DEF 14A: Definitive proxy statements

Published on April 16, 2018

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

FORTIVE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

|

|||

| 2) | Aggregate number of securities to which transaction applies:

|

|||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| 4) | Proposed maximum aggregate value of transaction:

|

|||

| 5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount previously paid:

|

|||

| 2) | Form, Schedule or Registration Statement No.:

|

|||

| 3) | Filing party:

|

|||

| 4) | Date Filed:

|

|||

Table of Contents

Table of Contents

FORTIVE CORPORATION

6920 Seaway Blvd

Everett, WA 98203

Notice of 2018 Annual Meeting of Shareholders

|

|

|

|

|||

| When:

June 5, 2018 at 3:00 p.m., PDT.

Where:

Fortive Corporation 6920 Seaway Blvd Everett, WA 98203 |

Items of Business:

4 proposals as listed below

Date of Mailing:

The date of mailing of this Proxy Statement or Notice of Internet Availability is on or about April 18, 2018. |

Who Can Vote:

Shareholders of Fortives common stock at the close of business on April 9, 2018. |

Attending the Meeting:

Shareholders who wish to attend the meeting in person should review the instructions set forth in the attached proxy statement under Annual Meeting Admission.

|

|||

Items of Business:

| 1. | To elect Mr. Feroz Dewan and Mr. James Lico to serve as Class II Directors, each for a three-year term expiring at the 2021 annual meeting and until their successors are elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as Fortives independent registered public accounting firm for the year ending December 31, 2018. |

| 3. | To approve on an advisory basis Fortives named executive officer compensation. |

| 4. | To approve the Fortive Corporation 2016 Stock Incentive Plan, as amended and restated. |

| 5. | To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Most shareholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card or voting instruction form. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 5, 2018:

The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com.

By Order of the Board of Directors,

Daniel B. Kim

Secretary

April 18, 2018

Table of Contents

Table of Contents

| ii | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

|

Proxy Statement Summary

|

To assist you in reviewing the proposals to be acted upon at our 2018 Annual Meeting, below is summary information regarding the meeting contained elsewhere in this Proxy Statement. The following description is only a summary. For more information about these topics, please review the complete Proxy Statement.

2018 Annual Meeting of Shareholders

| Date and time: |

June 5, 2018, 3:00 p.m. PDT | |

| Place: |

Fortive Corporation 6920 Seaway Blvd Everett, WA 98203 |

|

| Record date: |

April 9, 2018 | |

| Voting: |

Shareholders of Fortives common stock at the close of business on April 9, 2018 are entitled to one vote per share of common stock on each matter to be voted upon at the 2018 Annual Meeting of Shareholders (Annual Meeting). | |

| Admission: |

Shareholders who wish to attend the meeting in person should review the instructions set forth under Annual Meeting Admission on page 7 | |

Items of Business

| PROPOSAL | VOTE REQUIRED | BOARD RECOMMENDATION |

||

| Proposal 1: Election of Class II Directors (page 13) |

For each Class II Director nominee, majority of votes cast. | FOR each nominee | ||

| Proposal 2: Ratification of the appointment of the independent registered public accounting firm (page 32) |

The affirmative vote of a majority of the shares represented in person or by proxy. | FOR | ||

| Proposal 3: Approval on an advisory basis of Fortives named executive officer compensation (page 68) |

The affirmative vote of a majority of the shares represented in person or by proxy. | FOR | ||

| Proposal 4: Approval of the Fortive Corporation 2016 Stock Incentive Plan, as amended and restated (page 69) |

The affirmative vote of a majority of the shares represented in person or by proxy. | FOR |

Company Overview

Fortive is a diversified industrial growth company comprised of Professional Instrumentation and Industrial Technologies businesses that are recognized leaders in attractive markets. With 2017 revenues of $6.7 billion, Fortives well-known brands hold leading positions in field instrumentation, transportation, sensing, product realization, automation and specialty, and franchise distribution. Fortive is headquartered in Everett, Washington and employs a team of more than 26,000 research and development, manufacturing, sales, distribution, service and administrative employees in more than 50 countries around the world. With a culture rooted in continuous improvement, the core of our companys operating model is the Fortive Business System.

|

2018 Proxy Statement | 1 |

Table of Contents

Proxy Statement Summary

2017 Company Performance Highlights

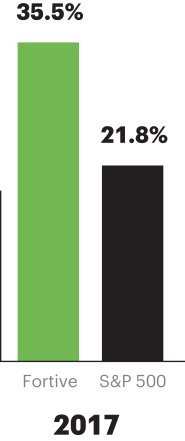

| Total Shareholder Return

Our one-year total shareholder return (TSR) was

|

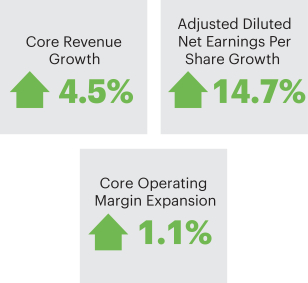

Financial Performance*

We continued to grow our business on a year-over-year basis. The following non-GAAP measures were used, among others, in our annual incentive compensation program:

* Core revenue, adjusted earnings per share and core operating margin are non-GAAP measures and are reconciled to the most directly comparable GAAP measures in Appendix A. |

Acquisitions

| $1.6 BILLION IN CAPITAL DEPLOYED IN 2017 FOR ACQUISITIONS

|

|

Landauer, Inc.

Leading global provider of subscription-based technical and analytical services to manage occupational and environmental radiation exposure

|

|

Industrial Scientific Corporation

Leading provider of portable gas detection solutions, including sensors, instruments and software, offered to customers as safety-as-a-service

|

|

Orpak Systems Limited

Leading provider of fuel station automation solutions, fleet management, automatic vehicle identification, payments and point-of-sale software in high growth markets |

| 2 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement Summary

Corporate Governance Highlights

Our Board of Directors recognizes that enhancing and protecting long-term value for our shareholders requires a robust framework of corporate governance that serves the best interests of all our shareholders.

In connection with our Boards dedication to strong corporate governance, our Board has approved the following corporate governance matters following the separation of Fortive from Danaher Corporation (the Separation):

Recent Governance Actions

|

Adopted proxy access to permit a shareholder, or a group of up to 20 shareholders, owning at least 3% of the outstanding shares continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 20% of the board of directors, as further detailed in our Bylaws | |

|

Commenced the declassification of the Board to provide for the annual election of directors after a sunset period | |

|

Documented our commitment to Board diversity in our Corporate Governance Guidelines and the Nominating and Governance Committee Charter | |

|

Adopted and launched a formal annual shareholder engagement process, with the first shareholder outreach conducted in the fourth quarter of 2017 | |

|

Formalized and documented in the Audit Committee Charter oversight of our cybersecurity by the Audit Committee, with quarterly review by the Audit Committee of our cybersecurity planning, monitoring, risk management, remediation, and controls | |

|

Adopted, launched and conducted an annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees | |

|

Increased the stock ownership requirements for non-CEO executive officers to a multiple of three times base salary and maintained the stock ownership requirements for CEO and directors as a multiple of five times base salary and annual cash retainer, respectively | |

Additional highlights of our corporate governance framework

|

Our Chairman and CEO positions are separate, with an independent Chairman | |

|

We maintain a majority vote requirement for the election of directors in uncontested elections | |

|

We have no shareholder rights plan | |

|

We have an anti-overboarding policy that limits the number of boards of other public companies on which our directors may serve to four | |

|

All members of the Audit Committee are audit committee financial experts | |

|

We maintain a related person transaction policy with oversight by the Nominating and Governance Committee | |

|

All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable Securities and Exchange Commission rules | |

|

2018 Proxy Statement | 3 |

Table of Contents

Proxy Statement Summary

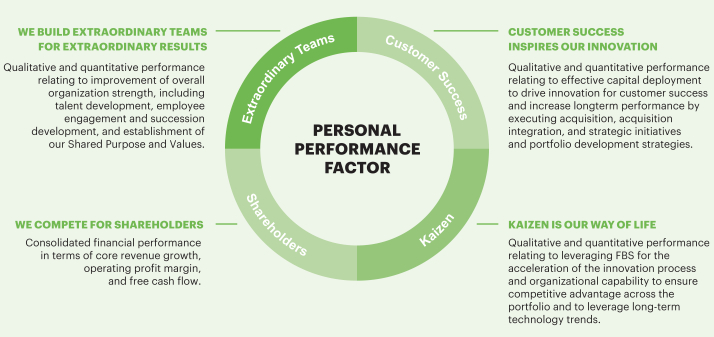

Executive Compensation Philosophy

Our compensation philosophy is aligned with building long-term shareholder value, with our executive compensation program designed to:

|

ATTRACT, RECRUIT & RETAIN | Recruit, retain, and motivate talented, curious people with a passion for creativity, innovation, continuous improvement, and customer experience | ||

|

COMPETITIVE | Deliver a total pay opportunity that is competitive in the market for our executive talent | ||

|

ALIGNMENT WITH BUSINESS STRATEGY | Focus our incentive compensation programs on performance that leads to sustained shareholder value creation, consistent with our business strategy | ||

|

PAY FOR PERFORMANCE | With a culture of high expectations, set, achieve, and reward for both the short-term and long-term performance | ||

|

ALIGNMENT WITH SHAREHOLDERS | Support alignment with shareholders with an emphasis on long-term, equity-based compensation |

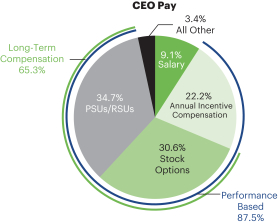

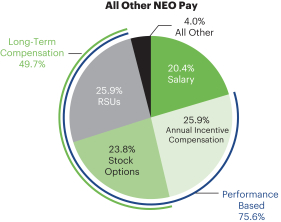

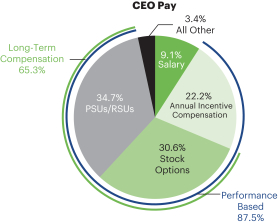

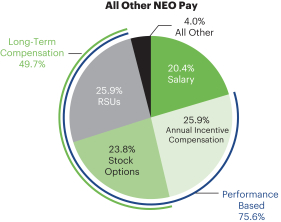

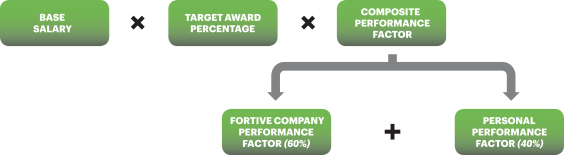

2017 Summary Compensation

|

|

2017 Compensation Enhancements

The Compensation Committee made the following enhancements to our 2017 executive compensation program consistent with our compensation philosophy:

|

|

Added Free Cash Flow and ROIC to supplement Adjusted EPS as financial performance measures for the 2017 annual incentive awards to better align compensation performance measures with our overall strategy and internal core value drivers

|

|

|

|

Increased minimum stock ownership requirements for each of the non-CEO executive officers to a multiple of three times base salary while maintaining the requirement for Mr. Lico to a multiple of five times base salary

|

| 4 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement Summary

|

|

Revised the vesting schedule for the equity awards that we granted to the executive officers (other than our CEO) so that one-third of such awards vest on each of the 3rd, 4th and 5th anniversaries of the grant date rather than having them vest in 5 equal installments beginning on the first anniversary of the grant date, while the equity awards for our CEO will continue to vest 50% per year on the 4th and 5th anniversaries of the grant date

|

|

|

|

Adopted a change in control plan that provides for a double trigger (an executive is entitled to benefits only if there is both a change in control and a termination of employment), includes a limited definition of change in control, and prohibits a tax gross up, to ensure that our executive officers remain focused on our businesses during periods of uncertainty and pursue transactions in the best interest of the shareholders

|

Compensation Governance Highlights

| WHAT WE DO | WHAT WE DONT DO | |||||||

|

2018 Proxy Statement | 5 |

Table of Contents

Proxy Statement Summary

[THIS PAGE INTENTIONALLY LEFT BLANK]

| 6 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

|

|

Fortive Corporation

6920 Seaway Blvd

Everett, WA 98203

2018 Annual Meeting of Shareholders

June 5, 2018

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (Board) of Fortive Corporation, a Delaware corporation (Fortive), of proxies for use at the 2018 Annual Meeting of Shareholders (the Annual Meeting) to be held at Fortive Corporation, Headquarters, 6920 Seaway Blvd., Everett, WA 98203 at 3:00 p.m., PDT, and at any and all postponements or adjournments thereof. Fortives principal address is 6920 Seaway Blvd., Everett, WA 98203. The date of mailing of this Proxy Statement is on or about April 18, 2018.

The purpose of the meeting is to:

| 1. | Elect Mr. Feroz Dewan and Mr. James Lico to serve as Class II Directors, each for a three-year term expiring at the 2021 annual meeting and until their successors are elected and qualified; |

| 2. | Ratify the selection of Ernst & Young LLP as Fortives independent registered public accounting firm for the year ending December 31, 2018; |

| 3. | Approve on an advisory basis Fortives named executive officer compensation; |

| 4. | Approve the Fortive Corporation 2016 Stock Incentive Plan, as amended and restated; and |

| 5. | Consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

Please be prepared to present photo identification for admittance. If you are a shareholder of record or hold your shares through the Fortive Corporation Retirement Savings Plan or the Fortive Corporation Union Retirement Savings Plan (collectively, the Savings Plans), your name will be verified against the list of shareholders of record or plan participants on the record date prior to your being admitted to the Annual Meeting. If you are not a shareholder of record or a Savings Plan participant but hold shares through a broker, bank or nominee (i.e., in street name), you should also be prepared to provide proof of beneficial ownership as of the record date, such as a brokerage account statement showing your ownership as of the record date, a copy of the voting instruction card provided by your broker, bank or nominee, or other similar evidence of ownership.

Outstanding Stock and Voting Rights

In accordance with Fortives Amended and Restated Bylaws, the Board has fixed the close of business on April 9, 2018 as the record date for determining the shareholders entitled to notice of, and to vote at, the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to vote. The only outstanding securities of Fortive entitled to vote at the Annual Meeting are shares of Common Stock, $.01 par value (Common Stock). Each outstanding share of Common Stock entitles the holder to one vote on each directorship and other matter brought before the Annual Meeting. As of the close of business on April 9, 2018, 348,538,488 shares of Common Stock were outstanding, excluding shares held by or for the account of Fortive.

|

2018 Proxy Statement | 7 |

Table of Contents

Proxy Statement

The proxies being solicited hereby are being solicited by Fortives Board. The total expense of the solicitation will be borne by Fortive, including reimbursement paid to banks, brokerage firms and nominees for their reasonable expenses in forwarding material regarding the Annual Meeting to beneficial owners. Solicitation of proxies may be made personally or by mail, telephone, internet, e-mail or facsimile by officers and other management employees of Fortive, who will receive no additional compensation for their services.

Proxies will be voted as specified in the shareholders proxy.

If you sign and submit your proxy card with no further instructions, your shares will be voted:

| | FOR the election of each of Mr. Dewan and Mr. Lico to serve as Class II directors; |

| | FOR ratification of the selection of Ernst & Young LLP as Fortives independent registered public accounting firm for the year ending December 31, 2018; |

| | FOR approval of the Companys named executive officer compensation; |

| | FOR approval of the Fortive Corporation 2016 Stock Incentive Plan, as amended and restated; and |

| | In the discretion of the proxy holders on any other matter that properly comes before the meeting or any adjournment thereof. The Board has selected Peter C. Underwood and Daniel B. Kim to act as proxies with full power of substitution. |

Notice of Electronic Availability of Proxy Materials

As permitted by the SEC rules, we are making the proxy materials available to our shareholders primarily via the Internet. By doing so, we can reduce the printing and delivery costs and the environmental impact of the Annual Meeting. On April 18, 2018, we mailed a Notice of Internet Availability of Proxy Materials (the Notice) to our shareholders. The Notice contains instructions on how to access our proxy materials and how to vote online or by telephone. If you would like to receive a paper copy of the proxy materials, please follow the instructions in the Notice.

Voting Requirements With Respect to Each of the Proposals Described in this Proxy Statement

Quorum. The quorum necessary to conduct business at the Annual Meeting consists of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting as of the record date. Abstentions and broker non-votes will be counted as present in determining whether the quorum requirement is satisfied.

Broker Non-Votes. Under New York Stock Exchange (NYSE) rules, if your broker holds your shares in its name and does not receive voting instructions from you, your broker has discretion to vote those shares on Proposal 2, which is considered a routine matter. However, on non-routine matters such as Proposals 1, 3 and 4, your broker must receive voting instructions from you, as it does not have discretionary voting power for these particular items. Therefore, if you are a beneficial owner and do not provide your broker with voting instructions, your shares may constitute broker non-votes with respect to Proposals 1, 3 and 4. Broker non-votes will not affect the required vote with respect to Proposals 1, 3 and 4.

Approval Requirements. If a quorum is present, the vote required under the Companys Amended and Restated Bylaws and the Amended and Restated Certificate of Incorporation to approve each of the proposals is as follows:

| | With respect to Proposal 1, the election of directors, you may vote for or against any or all Class II director nominees or you may abstain as to any or all director nominees. In uncontested elections of directors, such as this election, a nominee is elected by a majority of the votes cast by the shares present in person or represented by proxy and entitled to |

| 8 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proxy Statement

| vote. A majority of the votes cast means that the number of votes cast for a director nominee must exceed the number of votes cast against that nominee. A vote to abstain is not treated as a vote for or against, and thus will have no effect on the outcome of the vote. Under our director resignation policy, our Board will not appoint or nominate for election to the Board any person who has not tendered in advance an irrevocable resignation effective in such circumstances where the individual does not receive a majority of the votes cast in an uncontested election and such resignation is accepted by the Board. If an incumbent director is not elected by a majority of the votes cast in an uncontested election, our Nominating and Governance Committee will submit for prompt consideration by the Board a recommendation whether to accept or reject the directors resignation. The Board expects the director whose resignation is under consideration to abstain from participating in any decision regarding that resignation. |

| | With respect to Proposals 2, 3 and 4, the affirmative vote of a majority of the shares of Common Stock represented in person or by proxy and entitled to vote on the proposal is required for approval. For these proposals, abstentions are counted for purposes of determining the minimum number of affirmative votes required for approval and, accordingly, have the effect of a vote against the proposal. |

Tabulation of Votes. Our inspector of election, Broadridge Financial Services, will tabulate votes cast by proxy or in person at the meeting. We will report the results in a Current Report on Form 8-K filed with the SEC within four business days of the Annual Meeting.

If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered the registered holder of those shares. As the registered shareholder, you can ensure your shares are voted at the Annual Meeting by submitting your instructions by telephone, over the internet, by completing, signing, dating and returning the enclosed proxy card in the envelope provided, or by attending the Annual Meeting and voting your shares at the meeting. Telephone and internet voting for registered shareholders will be available 24 hours a day, up until 11:59 p.m., Central time on June 4, 2018.

Detailed instructions for telephone and internet voting are set forth on the Notice.

|

|

Vote your shares at www.proxyvote.com. | |

| Have your Notice of Internet Availability or proxy card in hand for the 16-digit control number needed to vote. | ||

|

|

Call toll-free number 1-800-690-6903 | |

|

|

Mark, sign, date, and return the enclosed proxy card or voting instruction form in the envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | |

If you hold your shares through a broker, bank or nominee, rather than registered directly in your name, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or nominee, together with a voting instruction form. As the beneficial owner, you are entitled to direct the voting of your shares by your intermediary. Brokers, banks and nominees typically offer telephonic or electronic means by which the beneficial owners of shares held by them can submit voting instructions, in addition to the traditional mailed voting instruction forms.

|

2018 Proxy Statement | 9 |

Table of Contents

Proxy Statement

If you participate in the Fortive Stock Fund through either of the Savings Plans, your proxy will also serve as a voting instruction for Fidelity Management Trust Company (Fidelity), the trustee of the Savings Plans, with respect to shares of Common Stock attributable to your Savings Plan account as of the record date. Fidelity will vote your Savings Plan shares as of the record date in the manner directed by you. If Fidelity does not receive voting instructions from you by June 1, 2018, Fidelity will not vote your Savings Plan shares on any of the proposals brought at the Annual Meeting.

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing with the Secretary of Fortive a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or nominee and you wish to revoke your proxy or vote at the meeting, you must follow the instructions provided to you by the record holder and/or obtain from the record holder a proxy issued in your name. Attendance at the meeting will not, by itself, revoke a proxy.

We are permitted to send a single set of our proxy statement and annual report to shareholders who share the same last name and address. This procedure is called householding and is intended to reduce our printing and postage costs. We will promptly deliver a separate copy of our annual report and proxy statement to you if you contact us at Fortive Corporation, Attn: Investor Relations, 6920 Seaway Blvd., Everett, WA 98203; telephone us at 425-446-5000; or email us at investors@fortive.com. In addition, if you want to receive separate copies of the proxy statement or annual report in the future; if you and another shareholder sharing an address would like to request delivery of a single copy of the proxy statement or annual report at such address in the future; or if you would like to make a permanent election to receive either printed or electronic copies of the proxy materials and annual report in the future, you may contact us at the same address, telephone number or email address. If you hold your shares through a broker or other intermediary and would like additional copies of our proxy statement or annual report or would like to request householding, please contact your broker or other intermediary.

| 10 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

|

Beneficial Ownership of Common Stock by Directors, Officers and Principal Shareholders

|

Directors and Executive Officers

The following table sets forth as of April 9, 2018 (unless otherwise indicated) the number of shares and percentage of Common Stock beneficially owned by each of Fortives directors, nominees for director and each of the executive officers named in the Summary Compensation Table (the named executive officers), and all executive officers and directors of Fortive as a group. Except as otherwise indicated and subject to community property laws where applicable, each person or entity included in the table below has sole voting and investment power with respect to the shares beneficially owned by that person or entity. Under applicable SEC rules, the definition of beneficial ownership for purposes of this table includes shares over which a person or entity has sole or shared voting or investment power, whether or not the person or entity has any economic interest in the shares, and also includes shares as to which the person has the right to acquire beneficial ownership within 60 days of April 9, 2018. Except as indicated, the address of each director and executive officer shown in the table below is c/o Fortive Corporation, 6920 Seaway Blvd, Everett, WA 98203.

| NAME | NUMBER OF SHARES BENEFICIALLY OWNED (1) |

PERCENT OF CLASS (1) |

||||||||

| Feroz Dewan |

8,580 | (2) | * | |||||||

| James A. Lico |

1,405,979 | (3) | * | |||||||

| Kate D. Mitchell |

8,580 | (4) | * | |||||||

| Mitchell P. Rales |

18,565,530 | (5) | 5.3 | % | ||||||

| Steven M. Rales |

21,570,210 | (6) | 6.2 | % | ||||||

| Israel Ruiz |

8,580 | (7) | * | |||||||

| Alan G. Spoon |

36,363 | (8) | * | |||||||

| Martin Gafinowitz |

271,242 | (9) | * | |||||||

| Barbara B. Hulit |

261,964 | (10) | * | |||||||

| Charles E. McLaughlin |

137,662 | (11) | * | |||||||

| William W. Pringle |

124,453 | (12) | * | |||||||

| All current executive officers and directors as a group (18 persons) |

42,867,828 | (13) | 12.2 | % | ||||||

| (1) | Balances credited to each executive officers account under the Fortive Executive Deferred Incentive Plan (the EDIP) which are vested or are scheduled to vest within 60 days of April 9, 2018, are included in the table. See Employee Benefit PlansFortive Executive Deferred Incentive Plan for a description of our EDIP. The incremental number of notional phantom shares of Common Stock credited to a persons EDIP account is based on the incremental amount of contribution to the persons EDIP balance divided by the closing price of Common Stock as reported on the NYSE on the date of the contribution. In addition, for purposes of the table, the number of shares attributable to each executive officers 401(k) Plan account is equal to (a) the officers balance, as of March 31, 2018, in the Fortive stock fund included in the executive officers 401(k) Plan account (the 401(k) Fortive Stock Fund), divided by (b) the closing price of Common Stock as reported on the NYSE on March 31, 2018. The 401(k) Fortive Stock Fund consists of a unitized pool of Common Stock and cash. The table also includes shares that may be acquired upon exercise of options that are exercisable within 60 days of April 9, 2018 or upon vesting of Restricted Stock Units (RSUs) that vest within 60 days of April 9, 2018. The table also includes unvested restricted shares that are subject only to time-vesting requirements. Restricted shares and performance shares, in each case, granted to executive officers that are subject to satisfaction of performance measures (all of which are subject to measurement more than 60 days after April 9, 2018) are not included in the table. In addition, RSUs granted to a non-executive director for which shares are not delivered until the earlier of the directors death or the first day of the seventh month following the directors resignation from the board are not included in the table. |

| (2) | Includes options to acquire 8,580 shares. |

| (3) | Includes options to acquire 1,041,453 shares, 11,585 RSUs, 92,338 unvested restricted shares, 49,996 shares attributable to Mr. Licos 401(k) Fortive Stock Fund and 95,661 notional phantom shares attributable to Mr. Licos EDIP account. |

| (4) | Includes options to acquire 8,580 shares. |

| (5) | Includes 17,000,000 shares (the MR LLC Shares) owned by limited liability companies of which Mr. Rales is the sole member (the MR LLCs), 1,184,955 other shares owned indirectly, and options to acquire 4,340 shares. Prior to the Separation, shares of Danaher Common Stock owned by MR LLCs were pledged to secure lines of credit with certain banks (the Pre-existing Pledged MR DHR Shares). The MR LLC Shares that were issued as a dividend in the Separation on the Pre-existing Pledged MR DHR Shares were pledged to secure the corresponding lines of credit, and each of these entities and Mr. Rales is in compliance with these lines of credit. Other than the MR LLC Shares issued as a dividend on the Pre-existing Pledged MR DHR Shares, no shares of Common Stock have been pledged or are permitted to be pledged by Mr. Rales. The business address of Mitchell Rales, and of each of the MR LLCs, is 11790 Glen Road, Potomac, MD 20854. |

|

2018 Proxy Statement | 11 |

Table of Contents

Beneficial Ownership of Common Stock by Directors, Officers and Principal Shareholders

| (6) | Includes 17,000,000 shares owned by limited liability companies (the SR LLC Shares) of which Mr. Rales is the sole member (the SR LLCs), options to acquire 4,340 shares, and 58,500 shares owned by a charitable foundation of which Mr. Rales is a director. Mr. Rales disclaims beneficial ownership of the 58,500 shares held by the charitable foundation. Prior to the Separation, shares of Danaher Common Stock owned by SR LLCs were pledged to secure lines of credit with certain banks (the Pre-existing Pledged SR DHR Shares). The SR LLC Shares that were issued as a dividend in the Separation on the Pre-existing Pledged SR DHR Shares were pledged to secure the corresponding lines of credit, and each of these entities and Mr. Rales is in compliance with these lines of credit. Other than the SR LLC Shares issued as a dividend on the Pre-existing Pledged SR DHR Shares, no shares of Common Stock have been pledged or are permitted to be pledged by Mr. Rales. The business address of Steven Rales, and of each of the SR LLCs, is 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037-1701. |

| (7) | Includes options to acquire 8,580 shares. |

| (8) | Includes options to acquire 13,690 shares. |

| (9) | Includes options to acquire 143,212 shares, 1,163 RSUs, 36,300 unvested restricted shares, and 52,276 notional phantom shares attributable to Mr. Gafinowitzs EDIP account. |

| (10) | Includes options to acquire 179,991 shares, 2,321 RSUs, 31,553 unvested restricted shares, and 19,396 notional phantom shares attributable to Ms. Hulits EDIP account. |

| (11) | Includes options to acquire 103,377 shares, 17,685 unvested restricted shares, and 12,930 notional phantom shares attributable to Mr. McLaughlins EDIP account. |

| (12) | Includes options to acquire 92,104 shares, 1,855 RSUs, 10,615 unvested restricted shares, and 715 notional phantom shares attributable to Mr. Pringles EDIP account. |

| (13) | Includes options to acquire 1,956,838 shares, 26,862 RSUs, 240,461 unvested restricted shares, 49,996 shares attributable to 401(k) accounts and 188,294 notional phantom shares attributable to executive officers EDIP accounts. |

| * | Represents less than 1% of the outstanding Common Stock. |

The following table sets forth the number of shares and percentage of Common Stock beneficially owned by each person who owns of record or is known to Fortive to beneficially own more than five percent of Common Stock.

| NAME AND ADDRESS | NUMBER OF SHARES BENEFICIALLY OWNED |

PERCENT OF CLASS |

||||||||

| T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202

|

36,677,427 | (1) | 10.5 | % | ||||||

| The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355

|

21,445,917 | (2) | 6.2 | % | ||||||

| FMR LLC 245 Summer Street, Boston, MA 02210

|

20,744,968 | (3) | 6.0 | % | ||||||

| BlackRock, Inc. 55 East 52nd Street, New York, NY 10055

|

20,013,760 | (4) | 5.7 | % | ||||||

| (1) | The amount shown and the following information is derived from a Schedule 13G/A filed February 14, 2018 by T. Rowe Price Associates, Inc. (Price Associates), which sets forth Price Associates beneficial ownership as of December 31, 2017. According to the Schedule 13G/A, Price Associates has sole voting power over 12,308,444 shares and sole dispositive power over 36,677,427 shares. Price Associates does not serve as custodian of the assets of any of its clients; accordingly, in each instance only the client or the clients custodian or trustee bank has the right to receive dividends paid with respect to, and proceeds from the sale of, such securities. The ultimate power to direct the receipt of dividends paid with respect to, and the proceeds from the sale of, such securities, is vested in the individual and institutional clients which Price Associates serves as investment adviser. Any and all discretionary authority which has been delegated to Price Associates may be revoked in whole or in part at any time. |

| (2) | The amount shown and the following information is derived from a Schedule 13G/A filed February 12, 2018 by The Vanguard Group, which sets forth their respective beneficial ownership as of December 31, 2017. According to the Schedule 13G/A, The Vanguard Group has sole voting power over 438,524 shares, shared voting power over 67,404 shares, sole dispositive power over 20,948,035 shares and shared dispositive power over 497,882 shares. |

| (3) | The amount shown and the following information is derived from a Schedule 13G/A filed February 13, 2018 by FMR LLC and Abigail P. Johnson, which sets forth their respective beneficial ownership as of December 31, 2017. According to the Schedule 13G/A, FMR LLC has sole voting power over 3,095,586 shares and FMR LLC and Abigail P. Johnson have sole dispositive power over 20,744,968 shares. |

| (4) | The amount shown and the following information is derived from a Schedule 13G filed February 1, 2018 by BlackRock, Inc. which sets forth BlackRock, Inc.s beneficial ownership as of December 31, 2017. According to the Schedule 13G, BlackRock, Inc. has sole voting power over 17,434,028 shares and sole dispositive power over 20,013,760 shares. |

| 12 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

|

Proposal 1. Election of Directors

|

Our Board is comprised of directors with diverse skills, background, and experience, which the Board believes contributes to the effective oversight of our Company. Additional details on board membership criteria are set forth on page 25 under Corporate Governance Director Nomination Process.

|

|

|

|

|

||

|

2018 Proxy Statement | 13 |

Table of Contents

Proposal 1. Election of Directors

Pursuant to our Certificate of Incorporation adopted prior to our separation from Danaher (the Separation), our Board has been constituted into three classes as follows:

| | Class I: Kate D. Mitchell and Israel Ruiz, whose terms expire at the 2020 Annual Meeting of Shareholders; |

| | Class II: Feroz Dewan and James A. Lico, whose terms expire at the Annual Meeting; and |

| | Class III: Mitchell P. Rales, Steven M. Rales, and Alan G. Spoon, whose terms expire at the 2019 Annual Meeting of Shareholders. |

At the 2017 Annual Meeting of Shareholders, the shareholders approved a proposal from our Board to amend our Certificate of Incorporation to declassify the Board and to provide, starting with the 2019 Annual Meeting of Shareholders, for the election of directors to one-year terms. As a result, our Board will be declassified in the following manner:

|

The Class II directors elected at the Annual Meeting will serve three-year terms expiring at the 2021 Annual Meeting of Shareholders | |

|

The directors elected at the 2019 Annual Meeting of Shareholders (and at each annual meeting thereafter) will serve one-year terms | |

|

Beginning with the 2020 Annual Meeting of Shareholders, a majority of the directors will be elected annually | |

|

Beginning with the 2021 Annual Meeting of Shareholders, the entire Board will be elected annually | |

At the Annual Meeting, shareholders will be asked to elect each of the Class II director nominees (each of whom has been recommended by the Nominating and Governance Committee, has been nominated by the Board and currently serves as a Class II Director of Fortive) to serve until the 2021 Annual Meeting of Shareholders and until his or her successor is duly elected and qualified.

We have included information as of April 9, 2018 relating to each nominee for election as director and each director continuing in office, including his or her age, the year in which he or she became a director, his or her principal occupation, any board memberships at other public companies during the past five years, and the other experience, qualifications, attributes or skills that led the Board to conclude that he or she should continue to serve as a director of Fortive. Please see Corporate Governance Director Nomination Process for a further discussion of the Boards process for nominating Board candidates. In the event a nominee declines or is unable to serve, the proxies may be voted at the discretion of the proxy holders for a substitute nominee designated by the Board, or the Board may reduce the number of directors to be elected. We know of no reason why this will occur.

| 14 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proposal 1. Election of Directors

Class II Director Nominees Three-Year Terms That Will Expire in 2021

| Feroz Dewan |

Director since: 2016 | Other Current Public Company Directorships: The Kraft Heinz Company |

||

| Age: 41 |

Independent | |||

Feroz Dewan has served as the Chief Executive Officer of Arena Holdings Management LLC, an investment holding company, since 2016. Previously, Mr. Dewan served in a series of positions with Tiger Global Management, an investment firm with approximately $20 billion under management across public and private equity funds, from 2003 to 2015, including most recently as Head of Public Equities. He also served as a Private Equity Associate at Silver Lake Partners, a private equity firm focused on leveraged buyout and growth capital investments in technology, technology-enabled and related industries, from 2002 to 2003.

Qualifications: Mr. Dewans qualifications to sit on the Board include, among other factors, extensive experience in the technology industries and technology-related companies, including extensive experience in valuation, investments and acquisitions, financial reporting, risk management, corporate governance, capital allocation, and operational oversight.

| James A. Lico |

Director since: 2016 | Other Current Public Company Directorships: NetScout Systems, Inc. |

||

| Age: 52 |

||||

James A. Lico has served as the Chief Executive Officer and President of Fortive since the Separation in 2016. From 1996 to 2016, Mr. Lico served in various leadership positions at Danaher Corporation, a global science and technology company, including as Executive Vice President from 2005 to 2016.

Qualifications: Mr. Licos qualifications to sit on the Board include, among other factors, over 20 years of extensive experience in senior leadership positions, including as an Executive Vice President of Danaher with oversight at various times of each of the businesses that was separated from Danaher into Fortive. Mr. Lico, through his various senior leadership positions at Danaher and Fortive, has broad operating and functional experience with, and deep knowledge of, Fortives businesses, the Fortive Business System, capital allocation strategies, acquisitions, marketing and branding, and leadership strategies.

| The Board of Directors recommends that shareholders vote FOR the election to the Board of each of the foregoing Class II Director Nominees. |

|

2018 Proxy Statement | 15 |

Table of Contents

Proposal 1. Election of Directors

Current Class I Directors Directors with Terms That Will Expire in 2020

| Kate D. Mitchell |

Director since: 2016 | Other Current Public Company Directorships: SVB Financial Group |

||

| Age: 59 |

Independent | |||

Kate D. Mitchell has served as a partner and co-founder of Scale Venture Partners, a Silicon Valley-based firm that invests in early-in-revenue technology companies, since 1997. Prior to her current role, Ms. Mitchell served with Bank of America, a multinational banking and financial services corporation, from 1988 to 1996, most recently as Senior Vice President for Bank of America Interactive Banking. Ms. Mitchell currently serves on the boards of directors of SVB Financial Group, Silicon Valley Community Foundation and other private company boards on behalf of Scale Venture Partners.

Qualifications: Ms. Mitchells qualifications to sit on the Board include, among other factors, over 35 years of extensive experience in the technology industry, with a focus on innovative software and technology markets. In addition, Ms. Mitchell has deep experience as a director, investor and senior executive in the areas of business management and operations, finance, financial reporting, risk management, investment and acquisition strategy, and executive compensation.

| Israel Ruiz |

Director since: 2016 | Other Current Public Directorships: None | ||

| Age: 46 |

Independent | |||

Israel Ruiz has been the Executive Vice President and Treasurer at Massachusetts Institute of Technology (MIT), a private research university of science and technology, since 2011. In this role, Mr. Ruiz oversees all principal administrative and financial functions of MIT. Prior to his current role, Mr. Ruiz served as the Vice President for Finance for MIT from 2007 to 2011 and as a principal for MITs Office of Budget and Financial Planning from 2001 to 2007.

Qualifications: Mr. Ruizs qualifications to sit on the Board include, among other factors, his deep financial and accounting experience as the functioning chief financial officer of MIT, including experience in internal control over financial reporting, external and internal audit, and financial statement preparation. In addition, Mr. Ruiz, through his roles at MIT, has extensive experience overseeing risk management, compliance programs, corporate governance, capitalization strategies, and development and investment in technology and innovation.

| 16 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Proposal 1. Election of Directors

Current Class III Directors Directors with Terms That Will Expire in 2019

| Mitchell P. Rales |

Director since: 2016 | Other Current Public Company Directorships: Danaher Corporation and Colfax Corporation |

||

| Age: 61 |

||||

Mr. Rales is a co-founder of Danaher Corporation and has served as Chairman of the Executive Committee of Danaher since 1984. He was also President of Danaher from 1984 to 1990. In addition, for more than the past five years, he has been a principal in private and public business entities in the manufacturing area.

Qualifications: The strategic vision and leadership of Mr. Rales and his brother, Steven Rales, helped create the foundation of the Fortive Business System and the Danaher Business System and have guided the respective businesses of Fortive and Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Fortive, he is well-positioned to understand, articulate and advocate for the rights and interests of Fortives shareholders.

| Steven M. Rales |

Director since: 2016 | Other Current Public Company Directorships: Danaher Corporation |

||

| Age: 67 |

||||

Mr. Rales is co-founder of Danaher Corporation and has served as Chairman of the Board of Danaher since 1984. He was also CEO of Danaher from 1984 to 1990. In addition, for more than the past five years, he has been a principal in a private business entity in the area of film production.

Qualifications: The strategic vision and leadership of Mr. Rales and his brother, Mitchell Rales, helped create the foundation of the Fortive Business System and the Danaher Business System and have guided the respective businesses of Fortive and Danaher down a path of consistent, profitable growth that continues today. In addition, as a result of his substantial ownership stake in Fortive, he is well-positioned to understand, articulate and advocate for the rights and interests of Fortives shareholders.

| Alan G. Spoon Age: 66 |

Director since: 2016 Independent |

Other Current Public Company Directorships: Danaher Corporation, IAC/InteractiveCorp., Match Group, Inc., and Cable One, Inc. |

||

Mr. Spoon has served as Partner Emeritus of Polaris Partners, a company that invests in private technology and life science firms, since January 2015. Mr. Spoon has been a partner at Polaris since May 2000, and served as Managing General Partner from 2000 to 2010. In addition to his leadership role at Polaris Partners, Mr. Spoon previously served as president, chief operating officer and chief financial officer of one of the countrys largest, publicly-traded education and media companies, and has served on the boards of numerous public and private companies.

Qualifications: Mr. Spoons public and private company leadership experience gives him insight into business strategy, leadership, marketing, finance, corporate governance, executive compensation and board management. His public company and private equity experience gives him insight into trends in the internet and technology industries, acquisition strategy and financing, each of which represents an area of key strategic opportunity for Fortive.

|

2018 Proxy Statement | 17 |

Table of Contents

|

|

Our Board of Directors recognizes that protecting long-term value for our shareholders requires a robust framework of corporate governance that serves the best interests of all our shareholders.

In connection with our Boards dedication to strong corporate governance, our Board has approved the following corporate governance matters following the Separation in 2016:

Recent Governance Actions

|

Adopted proxy access to permit a shareholder, or a group of up to 20 shareholders, owning at least 3% of the outstanding shares continuously for at least 3 years to nominate and include in our proxy materials director nominees constituting up to 20% of the board of directors, as further detailed in our Bylaws | |

|

Commenced the declassification of the Board to provide for the annual election of directors after a sunset period | |

|

Documented our commitment to Board diversity in our Corporate Governance Guidelines and the Nominating and Governance Committee Charter | |

|

Adopted and launched a formal annual shareholder engagement process, with the first shareholder outreach conducted in the fourth quarter of 2017 | |

|

Formalized and documented in the Audit Committee Charter oversight of our cybersecurity by the Audit Committee, with quarterly review by the Audit Committee of our cybersecurity planning, monitoring, risk management, remediation, and controls | |

|

Adopted, launched and conducted an annual self-assessment process to assess in detail the effectiveness of the Board and each of its committees | |

|

Increased the stock ownership requirements for non-CEO executive officers to a multiple of three times base salary and maintained the stock ownership requirements for CEO and directors as a multiple of five times base salary and annual cash retainer, respectively | |

Additional highlights of our corporate governance framework

|

Our Chairman and CEO positions are separate, with an independent Chairman | |

|

We maintain a majority vote requirement for the election of directors in uncontested elections | |

|

We have no shareholder rights plan | |

|

We have an anti-overboarding policy that limits the number of boards of other public companies on which our directors may serve to four | |

|

All members of the Audit Committee are audit committee financial experts | |

|

We maintain a related person transaction policy with oversight by the Nominating and Governance Committee | |

|

All members of our Audit, Compensation, and Nominating and Governance Committees are independent as defined by the New York Stock Exchange listing standards and applicable Securities and Exchange Commission rules | |

| 18 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

Corporate Governance Guidelines, Committee Charters and Standards of Conduct

As part of its ongoing commitment to good corporate governance, our Board of Directors has codified its corporate governance practices into a set of Corporate Governance Guidelines and adopted written charters for each of the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, and the Finance Committee of the Board. The Board of Directors has also adopted for the Company our Standards of Conduct that includes, among others, a code of business conduct and ethics for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Nominating and Governance Committee Charter, and Standards of Conduct referenced above are each available in the Investor Corporate Governance section of our website at http://www.fortive.com.

Board Leadership Structure, Risk Oversight and Management Succession Planning

Board Leadership Structure

The Board has separated the positions of Chairman and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our shareholders.

The entire Board selects its Chairman, and our Board has selected Alan G. Spoon, an independent director, as its Chairman, in light of Mr. Spoons independence and his deep experience and knowledge with corporate governance, board management, shareholder engagement, risk management and Fortives diverse businesses and industries.

As the independent Chairman of the Board, Mr. Spoon leads the activities of the Board, including:

| | Calling and presiding at all meetings of the Board; |

| | Together with the CEO and the Corporate Secretary, setting the agenda for the Board; |

| | Calling and presiding at the executive sessions of non-management directors and of the independent directors; |

| | Advising the CEO on strategic aspects of the Companys business, including developments and decisions that are to be discussed with, or would be of interest to, the Board; |

| | Acting as a liaison as necessary between the non-management directors and the management of the Company; and |

| | Acting as a liaison as necessary between the Board and the committees of the Board. |

In the event that the Chairman of the Board is not an independent director, the Corporate Governance Guidelines provide that the independent directors, upon recommendation from the Nominating and Governance Committee, will select by majority vote an independent director to serve as the Lead Independent Director with the authority to:

| | Preside at all meetings of the Board at which the Chair is not present, including the executive sessions; |

| | Call meetings of the independent directors; |

| | Act as a liaison as necessary between the independent directors and the CEO; and |

| | Advise with respect to the Boards agenda. |

The Boards non-management directors meet in executive session following the Boards regularly-scheduled meetings, with the executive sessions chaired by the independent Chairman. In addition, the independent directors meet as a group in executive session at least once a year.

|

2018 Proxy Statement | 19 |

Table of Contents

Corporate Governance

Risk Oversight

The Boards role in risk oversight at the Company is consistent with the Companys leadership structure, with management having day-to-day responsibility for assessing and managing the Companys risk exposure and the Board and its committees overseeing those efforts, with particular emphasis on the most significant risks facing the Company.

In determining to separate the position of the CEO and the Chairman, and in determining the appointment of the Chairman of the Board and the Chairs of the committees of the Board, the Board and the Nominating and Governance Committee considered the implementation of a governance structure and appointment of chairpersons with appropriate and relevant risk management experience that would enable Fortive to efficiently and effectively assess and oversee its risks.

Risk Oversight by the Board of Directors

The Board oversees the Companys risk management processes directly and through its committees. In general, the Board oversees the management of risks inherent in the operation of the Companys businesses, the implementation of its strategic plan, its acquisition and capital allocation program, its capital structure and liquidity and its organizational structure, and also oversees the Companys risk assessment and risk management policies.

Risk Oversight by the Committees

| AUDIT COMMITTEE | COMPENSATION COMMITTEE |

NOMINATING AND COMMITTEE |

FINANCE COMMITTEE |

|||

| The Audit Committee oversees risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks. The Audit Committee also assists the Board in overseeing the Companys risk assessment and risk management policies. Finally, the Audit Committee oversees our cybersecurity risk management and risk controls. |

The Compensation Committee oversees risks associated with the Companys compensation policies and practices. | The Nominating and Governance Committee oversees risks associated with corporate governance and board management. |

The Finance Committee oversees risks associated with the execution of the Companys acquisition, investment and divestiture strategies. |

Each committee reports to the full Board on a regular basis, including as appropriate with respect to the committees risk oversight activities. In addition, since risk issues often overlap, committees from time to time request that the full Board discuss particular risks.

Cybersecurity

The Board has delegated to the Audit Committee the responsibility of exercising oversight with respect to the Companys cybersecurity risk management and risk controls. Consistent with such delegation, our Chief Information Officer provides a report to the Audit Committee on quarterly basis, and to the Board on an annual basis, regarding the Companys cybersecurity program, including the Companys monitoring, auditing, implementation and communication processes, controls, and procedures.

| 20 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

Risk Committee

The Companys Risk Committee (consisting of members of senior management) inventories, assesses and prioritizes the most significant risks facing the Company as well as related mitigation efforts, and, on at least an annual basis, provides a report to the Board and provides a report of the process to the Audit Committee.

Management Succession Planning

The entire Board oversees the recruitment, development, and retention of our executive officers, including oversight of management succession planning. In addition to the formal activities noted below, the Board and its committee members engage and assess our executive officers and high-potential employees during management presentations, our annual multi-day leadership conference, and periodic informal meetings.

| BOARD MEETING DATE |

ACTIVITY | SUCCESSION PLANNING IMPACT | ||

| January |

Employee Engagement and Organizational Effectiveness Update |

Reviewing employee engagement and overall organizational effectiveness | ||

| April |

Enterprise Risk Assessment Report | Oversight on risk and mitigation efforts relating to talent recruitment, development and retention | ||

| August |

Talent, Succession and Engagement Update |

Review of senior management selection, succession readiness with respect to three different time periods (immediate, short-term and long-term), leadership development, diversity and employee engagement |

At least a majority of the Board must qualify as independent within the meaning of the listing standards of the NYSE. The Board has affirmatively determined that Ms. Kate D. Mitchell and Messrs. Feroz Dewan, Israel Ruiz and Alan G. Spoon are independent within the meaning of the listing standards of the NYSE.

Board of Directors and Committees of the Board

Director Attendance

In 2017, the Board met ten times and acted by unanimous written consent two times. All directors attended at least 75% of the aggregate of the total number of meetings of the Board and of all committees of the Board on which they served during 2017. All members of the Board attended the 2017 Annual Meeting of Shareholders.

|

2018 Proxy Statement | 21 |

Table of Contents

Corporate Governance

Committee Membership

The membership of each of the Audit, Compensation, Nominating and Governance and Finance committees as of April 9, 2018 is set forth below.

| NAME OF DIRECTOR | AUDIT | COMPENSATION | NOMINATING AND GOVERNANCE |

FINANCE | ||||

| Feroz Dewan

|

Member

|

Member

|

||||||

| James A. Lico

|

Member

|

|||||||

| Kate D. Mitchell

|

Member

|

Chair

|

||||||

| Mitchell P. Rales

|

Member

|

|||||||

| Steven M. Rales

|

Member

|

|||||||

| Israel Ruiz

|

Chair

|

Chair

|

||||||

| Alan G. Spoon

|

Member

|

Chair

|

In 2017, the Audit Committee met eight times. The Audit Committee is responsible for:

| | Assessing the qualifications and independence of Fortives independent auditors; |

| | Appointing, compensating, retaining, and evaluating Fortives independent auditors; |

| | Overseeing the quality and integrity of Fortives financial statements and making a recommendation to the Board regarding the inclusion of the audited financial statements in Fortives Annual Report on Form 10-K; |

| | Overseeing Fortives internal auditing processes; |

| | Overseeing managements assessment of the effectiveness of Fortives internal control over financial reporting; |

| | Overseeing managements assessment of the effectiveness of Fortives disclosure controls and procedures; |

| | Overseeing risks related to financial controls, legal and compliance risks and major financial, privacy, security and business continuity risks; |

| | Overseeing Fortives risk assessment and risk management policies; |

| | Overseeing Fortives compliance with legal and regulatory requirements; |

| | Overseeing Fortives cybersecurity risk management and risk controls; and |

| | Overseeing swap and derivative transactions and related policies and procedures. |

The Audit Committee relies on the expertise and knowledge of management, the internal auditor, and the independent auditor in carrying out its oversight responsibilities. Management is responsible for the preparation, presentation, and integrity of Fortives financial statements, accounting and financial reporting principles, internal control over financial reporting, and disclosure controls and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. Management is also responsible for objectively reviewing and evaluating the adequacy, effectiveness, and quality of Fortives system of internal control over financial reporting. Fortives independent auditor, Ernst & Young LLP, is responsible for performing independent audits of Fortives financial statements and internal control over financial reporting and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the United States.

The Audit Committee also prepares a report as required by the SEC to be included in this proxy statement. The Audit Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.

| 22 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

The Board has determined that each member of the Audit Committee is:

| | Independent for purposes of Rule 10A-3(b)(1) under the Securities Exchange Act and the NYSE listing standards; |

| | Qualified as an audit committee financial expert as that term is defined in SEC rules; and |

| | Financially literate within the meaning of the NYSE listing standards. |

Furthermore, as of the date of this proxy statement, no Audit Committee member serves on the audit committee of more than three public companies.

In 2017, the Compensation Committee met nine times and acted by unanimous written consent three times.

The Compensation Committee is responsible for:

| | Determining and approving the form and amount of annual compensation of the CEO and our other executive officers, including evaluating the performance of, and approving the compensation paid to, our CEO and other executive officers; |

| | Reviewing and making recommendations to the Board with respect to the adoption, amendment and termination of all executive incentive compensation plans and all equity compensation plans, and exercising all authority with respect to the administration of such plans; |

| | Reviewing and making recommendations to the Board with respect to the form and amounts of director compensation; |

| | Overseeing and monitoring compliance with Fortives compensation recoupment policy; |

| | Overseeing and monitoring compliance by directors and executive officers with Fortives stock ownership requirements; |

| | Overseeing risks associated with Fortives compensation policies and practices; |

| | Overseeing our engagement with shareholders and proxy advisory firms regarding executive compensation matters; and |

| | Reviewing and discussing with management the Compensation Discussion & Analysis (CD&A) in the annual proxy statement and recommending to the Board the inclusion of the CD&A in the proxy statement. |

The Chair of the Compensation Committee works with our Senior Vice President-Human Resources and our Corporate Secretary to schedule the Compensation Committees meetings and set the agenda for each meeting. Our Senior Vice President-Human Resources, Vice President-Total Rewards, Senior Vice President-General Counsel, and Vice President-Associate General Counsel and Secretary generally attend, and from time-to-time our CEO and CFO attend, the Compensation Committee meetings and support the Compensation Committee in preparing meeting materials and taking meeting minutes. In particular, our CEO provides background regarding the interrelationship between our business objectives and executive compensation matters and advises on the alignment of incentive plan performance measures with our overall strategy; participates in the Compensation Committees discussions regarding the performance and compensation of the other executive officers; and provides recommendations to the Compensation Committee regarding all significant elements of compensation paid to such other executive officers, their annual, personal performance objectives and his evaluation of their performance. The Compensation Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting, and reports to the Board on its actions and recommendation at each regularly scheduled Board meeting.

Under the terms of its charter, the Compensation Committee has the authority to engage the services of outside advisors and experts to assist the Compensation Committee. Following the assessment and determination of Frederic W. Cook & Co, Inc.s (F.W. Cook) and Pearl Meyer & Partners, LLCs (Pearl Meyer) respective independence from Fortives management, the Compensation Committee engaged F.W. Cook and Pearl Meyer as the Compensation Committees independent compensation consultants for 2017. The Compensation Committee had the sole discretion and authority to select, retain and terminate each of F.W. Cook and Pearl Meyer as well as to approve any fees, terms and other conditions of their

|

2018 Proxy Statement | 23 |

Table of Contents

Corporate Governance

respective services. Each of F.W. Cook and Pearl Meyer reported directly to the Compensation Committee and took its direction solely from the Compensation Committee. F.W. Cooks and Pearl Meyers primary responsibilities in 2017 were to provide advice and data in connection with the selection of Fortives peer group for assessing executive compensation, the structuring of the executive compensation programs in 2017 and 2018, the compensation levels for our executive officers, and the compensation levels for our directors; assess our executive compensation program in the context of market practices and corporate governance best practices; and advise the Compensation Committee regarding our proposed executive compensation public disclosures. In the course of discharging its responsibilities, the Compensation Committees independent compensation consultants may, from time to time and with the Compensation Committees consent, request from management certain information regarding compensation amounts and practices, the interrelationship between our business objectives and executive compensation matters, the nature of our executive officer responsibilities and other business information. Neither F.W. Cook nor Pearl Meyer provided any services to Fortive or its management in 2017, and the Compensation Committee is not aware of any work performed by F.W. Cook or Pearl Meyer that raises any conflicts of interest.

Each member of the Compensation Committee is:

| | A non-employee director for purposes of Rule 16b-3 under the Securities Exchange Act; and |

| | Based on the determination of the Board, independent under NYSE listing standards and under Rule 10C-1 under the Securities Exchange Act. |

Compensation Committee Interlocks and Insider Participation

During 2017, none of the members of the Compensation Committee was an officer or employee of Fortive. No executive officer of Fortive served on the compensation committee (or other board committee performing equivalent functions) or on the board of directors of any entity having an executive officer who served on the Compensation Committee.

Nominating and Governance Committee

In 2017, the Nominating and Governance Committee met three times.

The Nominating and Governance Committee is responsible for:

| | Reviewing and making recommendations to the Board regarding the size, classification and composition of the Board; |

| | Assisting the Board in identifying individuals qualified to become Board members; |

| | Assisting the Board in identifying characteristics, skills, and experiences for the Board with the objective of having a Board with diverse backgrounds, experiences, skills, and perspectives; |

| | Proposing to the Board the director nominees for election by our shareholders at each annual meeting; |

| | Assisting the Board in determining the independence and qualifications of the Board and Committee members and making recommendations to the Board regarding committee membership; |

| | Developing and making recommendations to the Board regarding a set of corporate governance guidelines and reviewing such guidelines on an annual basis; |

| | Overseeing compliance with the corporate governance guidelines; |

| | Overseeing director education and director orientation process and programs; |

| | Assisting the Board and the Committees in engaging in annual self-assessment of their performance; and |

| | Administering Fortives Related Person Transactions Policy. |

The Board has determined that each member of the Nominating and Governance Committee is independent within the meaning of the NYSE listing standards.

| 24 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

The Nominating and Governance Committee typically meets in executive session, without the presence of management, at each regularly scheduled meeting and reports to the Board on its actions and recommendations at each regularly scheduled Board meeting.

The Finance Committee assists the Board in assessing potential acquisition, investment and divestiture opportunities and approving business acquisitions, investments and divestitures up to the levels of authority delegated to it by the Board.

The Nominating and Governance Committee recommends to the Board director candidates for nomination and election at the annual meeting of shareholders and, in the event of vacancies between annual meetings of shareholders, for appointment to fill such vacancies.

Board Membership Criteria

In assessing the candidates for recommendation to the Board as director nominees, the Nominating and Governance Committee will evaluate such candidates against the standards and qualifications set out in our Corporate Governance Guidelines, including:

|

Personal and professional integrity and character | |

|

Prominence and reputation in the candidates profession | |

|

Skills, knowledge, diversity of background and experience, and expertise (including business or other relevant experience) useful and appropriate to the effective oversight of our business | |

|

The extent to which the interplay of the candidates skills, knowledge, expertise and diversity of background and experience with that of the other Board members will help build a Board that is effective in collectively meeting our strategic needs and serving the long-term interests of the shareholders | |

|

The capacity and desire to represent the interests of the shareholders as a whole | |

|

Availability to devote sufficient time to the affairs of Fortive | |

|

2018 Proxy Statement | 25 |

Table of Contents

Corporate Governance

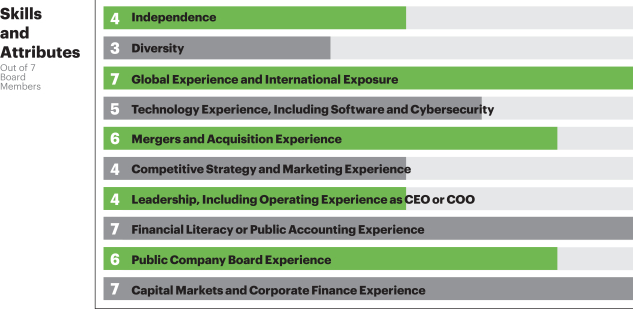

The Nominating and Governance Committee annually reviews with the Board the skills, knowledge, experience, background and attributes required of Board nominees, considering current Board composition and the Companys circumstances. In making its recommendations to our Board, the Nominating and Governance Committee considers the criteria noted above, as well as, among others, the following skills, knowledge, experience, background and attributes:

The Nominating and Governance Committee takes into account a candidates ability to contribute to the diversity of perspective and analysis of the Board and, as such, believes it is important to consider attributes such as race, ethnicity, gender, age, education, cultural experience, and professional experience in evaluating candidates who may be able to contribute to the diverse perspective and practical insight of the Board as a whole. Although we do not have a formal diversity policy and the Board does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors, the Boards and the Nominating and Governance Committees commitment to diversity as an essential consideration in the director nominee selection process has been documented in both the Corporate Governance Guidelines and the Nominating and Governance Committees Charter.

Shareholder Recommendations

Shareholders may recommend a director nominee to the Nominating and Governance Committee. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Nominating and Governance Committee in writing using the procedures described below under Communications with the Board of Directors with whatever supporting material the shareholder considers appropriate. If a prospective nominee has been identified other than in connection with a director search process initiated by the Nominating and Governance Committee, the Nominating and Governance Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. The Nominating and Governance Committees determination of whether to conduct a full evaluation is based primarily on the Nominating and Governance Committees view as to whether a new or additional Board member is necessary or appropriate at such time, and the likelihood that the prospective nominee can satisfy the evaluation factors described above under Board Membership Criteria and any such other factors as the Nominating and Governance Committee may deem appropriate. The Nominating and Governance Committee takes into account whatever information is provided to it with the recommendation of the prospective candidate and any additional inquiries the Nominating and Governance Committee may in its discretion conduct or have conducted with respect to such prospective nominee. The Nominating and Governance Committee evaluates director nominees in the same manner whether a shareholder or the Board has recommended the candidate.

| 26 | 2018 Proxy Statement | FORTIVE CORPORATION |

Table of Contents

Corporate Governance

Proxy Access