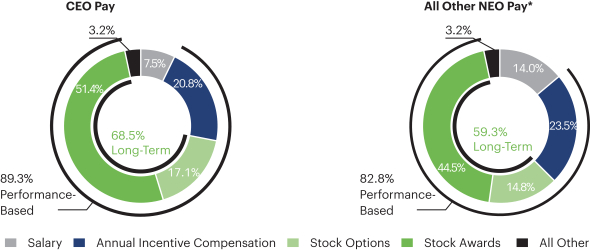

2022 Pay Mix

Our 2022 executive compensation program aligned compensation with the creation of long-term value for our shareholders. As shown below, the significant majority of our 2022 executive compensation was performance-based (including compensation that was dependent on performance of our stock price).

|

|

The Board of Directors recommends that shareholders vote “FOR” the resolution set forth in Proposal 2.

|

|

Table of Contents

| Proxy Voting Roadmap | 7 |

| Proposal 3

(page 88) › |

Advisory Vote on Frequency of Future |

After careful consideration of this Proposal, our Board has determined that an advisory vote on executive officer compensation that occurs every year is most appropriate for the Company at this time as it has allowed our shareholders to provide us with their direct, timely input on our executive compensation program as disclosed in the proxy statement every year. An annual vote is therefore consistent with the Company’s efforts to engage our shareholders on executive compensation and corporate governance matters.

|

|

The Board of Directors recommends that shareholders vote for future advisory votes relating to the company’s executive officer compensation to be held every “ONE YEAR”.

|

| Proposal 4

(page 89) › |

Ratification of Independent |

After careful consideration of the independence and performance of the Company’s independent registered public accounting firm, the Audit Committee believes that the continued retention of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm is in the best interests of the Company and its shareholders. Consequently, the Audit Committee has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for 2023.

|

|

The Board of Directors recommends that shareholders vote “FOR” the ratification of the appointment of Ernst & Young LLP to serve as the Company’s independent registered public accounting firm for 2023.

|

| 2023 Proxy Statement |

Table of Contents

| 8 | Proxy Voting Roadmap |

| Proposal 5

(page 92) › |

Shareholder Proposal Seeking Shareholder Ratification of Termination Pay |

The Board of Directors recommends that shareholders vote “AGAINST” the shareholder proposal for the following reasons:

| ● | We have previously adopted a policy requiring shareholder approval of any cash severance payment to an executive officer in excess of 2.99 times the sum of the executive officer’s base salary and annual target cash incentive award; |

| ● | The shareholder proposal, if implemented, would create a disincentive for senior employees, including executive officers, to remain with the company during a potential change-in-control transaction and could materially detract from the incentive to maximize shareholder value in a change-in-control scenario; |

| ● | The shareholder proposal, if implemented, would discourage the use of long-term equity awards in our executive compensation program and would create misalignment between our executive officers and our long-term shareholders; and |

| ● | The shareholder proposal is unnecessary because our shareholders already have an annual opportunity to express their approval of our executive compensation program, including our severance program. |

|

|

The Board of Directors recommends that shareholders vote “AGAINST” the approval of the shareholder proposal seeking shareholder ratification of termination pay.

|

|

Table of Contents

| 9 |

OWNERSHIP OF OUR STOCK

Directors and Executive Officers

The following table sets forth as of April 10, 2023 (unless otherwise indicated) the number of shares and percentage of Common Stock beneficially owned by each of Fortive’s directors, nominees for director and each of the executive officers named in the Summary Compensation Table, and all executive officers and directors of Fortive as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of April 10, 2023. Except as indicated, the address of each director and executive officer shown in the table below is c/o Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203.

| Name |

Number of Shares Beneficially Owned(1) |

Percent of Class(1) |

||||||

| Eric Branderiz |

2,315 | (2) | ||||||

| Daniel L. Comas |

43,990 | (3) | * | |||||

| Sharmistha Dubey |

12,910 | (4) | * | |||||

| Rejji P. Hayes |

1,900 | (5) | * | |||||

| Wright Lassiter III |

6,430 | (6) | * | |||||

| James A. Lico |

1,877,776 | (7) | * | |||||

| Kate D. Mitchell |

32,381 | (8) | * | |||||

| Jeannine Sargent |

9,429 | (9) | * | |||||

| Alan G. Spoon |

128,117 | (10) | * | |||||

| Charles E. McLaughlin |

379,563 | (11) | * | |||||

| Patrick Murphy |

222,498 | (12) | * | |||||

| Olumide Soroye |

2,345 | (13) | * | |||||

| Stacey Walker |

139,903 | (14) | * | |||||

| All current executive officers and directors as a group (17 persons) |

3,365,151 | (15) | * | |||||

| * | Represents less than 1% of the outstanding Common Stock. |

| (1) | Balances credited to each executive officer’s account under the Fortive Executive Deferred Incentive Plan (the “EDIP”) which are vested or are scheduled to vest within 60 days of April 10, 2023 are included in the table. The incremental number of notional phantom shares of Common Stock credited to a person’s EDIP account is based on the incremental amount of contribution to the person’s EDIP balance divided by the closing price of Common Stock as reported on the NYSE on the date of the contribution. In addition, for purposes of the table, the number of shares attributable to each executive officer’s 401(k) Plan account is equal to (a) the officer’s balance, as of March 31, 2023 in the Fortive stock fund included in the executive officer’s 401(k) Plan account (the “401(k) Fortive Stock Fund”), divided by (b) the closing price of Common Stock as reported on the NYSE on March 31, 2023. The 401(k) Fortive Stock Fund consists of a unitized pool of Common Stock and cash. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of April 10, 2023 or upon vesting of Restricted Stock Units (“RSUs”) that vest within 60 days of April 10, 2023. In addition, RSUs granted to a non-executive director for which shares are not delivered until the earlier of the director’s death or, at the earliest, the first day of the seventh month following the director’s resignation from the board are not included in the table. |

| (2) | Includes options to acquire 2,080 shares, but does not include 1,685 unvested RSUs. |

| (3) | Includes options to acquire 5,530 shares, 75 shares held in an irrevocable trusts and 1,721 shares beneficially owned by Mr. Comas’ spouse, but does not include 1,510 unvested RSUs or 2,845 vested RSUs. Mr. Comas disclaims beneficial ownership of the shares held by the trusts and by his spouse. |

| (4) | Includes options to acquire 12,910 shares, but does not include 3,605 unvested RSUs or 5,563 vested RSUs. |

| (5) | Includes options to acquire 1,900 shares, but does not include 5,195 unvested RSUs or 5,115 vested RSUs. |

| (6) | Includes options to acquire 6,430 shares, but does not include 3,440 unvested RSUs or 1,400 vested RSUs. |

| (7) | Includes options to acquire 1,476,903 shares, 29,841 shares attributable to Mr. Lico’s 401(k) Fortive Stock Fund and 136,365 notional phantom shares attributable to Mr. Lico’s EDIP account. |

| (8) | Includes options to acquire 32,381 shares, but does not include 4,025 unvested RSUs or 17,417 vested RSUs. |

| (9) | Includes options to acquire 9,429 shares, but does not include 3,015 unvested RSUs or 9,606 vested RSUs. |

| (10) | Includes options to acquire 50,044 shares, but does not include 4,190 unvested RSUs or 20,788 vested RSUs. |

| 2023 Proxy Statement |

Table of Contents

| 10 | Ownership of Our Stock |

| (11) | Includes options to acquire 322,535 shares and 23,294 notional phantom shares attributable to Mr. McLaughlin’s EDIP account. |

| (12) | Includes options to acquire 173,859 shares and 9,797 notional phantom shares attributable to Mr. Murphy’s EDIP account. |

| (13) | Includes 2,345 notional phantom shares attributable to Mr. Soroye’s EDIP account. |

| (14) | Includes options to acquire 129,543 shares and 6,580 notional phantom shares attributable to Ms. Walker’s EDIP account. |

| (15) | Includes options to acquire 2,637,820 shares, 1,177 RSUs, 29,841 shares attributable to 401(k) accounts and 196,294 notional phantom shares attributable to executive officers’ EDIP accounts. |

Principal Shareholders

The following table sets forth the number of shares and percentage of Common Stock beneficially owned by each person who owns of record or is known to Fortive to beneficially own more than five percent of Common Stock.

| Name and Address |

Number of Shares Beneficially Owned |

Percentage of Class |

||||||

| The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 |

39,402,796 | (1) | 11.15 | % | ||||

| T. Rowe Price Associates, Inc. 4515 Painters Mill Road, Owings Mills, MD 21117 |

34,523,024 | (2) | 9.77 | % | ||||

| BlackRock, Inc. 55 East 52nd Street, New York, NY 10055 |

30,542,592 | (3) | 8.64 | % | ||||

| Wellington Management Group LLP c/o Wellington Management Group LLP 280 Congress Street, Boston, MA 02210 |

18,122,141 | (4) | 5.13 | % | ||||

| (1) | The amount shown and the following information is derived from a Schedule 13G/A filed February 9, 2023 by The Vanguard Group, which sets forth their respective beneficial ownership as of December 31, 2022. According to the Schedule 13G/A, The Vanguard Group has shared voting power over 472,136 shares, sole dispositive power over 38,006,472 shares and shared dispositive power over 1,396,324 shares. |

| (2) | The amount shown and the following information is from T. Rowe Price Associates, Inc. (“Price Associates”), with their beneficial ownership as of December 31, 2022. According to Price Associates, Price Associates and its advisory affiliates have sole voting power over 11,005,328 shares and sole dispositive power over 34,523,024 shares. These securities are owned by various individual and institutional investors which Price Associates serves as an investment adviser with power to direct investments and/or sole power to vote the securities. For the purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. |

| (3) | The amount shown and the following information is derived from a Schedule 13G/A filed February 7, 2023 by BlackRock, Inc. which sets forth BlackRock, Inc.’s beneficial ownership as of December 31, 2022. According to the Schedule 13G/A, BlackRock, Inc. has sole voting power over 28,265,730 shares and sole dispositive power over 30,542,592 shares. |

| (4) | The amount shown and the following information is derived from a Schedule 13G/A filed February 6, 2023 jointly by Wellington Management Group LLP, Wellington Group Holdings LLP, and Wellington Investment Advisors Holding LLP, (collectively, the “Wellington Reporting Entities”), which sets forth their respective beneficial ownership as of December 31, 2022. According to the Schedule 13G/A, the Wellington Reporting Entities have shared voting power over 16,304,594 shares and shared dispositive power over 18,122,141 shares. The shares are owned of record by clients of one or more investment advisers directly or indirectly owned by Wellington Management Group LLP. Those clients have the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, such shares. No such client is known to have such right or power with respect to more than five percent of the Company’s common stock. |

|

Table of Contents

| 11 |

DIRECTORS

Overview of Director Nominees

Our nine director nominees are comprised of current directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of the Company. Additional details on board membership criteria are set forth on page 30 under “Corporate Governance – Director Nomination Process.”

| Skills and Attributes |

|

|

|

|

|

|

|

|

|

|||||||||

| Global Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Senior Executive Leadership Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Relevant Industry Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Sustainability (ESG) Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Technology Management Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Cybersecurity Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Financial Literacy or Public Accounting Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Human Capital Management Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Mergers and Acquisition Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Public Company Board Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Legal and Corporate Governance Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Capital Markets and Corporate Finance Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| Operational and Risk Management Experience |

|

|

|

|

|

|

|

|

|

|||||||||

| * | Calculated as of the date of this Proxy Statement |

|

Indicates Expertise |

|

Indicates Experienced |

| 2023 Proxy Statement |

Table of Contents

| 12 | Directors |

Six Directors Appointed Since Separation in 2016

|

Table of Contents

| Directors | 13 |

Director Nominees

We have included information as of April 10, 2023 relating to each nominee for election as director, including his or her age, the year in which he or she became a director, his or her principal occupation, any board memberships at other public companies (to the extent required under Item 401(e)(2) of Regulation S-K) during the past five years, and the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Fortive. Please see “Corporate Governance – Director Nomination Process” for a further discussion of the Board’s process for nominating Board candidates. In the event a nominee declines or is unable to serve, the proxies may be voted at the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

|

Eric Branderiz

Age: 58

Director Since: 2023*

Independent

* Mr. Branderiz, who was appointed by the Board effective January 1, 2023, was recommended by a third-party search firm engaged by the Nominating and Governance Committee. |

| Background

|

||||||||

|

u Previously served as Executive Vice President and Chief Financial Officer of Enphase Energy, Inc., a publicly traded semiconductor and renewable energy technology company, from 2018 through 2022

u Had served as Vice President, Chief Accounting Officer and Corporate Controller of Tesla, Inc., an automotive and renewable energy company, from 2016 to 2018

u Had also served in various senior roles, including as a Senior Vice President, Chief Accounting Officer and Corporate Controller of SunPower Corporation, from 2010 to 2016

u Held various senior roles with Knowledge Learning Corporation, Spansion, Inc. and Advanced Micro Devices, in addition to the executive roles with Enphase Energy, Tesla and SunPower Corporation, with oversight of global business operations and strategy, financial operations, business transformation, product development, commercial and service operations, logistics, supply chain, and procurement

u Currently serves as a director of Cognizant Technology Solutions Corporation, an information technology services and consulting company

u Currently certified as a public accountant in California

u Holds a bachelor’s degree from University of Alberta

|

||||||||

|

Other Current Public Company Directorships Cognizant Technology Solutions Corporation

Director Qualifications u Deep knowledge and experience with innovation and disruptive technology, hypergrowth, and the sustainable energy and semiconductor sectors u Extensive expertise in financial operations, accounting and financial reporting, mergers & acquisitions, capital markets, risk management, legal operations, and ESG u Extensive experience in business operations, innovative product development and strategy, business transformation, logistics, commercial operations, procurement, and supply chain |

||||||||

| 2023 Proxy Statement |

Table of Contents

| 14 |

Directors |

|

Daniel L. Comas

Age: 59

Director Since: 2021

Independent |

| Background

|

||||||||

|

u Previously served as Executive Vice President of Danaher Corporation, a global science and technology company, from April 2005 through December 2020, including as Chief Financial Officer through December 2018

u Had served in various other roles at Danaher, including in roles with responsibilities over corporate development, treasury, finance and risk management after joining Danaher in 1991

u Currently serves as an advisor to Danaher and is an adjunct professor at Georgetown University

u Holds a Bachelor’s degree in Economics from Georgetown University and a Master’s degree in Business Administration from Stanford University

|

||||||||

|

Other Current Public Company Directorships None

Director Qualifications u Deep expertise in finance, strategy, corporate development, capital allocation, accounting, human capital management, and risk management

u Through his extensive leadership experience at Danaher, direct understanding of the principles of the Fortive Business System and our culture of continuous improvement

|

||||||||

|

Sharmistha Dubey

Age: 52

Director Since: 2020

Independent |

| Background

|

||||||||

|

u Previously served as the Chief Executive Officer of Match Group, Inc., a publicly-traded provider of global dating products, from March 2020 to May 2022, overseeing growth for the portfolio of brands, including Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime

u Had served in various other senior leadership positions at Match Group, Inc., including as Match Group’s President, Chief Operating Officer of Tinder, President of Match Group Americas, Chief Product Officer of Match, and Chief Product Officer and EVP of The Princeton Review after joining Match Group in 2016

u Currently serves as a director of Naspers Limited, a technology investment company, and Prosus N.V., a global consumer internet group that is majority-owned by Naspers

u Holds an undergraduate degree in Engineering from the Indian Institute of Technology and a master’s degree in Engineering from Ohio State University

|

||||||||

|

Other Current Public Company Directorships Match Group, Inc. Naspers Ltd. (listed outside United States) Prosus Ltd. (listed outside United States)

Director Qualifications u Extensive experience and leadership in operation, innovative product development, competitive strategy and marketing in the technology industry

u Extensive significant experience in data privacy, cybersecurity, human capital management, scaling of new technologies into new markets, financial reporting, and execution of portfolio and investment strategies

|

||||||||

|

Table of Contents

| Directors | 15 |

|

Rejji P. Hayes

Age: 48

Director Since: 2020

Independent |

| Background

|

||||||||

|

u Currently serves as Executive Vice President and Chief Financial Officer of CMS Energy Corporation, a publicly-traded electric and natural gas company since 2017, overseeing all treasury, tax, investor relations, accounting, financial planning and analysis, internal audit services, supply chain, facilities, fleet, corporate safety, real estate, and mergers & acquisitions

u Previously served as Chairman of the Board of EnerBank USA®, a nationwide provider of home improvement loans and former CMS Energy subsidiary

u Had served as the Chief Financial Officer of ITC Holdings Corp, a publicly-traded electric transmission company, from 2014 to 2016, and as its Vice President, Finance and Treasurer from 2012 to 2014

u Held strategy and financial leadership roles for Exelon Corporation, Lazard Freres & Co., and Bank of America Securities prior to joining ITC Holdings Corp.

u Holds a bachelor’s degree from Amherst College and a master’s degree in business from Harvard Business School

|

||||||||

|

Other Current Public Company Directorships None

Director Qualifications u Strong knowledge of the power and energy sector

u Extensive experience in finance, capital markets, accounting and financial reporting, valuation, mergers & acquisitions, risk management, ESG and regulatory matters, cybersecurity, and corporate governance

u Significant expertise in structuring capital financing and executing investment and acquisition strategies |

||||||||

|

Wright Lassiter III

Age: 59

Director Since: 2022

Independent |

| Background

|

||||||||

|

u Currently serves as CEO of CommonSpirit Health, a private, integrated health system comprising over 140 hospitals and more than 1,500 care sites in 21 states, since 2022

u Serves as the chair of The American Hospital Association Board of Trustees, a national organization that represents America’s hospitals and health systems to advance health in America

u Serves as a director of Quest Diagnostics, a publicly-traded diagnostic information services company, as well as a member of its Audit and Finance Committee and its Quality and Compliance Committee

u Serves as the lead independent director of DT Midstream, a publicly-traded energy company, as well as the chair of its Corporate Governance Committee, a member of its Environmental, Social and Governance Committee, and a member of its Organization and Compensation Committee

u Previously served as President and CEO of Henry Ford Health System, a $7 billion, private, not-for-profit health system comprised of six hospitals, a health plan and wide range of ambulatory and retail health services

u Had served as the CEO of Alameda Health System in Oakland, California, from 2005 to 2014

u Had also served as a Director of the Federal Reserve Bank of Chicago from 2018 to 2021

|

||||||||

|

Other Current Public Company Directorships DT Midstream Inc. Quest Diagnostics, Inc.

Director Qualifications u Extensive experience and leadership in healthcare services

u Extensive experience in innovation, strategic planning, operation, and execution, corporate governance, ESG, human capital management, finance and community service |

||||||||

| 2023 Proxy Statement |

Table of Contents

| 16 |

Directors |

|

James A. Lico

Age: 57

Director Since: 2016

|

| Background

|

||||||||

|

u Currently serves as the Chief Executive Officer and President of Fortive since 2016

u Had served in various leadership positions at Danaher Corporation, a global science and technology company, including as Executive Vice President from 2005 to 2016

u Had also served as a director of NetScout Systems, Inc., a public company, from 2015 to 2018

|

||||||||

|

Other Current Public Company Directorships None

Director Qualifications u Over 20 years of extensive experience in senior leadership positions, including as an Executive Vice President of Danaher with oversight at various times of each of the businesses that was separated from Danaher into Fortive

u Through his various senior leadership positions at Danaher and Fortive, broad operating and functional experience with, and deep knowledge of, Fortive’s businesses, the Fortive Business System, capital allocation strategies, acquisitions, marketing and branding, and leadership strategies

|

||||||||

|

Kate D. Mitchell

Age: 64

Director Since: 2016

Independent |

| Background

|

||||||||

|

u Currently serves as a partner and co-founder of Scale Venture Partners, a Silicon Valley-based firm that invests in early-in-revenue technology companies, since 1997

u Had served with Bank of America, a multinational banking and financial services corporation, from 1988 to 1996, most recently as Senior Vice President for Bank of America Interactive Banking

u Serves as director of SVB Financial Group, a publicly-traded financial holding company

u Serves as a director of Silicon Valley Community Foundation and other private company boards on behalf of Scale Venture Partners

|

||||||||

|

Other Current Public Company Directorships SVB Financial Group

Director Qualifications u Over 40 years of extensive experience in the technology industry, with a focus on innovative software and technology markets

u Deep experience as a director, investor and senior executive in the areas of business management and operations, finance, financial reporting, risk management, investment and acquisition strategy, cybersecurity, and executive compensation |

||||||||

|

Table of Contents

| Directors | 17 |

|

Jeannine Sargent

Age: 59

Director Since: 2019

Independent |

| Background

|

||||||||

|

u Currently serves as an operating partner of Katalyst Ventures, an early-stage technology venture fund, since 2018

u Had served as president of Innovation and New Ventures at Flex, a leader in global design and manufacturing, from 2012 until 2017

u Had also served as the chief executive officer at Oerlikon Solar, a thin-film silicon solar photovoltaic module manufacturer and a wholly owned subsidiary of Oerlikon, a publicly-traded Swiss company, and Voyan Technology, an embedded systems software provider

u Serves as a senior advisor at Generation Investment Management, LLP since 2017 and as an advisor at Breakthrough Energy Ventures since 2019, each an investment venture focused on sustainable innovation

u Serves as a director of Synopsys, Inc., a publicly-traded electronic design automation company, as well as a member of its Corporate Governance and Nominating Committee

u Serves as the lead independent director of Proterra Inc., a publicly-traded commercial vehicle electrification technology company, as well as the chair of its Nominating and ESG Committee

|

||||||||

|

Other Current Public Company Directorships Proterra Inc. Synopsys, Inc.

Director Qualifications u Over 30 years of experience encompassing leadership, operations, marketing and engineering roles with a diverse mix of high technology hardware and software companies across multiple industries

u Significant experience with development and global launch of disruptive technology, execution of investment and acquisition strategies, corporate governance, cybersecurity, sustainable innovation and ESG, and executive compensation

|

||||||||

|

Alan G. Spoon

Age: 72

Director Since: 2016

Independent |

| Background

|

||||||||

|

u Has served as the Chairman of the Board of Fortive since 2016

u Had served as a Partner of Polaris Partners, a company that invests in private technology and life science firms, from 2000 to 2018, including as Managing General Partner from 2000 to 2010 and as Partner Emeritus from 2015 to 2018

u Had also served in senior leadership roles at the Washington Post Company (now known as Graham Holdings Company), including as Chief Operating Officer and a director from 1991 to 2000, as President from 1993 to 2000, and as President of Newsweek from 1989 to 1991

u Serves as a director of IAC/InterActiveCorp, including as a chair of its Audit Committee

u Serves as a director of Match Group, Inc., including as a chair of its Audit Committee

u Serves as a director of Danaher Corporation, including as the chair of its Compensation Committee

|

||||||||

|

Other Current Public Company Directorships Danaher Corporation IAC/InterActiveCorp Match Group, Inc.

Director Qualifications

u Public and private company leadership experience that gives Mr. Spoon insight into business strategy, leadership, marketing, finance, cybersecurity, corporate governance, executive compensation and board management

u Public company and private equity experience that gives Mr. Spoon insight into trends in the internet and technology industries, acquisition strategy and financing, each of which represents an area of key strategic opportunity for Fortive |

||||||||

| 2023 Proxy Statement |

Table of Contents

| 18 |

Directors |

| Proposal 1

|

Election of Directors |

At the Annual Meeting, shareholders will be asked to elect Eric Branderiz, Daniel L. Comas, Sharmistha Dubey, Rejji P. Hayes, Wright L. Lassiter III, James A. Lico, Kate D. Mitchell, Jeannine Sargent, and Alan G. Spoon (each of whom has been recommended by the Nominating and Governance Committee, has been nominated by the Board and currently serves as a director of Fortive) to serve a one-year term until the 2024 Annual Meeting of Shareholders and until his or her respective successor is duly elected and qualified.

In the event a nominee declines or is unable to serve, the proxies may be voted at the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this would occur.

|

|

The Board of Directors recommends that shareholders vote “FOR” the election of each of the Director Nominees to the Board.

|

|

Table of Contents

| 19 |

CORPORATE GOVERNANCE

Corporate Governance Overview

Governance Highlights

Board Composition

|

|

We have documented and executed our commitment to Board diversity in our Corporate Governance Guidelines and the Nominating and Governance Committee Charter, with three female directors and four ethnically/racially diverse directors | |

|

|

We have engaged in rigorous refreshment of the Board, with a majority of the Board appointed during or after 2019 | |

|

|

We have fully declassified the Board to provide for the election of all directors for one-year terms | |

|

|

We have adopted proxy access to permit a shareholder, or a group of up to 20 shareholders, owning at least 3% of the outstanding shares continuously for at least 3 years, to nominate and include in our proxy materials director nominees constituting up to 20% of the board of directors, as further detailed in our Bylaws | |

|

|

We maintain a majority vote requirement for the election of directors in uncontested elections | |

|

|

We have implemented the “Rooney Rule” policy with respect to new director searches | |

Board Structure

|

|

We have separated our Chairman and CEO positions, with an independent Chairman | |

Board Role and Responsibilities

|

|

We have implemented a Sustainability (ESG) program, as reported in our annual Sustainability Report, with multi-layered oversight by the Nominating and Governance Committee and the full Board | |

|

|

We have formalized and documented in the Compensation Committee Charter oversight of our human capital management by the Compensation Committee, including matters related to overall employee retention and inclusive and diverse company culture, with annual review by the full Board | |

|

|

We have formalized and documented in the Nominating and Governance Committee Charter oversight of our CEO succession planning by the Nominating and Governance Committee, with annual review by the full Board | |

|

|

We have formalized and documented in the Nominating and Governance Committee Charter oversight of climate-related risk management and strategies by the Nominating and Governance Committee, with annual review by the full Board | |

|

|

We have formalized and documented in the Audit Committee Charter oversight of our cybersecurity by the Audit Committee, with quarterly review by the Audit Committee of our cybersecurity planning, monitoring, risk management, remediation, and controls and annual review by the full Board | |

|

|

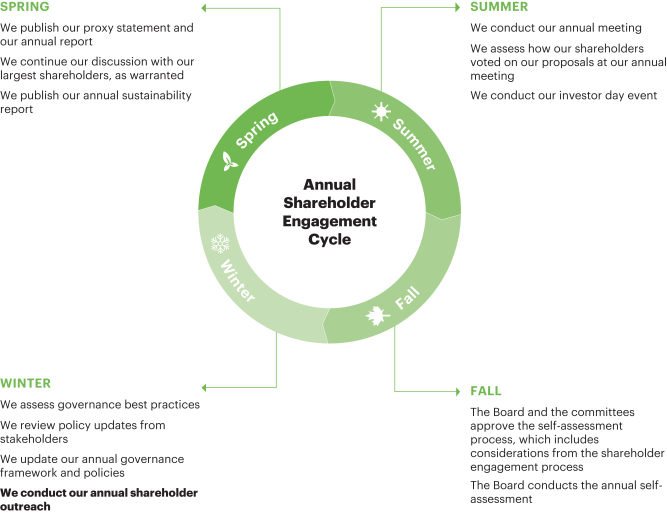

We have implemented a robust annual shareholder engagement program | |

Other Governance Policies and Practices

|

|

We have no shareholder rights plan | |

|

|

We have implemented the right of shareholders to call a special meeting | |

|

|

We have eliminated all supermajority voting requirements | |

|

|

We have adopted a Political Contribution Policy overseen by the Nominating and Governance Committee | |

|

|

We have an absolute prohibition against pledging of our stock by our director and executive officers | |

|

|

We have implemented stock ownership requirements for non-CEO executive officers at multiple of three times base salary and for CEO and directors at multiple of five times base salary and annual cash retainer respectively, with no credit for options and equity awards with outstanding performance-vesting requirements | |

| 2023 Proxy Statement |

Table of Contents

| 20 |

Corporate Governance |

Corporate Governance Guidelines, Committee Charters and Code of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and adopted written charters for each of the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Finance Committee of the Board. The Board of Directors has also adopted our Code of Conduct that includes, among other things, a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Nominating and Governance Committee Charter, and Code of Conduct referenced above are each available in the “Investors – Corporate Governance” section of our website at http://www.fortive.com.

Board Leadership Structure

The Board has separated the positions of Chairman and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our shareholders.

The entire Board selects its Chairman, and our Board has selected Alan G. Spoon, an independent director, as its Chairman, in light of Mr. Spoon’s independence and his deep experience and knowledge with corporate governance, board management, shareholder engagement, risk management and Fortive’s diverse businesses and industries.

As the independent Chairman of the Board, Mr. Spoon leads the activities of the Board, including:

| u | Calling, and presiding over, all meetings of the Board; |

| u | Together with the CEO and the Corporate Secretary, setting the agenda for the Board; |

| u | Calling, and presiding over, the executive sessions of the independent directors; |

| u | Advising the CEO on strategic aspects of the Company’s business, including developments and decisions that are to be discussed with, or would be of interest to, the Board; |

| u | Acting as a liaison, as necessary, between the non-management directors and the management of the Company; and |

| u | Acting as a liaison, as necessary, between the Board and the committees of the Board. |

In the event that the Chairman of the Board is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select by majority vote an independent director to serve as the Lead Independent Director with the authority to:

| u | Preside over all meetings of the Board at which the Chair is not present, including the executive sessions; |

| u | Call meetings of the independent directors; |

| u | Act as a liaison, as necessary, between the independent directors and the CEO; and |

| u | Advise with respect to the Board’s agenda. |

The Board’s non-management directors meet in executive session following the Board’s regularly scheduled meetings, with the executive sessions chaired by the independent Chairman. In addition, the independent directors meet as a group in executive session at least once a year.

|

Table of Contents

| Corporate Governance | 21 |

Risk Oversight

The Board’s role in risk oversight of the Company is consistent with the Company’s leadership structure, with management having day-to-day responsibility for assessing and managing the Company’s risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company.

| Risk Category |

Board Oversight Responsibility | Director Expertise | ||

|

Enterprise Risk |

Board of Directors

Audit Committee

Compensation Committee

Nominating and Governance Committee

Finance Committee

|

All Directors |

||

|

Portfolio Strategy |

Board of Directors

Finance Committee |

Eric Branderiz

Daniel Comas

Rejji Hayes

Wright Lassiter

James Lico

Kate Mitchell

Jeannine Sargent

Alan Spoon

|

||

|

Cybersecurity |

Board of Directors

Audit Committee |

Sharmistha Dubey

Rejji Hayes

Kate Mitchell

Jeannine Sargent

Alan Spoon

|

||

|

Sustainability (ESG) |

Board of Directors

Nominating and Governance Committee |

Eric Branderiz

Rejji Hayes

Jeannine Sargent

|

||

|

Human Capital Management |

Board of Directors

Compensation Committee |

Eric Branderiz

Daniel Comas

Sharmistha Dubey

Wright Lassiter

Kate Mitchell

Jeannine Sargent

Alan Spoon

|

||

|

Management Succession |

Board of Directors

Nominating and Governance Committee

|

All Directors

|

||

| 2023 Proxy Statement |

Table of Contents

| 22 |

Corporate Governance |

Risk Oversight Process

Enterprise Risk

The Board oversees the Company’s risk management processes directly and through each of its committees. In general, the Board oversees the management of risks inherent in the operation of the Company’s businesses on a consolidated basis, by each operating segment and by key corporate functions. In addition, the enterprise risk oversight includes review of the risks and opportunities related to the implementation by the Company of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure. Furthermore, through the Audit Committee, the Board oversees the Company’s enterprise risk management process and policies. At least on an annual basis or more frequently as deemed appropriate by the Board, the Board reviews in depth with senior leaders of the Company the Company’s enterprise risk management, with particular focus on the enterprise risks and opportunities with the greatest impact and highest probability. In addition, the chairs of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee review with each other and with the rest of the Board during executive sessions of Board meetings as appropriate updates to the Company’s enterprise risk management discussed during the corresponding committee meetings. Furthermore, at least on an annual basis or more frequently as deemed appropriate by the Board, the Board reviews with the SVP – General Counsel our insurance policies, including our D&O insurance policy, general liability policy, and our information security risk insurance policy.

Portfolio Strategy

At each Board meeting, the Board oversees the Company’s performance and execution against the strategic goals for the Company’s operating segments, overall portfolio, and innovation, including overseeing the corresponding management of risks and opportunities. In addition, on an annual basis, the Board conducts an informal meeting led by senior management and dedicated entirely to deeper review of the acquisition, product development, commercial, innovation, capital allocation, human capital and risk management strategies for each of the operating segments. Furthermore, the Finance Committee meets with management to assess acquisition and other corporate development strategies as appropriate.

Cybersecurity and Product Security

The Board has delegated to the Audit Committee the responsibility of exercising oversight with respect to the Company’s cybersecurity risk management and risk controls. Consistent with such delegation, our Chief Information Officer provides a report to the Audit Committee on a quarterly basis, and to the Board on an annual basis, regarding the Company’s cybersecurity and data privacy program, including the Company’s compliance program, monthly training program, monitoring, auditing, comprehensive incident responsive plan, data recovery and business continuity infrastructure and contingencies, cyber threat management program, implementation and communication processes, controls, and procedures. In addition, our Chief Information Officer and our Chief Information Security Officer review with the Audit Committee the results of the assessment from BitSight Technologies as well as the annual risk assessment and penetration test performed by an independent third party. The incident response and escalation procedures are tested through our annual tabletop exercises with senior management and our quarterly tabletop exercises with the IT operations teams. The Company’s security framework is based on the National Institute of Security and Technology (NIST) Frameworks, Generally Accepted Privacy Program (GAPP) guiding principles, and ISO 27001/2 standards. Although, as of the date of this proxy statement, there have been no cybersecurity breaches nor cybersecurity incidents that have had a material financial impact, our Chief Information Officer and our Chief Information Security Officer review with the Audit Committee the results of any notable incidents or attempted breaches on a quarterly basis.

Sustainability (ESG)

The Board has delegated to the Nominating and Governance Committee the responsibility of exercising oversight with respect to the reporting of our Sustainability disclosure as well as oversight of our climate-related strategies, goals, risk management and performance. Consistent with such delegation, our SVP – General Counsel provides frequent reports and updates to the Nominating and Governance Committee, and a report to the Board on an annual basis, regarding the Company’s Sustainability program and strategies, including the corresponding risks and opportunities, climate-related goals and strategies, progress, shareholder engagement and disclosure. See “Sustainability” for further discussion on governance structure of our Sustainability program.

|

Table of Contents

| Corporate Governance | 23 |

Human Capital Management

The Board has delegated to the Compensation Committee the responsibility of exercising oversight of the Company’s human capital and compensation, including oversight of overall compensation, retention and inclusion and diversity strategies. Our SVP of Human Resources provides regular reports on compensation and other human capital management risks, trends, best practices, strategies and disclosure to the Compensation Committee. While the Board has delegated these responsibilities to the Compensation Committee, the Board remains actively involved and receives additional reports throughout the year on employee engagement, inclusion and diversity, talent development, company culture and alignment of human capital strategies with the Company’s overall portfolio and operational strategies.

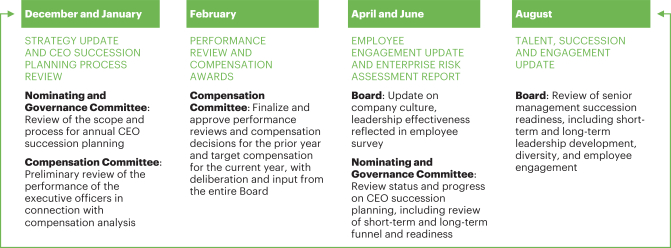

Management Succession

The entire Board oversees the recruitment, development, retention, and succession planning of our executive officer positions, with the responsibilities of oversight of CEO succession planning delegated to the Nominating and Governance Committee, and the responsibilities of ensuring appropriate compensation strategies and programs to align with the retention and recruitment delegated to the Compensation Committee. Our SVP of Human Resources provides regular reports on the CEO succession planning process and strategies to the Nominating and Governance Committee and on compensation strategies and programs to assist in retention and recruitment of future leaders to the Compensation Committee. The SVP of Human Resources also provides additional reports throughout the year to the full Board on short-term and long-term readiness of potential successors, outside recruitment to populate the succession funnel as necessary, and development plans of future leaders. In addition to the formal activities noted below, the Board and its committee members engage and assess our executive officers and high-potential employees during management presentations, our annual multi-day leadership conference, our annual strategy sessions for the Board, regular visits to our operating companies, and periodic informal meetings and communications.

| 2023 Proxy Statement |

Table of Contents

| 24 |

Corporate Governance |

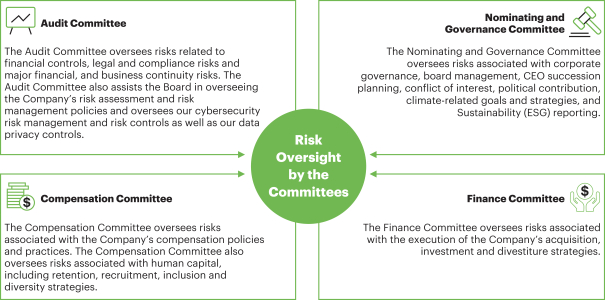

Committees’ Role in Risk Oversight

Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committee’s risk oversight activities.

Internal Risk Committee

The Company’s Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts, and, on at least an annual basis, provides a report to the Board and provides a report of the process to the Audit Committee.

| Director Independence

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the NYSE. The Board has affirmatively determined that eight out of our nine current directors, including Mss. Sharmistha Dubey, Kate D. Mitchell and Jeannine Sargent and Messrs. Eric Branderiz, Daniel L. Comas, Rejji P. Hayes, Wright Lassiter III, and Alan G. Spoon, are independent within the meaning of the listing standards of the NYSE. |

|

|

Table of Contents

| Corporate Governance | 25 |

Board of Directors and Committees of the Board

Director Attendance

In 2022, the Board met five times and acted by unanimous written consent two times. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served during 2022. As a general matter, directors are expected to attend annual meetings of shareholders. Each of our current directors who were serving on the Board at the time attended our virtual 2022 Annual Meeting of Shareholders.

Committee Membership

The membership of each of the Audit, Compensation, Nominating and Governance, and Finance Committees as of April 10, 2023 is set forth below.

| Name of Director |

Audit | Compensation | Nominating and Governance |

Finance | ||||||||||||

| Eric Branderiz |

Member | Member | ||||||||||||||

| Daniel L. Comas |

Member | Member | ||||||||||||||

| Sharmistha Dubey |

Member | Member | ||||||||||||||

| Rejji P. Hayes |

Chair | |||||||||||||||

| Wright Lassiter III |

Member | |||||||||||||||

| James A. Lico |

Member | |||||||||||||||

| Kate D. Mitchell |

Member | Chair | Member | |||||||||||||

| Jeannine Sargent |

Member | Chair | ||||||||||||||

| Alan G. Spoon |

Member | Chair | ||||||||||||||

| 2023 Proxy Statement |

Table of Contents

| 26 |

Corporate Governance |

|

Audit Committee |

|

Rejji P. Hayes (Chair)

|

||

|

Eric Branderiz |

Kate D. Mitchell |

|

|

Jeannine Sargent

|

||

|

Meetings in 2022:

7 |

||

| The Audit Committee is responsible for:

|

||||||||

|

u Assessing the qualifications and independence of Fortive’s independent auditors;

u Appointing, compensating, retaining, and evaluating Fortive’s independent auditors;

u Overseeing the quality and integrity of Fortive’s financial statements and making a recommendation to the Board regarding the inclusion of the audited financial statements in Fortive’s Annual Report on Form 10-K;

u Overseeing Fortive’s internal auditing processes;

u Overseeing management’s assessment of the effectiveness of Fortive’s internal control over financial reporting;

u Overseeing management’s assessment of the effectiveness of Fortive’s disclosure controls and procedures;

u Overseeing risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks;

u Overseeing Fortive’s risk assessment and risk management policies;

u Overseeing Fortive’s compliance with legal and regulatory requirements;

u Overseeing Fortive’s cybersecurity and product security risk management and risk controls;

u Overseeing swap and derivative transactions and related policies and procedures; and

u Preparing a report as required by the SEC to be included in this proxy statement.

|

||||||||

|

The Board has determined that each member of the Audit Committee is: |

||||||

|

u Independent for purposes of Rule 10A-3(b)(1) under the Exchange Act and the NYSE listing standards;

u Qualified as an audit committee financial expert as that term is defined in SEC rules; and

u Financially literate within the meaning of the NYSE listing standards. |

||||||

As of the date of this proxy statement, no Audit Committee member serves on the audit committee of more than three public companies.

The Audit Committee typically meets in executive session, without the presence of management, at regularly scheduled meetings, and reports to the Board on its actions and recommendations at regularly scheduled Board meetings.

The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and the independent auditor in carrying out its oversight responsibilities. Management is responsible for the preparation, presentation, and integrity of Fortive’s financial statements, accounting and financial reporting principles, internal control over financial reporting, and disclosure controls and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of Fortive’s system of internal control over financial reporting. Fortive’s independent auditor, Ernst & Young LLP, is responsible for performing independent audits of Fortive’s financial statements and internal control over financial reporting and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

|

Table of Contents

| Corporate Governance | 27 |

|

Compensation Committee |

|

Kate D. Mitchell (Chair)

|

||

|

Daniel L. |

Sharmistha |

|

|

Wright |

||

|

Meetings in 2022:

4 |

||

|

The Compensation Committee acted by unanimous written consent two times in 2022. |

||

| The Compensation Committee is responsible for:

|

||||||||

|

u Determining and approving the form and amount of annual compensation of the CEO and our other executive officers, including evaluating the performance of, and approving the compensation paid to, our CEO and other executive officers;

u Reviewing and making recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercising all authority with respect to the administration of such plans;

u Reviewing and making recommendations to the Board with respect to the form and amounts of director compensation;

u Overseeing and monitoring compliance with Fortive’s compensation recoupment policy;

u Overseeing and monitoring compliance by directors and executive officers with Fortive’s stock ownership requirements;

u Overseeing risks associated with Fortive’s compensation policies and practices;

u Overseeing our engagement with shareholders and proxy advisory firms regarding executive compensation matters;

u Assisting the Board in oversight of our human capital management practices, including strategies, risk management, employee retention and inclusive and diverse culture;

u Overseeing the Company’s reporting on the Company’s human capital management practices; and

u Reviewing and discussing with management the Compensation Discussion & Analysis (“CD&A”) in the annual proxy statement and recommending to the Board the inclusion of the CD&A in the proxy statement.

|

||||||||

|

Each member of the Compensation Committee is: |

||||||

|

u Independent under NYSE listing standards and under Rule 10C-1 under the Exchange Act. |

||||||

The Chair of the Compensation Committee works with our Senior Vice President-Human Resources, Vice President-Total Rewards, and our Corporate Secretary to schedule the Compensation Committee’s meetings and set the agenda for each meeting. Our Senior Vice President-Human Resources, Vice President-Total Rewards, Senior Vice President-General Counsel, and Vice President-Corporate Secretary generally attend, and from time-to-time our CEO and CFO attend, the Compensation Committee meetings and support the Compensation Committee in preparing meeting materials and taking meeting minutes. In particular, our CEO provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy; participates in the Compensation Committee’s discussions regarding the performance and compensation of the other executive officers; and provides recommendations to the Compensation Committee regarding all significant elements of compensation paid to such other executive officers, their annual strategic performance objectives and his evaluation of their performance. The Compensation Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendation at regularly scheduled Board meetings.

Under the terms of its charter, the Compensation Committee has the authority to engage the services of outside advisors and experts to assist the Compensation Committee. Following the assessment and determination of Pearl Meyer & Partners, LLC’s (“Pearl Meyer”) independence from Fortive’s management, the Compensation Committee engaged Pearl Meyer as the Compensation Committee’s independent compensation consultant for 2022. The

| 2023 Proxy Statement |

Table of Contents

| 28 | Corporate Governance |

Compensation Committee had the sole discretion and authority to select, retain and terminate Pearl Meyer as well as to approve any fees, terms and other conditions of its services. Pearl Meyer reported directly to the Compensation Committee and took its direction solely from the Compensation Committee. Pearl Meyer’s primary responsibilities in 2022 were to provide advice and data in connection with the selection of Fortive’s peer group for assessing executive compensation, the structuring of the executive compensation programs in 2022 and 2023, the compensation levels for our executive officers, and the compensation levels for our directors; assess our executive compensation program in the context of market practices and corporate governance best practices; and advise the Compensation Committee regarding our proposed executive compensation public disclosures. In the course of discharging its responsibilities, the Compensation Committee’s independent compensation consultant may, from time to time and with the Compensation Committee’s consent, request from management certain information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of our executive officer responsibilities and other business information. Pearl Meyer did not provide any services to Fortive or its management in 2022, and the Compensation Committee is not aware of any work performed by Pearl Meyer that raises any conflicts of interest.

Compensation Committee Interlocks and Insider Participation

During 2022, none of the members of the Compensation Committee was an officer or employee of Fortive. No executive officer of Fortive served on the compensation committee (or other board committee performing equivalent functions) or on the board of directors of any entity having an executive officer who served on the Compensation Committee.

Table of Contents

| Corporate Governance | 29 |

|

Nominating and Governance Committee |

|

Jeannine Sargent (Chair)

|

||

|

Eric Branderiz

|

Sharmistha Dubey |

|

|

Alan G. Spoon |

||

|

Meetings in 2022:

6 |

||

| The Nominating and Governance Committee is responsible for:

|

||||||||

|

u Reviewing and making recommendations to the Board regarding the size, classification and composition of the Board;

u Assisting the Board in identifying individuals qualified to become Board members;

u Assisting the Board in identifying characteristics, skills, and experiences for the Board with the objective of having a Board with diverse backgrounds, experiences, skills, and perspectives;

u Proposing to the Board the director nominees for election by our shareholders at each annual meeting;

u Overseeing and reviewing the process for, and making recommendations to the Board relating to the management of, the Company’s CEO succession planning;

u Assisting the Board in determining the independence and qualifications of the Board and Committee members and making recommendations to the Board regarding committee membership;

u Developing and making recommendations to the Board regarding a set of corporate governance guidelines and reviewing such guidelines on an annual basis;

u Overseeing compliance with the corporate governance guidelines;

u Overseeing director education and director orientation process and programs;

u Overseeing Fortive’s Sustainability (ESG) reporting;

u Overseeing climate-related risk management and strategies;

u Reviewing and making recommendation to the Board relating to the governance matters set forth in the Company’s Certificate of Incorporation and Bylaws;

u Administrating the Company’s Political Contribution Policy;

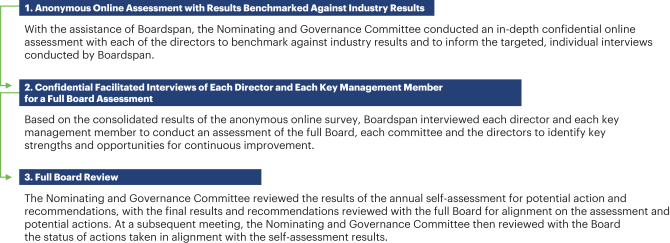

u Assisting the Board and the Committees in engaging in annual self-assessment of their performance; and

u Administering Fortive’s Related Person Transactions Policy.

|

||||||||

| 2023 Proxy Statement |

The Board has determined that each member of the Nominating and Governance Committee is independent within the meaning of the NYSE listing standards.

The Nominating and Governance Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting and reports to the Board on its actions and recommendations at regularly scheduled Board meetings.

Table of Contents

| 30 | Corporate Governance |

|

|

Finance Committee |

|

Alan G. Spoon (Chair)

|

||

|

Daniel L.

|

James A. |

|

|

Kate D. |

||

| The Finance Committee is responsible for:

|

||||||||

|

u Assisting the Board in assessing potential acquisition, investment and divestiture opportunities; and

u Approving business acquisitions, investments and divestitures up to the levels of authority delegated to it by the Board.

|

||||||||

Director Nomination Process

The Nominating and Governance Committee recommends to the Board director candidates for nomination and election at the annual meeting of shareholders and, in the event of vacancies between annual meetings of shareholders, for appointment to fill such vacancies.

Board Membership Criteria

In assessing the candidates for recommendation to the Board as director nominees, the Nominating and Governance Committee will evaluate such candidates against the standards and qualifications set out in our Corporate Governance Guidelines, including:

|

|

Personal and professional integrity and character

Skills, knowledge, diversity of background and experience, and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of our business |

|

The extent to which the interplay of the candidate’s skills, knowledge, expertise and diversity of background and experience with that of the other Board members will help build a Board that is effective in collectively meeting our strategic needs and serving the long-term interests of the shareholders |

|

Prominence and reputation in the candidate’s profession

The capacity and desire to represent the interests of the shareholders as a whole

Availability to devote sufficient time to the affairs of Fortive

|

|||||

|

Table of Contents

| Corporate Governance | 31 |

Skills and Attributes