DEF 14A: Definitive proxy statements

Published on April 20, 2020

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

FORTIVE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

|

|||

| 2) | Aggregate number of securities to which transaction applies:

|

|||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| 4) | Proposed maximum aggregate value of transaction:

|

|||

| 5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount previously paid:

|

|||

| 2) | Form, Schedule or Registration Statement No.:

|

|||

| 3) | Filing party:

|

|||

| 4) | Date Filed:

|

|||

Table of Contents

2020 Notice of Annual Meeting of Shareholders and Proxy Statement Fortive Essential technology for the people who accelerate progress.

Table of Contents

FORTIVE CORPORATION

6920 Seaway Blvd

Everett, WA 98203

Notice of 2020 Annual Meeting of Shareholders

|

|

|

|

|||

| When:

June 2, 2020 at 3:00 p.m., PDT.

Where:*

Fortive Corporation 6920 Seaway Blvd Everett, WA 98203 |

Items of Business:

4 proposals as listed below

Date of Mailing:

The date of mailing of this Proxy Statement is on or about April 20, 2020. |

Who Can Vote:

Shareholders of Fortives common stock at the close of business on April 6, 2020. |

Attending the Meeting:*

Shareholders who wish to attend the meeting in person should review the instructions set forth in the attached proxy statement under Annual Meeting Admission.

|

|||

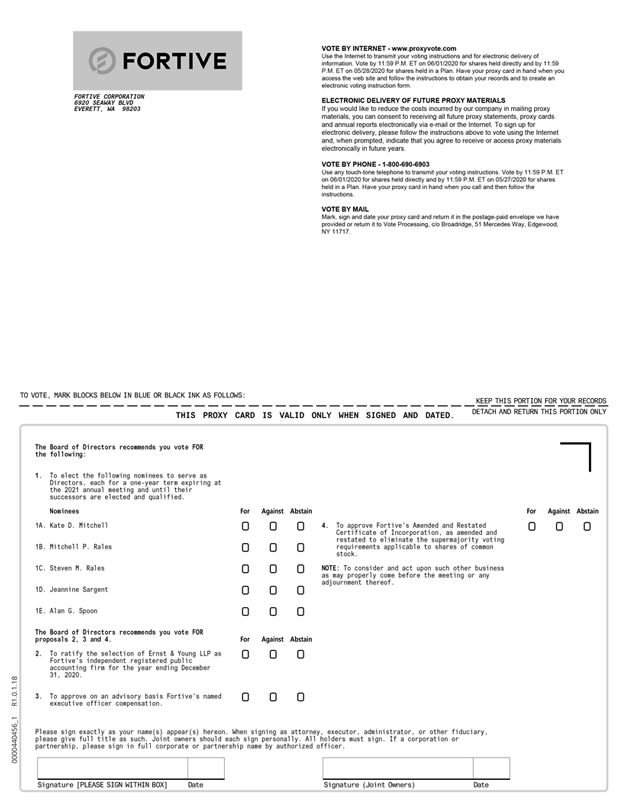

Items of Business:

| 1. | To elect Ms. Kate D. Mitchell, Mr. Mitchell P. Rales, Mr. Steven M. Rales, Ms. Jeannine Sargent and Mr. Alan G. Spoon to serve as directors, each for a one-year term expiring at the 2021 annual meeting and until their successors are elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as Fortives independent registered public accounting firm for the year ending December 31, 2020. |

| 3. | To approve on an advisory basis Fortives named executive officer compensation. |

| 4. | To approve Fortives Amended and Restated Certificate of Incorporation, as amended and restated to eliminate the supermajority voting requirements applicable to shares of common stock. |

| 5. | To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most shareholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card or voting instruction form. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 2, 2020:

The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com.

| * | As of the date of mailing of the notice and proxy statement for our 2020 Annual Meeting, we intend to hold the meeting in person at Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203. However, as a result of the coronavirus (COVID-19) pandemic and the corresponding public health and travel concerns of our shareholders, directors, officers, employees and service providers, we may change the location of our 2020 Annual Meeting to a virtual only meeting format. If we change the location of our 2020 Annual Meeting to a virtual only meeting format, we will announce the change as promptly as practicable through a press release which will also be filed with the Securities and Exchange Commission. In addition, please monitor our investor website at www.fortive.com for updated information. If you are planning to attend our 2020 Annual Meeting in person, please check the website at least one week prior to the meeting date. If we change the location of our 2020 Annual Meeting to a virtual meeting format only, you will not be able to attend our meeting in person. |

By Order of the Board of Directors,

Daniel B. Kim

Secretary

April 20, 2020

Table of Contents

Table of Contents

| ii | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

|

|

To assist you in reviewing the proposals to be acted upon at our 2020 Annual Meeting, below is a summary of information regarding the meeting contained elsewhere in this Proxy Statement. The following description is only a summary. For more information about these topics, please review the complete Proxy Statement.

2020 Annual Meeting of Shareholders

| Date and time: |

June 2, 2020, 3:00 p.m. PDT | |

| Place*: |

Fortive Corporation 6920 Seaway Blvd Everett, WA 98203 |

|

| Record date: |

April 6, 2020 | |

| Voting: |

Shareholders of Fortives common stock at the close of business on April 6, 2020 are entitled to one vote per share of common stock on each matter to be voted upon at the 2020 Annual Meeting of Shareholders (Annual Meeting) | |

| Admission*: |

Shareholders who wish to attend the meeting in person should review the instructions set forth under Annual Meeting Admission on page 7 | |

| * | As of the date of mailing of the notice and proxy statement for our 2020 Annual Meeting, we intend to hold the meeting in person at Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203. However, as a result of the coronavirus (COVID-19) pandemic and the corresponding public health and travel concerns of our shareholders, directors, officers, employees and service providers, we may change the location of our 2020 Annual Meeting to a virtual only meeting format. If we change the location of our 2020 Annual Meeting to a virtual only meeting format, we will announce the change as promptly as practicable through a press release which will also be filed with the Securities and Exchange Commission. In addition, please monitor our investor website at www.fortive.com for updated information. If you are planning to attend our 2020 Annual Meeting in person, please check the website at least one week prior to the meeting date. If we change the location of our 2020 Annual Meeting to a virtual meeting format only, you will not be able to attend our meeting in person. |

Items of Business

| PROPOSAL | VOTE REQUIRED | BOARD RECOMMENDATION |

||

| Proposal 1: Election of Ms. Kate D. Mitchell, Mr. Mitchell P. Rales, Mr. Steven M. Rales, Ms. Jeannine Sargent and Mr. Alan G. Spoon to serve as directors, in each case, for a one-year term (page 12) |

For each nominee, majority of votes cast. | FOR each nominee | ||

| Proposal 2: Ratification of the appointment of the independent registered public accounting firm (page 36) |

The affirmative vote of a majority of the shares represented in person or by proxy. | FOR | ||

| Proposal 3: Approval on an advisory basis of Fortives named executive officer compensation (page 77) |

The affirmative vote of a majority of the shares represented in person or by proxy. | FOR | ||

| Proposal 4: Approval of Fortives Amended and Restated Certificate of Incorporation, as amended and restated to eliminate the supermajority voting requirements applicable to shares of common stock (page 78) |

The affirmative vote of at least 80 percent of the shares entitled to vote generally as of the record date. | FOR | ||

|

2020 Proxy Statement | 1 |

Table of Contents

Proxy Statement Summary

Company Overview

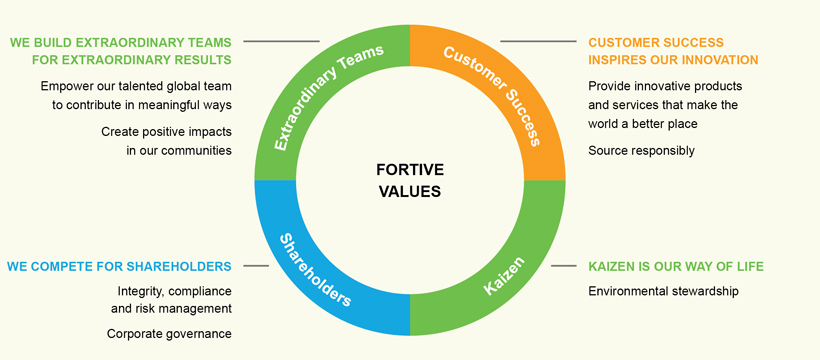

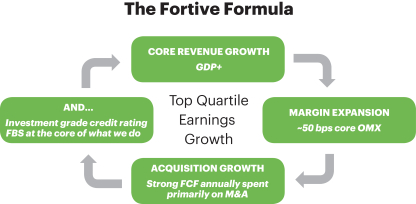

Fortive is a diversified industrial technology growth company encompassing businesses that are recognized leaders in attractive markets. Our well-known brands hold leading positions in field solutions, product realization, sensing technologies, health, transportation technology, and franchise distribution. We are guided by our shared purpose to deliver essential technology for the people who accelerate progress, and we are united by our culture of continuous improvement and bias for action that embody our Fortive Business System (FBS). Through rigorous application of our proprietary FBS set of growth, lean, and leadership tools and processes, we continuously improve business performance in the critical areas of innovation, product development and commercialization, global supply chain, sales and marketing and leadership development. Our commitment to FBS and our goal of creating long-term shareholder value enable us to drive customer satisfaction and profitability, significant improvements in innovation, growth and operating margins, and disciplined acquisitions to execute strategy and expand our portfolio into new and attractive markets. We are headquartered in Everett, Washington and, as of December 31, 2019, employed a team of approximately 25,000 research and development, manufacturing, sales, distribution, service and administrative employees in more than 50 countries around the world.

2019 Company Performance Highlights

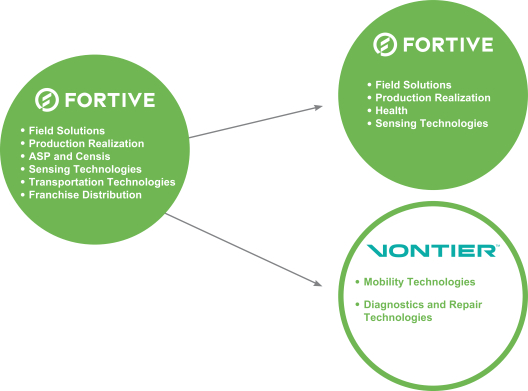

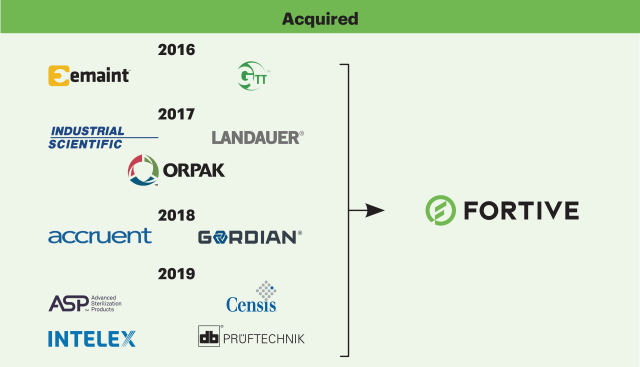

Portfolio Evolution

Since our separation from Danaher in July 2016, we have identified and executed acquisitions to enhance our portfolio with operating companies which have exposure to attractive, higher growth end markets, less cyclicality, stronger margin potential and significant opportunities for value creation through implementation of FBS. In 2019, we continued our progress in this regard with a number of transactions that accelerated our portfolio evolution and transformation. The 2019 acquisitions brought a mix of hardware, sensing, software, and service capabilities to our portfolio, furthering our strategy aimed at providing our customers with broader, software-enabled solutions to address their critical workflows.

|

OVER $3.9 BILLION IN CAPITAL DEPLOYED IN 2019 FOR ACQUISITIONS

|

|

Leader in infection prevention through delivering products, solutions and processes to protect patients during critical moments and advancing infection prevention technologies

|

|

Leader in surgical inventory management software, offering advanced, web-based software systems to enhance patient safety and advance efficiency, transparency, and regulatory compliance

|

|

Leader in environmental, safety and quality management software solutions to advance compliance and reduce risk

|

|

Leader in maintenance solution for shaft alignment, vibration analysis, condition monitoring and nondestructive testing

|

Our portfolio shaping efforts since 2016 also included the tax-efficient divestiture of four of our legacy businesses that participate in more cyclical industries, which was completed in 2018.

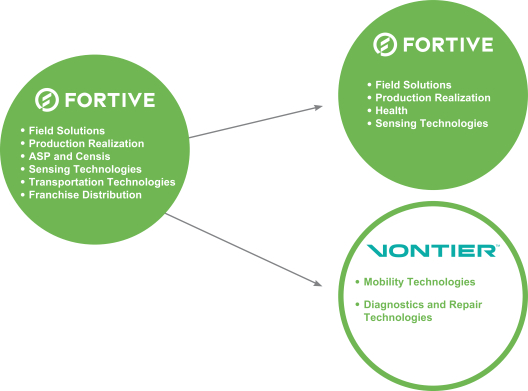

In addition, in September 2019, we announced our intention to separate certain assets from our Industrial Technologies segment into a separate publicly-traded company, Vontier Corporation, which will be focused on mobility technologies and

| 2 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement Summary

diagnostics and repair technologies end markets. We believe that effecting this separation will allow both Fortive and Vontier to benefit from increased focus on their specific growth and capital allocation opportunities.

| * | Following pending separation of Vontier from Fortive |

|

2020 Proxy Statement | 3 |

Table of Contents

Proxy Statement Summary

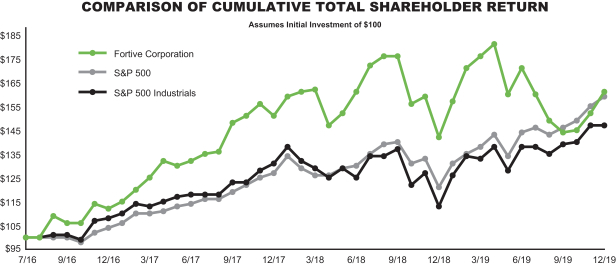

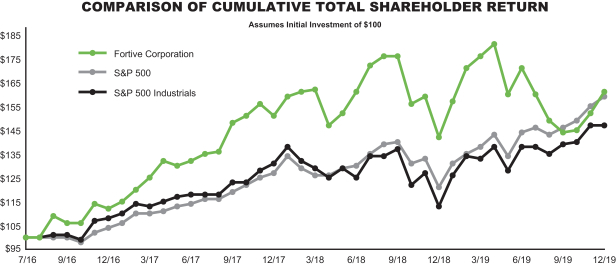

Total Shareholder Return

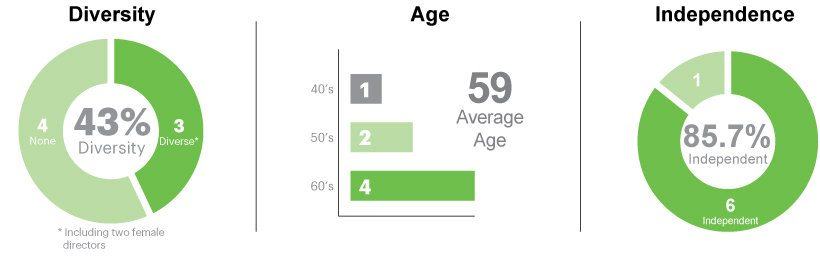

Corporate Governance Highlights

Our Board of Directors recognizes that enhancing and protecting long-term value for our shareholders requires a robust framework of corporate governance that serves the best interests of all our shareholders.

In connection with our Boards dedication to strong corporate governance, our Board has implemented the following corporate actions:

Governance Enhancements

|

|

Adopted proxy access to permit a shareholder, or a group of up to 20 shareholders, owning at least 3% of the outstanding shares continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 20% of the board of directors, as further detailed in our Bylaws | |

|

|

Implemented the declassification of the Board to provide for the election of directors for one-year terms | |

|

|

Subject to approval by the shareholders of Proposal 4, approved the elimination of the supermajority voting requirements applicable to shares of common stock | |

|

|

Documented and executed our commitment to Board diversity in our Corporate Governance Guidelines and the Nominating and Governance Committee Charter | |

|

|

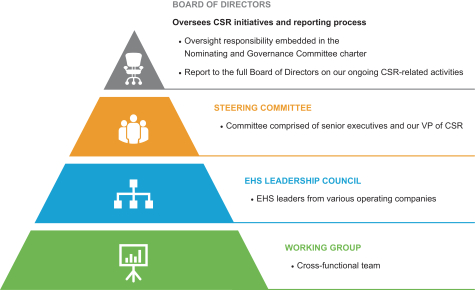

Implemented a corporate social responsibility program, as reported in our Corporate Social Responsibility Report with oversight by the Nominating and Governance Committee | |

|

|

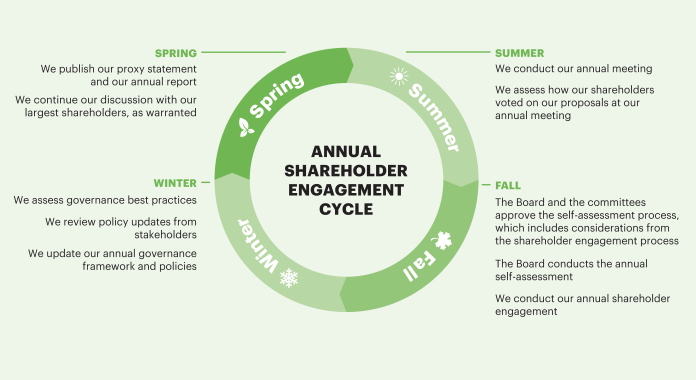

Implemented an annual shareholder engagement program | |

|

|

Formalized and documented in the Audit Committee Charter oversight of our cybersecurity by the Audit Committee, with quarterly review by the Audit Committee of our cybersecurity planning, monitoring, risk management, remediation, and controls | |

|

|

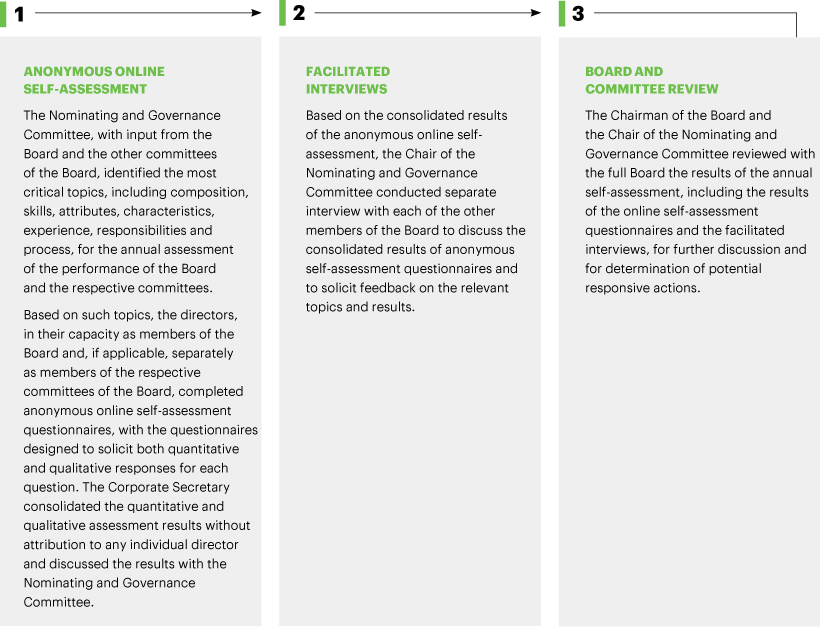

Conducted our annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees | |

|

|

Implemented stock ownership requirements for non-CEO executive officers at multiple of three times base salary and for CEO and directors at multiple of five times base salary and annual cash retainer, respectively | |

| 4 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement Summary

Additional highlights of our corporate governance framework

|

Our Chairman and CEO positions are separate, with an independent Chairman | |

|

We maintain a majority vote requirement for the election of directors in uncontested elections | |

|

We have no shareholder rights plan | |

|

We have an anti-overboarding policy that limits the number of boards of other public companies on which our directors may serve to four | |

|

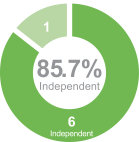

Approximately 86% of our Board is comprised of independent directors | |

|

All members of the Audit Committee are audit committee financial experts | |

|

We maintain a related person transaction policy with oversight by the Nominating and Governance Committee | |

|

All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable Securities and Exchange Commission rules | |

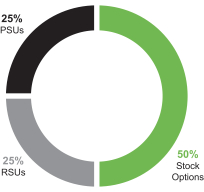

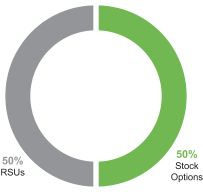

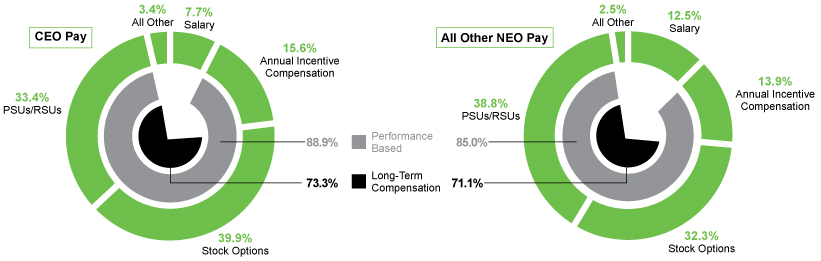

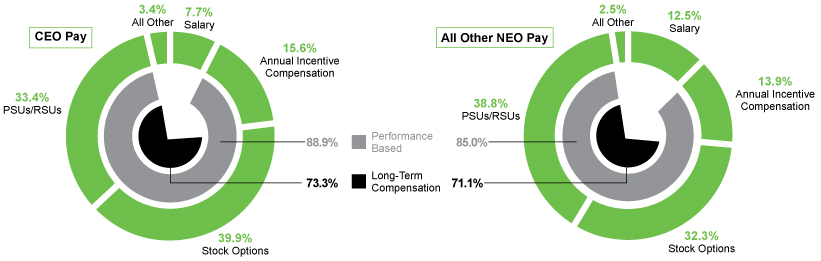

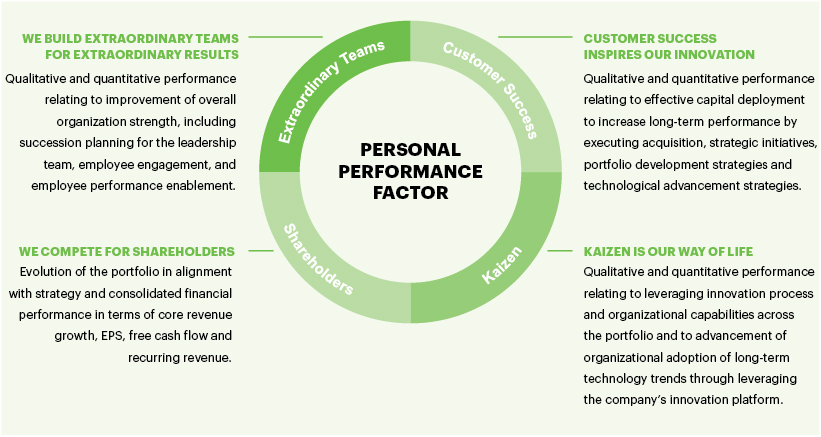

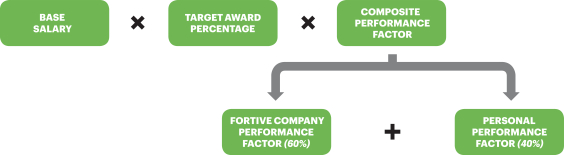

2019 Pay Mix

Compensation Governance Highlights

| WHAT WE DO | WHAT WE DONT DO | |||||||

|

2020 Proxy Statement | 5 |

Table of Contents

|

|

Fortive Corporation

6920 Seaway Blvd

Everett, WA 98203

2020 Annual Meeting of Shareholders

June 2, 2020

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (Board) of Fortive Corporation, a Delaware corporation (Fortive), of proxies for use at the 2020 Annual Meeting of Shareholders (the Annual Meeting) to be held at Fortive Corporation, 6920 Seaway Blvd., Everett, WA 98203 at 3:00 p.m., PDT, and at any and all postponements or adjournments thereof. Fortives principal address is 6920 Seaway Blvd., Everett, WA 98203. The date of mailing of this Proxy Statement is on or about April 20, 2020.

The purpose of the meeting is to:

| 1. | Elect Ms. Kate D. Mitchell, Mr. Mitchell P. Rales, Mr. Steven M. Rales, Ms. Jeannine Sargent and Mr. Alan G. Spoon to serve as directors, each for a one-year term expiring at the 2021 annual meeting and until their successors are elected and qualified; |

| 2. | Ratify the selection of Ernst & Young LLP as Fortives independent registered public accounting firm for the year ending December 31, 2020; |

| 3. | Approve on an advisory basis Fortives named executive officer compensation; |

| 4. | Approve Fortives Amended and Restated Certificate of Incorporation, as amended and restated, to eliminate the supermajority voting requirements applicable to shares of common stock; and |

| 5. | Consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

Please be prepared to present photo identification for admittance. If you are a shareholder of record or hold your shares through the Fortive Corporation Retirement Savings Plan or the Fortive Corporation Union Retirement Savings Plan (collectively, the Savings Plans), your name will be verified against the list of shareholders of record or plan participants on the record date prior to your being admitted to the Annual Meeting. If you are not a shareholder of record or a Savings Plan participant but hold shares through a broker, bank or nominee (i.e., in street name), you should also be prepared to provide proof of beneficial ownership as of the record date, such as a brokerage account statement showing your ownership as of the record date, a copy of the voting instruction card provided by your broker, bank or nominee, or other similar evidence of ownership.

As of the date of mailing of the notice and proxy statement for our 2020 Annual Meeting, we intend to hold the meeting in person at Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203. However, as a result of the coronavirus (COVID-19) pandemic and the corresponding public health and travel concerns of our shareholders, directors, officers, employees and service providers, we may change the location of our 2020 Annual Meeting to a virtual only meeting format. If we change the location of our 2020 Annual Meeting to a virtual only meeting format, we will announce the change as promptly as practicable through a press release which will also be filed with the Securities and Exchange Commission. In addition, please monitor our investor website at www.fortive.com for updated information. If you are planning to attend our 2020 Annual Meeting in person, please check the website at least one week prior to the meeting date. If we change the location of our 2020 Annual Meeting to a virtual meeting format only, you will not be able to attend our meeting in person.

| 6 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement

Outstanding Stock and Voting Rights

In accordance with Fortives Amended and Restated Bylaws, the Board has fixed the close of business on April 6, 2020 as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to vote. The only outstanding securities of Fortive entitled to vote at the Annual Meeting are shares of Common Stock, $.01 par value (Common Stock). Each outstanding share of Common Stock entitles the holder to one vote on each directorship and other matter brought before the Annual Meeting. As of the close of business on April 6, 2020, 336,792,858 shares of Common Stock were outstanding, excluding shares held by or for the account of Fortive.

The proxies being solicited hereby are being solicited by Fortives Board. The total expense of the solicitation will be borne by Fortive, including reimbursement paid to banks, brokerage firms and nominees for their reasonable expenses in forwarding material regarding the Annual Meeting to beneficial owners. Solicitation of proxies may be made personally or by mail, telephone, internet, e-mail or facsimile by officers and other management employees of Fortive, who will receive no additional compensation for their services.

Proxies will be voted as specified in the proxy.

If you sign and submit your proxy card with no further instructions, your shares will be voted:

|

FOR the election of each of Ms. Kate D. Mitchell, Mr. Mitchell P. Rales, Mr. Steven M. Rales, Ms. Jeannine Sargent and Mr. Alan G. Spoon to serve as directors, each for a one-year term; | |

|

FOR ratification of the selection of Ernst & Young LLP as Fortives independent registered public accounting firm for the year ending December 31, 2020; | |

|

FOR approval of the Companys named executive officer compensation; | |

|

FOR approval of an amendment to the Amended and Restated Certificate of Incorporation to eliminate the supermajority voting requirement applicable to shares of common stock; and | |

|

In the discretion of the proxy holders on any other matter that properly comes before the meeting or any adjournment thereof. The Board has selected Peter C. Underwood and Daniel B. Kim to act as proxies with full power of substitution. | |

Notice of Electronic Availability of Proxy Materials

As permitted by the SEC rules, we are making the proxy materials available to our shareholders primarily via the Internet. By doing so, we can reduce the printing and delivery costs and the environmental impact of the Annual Meeting. On April 20, 2020, we mailed a Notice of Internet Availability of Proxy Materials (the Notice) to our shareholders. The Notice contains instructions on how to access our proxy materials and how to vote online or by telephone. If you would like to receive a paper copy of the proxy materials, please follow the instructions in the Notice.

Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement

Quorum. The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting as of the record date. Abstentions and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied.

|

2020 Proxy Statement | 7 |

Table of Contents

Proxy Statement

Broker Non-Votes. Under New York Stock Exchange (NYSE) rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote those shares on Proposal 2, which is considered a routine matter. However, on non-routine matters such as Proposals 1, 3 and 4, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. Therefore, if you are a beneficial owner and do not provide your broker with voting instructions, your shares may constitute broker non-votes with respect to Proposals 1, 3 and 4. Broker non-votes will not affect the required vote with respect to Proposals 1 and 3. However, because approval of Proposal 4 requires the affirmative vote of the holders of 80 percent of the outstanding shares entitled to vote generally in the election of directors on the record date, broker non-votes will have the same effect as a vote against Proposal 4.

Approval Requirements. If a quorum is present, the vote required under the Companys Amended and Restated Bylaws and the Amended and Restated Certificate of Incorporation to approve each of the proposals is as follows:

| | With respect to Proposal 1, the election of directors, you may vote for or against any or all director nominees or you may abstain as to any or all director nominees. In uncontested elections of directors, such as this election, a nominee is elected by a majority of the votes cast by the shares present in person or represented by proxy and entitled to vote. A majority of the votes cast means that the number of votes cast for a director nominee must exceed the number of votes cast against that nominee. A vote to abstain is not treated as a vote for or against, and thus will have no effect on the outcome of the vote. Under our director resignation policy, our Board will not appoint or nominate for election to the Board any person who has not tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election and such resignation is accepted by the Board. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the directors resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation. |

| | With respect to Proposals 2 and 3, the affirmative vote of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal. |

| | With respect to Proposal 4, the affirmative vote of the holders of 80% of the outstanding shares of Common Stock entitled to vote generally in the election of directors on the record date is required to approve this proposal. For this proposal abstentions are counted for the purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal. |

Tabulation of Votes. Our inspector of election, Broadridge Financial Services, will tabulate votes cast by proxy or in person at the meeting. We will report the results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the registered holder of those shares. As the registered shareholder, you can ensure your shares are voted at the Annual Meeting by submitting your instructions by telephone, over the internet, by completing, signing, dating and returning the enclosed proxy card in the envelope provided, or by attending the Annual Meeting and voting your shares at the meeting. Telephone and internet voting for registered shareholders will be available 24 hours a day, up until 11:59 p.m., Central time on June 1, 2020.

| 8 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement

Detailed instructions for telephone and internet voting are set forth on the Notice.

|

|

Vote your shares at www.proxyvote.com. | |

| Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number needed to vote. | ||

|

|

Call toll-free number 1-800-690-6903 | |

|

|

Mark, sign, date, and return the enclosed proxy card or voting instruction form in the envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | |

If you hold your shares through a broker, bank or nominee, rather than registered directly in your name, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or nominee, together with a voting instruction form. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction forms.

If you participate in the Fortive Stock Fund through either of the Savings Plans, your proxy will also serve as a voting instruction for Fidelity Management Trust Company (Fidelity), the trustee of the Savings Plans, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by May 28, 2020, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Fortive a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Attendance at the meeting will not, by itself, revoke a proxy.

We are permitted to send a single set of our proxy statement and annual report to shareholders who share the same last name and address. This procedure is called householding and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our annual report and proxy statement to you if you contact us at Fortive Corporation, Attn: Investor Relations, 6920 Seaway Blvd., Everett, WA 98203; telephone us at 425-446-5000; or email us at investors@fortive.com. In addition, if you want to receive separate copies of the proxy statement or annual report in the future; if you and another shareholder sharing an address would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

|

2020 Proxy Statement | 9 |

Table of Contents

|

Beneficial Ownership of Common Stock by Directors, Officers and Principal Shareholders

|

Directors and Executive Officers

The following table sets forth as of April 6, 2020 (unless otherwise indicated) the number of shares and percentage of Common Stock beneficially owned by each of Fortives directors, nominees for director and each of the executive officers named in the Summary Compensation Table (the named executive officers), and all executive officers and directors of Fortive as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of April 6, 2020. Except as indicated, the address of each director and executive officer shown in the table below is c/o Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203.

| NAME | NUMBER OF SHARES BENEFICIALLY OWNED (1) |

PERCENT OF CLASS (1) |

||||||||

| Feroz Dewan |

|

15,440 |

(2) |

|

* |

|||||

| James A. Lico |

|

1,423,894 |

(3) |

|

* |

|||||

| Kate D. Mitchell |

|

15,440 |

(4) |

|

* |

|||||

| Mitchell P. Rales |

|

17,673,802 |

(5) |

|

5.4 |

% |

||||

| Steven M. Rales |

|

21,570,210 |

(6) |

|

6.4 |

% |

||||

| Jeannine Sargent |

|

3,340 |

(7) |

|

* |

|||||

| Alan G. Spoon |

|

64,833 |

(8) |

|

* |

|||||

| Barbara B. Hulit |

|

342,697 |

(9) |

|

* |

|||||

| Charles E. McLaughlin |

|

187,668 |

(10) |

|

* |

|||||

| Patrick K. Murphy |

|

139,853 |

(11) |

|

* |

|||||

| William W. Pringle |

|

178,889 |

(12) |

|

* |

|||||

| All current executive officers and directors as a group (15 persons) |

|

42,611,516 |

(13) |

|

12.6 |

% |

||||

| (1) | Balances credited to each executive officers account under the Fortive Executive Deferred Incentive Plan (the EDIP) which are vested or are scheduled to vest within 60 days of April 6, 2020, are included in the table. See Employee Benefit PlansFortive Executive Deferred Incentive Plan for a description of our EDIP. The incremental number of notional phantom shares of Common Stock credited to a persons EDIP account is based on the incremental amount of contribution to the persons EDIP balance divided by the closing price of Common Stock as reported on the NYSE on the date of the contribution. In addition, for purposes of the table, the number of shares attributable to each executive officers 401(k) Plan account is equal to (a) the officers balance, as of February 28, 2020, in the Fortive stock fund included in the executive officers 401(k) Plan account (the 401(k) Fortive Stock Fund), divided by (b) the closing price of Common Stock as reported on the NYSE on February 28, 2020. The 401(k) Fortive Stock Fund consists of a unitized pool of Common Stock and cash. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of April 6, 2020 or upon vesting of Restricted Stock Units (RSUs) that vest within 60 days of April 6, 2020. The table also includes unvested restricted shares that are subject only to time-vesting requirements. Restricted shares and performance shares, in each case, granted to executive officers that are subject to satisfaction of performance measures (all of which are subject to measurement more than 60 days after April 6, 2020) are not included in the table. In addition, RSUs granted to a non-executive director for which shares are not delivered until the earlier of the directors death or, at the earliest, the first day of the seventh month following the directors resignation from the board are not included in the table. |

| (2) | Includes options to acquire 15,440 shares. |

| (3) | Includes options to acquire 980,738 shares, 78,888 unvested restricted shares, 19,500 shares attributable to Mr. Licos 401(k) Fortive Stock Fund and 103,734 notional phantom shares attributable to Mr. Licos EDIP account. |

| (4) | Includes options to acquire 15,440 shares. |

| (5) | Includes 16,000,000 shares (the MR LLC Shares) owned by limited liability companies (MR LLCs), with Mr. Rales, as the grantor and trustee of the sole member of the MR LLCs, having sole voting power and sole dispositive power over the MR LLC Shares. In addition, includes 1,669,462 other shares owned indirectly, and options to acquire 4,340 shares. Prior to the separation of Fortive from Danaher (the Separation), shares of Danaher Common Stock owned by MR LLCs were pledged to secure lines of credit with certain banks (the Pre-existing Pledged MR DHR Shares). The MR LLC Shares that were issued as a dividend in the Separation on the Pre-existing Pledged MR DHR Shares were pledged to secure the corresponding lines of credit, and |

| 10 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Beneficial Ownership of Common Stock by Directors, Officers and Principal Shareholders

| each of these entities and Mr. Rales is in compliance with these lines of credit. Other than shares issued as a dividend on the Pre-existing Pledged MR DHR Shares, no shares of Common Stock are pledged by Mr. Rales. The business address of Mitchell Rales, and of each of the MR LLCs, is 11790 Glen Road, Potomac, MD 20854. |

| (6) | Includes 17,000,000 shares (SR LLC Shares) owned by limited liability companies (the SR LLCs), with Mr. Rales, as the grantor and trustee of the sole member of the SR LLCs, having sole voting power and sole dispositive power over the SR LLC Shares. In addition, includes 4,507,370 other shares owned indirectly, options to acquire 4,340 shares, and 58,500 shares owned by a charitable foundation of which Mr. Rales is the sole director. Mr. Rales disclaims beneficial ownership of the 58,500 shares held by the charitable foundation. Prior to the Separation, shares of Danaher Common Stock owned by SR LLCs were pledged to secure lines of credit with certain banks (the Pre-existing Pledged SR DHR Shares). The SR LLC Shares that were issued as a dividend in the Separation on the Pre-existing Pledged SR DHR Shares were pledged to secure the corresponding lines of credit, and each of these entities and Mr. Rales is in compliance with these lines of credit. Other than shares issued as a dividend on the Pre-existing Pledged SR DHR Shares, no shares of Common Stock are pledged by Mr. Rales. The business address of Steven Rales, and of each of the SR LLCs, is 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037-1701. |

| (7) | Includes options to acquire 3,340 shares. |

| (8) | Includes options to acquire 24,160 shares. |

| (9) | Includes options to acquire 277,975 shares, 14,055 unvested restricted shares, and 26,591 notional phantom shares attributable to Ms. Hulits EDIP account. |

| (10) | Includes options to acquire 149,221 shares, 11,790 unvested restricted shares, and 15,910 notional phantom shares attributable to Mr. McLaughlins EDIP account. |

| (11) | Includes options to acquire 106,637 shares, 6,487 unvested restricted shares, and 6,305 notional phantom shares attributable to Mr. Murphys EDIP account. |

| (12) | Includes options to acquire 141,186 shares, 7,077 unvested restricted shares, and 8,763 notional phantom shares attributable to Mr. Pringles EDIP account. |

| (13) | Includes options to acquire 2,094,662 shares, 1,911 RSUs, 150,299 unvested restricted shares, 19,500 shares attributable to 401(k) accounts and 227,254 notional phantom shares attributable to executive officers EDIP accounts. |

* Represents less than 1% of the outstanding Common Stock.

The following table sets forth the number of shares and percentage of Common Stock beneficially owned by each person who owns of record or is known to Fortive to beneficially own more than five percent of Common Stock.

| NAME AND ADDRESS | NUMBER OF SHARES BENEFICIALLY OWNED |

PERCENT OF CLASS |

||||||||

|

T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202

|

|

43,984,137 |

(1) |

|

13.1 |

% |

||||

|

BlackRock, Inc. 55 East 52nd Street, New York, NY 10055

|

|

22,427,734 |

(2) |

|

6.7 |

% |

||||

|

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355

|

|

22,198,600 |

(3) |

|

6.6 |

% |

||||

|

FMR LLC 245 Summer Street, Boston, MA 02210

|

|

20,627,159 |

(4) |

|

6.1 |

% |

||||

| (1) | The amount shown and the following information is derived from a Schedule 13G/A filed February 14, 2020 by T. Rowe Price Associates, Inc. (Price Associates), which sets forth Price Associates beneficial ownership as of December 31, 2019. According to the Schedule 13G/A, Price Associates has sole voting power over 14,731,096 shares and sole dispositive power over 43,984,137 shares. Price Associates does not serve as custodian of the assets of any of its clients; accordingly, in each instance only the client or the clients custodian or trustee bank has the right to receive dividends paid with respect to, and proceeds from the sale of, such securities. The ultimate power to direct the receipt of dividends paid with respect to, and the proceeds from the sale of, such securities, is vested in the individual and institutional clients which Price Associates serves as investment adviser. Any and all discretionary authority which has been delegated to Price Associates may be revoked in whole or in part at any time. |

| (2) | The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 2020 by BlackRock, Inc. which sets forth BlackRock, Inc.s beneficial ownership as of December 31, 2019. According to the Schedule 13G/A, BlackRock, Inc. has sole voting power over 22,427,734 shares and sole dispositive power over 19,715,569 shares. |

| (3) | The amount shown and the following information is derived from a Schedule 13G/A filed February 10, 2020 by The Vanguard Group, which sets forth their respective beneficial ownership as of December 31, 2019. According to the Schedule 13G/A, The Vanguard Group has sole voting power over 442,669 shares, shared voting power over 86,135 shares, sole dispositive power over 21,694,910 shares and shared dispositive power over 503,750 shares. |

| (4) | The amount shown and the following information is derived from a Schedule 13G/A filed February 7, 2020 by FMR LLC and Abigail P. Johnson, which sets forth their respective beneficial ownership as of December 31, 2019. According to the Schedule 13G/A, FMR LLC has sole voting power over 4,346,261 shares and FMR LLC and Abigail P. Johnson have sole dispositive power over 20,627,159 shares. |

|

2020 Proxy Statement | 11 |

Table of Contents

|

Proposal 1. Election of Directors

|

Our Board is comprised of directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of the Company. Additional details on board membership criteria are set forth on page 26 under Corporate Governance Director Nomination Process.

| 12 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proposal 1. Election of Directors

At the 2017 Annual Meeting of Shareholders, the shareholders approved a proposal from our Board to amend our Certificate of Incorporation to declassify the Board and to provide, starting with the 2019 Annual Meeting of Shareholders, for the election of directors to one-year terms. As a result, our Board will be declassified in the following manner:

|

Beginning with the 2019 Annual Meeting, the directors up for election have been elected to serve one-year terms; | |

|

At this Annual Meeting, a majority of the Board (five out of seven) will be elected by the shareholders to serve one-year terms; and | |

|

Beginning with the 2021 Annual Meeting of Shareholders, the entire Board will be elected annually. | |

At the Annual Meeting, shareholders will be asked to elect Kate D. Mitchell, Mitchell P. Rales, Steven M. Rales, Jeannine Sargent, and Alan G. Spoon (each of whom has been recommended by the Nominating and Governance Committee, has been nominated by the Board and currently serves as a director of Fortive) to serve a one-year term until the 2021 Annual Meeting of Shareholders and until his or her successor is duly elected and qualified.

We have included information as of April 6, 2020 relating to each nominee for election as director and each director continuing in office, including his or her age, the year in which he or she became a director, his or her principal occupation, any board memberships at other public companies during the past five years, and the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Fortive. Please see Corporate Governance Director Nomination Process for a further discussion of the Boards process for nominating Board candidates. In the event a nominee declines or is unable to serve, the proxies may be voted at the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

|

2020 Proxy Statement | 13 |

Table of Contents

Proposal 1. Election of Directors

Director Nominees For One-Year Terms That Will Expire in 2021

| Kate D. Mitchell Age: 61 |

Director since: 2016 Independent |

Other Current Public Company Directorships: SVB Financial Group |

||

Kate D. Mitchell has served as a partner and co-founder of Scale Venture Partners, a Silicon Valley-based firm that invests in early-in-revenue technology companies, since 1997. Prior to her current role, Ms. Mitchell served with Bank of America, a multinational banking and financial services corporation, from 1988 to 1996, most recently as Senior Vice President for Bank of America Interactive Banking. Ms. Mitchell currently serves on the boards of directors of SVB Financial Group, Silicon Valley Community Foundation and other private company boards on behalf of Scale Venture Partners.

Qualifications: Ms. Mitchells qualifications to sit on the Board include, among other factors, over 35 years of extensive experience in the technology industry, with a focus on innovative software and technology markets. In addition, Ms. Mitchell has deep experience as a director, investor and senior executive in the areas of business management and operations, finance, financial reporting, risk management, investment and acquisition strategy, and executive compensation.

| Mitchell P. Rales Age: 63 |

Director since: 2016 | Other Current Public Company Directorships: Danaher Corporation and Colfax Corporation |

||

Mr. Rales is a co-founder of Danaher Corporation and has served as Chairman of the Executive Committee of Danaher since 1984. He was also President of Danaher from 1984 to 1990. In addition, for more than the past five years, he has been a principal in private and public business entities in the manufacturing area.

Qualifications: The strategic vision and leadership of Mr. Rales and his brother, Steven Rales, helped create the foundation of the Fortive Business System and the Danaher Business System and have guided the respective businesses of Fortive and Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Fortive, he is well-positioned to understand, articulate and advocate for the rights and interests of Fortives shareholders.

| Steven M. Rales Age: 69 |

Director since: 2016 | Other Current Public Company Directorships: Danaher Corporation |

||

Mr. Rales is a co-founder of Danaher Corporation and has served as Chairman of the Board of Danaher since 1984. He was also CEO of Danaher from 1984 to 1990. In addition, for more than the past five years, he has been a principal in a private business entity in the area of film production.

Qualifications: The strategic vision and leadership of Mr. Rales and his brother, Mitchell Rales, helped create the foundation of the Fortive Business System and the Danaher Business System and have guided the respective businesses of Fortive and Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Fortive, he is well-positioned to understand, articulate and advocate for the rights and interests of Fortives shareholders.

| 14 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proposal 1. Election of Directors

| Jeannine Sargent Age: 56 |

Director since: 2019 | Other Current Public Company Directorships: Cypress Semiconductor Corp. |

||

Ms. Sargent has served as an operating partner of Katalyst Ventures, an early-stage technology venture fund, since 2018. Previously, Ms. Sargent served as president of Innovation and New Ventures at Flex, a leader in global design and manufacturing, from 2012 until 2017. Prior to joining Flex, Ms. Sargent served as the chief executive officer at Oerlikon Solar, a thin-film silicon solar photovoltaic module manufacturer and a wholly owned subsidiary of Oerlikon, a publicly-traded Swiss company, and Voyan Technology, an embedded systems software provider. Ms. Sargent is also a director and a member of the compensation committee and the nominating and governance committee of Cypress Semiconductor Corp., a publicly-traded provider of advanced embedded system solutions. She also currently serves on several investment and advisory boards and is on the board of trustees at Northeastern University. She holds a bachelor of science in chemical engineering from Northeastern University and certificates from the executive development programs at the MIT Sloan School of Management, Harvard University and Stanford University and CERT certificate of cyber risk oversight from National Association of Corporate Directors in conjunction with Carnegie Mellon University.

Qualifications: Ms. Sargents qualifications to sit on the Board include, among other factors, over 30 years of experience encompassing leadership, operations, marketing and engineering roles with a diverse mix of high technology hardware and software companies across multiple industries. In addition, Ms. Sargent has significant experience with development and global launch of disruptive technology, executing investment and acquisition strategies, corporate governance, cybersecurity and executive compensation.

| Alan G. Spoon Age: 68 |

Director since: 2016 Independent |

Other Current Public Company Directorships: Danaher Corporation, IAC/InteractiveCorp., Match Group, Inc. (Subsidiary of IAC/InteractiveCorp*), and Cable One, Inc. |

||

Mr. Spoon has served as our Chairman of the Board since 2016. In addition, Mr. Spoon served as a Partner of Polaris Partners, a company that invests in private technology and life science firms, from 2000 to 2018, including as Managing General Partner from 2000 to 2010 and as Partner Emeritus from 2015 to 2018. In addition to his prior leadership role at Polaris Partners, Mr. Spoon previously served as president, chief operating officer and chief financial officer of one of the countrys largest, publicly-traded education and media companies, and has served on the boards of numerous public and private companies.

Qualifications: Mr. Spoons public and private company leadership experience gives him insight into business strategy, leadership, marketing, finance, corporate governance, executive compensation and board management. His public company and private equity experience gives him insight into trends in the internet and technology industries, acquisition strategy and financing, each of which represents an area of key strategic opportunity for Fortive.

| * | Based on Schedule 13D/A filed by IAC/InteractiveCorp on February 4, 2020. |

| The Board of Directors recommends that shareholders vote FOR the election to the Board of each of the foregoing Director Nominees. |

|

2020 Proxy Statement | 15 |

Table of Contents

Proposal 1. Election of Directors

Other Directors Directors with Terms That Will Expire in 2021

| Feroz Dewan Age: 43 |

Director since: 2016 Independent |

Other Current Public Company Directorships: The Kraft Heinz Company |

||

Feroz Dewan has served as the Chief Executive Officer of Arena Holdings Management LLC, an investment holding company, since 2016. Previously, Mr. Dewan served in a series of positions with Tiger Global Management, an investment firm with approximately $20 billion under management across public and private equity funds, from 2003 to 2015, including most recently as Head of Public Equities. He also served as a Private Equity Associate at Silver Lake Partners, a private equity firm focused on leveraged buyout and growth capital investments in technology, technology-enabled and related industries, from 2002 to 2003.

Qualifications: Mr. Dewans qualifications to sit on the Board include, among other factors, extensive experience in the technology industries and technology-related companies, including extensive experience in valuation, investments and acquisitions, financial reporting, risk management, corporate governance, capital allocation, and operational oversight.

| James A. Lico Age: 54 |

Director since: 2016 | Other Current Public Company Directorships: None |

||

James A. Lico has served as the Chief Executive Officer and President of Fortive since 2016. From 1996 to 2016, Mr. Lico served in various leadership positions at Danaher Corporation, a global science and technology company, including as Executive Vice President from 2005 to 2016. Mr. Lico also served as a director of NetScout Systems, Inc., a public company, from 2015 to 2018.

Qualifications: Mr. Licos qualifications to sit on the Board include, among other factors, over 20 years of extensive experience in senior leadership positions, including as an Executive Vice President of Danaher with oversight at various times of each of the businesses that was separated from Danaher into Fortive. Mr. Lico, through his various senior leadership positions at Danaher and Fortive, has broad operating and functional experience with, and deep knowledge of, Fortives businesses, the Fortive Business System, capital allocation strategies, acquisitions, marketing and branding, and leadership strategies.

| 16 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

|

|

Our Board of Directors recognizes that protecting long-term value for our shareholders requires a robust framework of corporate governance that serves the best interests of all our shareholders.

In connection with our Boards dedication to strong corporate governance, our Board has implemented the following corporate actions:

Governance Enhancements

|

Adopted proxy access to permit a shareholder, or a group of up to 20 shareholders, owning at least 3% of the outstanding shares continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 20% of the board of directors, as further detailed in our Bylaws |

|

|

Implemented the declassification of the Board to provide for the election of directors for one-year terms |

|

|

Subject to approval by the shareholders of Proposal 4, approved the elimination of the supermajority voting requirements applicable to shares of common stock |

|

|

Documented and executed our commitment to Board diversity in our Corporate Governance Guidelines and the Nominating and Governance Committee Charter |

|

|

Implemented a corporate social responsibility program, as reported in our Corporate Social Responsibility Report with oversight by the Nominating and Governance Committee |

|

|

Implemented an annual shareholder engagement program |

|

|

Formalized and documented in the Audit Committee Charter oversight of our cybersecurity by the Audit Committee, with quarterly review by the Audit Committee of our cybersecurity planning, monitoring, risk management, remediation, and controls |

|

|

Conducted our annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees |

|

|

Implemented stock ownership requirements for non-CEO executive officers at multiple of three times base salary and for CEO and directors at multiple of five times base salary and annual cash retainer, respectively |

|

Additional highlights of our corporate governance framework

|

Our Chairman and CEO positions are separate, with an independent Chairman |

|

|

We maintain a majority vote requirement for the election of directors in uncontested elections |

|

|

We have no shareholder rights plan |

|

|

We have an anti-overboarding policy that limits the number of boards of other public companies on which our directors may serve to four |

|

|

Approximately 86% of our Board is comprised of independent directors |

|

|

All members of the Audit Committee are audit committee financial experts |

|

|

We maintain a related person transaction policy with oversight by the Nominating and Governance Committee |

|

|

All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable Securities and Exchange Commission rules |

|

|

2020 Proxy Statement | 17 |

Table of Contents

Corporate Governance

Corporate Governance Guidelines, Committee Charters and Standards of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and adopted written charters for each of the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Finance Committee of the Board. The Board of Directors has also adopted our Standards of Conduct that includes, among others, a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Nominating and Governance Committee Charter, and Standards of Conduct referenced above are each available in the Investors Corporate Governance section of our website at http://www.fortive.com.

Board Leadership Structure, Risk Oversight and Management Succession Planning

Board Leadership Structure

The Board has separated the positions of Chairman and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our shareholders.

The entire Board selects its Chairman, and our Board has selected Alan G. Spoon, an independent director, as its Chairman, in light of Mr. Spoons independence and his deep experience and knowledge with corporate governance, board management, shareholder engagement, risk management and Fortives diverse businesses and industries.

As the independent Chairman of the Board, Mr. Spoon leads the activities of the Board, including:

| | Calling, and presiding over, all meetings of the Board; |

| | Together with the CEO and the Corporate Secretary, setting the agenda for the Board; |

| | Calling, and presiding over, the executive sessions of non-management directors and of the independent directors; |

| | Advising the CEO on strategic aspects of the Companys business, including developments and decisions that are to be discussed with, or would be of interest to, the Board; |

| | Acting as a liaison as necessary between the non-management directors and the management of the Company; and |

| | Acting as a liaison as necessary between the Board and the committees of the Board. |

In the event that the Chairman of the Board is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select by majority vote an independent director to serve as the Lead Independent Director with the authority to:

| | Preside over all meetings of the Board at which the Chair is not present, including the executive sessions; |

| | Call meetings of the independent directors; |

| | Act as a liaison as necessary between the independent directors and the CEO; and |

| | Advise with respect to the Boards agenda. |

The Boards non-management directors meet in executive session following the Boards regularly-scheduled meetings, with the executive sessions chaired by the independent Chairman. In addition, the independent directors meet as a group in executive session at least once a year.

| 18 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

Risk Oversight

The Boards role in risk oversight at the Company is consistent with the Companys leadership structure, with management having day-to-day responsibility for assessing and managing the Companys risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company.

In determining to separate the position of the CEO and the Chairman, and in determining the appointment of the Chairman of the Board and the Chairs of the committees of the Board, the Board and the Nominating and Governance Committee considered the implementation of a governance structure and appointment of chairpersons with appropriate and relevant risk management experience that would enable Fortive to efficiently and effectively assess and oversee its risks.

Risk Oversight by the Board of Directors

The Board oversees the Companys risk management processes directly and through its committees. In general, the Board oversees the management of risks inherent in the operation of the Companys businesses, the implementation of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure, and also oversees the Companys risk assessment and risk management policies.

Risk Oversight by the Committees

| AUDIT COMMITTEE |

The Audit Committee oversees risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks. The Audit Committee also assists the Board in overseeing the Companys risk assessment and risk management policies. Finally, the Audit Committee oversees our cybersecurity risk management and risk controls.

|

|

|

COMPENSATION COMMITTEE

|

The Compensation Committee oversees risks associated with the Companys compensation policies and practices.

|

|

|

NOMINATING AND GOVERNANCE COMMITTEE

|

The Nominating and Governance Committee oversees risks associated with corporate governance, board management and corporate social responsibility. | |

|

FINANCE COMMITTEE

|

The Finance Committee oversees risks associated with the execution of the Companys acquisition, investment and divestiture strategies.

|

Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committees risk oversight activities. In addition, since risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

Cybersecurity

The Board has delegated to the Audit Committee the responsibility of exercising oversight with respect to the Companys cybersecurity risk management and risk controls, with the Chair of the Audit Committee having received CERT certification on cyber risk oversight. Consistent with such delegation, our Chief Information Officer provides a report to the Audit Committee on quarterly basis, and to the Board on an annual basis, regarding the Companys cybersecurity program, including the Companys monitoring, auditing, implementation and communication processes, controls, and procedures.

|

2020 Proxy Statement | 19 |

Table of Contents

Corporate Governance

Risk Committee

The Companys Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts, and, on at least an annual basis, provides a report to the Board and provides a report of the process to the Audit Committee.

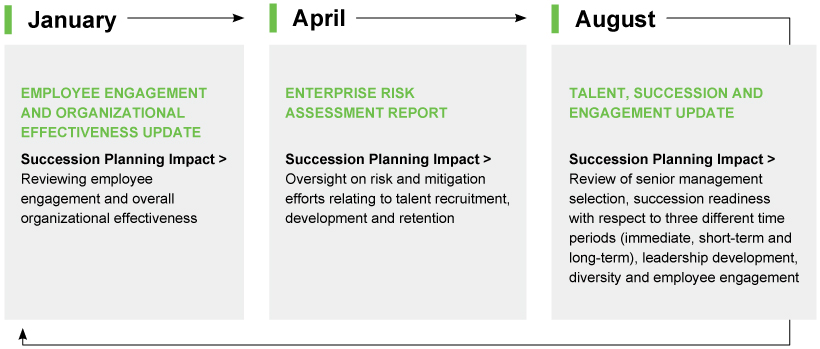

Management Succession Planning

The entire Board oversees the recruitment, development, and retention of our executive officers, including oversight of management succession planning. In addition to the formal activities noted below, the Board and its committee members engage and assess our executive officers and high-potential employees during management presentations, our annual multi-day leadership conference, and periodic informal meetings.

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the NYSE. The Board has affirmatively determined that Mss. Kate D. Mitchell and Jeannine Sargent and Messrs. Feroz Dewan, Mitchell P. Rales, Steven M. Rales, and Alan G. Spoon are independent within the meaning of the listing standards of the NYSE.

| 20 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

Board of Directors and Committees of the Board

Director Attendance

In 2019, the Board met seven times and acted by unanimous written consent two times. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served during 2019. As a general matter, directors are expected to attend annual meetings of shareholders. Seven out of the eight members of the Board attended the 2019 Annual Meeting of Shareholders.

Committee Membership

The membership of each of the Audit, Compensation, Nominating and Governance and Finance committees as of April 6, 2020 is set forth below.

|

NAME OF DIRECTOR

|

AUDIT

|

COMPENSATION

|

NOMINATING AND

|

FINANCE

|

||||

| Feroz Dewan

|

Member | Member | ||||||

| James A. Lico

|

Member | |||||||

| Kate D. Mitchell

|

Member | Chair | ||||||

| Mitchell P. Rales

|

Member | |||||||

| Steven M. Rales

|

Member | |||||||

| Jeannine Sargent

|

Chair | Member | Member | |||||

| Alan G. Spoon

|

Chair | Chair | ||||||

In 2019, the Audit Committee met eight times.

The Audit Committee is responsible for:

| | Assessing the qualifications and independence of Fortives independent auditors; |

| | Appointing, compensating, retaining, and evaluating Fortives independent auditors; |

| | Overseeing the quality and integrity of Fortives financial statements and making a recommendation to the Board regarding the inclusion of the audited financial statements in Fortives Annual Report on Form 10-K; |

| | Overseeing Fortives internal auditing processes; |

| | Overseeing managements assessment of the effectiveness of Fortives internal control over financial reporting; |

| | Overseeing managements assessment of the effectiveness of Fortives disclosure controls and procedures; |

| | Overseeing risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks; |

| | Overseeing Fortives risk assessment and risk management policies; |

| | Overseeing Fortives compliance with legal and regulatory requirements; |

| | Overseeing Fortives cybersecurity risk management and risk controls; and |

| | Overseeing swap and derivative transactions and related policies and procedures. |

|

2020 Proxy Statement | 21 |

Table of Contents

Corporate Governance

The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and the independent auditor in carrying out its oversight responsibilities. Management is responsible for the preparation, presentation, and integrity of Fortives financial statements, accounting and financial reporting principles, internal control over financial reporting, and disclosure controls and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of Fortives system of internal control over financial reporting. Fortives independent auditor, Ernst & Young LLP, is responsible for performing independent audits of Fortives financial statements and internal control over financial reporting and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

The Audit Committee also prepares a report as required by the SEC to be included in this proxy statement. The Audit Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.

The Board has determined that each member of the Audit Committee is:

| | Independent for purposes of Rule 10A-3(b)(1) under the Securities Exchange Act and the NYSE listing standards; |

| | Qualified as an audit committee financial expert as that term is defined in SEC rules; and |

| | Financially literate within the meaning of the NYSE listing standards. |

Furthermore, as of the date of this proxy statement, no Audit Committee member serves on the audit committee of more than three public companies.

In 2019, the Compensation Committee met six times.

The Compensation Committee is responsible for:

| | Determining and approving the form and amount of annual compensation of the CEO and our other executive officers, including evaluating the performance of, and approving the compensation paid to, our CEO and other executive officers; |

| | Reviewing and making recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercising all authority with respect to the administration of such plans; |

| | Reviewing and making recommendations to the Board with respect to the form and amounts of director compensation; |

| | Overseeing and monitoring compliance with Fortives compensation recoupment policy; |

| | Overseeing and monitoring compliance by directors and executive officers with Fortives stock ownership requirements; |

| | Overseeing risks associated with Fortives compensation policies and practices; |

| | Overseeing our engagement with shareholders and proxy advisory firms regarding executive compensation matters; and |

| | Reviewing and discussing with management the Compensation Discussion & Analysis (CD&A) in the annual proxy statement and recommending to the Board the inclusion of the CD&A in the proxy statement. |

The Chair of the Compensation Committee works with our Senior Vice President-Human Resources and our Corporate Secretary to schedule the Compensation Committees meetings and set the agenda for each meeting. Our Senior Vice President-Human Resources, Vice President-Total Rewards, Senior Vice President-General Counsel, and Vice President-Associate General Counsel and Secretary generally attend, and from time-to-time our CEO and CFO attend, the Compensation Committee meetings and support the Compensation Committee in preparing meeting materials and taking meeting minutes. In particular, our CEO provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with

| 22 | 2020 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

our overall strategy; participates in the Compensation Committees discussions regarding the performance and compensation of the other executive officers; and provides recommendations to the Compensation Committee regarding all significant elements of compensation paid to such other executive officers, their annual, personal performance objectives and his evaluation of their performance. The Compensation Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendation at each regularly scheduled Board meeting.

Under the terms of its charter, the Compensation Committee has the authority to engage the services of outside advisors and experts to assist the Compensation Committee. Following the assessment and determination of Pearl Meyer & Partners, LLCs (Pearl Meyer) independence from Fortives management, the Compensation Committee engaged Pearl Meyer as the Compensation Committees independent compensation consultant for 2019. The Compensation Committee had the sole discretion and authority to select, retain and terminate Pearl Meyer as well as to approve any fees, terms and other conditions of its services. Pearl Meyer reported directly to the Compensation Committee and took its direction solely from the Compensation Committee. Pearl Meyers primary responsibilities in 2019 were to provide advice and data in connection with the selection of Fortives peer group for assessing executive compensation, the structuring of the executive compensation programs in 2019 and 2020, the compensation levels for our executive officers, and the compensation levels for our directors; assess our executive compensation program in the context of market practices and corporate governance best practices; and advise the Compensation Committee regarding our proposed executive compensation public disclosures. In the course of discharging its responsibilities, the Compensation Committees independent compensation consultant may, from time to time and with the Compensation Committees consent, request from management certain information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of our executive officer responsibilities and other business information. Pearl Meyer did not provide any services to Fortive or its management in 2019, and the Compensation Committee is not aware of any work performed by Pearl Meyer that raises any conflicts of interest.

Each member of the Compensation Committee is:

| | A non-employee director for purposes of Rule 16b-3 under the Securities Exchange Act; and |

| | Based on the determination of the Board, independent under NYSE listing standards and under Rule 10C-1 under the Securities Exchange Act. |

Compensation Committee Interlocks and Insider Participation

During 2019, none of the members of the Compensation Committee was an officer or employee of Fortive. No executive officer of Fortive served on the compensation committee (or other board committee performing equivalent functions) or on the board of directors of any entity having an executive officer who served on the Compensation Committee.

Nominating and Governance Committee

In 2019, the Nominating and Governance Committee met three times and acted by unanimous written consent one time.

The Nominating and Governance Committee is responsible for:

| | Reviewing and making recommendations to the Board regarding the size, classification and composition of the Board; |

| | Assisting the Board in identifying individuals qualified to become Board members; |

| | Assisting the Board in identifying characteristics, skills, and experiences for the Board with the objective of having a Board with diverse backgrounds, experiences, skills, and perspectives; |

| | Proposing to the Board the director nominees for election by our shareholders at each annual meeting; |

| | Assisting the Board in determining the independence and qualifications of the Board and Committee members and making recommendations to the Board regarding committee membership; |

|

2020 Proxy Statement | 23 |

Table of Contents

Corporate Governance

| | Developing and making recommendations to the Board regarding a set of corporate governance guidelines and reviewing such guidelines on an annual basis; |

| | Overseeing compliance with the corporate governance guidelines; |

| | Overseeing director education and director orientation process and programs; |

| | Overseeing Fortives corporate social responsibility reporting; |

| | Assisting the Board and the Committees in engaging in annual self-assessment of their performance; and |

| | Administering Fortives Related Person Transactions Policy. |

The Board has determined that each member of the Nominating and Governance Committee is independent within the meaning of the NYSE listing standards.

The Nominating and Governance Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.