DEF 14A: Definitive proxy statements

Published on April 21, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required |

|

|

☐ |

Fee paid previously with preliminary materials |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

FORTIVE CORPORATION

6920 Seaway Blvd

Everett, WA 98203

Notice of 2025 Annual Meeting of Shareholders

|

|

|

|

|

|

|

|

ITEMS OF BUSINESS |

|

BOARD RECOMMENDATION |

|

PAGE |

|

When: June 3, 2025 at 3:00 p.m., PDT.

Items of Business: 5 proposals as listed here

Date of Mailing: The date of mailing of this Proxy Statement is on or about April 21, 2025.

Who Can Vote: Shareholders of Fortive’s common stock at the close of business on April 7, 2025.

Virtual-Only Meeting: The 2025 Annual Meeting of Shareholders will be held in a virtual-only meeting format.

Where: www.virtualshareholder meeting.com/FTV2025 |

|

1. To elect the nine director nominees named in the Proxy Statement, each for a one-year term expiring at the 2026 annual meeting and until his or her respective successor is duly elected and qualified.

|

|

|

FOR |

|

9 |

||

2. To approve on an advisory basis Fortive’s named executive officer compensation.

|

|

|

FOR |

|

42 |

||

3. To approve the amendment and restatement of the 2016 Stock Incentive Plan to extend the term of the plan.

|

|

|

FOR |

|

85 |

||

4. To ratify the appointment of Ernst & Young LLP as Fortive’s independent registered public accounting firm for the year ending December 31, 2025.

|

|

|

FOR |

|

93 |

||

5. To act upon a shareholder proposal regarding special shareholder meetings.

|

|

|

AGAINST |

|

96 |

||

|

YOUR VOTE IS IMPORTANT. PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AT YOUR EARLIEST CONVENIENCE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. Most shareholders have a choice of voting in advance over the Internet, by telephone or by using a traditional proxy card or voting instruction form. You may also vote during the annual meeting by following the instructions available on the meeting website during the meeting. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. The rules and procedures applicable to the 2025 Annual Meeting, together with a list of shareholders of record for inspection for any legally valid purpose, will be available at the 2025 Annual Meeting for shareholders of record at www.virtualshareholdermeeting.com/FTV2025. We are committed to ensuring that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically, and submit questions and receive technical support during the virtual meeting. IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON June 3, 2025: The Notice of Internet Availability, Notice of Annual Meeting, Proxy Statement and the Annual Report are available at: http://www.proxyvote.com. By Order of the Board of Directors,

Daniel B. Kim Secretary April 21, 2025 |

|||||||

Table of Contents

|

2 |

|

|

42 |

||

|

2 |

|

||||

|

2 |

|

Compensation Discussion and Analysis |

|

43 |

|

|

2 |

|

|

49 |

||

|

3 |

|

|

55 |

||

|

4 |

|

|

66 |

||

|

9 |

|

|

71 |

||

|

10 |

|

|

72 |

||

|

10 |

|

|

80 |

||

|

12 |

|

|

81 |

||

|

17 |

|

|

84 |

||

|

17 |

|

|

85 |

||

|

18 |

|

||||

|

|

|

||||

|

18 |

|

Proposal 4: Ratification of Independent Registered Public Accounting Firm |

|

93 |

|

|

19 |

|

||||

|

22 |

|

|

94 |

||

|

23 |

|

|

95 |

||

|

28 |

|

Proposal 5: shareholder proposal regarding special shareholder meetings |

|

96 |

|

|

31 |

|

||||

|

33 |

|

|

99 |

||

|

33 |

|

|

99 |

||

|

33 |

|

|

100 |

||

|

34 |

|

|

101 |

||

|

34 |

|

|

|

||

|

35 |

|

|

104 |

||

|

35 |

|

|

106 |

||

|

36 |

|

|

106 |

||

|

36 |

|

|

|

||

|

37 |

|

|

A-1 |

||

|

37 |

|

Appendix B Amended and Restated Fortive Corporation Stock Incentive Plan |

|

B-1 |

|

Business, Career Development, and Reward Systems |

|

37 |

|

|||

|

|

||||||

|

38 |

|

||||

|

39 |

|

||||

|

40 |

|

||||

|

|

|

|

|||

|

|

|

|

|||

Appendix A

Non-GAAP Financial Measures

Core Revenue Growth

We use the term “core revenue growth” when referring to a corresponding year-over-year GAAP revenue measure, excluding (1) the impact from acquired or divested businesses and (2) the impact of foreign currency translation. References to sales attributable to acquisitions or acquired businesses refer to GAAP sales from acquired businesses recorded prior to the first anniversary of the acquisition less the amount of sales attributable to certain divested businesses or product lines that have been divested or, at the time of reporting, are pending divestiture but are not, and will not be, considered discontinued operations prior to the first anniversary of the divestiture. The portion of sales attributable to the impact of currency translation is calculated as the difference between (a) the period-to-period change in sales (excluding sales impact from acquired businesses) and (b) the period-to-period change in sales (excluding sales impact from acquired businesses) after applying the current period foreign exchange rates to the prior year period. This non-GAAP measure should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies.

Management believes that this non-GAAP measure provides useful information to investors by helping identify underlying growth trends in our business and facilitating comparisons of our revenue performance with prior and future periods and to our peers. We exclude the effect of acquisition and divestiture-related items because the nature, size and number of such transactions can vary dramatically from period to period and between us and our peers. We exclude the effect of currency translation from sales measures because currency translation is not under management’s control and is subject to volatility. We believe that such exclusions, when presented with the corresponding GAAP measures, may assist in assessing the business trends and making comparisons of long-term performance.

Adjusted Net Earnings, Adjusted Diluted Net Earnings Per Share (“Adjusted EPS”), Adjusted EBITDA, Adjusted Gross Profit Margin, and Adjusted Operating Profit Margin

We disclose the non-GAAP measures of historical adjusted net earnings, historical adjusted diluted net earnings per share, historical adjusted EBITDA, historical adjusted gross profit margin, and historical adjusted operating profit margin, which to the extent applicable, make the following adjustments to GAAP net earnings, GAAP diluted net earnings per share, and GAAP operating profit margin:

In addition, with respect to the non-GAAP measures of historical adjusted net earnings and historical adjusted diluted net earnings per share, historical adjusted EBITDA, and historical adjusted operating profit margin, we make the following adjustments to GAAP net earnings, GAAP diluted net earnings per share, and GAAP operating profit margin:

FORTIVE CORPORATION 2025 PROXY STATEMENT A-1

In addition, with respect to the non-GAAP measures of historical adjusted net earnings, historical adjusted diluted net earnings per share, and historical adjusted EBITDA, we make the following adjustments to GAAP net earnings, and GAAP diluted net earnings per share:

In addition, with respect to the non-GAAP measure of historical adjusted EBITDA, we make the following adjustments to GAAP earnings before income taxes:

In addition, with respect to the non-GAAP measures of historical adjusted net earnings and historical adjusted diluted net earnings per share, we make the following adjustments to GAAP net earnings and GAAP diluted net earnings per share:

Amortization of Acquisition Related Intangible Assets and Non-cash Impairments

As a result of our acquisition activity, we have significant amortization expense associated with definite-lived intangible assets. We adjust for amortization expense of acquisition related intangible assets incurred in each period, and impairment charges incurred, if any. During the twelve month period ended December 31, 2023, we recognized $5.2 million, respectively, related to impairment charges. We believe that this adjustment provides our investors with additional insight into our operational performance and profitability as such impacts are not related to our core business performance.

Acquisition and Divestiture Related Items

While we have a history of acquisition and divestiture activity, we do not acquire and divest businesses or assets on a predictable cycle. The amount of an acquisition’s purchase price allocated to the deferred revenue and inventory fair value adjustments are unique to each acquisition and can vary significantly from acquisition to acquisition. In addition, transaction costs, which include acquisition, divestiture, integration, restructuring, and separation costs related to completed or announced transactions, and the non-recurring gains on divestitures of businesses or assets are unique to each transaction and are impacted from period to period depending on the number of acquisitions or divestitures evaluated, pending, or completed

A-2 FORTIVE CORPORATION 2025 PROXY STATEMENT

during such period, and the complexity of such transactions. As a result of the Separation, we also incurred costs primarily related to professional fees for legal, tax, accounting and finance, information technology services, and other general and administrative costs as well as costs to stand up the new company to operate as a stand alone entity . We adjust for transaction costs, costs related to the Separation, acquisition related fair value adjustments to inventory, integration costs and corresponding restructuring charges related to acquisitions, in each case, incurred in a given period.

Discrete Restructuring Costs

We will exclude costs incurred pursuant to discrete restructuring plans that are fundamentally different in terms of the size, strategic nature and planning requirements, as well as the inconsistent frequency, of such plans originating from significant macroeconomic trends or material disruptions to operations, economy or capital markets from the ongoing productivity improvements that result from application of the Fortive Business System or from execution of general cost saving strategies. Because these restructuring plans will be incremental to the fundamental activities that arise in the ordinary course of our business and we believe are not indicative of our ongoing operating costs in a given period, we exclude these costs to facilitate a more consistent comparison of operating results over time. Restructuring costs related primarily to an acquisition are not included in this adjustment but are instead included in acquisition and divestiture related items.

Gains and Losses from Equity Investments

We adjust for the effect of earnings and losses from our equity method investments over which we do not exercise control over the operations or the resulting earnings or losses. We believe that this adjustment provides our investors with additional insight into our operational performance. However, it should be noted that earnings and losses from our equity method investments will recur in future periods while we maintain such investments.

In addition, we adjust for remeasurement gains and losses, including impairment loss, on equity investments. We believe such adjustments facilitate comparison of our performance with prior and future periods and provides our investors with additional insight into our operational performance.

Loss from Divestiture

In June 2024, we divested and transferred ownership of Invetech, excluding the Motion Solution Business, to its management team (the “Invetech Divestiture”). We adjust for the loss from the Invetech Divestiture because we believe the adjustment facilitates comparison of our performance with prior and future periods and provides our investors with additional insight into our operational performance.

Gain on Sale of Property and Charitable Contribution Expense

On March 14, 2024, we completed a transaction to sell land and certain office buildings in our Precision Technologies segment for $90 million, for which we received $20 million cash proceeds and a $70 million promissory note secured by a letter of credit. We received $10 million of principal in August and the remaining in November 2024. During the year ended December 31, 2024, we recorded a gain on sale of property of $63.1 million in the Consolidated Statements of Earnings.

Concurrently, during the first quarter of 2024, we pledged to make a charitable donation of $20 million to the Fortive Foundation (“the Foundation”), a related party, without any donor imposed conditions or restrictions. In the third quarter of 2024, $20 million of the promissory note due in November 2024 was reassigned to the Foundation. We recorded a charitable contribution expense of $20 million within the “Other non-operating expense, net” line in the Consolidated Statements of Earnings.

We adjust for the gain on sale of property and charitable donation expense because we believe the adjustment facilitates comparison of our performance with prior and future periods and provides our investors with additional insight into our operational performance.

Russia Ukraine Conflict

In connection with the invasion of Ukraine by Russian forces, the Company exited business operations in Russia in the second quarter of 2022, other than for ASP’s sterilization products, which are exempt from international sanctions as humanitarian products. Our business in Russia and Ukraine accounted for less than 1.0% of total revenue and less than 0.2% of total assets for the fiscal year ended December 31, 2021.

FORTIVE CORPORATION 2025 PROXY STATEMENT A-3

As a result of the exit of our business operations in Russia, the Company recorded a pre-tax charge totaling $17.9 million during the twelve month periods ended December 31, 2022 to reflect the write-off of net assets, the write-off of the cumulative translation adjustment in earnings for legal entities deemed substantially liquidated, and to record provisions for employee severance and legal contingencies. These costs are identified as the “Russia exit and wind down costs” in the Consolidated Statements of Earnings. We adjust for the non-recurring Russia exit and wind down costs because we believe that this adjustment facilitates comparison of our performance with prior and future periods and provides our investors with additional insight into our operational performance.

Gain and Loss on Sale of Business

On September 30, 2022, we completed the sale of our Therapy Physics product line, which was reported in our Advanced Healthcare Solutions segment, to an unrelated third party for total consideration of $9.6 million. As a result of the sale, during the three and twelve month periods ended December 31, 2022, we recorded a net realized pre-tax loss totaling $1.8 million and a net realized pre-tax gain totaling $0.5 million, respectively, net of transaction costs, which is recorded as “Other non-operating expense, net” in the Consolidated Condensed Statements of Earnings. We adjust for gain on the sale of our Therapy Physics product line because we believe that this adjustment facilitates comparison of our operational performance with prior and future periods.

Adjustments on Litigation Resolution

In the event that a potential liability related to a legal contingency for an acquired entity existing at the time of the acquisition is allocated to the corresponding purchase price, we will adjust for the subsequent non-recurring effect of the gain or loss recognized upon resolution because we believe that this adjustment facilitates comparison of our performance with prior and future periods and provides our investors with additional insight into our operational performance.

Convertible Notes

On February 22, 2019, we issued $1.4 billion in aggregate principal amount of our 0.875% Convertible Senior Notes due 2022 (the “Convertible Notes”). The Notes matured on February 15, 2022 and were settled in cash.

On January 1, 2022, we adopted ASU 2020-06, which amends the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts in an entity’s own equity. Although the Convertible Notes were, pursuant to the terms of the corresponding indenture, repaid in cash only and retired without issuance of additional shares of common stock, we assumed share settlement of our outstanding Convertible Notes under the if-converted method when calculating GAAP diluted net earnings per share. Since we settled the Convertible Notes in cash on February 15, 2022 and no common share conversion occurred, we have reversed the share impacts of applying the if-converted method for purposes of calculating Adjusted average common stock and common equivalent shares outstanding. In addition, although the Company paid interest accrued on the Convertible Notes in cash, the interest expense is not included in the GAAP diluted net earnings and from GAAP diluted net earnings per share under the if-converted methodology. Because we paid the interest expense in cash and because the interest expense was included in the prior year’s results, we have added the cash interest expense on the Convertible Notes during the three months ended April 1, 2022 in calculating the adjusted net earnings for the same period.

Gain on Retained Investment in Vontier and Loss on Extinguishment of Debt

On October 9, 2020, we completed the Vontier Separation and retained 19.9% of the shares of Vontier common stock immediately following the Separation (“Retained Vontier Shares”). We did not retain a controlling interest in Vontier and therefore the fair value of our Retained Vontier Shares was included in our assets of continuing operations as of December 31, 2020, and subsequent fair value changes are included in our results from continuing operations for the twelve month period ended December 31, 2021.

On January 19, 2021, we completed the Debt-for-Equity Exchange of 33.5 million shares of common stock of Vontier, representing all of the Retained Vontier Shares, for $1.1 billion in aggregate principal amount of indebtedness of the Company held by Goldman Sachs & Co., including (i) all $400.0 million of the 364-day delayed-draw term loan due March 22, 2021 and (ii) $683.2 million of the delayed-draw term loan due May 30, 2021. The change in fair value of the Retained Vontier Shares and the resulting gain of $57.0 million was recorded in the twelve month period ended December 31, 2021. We recorded a loss on extinguishment of the debt included in the Debt-for-Equity Exchange of $94.4 million in the twelve month period ended December 31, 2021.

A-4 FORTIVE CORPORATION 2025 PROXY STATEMENT

Additionally, on February 9, 2021 we repurchased $281 million of the Convertible Notes at fair value using the remaining cash proceeds received from Vontier in the Separation and other cash on hand. In connection with the repurchase, we recorded a loss on debt extinguishment during the twelve month period ended December 31, 2021 of $10.5 million.

We adjust for the non-recurring effect of the gain on our investment in the Retained Vontier Shares and the corresponding loss on debt extinguishment because we believe that this adjustment facilitates comparison of our performance with prior and future periods and provides our investors with additional insight into our operational performance .

Discrete non-cash tax benefit

We adjust for discrete tax expense items that resulted from the Separation of NewCo. These discrete items are non-recurring expenses that resulted from the US GAAP calculation of income taxes from continuing operations and do not reflect our current or future cash tax obligations.

As a result of revaluation of deferred tax assets required due to changes in tax rates in Switzerland, we recognized a non-cash tax benefit during the twelve month period ended December 31, 2023. We adjust for this non-cash tax benefit because we believe such benefit occurs with inconsistent frequency and for reasons that are unrelated to our commercial performance. We believe such adjustment facilitates comparison with prior and future periods and provides our investors with additional insight into our ongoing tax expenses.

We adjust for non-cash discrete tax expense items that resulted from the Separation of Vontier. These discrete items are non-recurring, non-cash expenses that resulted from the US GAAP calculation of income taxes from continuing operations and do not reflect our current or future cash tax obligations .

Free Cash Flow

We use the term “free cash flow” when referring to net cash provided by operating activities calculated according to GAAP less payments for capital expenditures.

Management believes that such non-GAAP measure provides useful information to investors in assessing our ability to generate cash without external financing, fund acquisitions and other investments and, in the absence of refinancing, repay our debt obligations. However, it should be noted that free cash flow as a liquidity measure has material limitations because it excludes certain expenditures that are required or that we have committed to, such as debt service requirements and other non-discretionary expenditures. Such non-GAAP measure should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies.

Core Revenue Growth

|

|

|

|

|

|

|

|

|

|

|

|

COMPONENTS OF REVENUE GROWTH |

|

% CHANGE |

% CHANGE |

% CHANGE |

% CHANGE |

% CHANGE |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue growth (GAAP) |

|

1.5% |

|

13.4% |

|

10.9% |

|

4.1% |

|

2.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excluding impact of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition and divestiture (Non-GAAP) |

|

-7.3% |

|

-2.4% |

|

-3.9% |

|

0.1% |

|

-2.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency exchange rates |

|

-0.1% |

|

-1.5% |

|

3.1% |

|

0.6% |

|

0.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

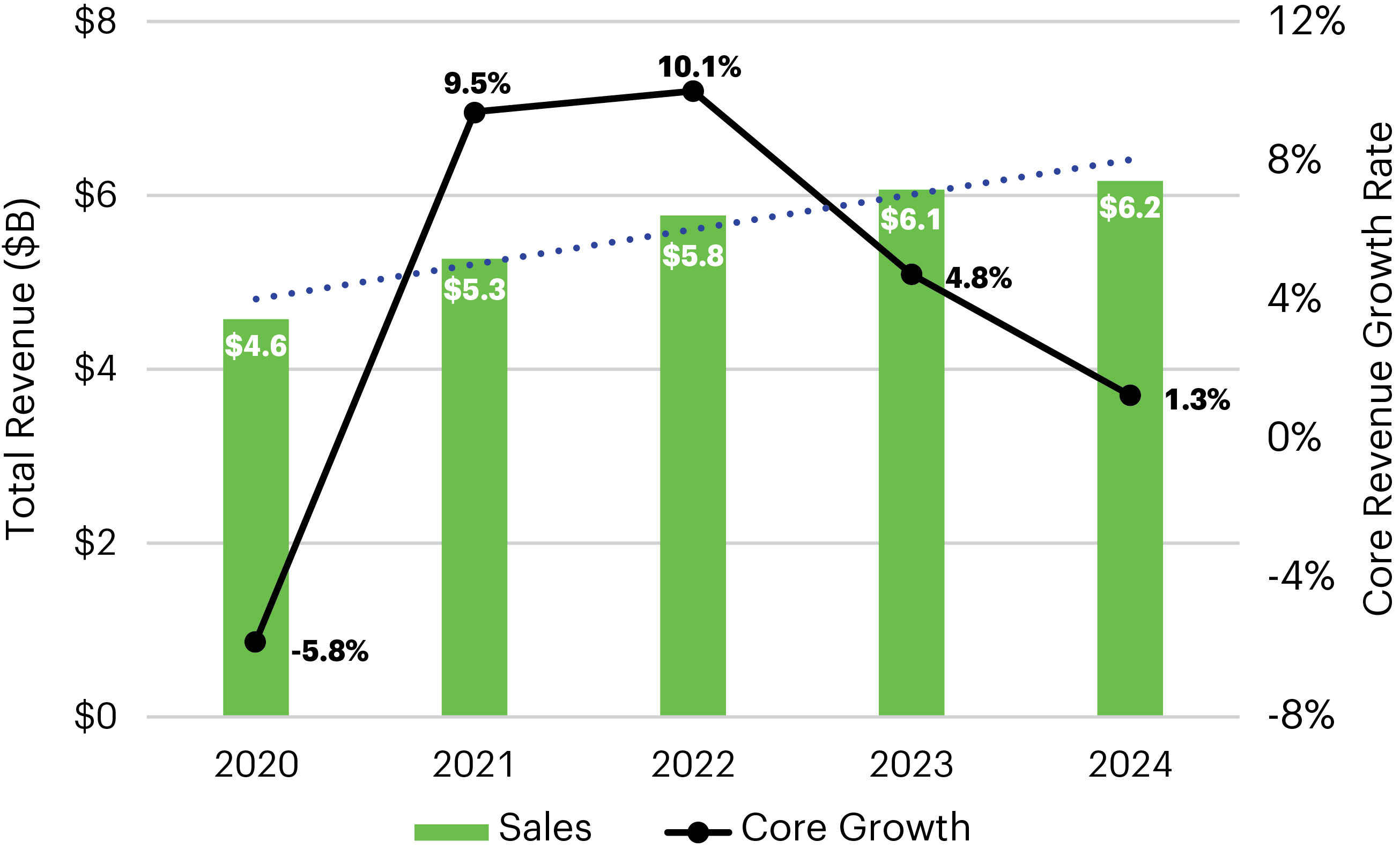

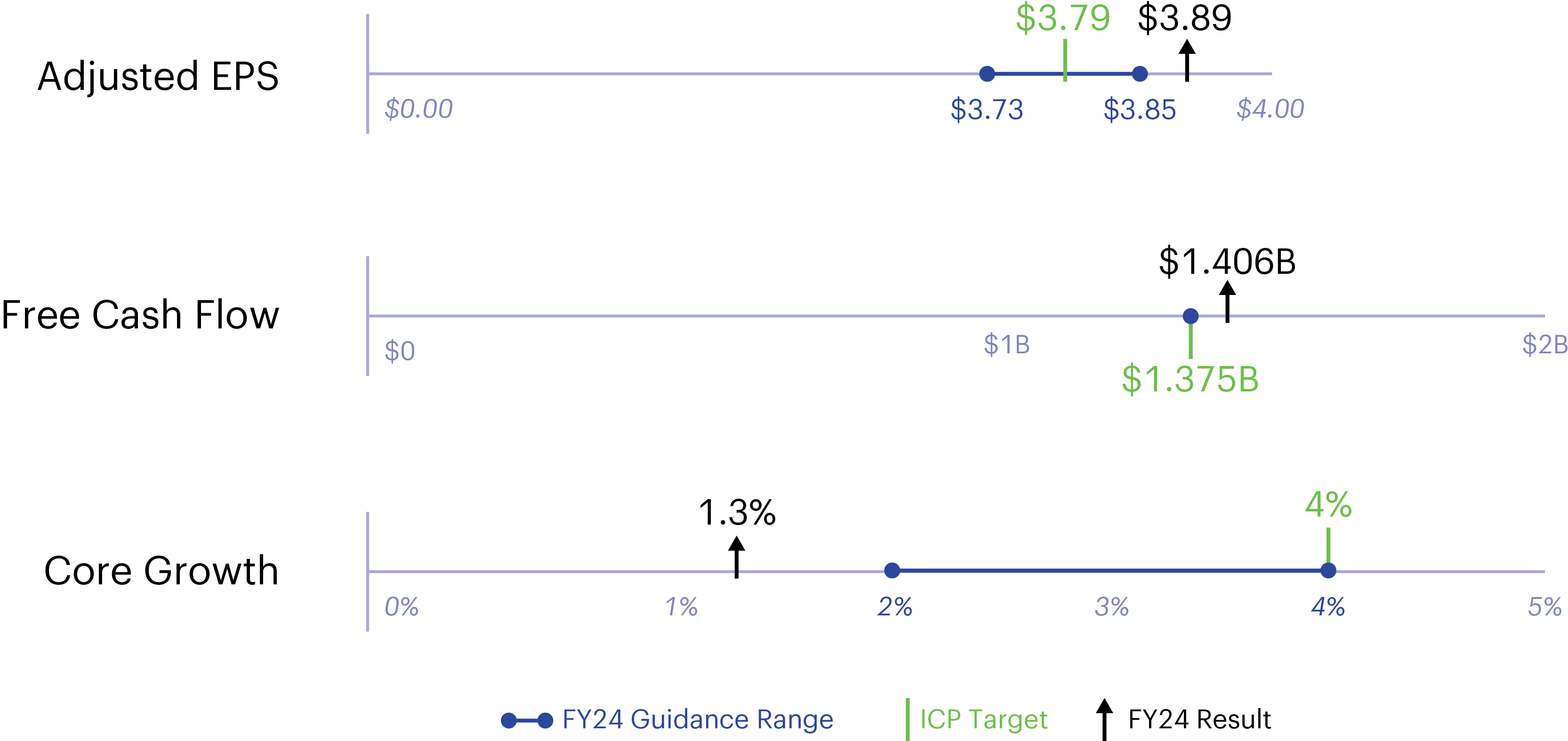

Core revenue growth (Non-GAAP) |

|

-5.9% |

|

9.5% |

|

10.1% |

|

4.8% |

|

1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

FORTIVE CORPORATION 2025 PROXY STATEMENT A-5

Adjusted Net Earnings

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ IN MILLIONS |

|

2024 |

2023 |

2022 |

2021 |

2020 |

2019 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings Attributable to Common Stockholders from Continuing Operations(GAAP) (a) |

|

$832.9 |

|

$865.8 |

|

$755.2 |

|

$579.7 |

|

$1,452.2 |

|

$199.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on the mandatory convertible preferred stock to apply if-converted method (a) |

|

— |

|

— |

|

— |

|

34.5 |

|

— |

|

69.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings from Continuing Operations (GAAP) |

|

832.9 |

|

865.8 |

|

755.2 |

|

614.2 |

|

1,452.2 |

|

268.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on the Convertible Notes to apply if-converted method (b) |

|

— |

|

— |

|

2.1 |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of the Convertible Notes to apply if-converted method |

|

— |

|

— |

|

(0.3) |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Net Earnings from Continuing Operations (GAAP) |

|

832.9 |

|

865.8 |

|

757.0 |

|

614.2 |

|

1,452.2 |

|

268.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax amortization of acquisition related intangible assets and non-cash impairments |

|

453.3 |

|

375.6 |

|

382.2 |

|

320.8 |

|

309.9 |

|

261.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax acquisition, divestiture, and separation related items (c) |

|

59.6 |

|

4.4 |

|

27.1 |

|

66.8 |

|

98.9 |

|

231.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax losses from equity investments (d) |

|

39.4 |

|

17.3 |

|

17.3 |

|

11.6 |

|

4.3 |

|

3.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from divestiture |

|

25.6 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on sale of property and charitable contribution expense |

|

(43.1) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax discrete restructuring charges |

|

19.7 |

|

58.6 |

|

— |

|

12.2 |

|

27.6 |

|

32.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax Russia exit and wind down costs |

|

— |

|

— |

|

17.9 |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax (gain) loss on sale of business |

|

— |

|

— |

|

(0.5) |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on litigation resolution |

|

— |

|

— |

|

— |

|

(29.9) |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on disposition of assets |

|

— |

|

— |

|

— |

|

— |

|

(5.3) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax non-cash interest expense associated with our 0.875% Convertible Notes |

|

— |

|

— |

|

— |

|

29.1 |

|

34.1 |

|

28.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax interest expense on Convertible Notes to reverse the if-converted method (b) |

|

— |

|

— |

|

(2.1) |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax loss on debt extinguishment, net of gain on Vontier common stock |

|

— |

|

— |

|

— |

|

47.9 |

|

(1,119.2) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on the disposition of the Tektronix Video Business |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(40.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of the adjustments reflected above (e) |

|

(80.7) |

|

(76.1) |

|

(65.9) |

|

(76.3) |

|

(70.8) |

|

(82.2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discrete tax expense (benefits) (f) |

|

65.6 |

|

(25.5) |

|

— |

|

— |

|

20.2 |

|

27.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Earnings from Continuing Operations (Non-GAAP) |

|

$1,372.3 |

|

$1,220.1 |

|

$1,133.0 |

|

$996.4 |

|

$751.9 |

|

$729.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The sum of the components of adjusted diluted net earnings per share may not equal due to rounding.

A-6 FORTIVE CORPORATION 2025 PROXY STATEMENT

Adjusted EPS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

2023 |

2022 |

2021 (a) |

2020 (a) |

2019 (a) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

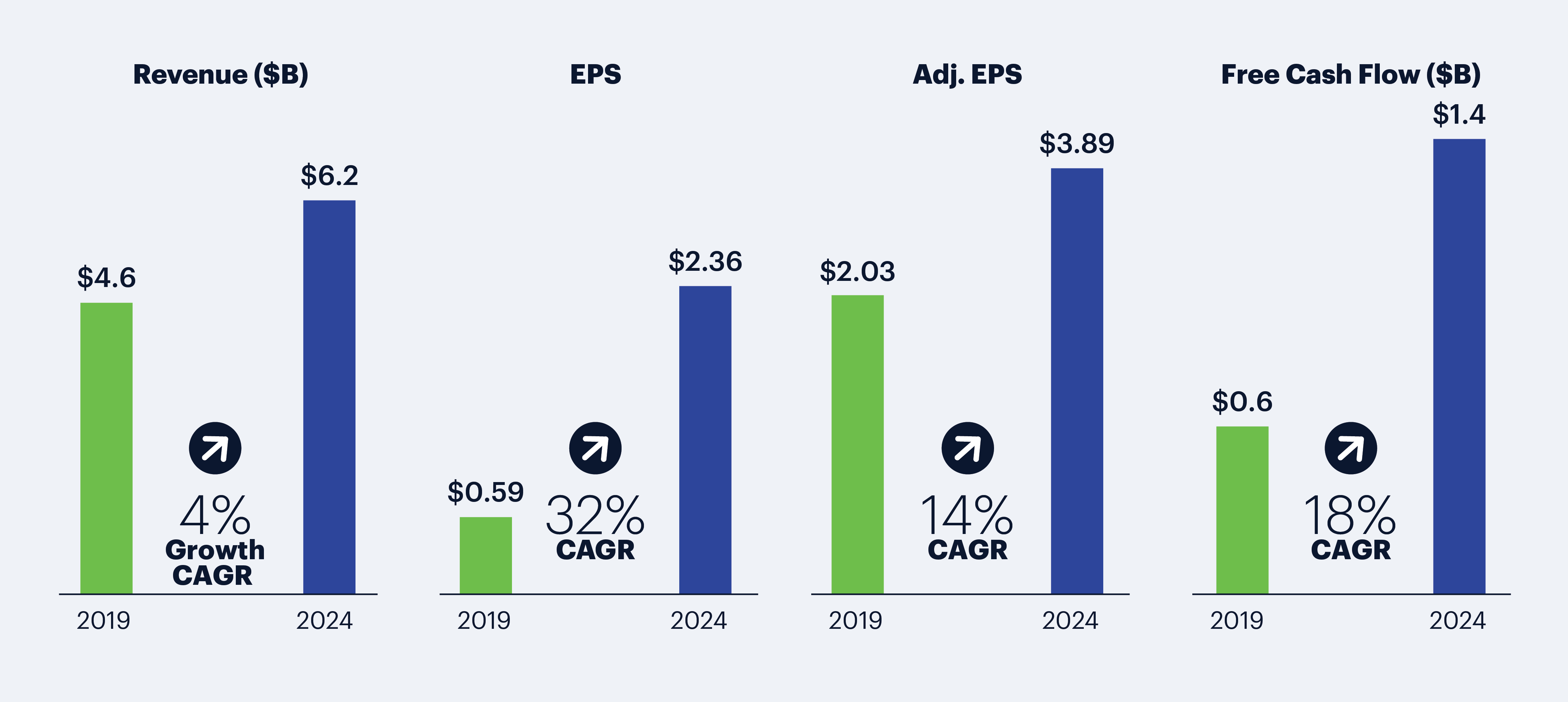

Net Earnings Per Share Attributable to Common Stockholders from Continuing Operations (GAAP) (b) |

|

$2.36 |

|

$2.43 |

|

$2.10 |

|

$1.65 |

|

$4.05 |

|

$0.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on the mandatory convertible preferred stock to apply if-converted method (b) |

|

— |

|

— |

|

— |

|

0.10 |

|

— |

|

0.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assumed dilutive impact on the Diluted Net Earnings Per Share Attributable to Common Stockholders if the MCPS Converted Shares had been outstanding (b) |

|

— |

|

— |

|

— |

|

(0.05) |

|

— |

|

(0.04) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings Per Share from Continuing Operations (GAAP) |

|

2.36 |

|

2.43 |

|

2.10 |

|

1.70 |

|

4.05 |

|

0.75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on the Convertible Notes to apply if-converted method (c) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of the Convertible Notes to apply if-converted method |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Net Earnings Per Share from Continuing Operations (GAAP) |

|

2.36 |

|

2.43 |

|

2.10 |

|

1.70 |

|

4.05 |

|

0.75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax amortization of acquisition related intangible assets and non-cash impairments |

|

1.28 |

|

1.06 |

|

1.06 |

|

0.89 |

|

0.86 |

|

0.73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax acquisition, divestiture, and separation related items (d) |

|

0.17 |

|

0.01 |

|

0.08 |

|

0.19 |

|

0.28 |

|

0.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax losses from equity investments (e) |

|

0.11 |

|

0.05 |

|

0.05 |

|

0.03 |

|

0.01 |

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from divestiture |

|

0.07 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on sale of property and charitable contribution expense |

|

(0.12) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax discrete restructuring charges |

|

0.06 |

|

0.16 |

|

— |

|

0.03 |

|

0.08 |

|

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax Russia exit and wind down costs |

|

— |

|

— |

|

0.05 |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax (gain) loss on sale of business |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on litigation resolution |

|

— |

|

— |

|

— |

|

(0.08) |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on disposition of assets |

|

— |

|

— |

|

— |

|

— |

|

(0.01) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax non-cash interest expense associated with our 0.875% Convertible Notes |

|

— |

|

— |

|

— |

|

0.08 |

|

0.09 |

|

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax interest expense on Convertible Notes to reverse the if-converted method (c) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax loss on debt extinguishment, net of gain on Vontier common stock |

|

— |

|

— |

|

— |

|

0.13 |

|

(3.12) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax gain on the disposition of the Tektronix Video Business |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(0.11) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax effect of the adjustments reflected above (f) |

|

(0.23) |

|

(0.21) |

|

(0.19) |

|

(0.21) |

|

(0.20) |

|

(0.23) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discrete tax expense (benefits) (g) |

|

0.19 |

|

(0.07) |

|

— |

|

— |

|

0.06 |

|

0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Diluted Net Earnings Per Share from Continuing Operations (Non-GAAP) |

|

$3.89 |

|

$3.43 |

|

$3.15 |

|

$2.75 |

|

$2.09 |

|

$2.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(shares in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average common diluted stock outstanding (GAAP) |

|

352.8 |

|

355.6 |

|

360.8 |

|

352.3 |

|

359.0 |

|

340.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MCPS Converted Shares (b) |

|

— |

|

— |

|

— |

|

9.9 |

|

— |

|

18.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Notes - if converted shares (c) |

|

— |

|

— |

|

(1.6) |

|

— |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted average common diluted stock and common equivalent shares outstanding (Non-GAAP) |

|

352.8 |

|

355.6 |

|

359.2 |

|

362.2 |

|

359.0 |

|

358.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORTIVE CORPORATION 2025 PROXY STATEMENT A-7

The sum of the components of adjusted diluted net earnings per share may not equal due to rounding.

Adjusted EBITDA

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|

|

|

|

|

|

|

|

|

$ IN MILLIONS |

|

DECEMBER 31, 2024 |

|

|

|

|

|

|

|

|

|

Net Earnings (GAAP) |

|

$6,231.8 |

|

|

|

|

|

|

|

|

|

Net Earnings (GAAP) |

|

$832.9 |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

152.8 |

|

|

|

|

|

|

|

|

|

Income taxes |

|

136.7 |

|

|

|

|

|

|

|

|

|

Depreciation |

|

90.6 |

|

|

|

|

|

|

|

|

|

Amortization |

|

453.3 |

|

|

|

|

|

|

|

|

|

Earnings before interest, taxes, depreciation and amortization (EBITDA) (Non-GAAP) |

|

1,666.3 |

|

|

|

|

|

|

|

|

|

Pretax acquisition, divestiture, and separation related items (a) |

|

59.6 |

|

|

|

|

|

|

|

|

|

Pretax losses from equity investments |

|

39.4 |

|

|

|

|

|

|

|

|

|

Loss from divestiture |

|

25.6 |

|

|

|

|

|

|

|

|

|

Pretax gain on sale of property and charitable contribution expense |

|

(43.1) |

|

|

|

|

|

|

|

|

|

Pretax discrete restructuring charges |

|

19.7 |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (Non-GAAP) |

|

$1,767.5 |

|

|

|

|

|

|

|

|

|

NET Earnings Margin (Non-GAAP) |

|

13.4% |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Margin (Non-GAAP) |

|

28.4% |

|

|

|

|

|

Adjusted Gross Profit and Adjusted Gross Profit Margin

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ IN MILLIONS |

|

DECEMBER 31, |

DECEMBER 31, |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (GAAP) |

|

$6,231.8 |

|

|

$4,563.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-Related Fair Value Adjustments to deferred revenue |

|

— |

|

|

54.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Revenue (Non-GAAP) |

|

$6,231.8 |

|

|

$4,618.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit (GAAP) |

|

$3,731.0 |

|

|

$2,483.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-Related Fair Value Adjustments to Inventory and deferred revenue |

|

2.3 |

|

|

121.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discrete Restructuring Charges |

|

4.9 |

|

|

7.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Gross Profit (Non-GAAP) |

|

$3,738.2 |

|

|

$2,611.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit (GAAP) Margin |

|

59.9% |

|

|

54.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Gross Profit Margin (Non-GAAP) |

|

60.0% |

|

|

56.6% |

|

|

|

|

|

|

|

|

|

|

A-8 FORTIVE CORPORATION 2025 PROXY STATEMENT

Adjusted Operating Profit and Adjusted Operating Profit Margin

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ IN MILLIONS |

|

DECEMBER 31, |

DECEMBER 31, |

DECEMBER 31, |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (GAAP) |

|

$6,231.8 |

|

$6,065.3 |

|

$4,563.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-related fair value adjustments to deferred revenue |

|

— |

|

— |

|

54.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Revenue (Non-GAAP) |

|

$6,231.8 |

|

$6,065.3 |

|

$4,618.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Profit (GAAP) |

|

$1,206.6 |

|

$1,133.7 |

|

$443.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets and non-cash impairments |

|

453.3 |

|

375.6 |

|

261.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition, divestiture, and separation related items (a) |

|

59.6 |

|

4.4 |

|

231.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of property |

|

(63.1) |

|

— |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discrete restructuring charges |

|

19.7 |

|

58.6 |

|

32.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating Profit (Non-GAAP) |

|

$1,676.1 |

|

$1,572.3 |

|

$968.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Profit Margin (GAAP) |

|

19.4% |

|

18.7% |

|

9.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating Profit Margin (Non-GAAP) |

|

26.9% |

|

25.9% |

|

21.0% |

|

|

|

|

|

|

|

|

|

The sum of the components of adjusted operating profit may not equal due to rounding.

Free Cash Flow

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ IN MILLIONS |

|

DECEMBER 31, |

DECEMBER 31, |

DECEMBER 31, |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Cash Flows (GAAP): |

|

$1,526.8 |

|

$1,353.6 |

|

$702.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Purchases of property, plant & equipment (capital expenditure) (GAAP) |

|

(120.4) |

|

(107.8) |

|

(74.5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow (Non-GAAP): |

|

$1,406.4 |

|

$1,245.8 |

|

$627.5 |

|

|

|

|

|

|

|

|

|

FORTIVE CORPORATION 2025 PROXY STATEMENT A-9

Appendix B

Fortive Corporation Amended and Restated 2016 Stock Incentive Plan

“Administrator” means the Compensation Committee of the Board, unless the Board specifies another committee or the Board elects to act in such capacity.

“Award” means an award of Options, Stock Appreciation Rights, Restricted Stock Grants, Restricted Stock Units, Other Stock-Based Awards or Conversion Awards (each as defined below).

“Board” means the Board of Directors of the Company.

“Code” means the U.S. Internal Revenue Code of 1986, as amended from time to time and the regulations issued with respect thereof.

“Committee” means the Compensation Committee of the Board. “Common Stock” means the common stock of the Company. “Company” means Fortive Corporation, a Delaware corporation.

“Consultant” means any person engaged as a consultant or advisor of the Company or an Eligible Subsidiary for whom a Form S-8 Registration Statement is available for the issuance of securities.

“Danaher” shall mean Danaher Corporation, a corporation organized under the laws of the State of Delaware.

“Date of Grant” means the date as of which the Administrator grants an Award to a person.

“Disability” means a Participant (i) is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or that has lasted or can be expected to last for a continuous period of not less than twelve months, or (ii) is, by reason of any medically determinable physical or mental impairment which can be expected to result in death or that has lasted or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than 3 months under an accident and health plan covering employees of the Participant’s employer.

“Early Retirement” means an employee voluntarily ceases to be an Employee and the Administrator determines (either initially or subsequent to the grant of the relevant Award) that the cessation constitutes Retirement for purposes of this Plan. In deciding whether a termination of employment is an Early Retirement, the Administrator need not consider the definition under any other Company benefit plan.

“Eligible Director” (or “Director”) means a non-employee director of the Company or one of its Eligible Subsidiaries.

“Eligible Subsidiary” means each of the Company’s Subsidiaries, except as the Administrator otherwise specifies.

“Employee” means any person employed as an employee of the Company or an Eligible Subsidiary.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

FORTIVE CORPORATION 2025 PROXY STATEMENT B-1

“Exercise Price” means, in the case of an Option, the value of the consideration that an Optionee must provide in exchange for one share of Common Stock. In the case of a SAR, “Exercise Price,” means an amount which is subtracted from the Fair Market Value in determining the amount payable upon exercise of such SAR.

“Fair Market Value” means, as of any date, the fair market value of a share of Common Stock for purposes of the Plan which will be determined as follows:

“Full Value Award” means any Award settled in shares of Common Stock, other than (i) an Option, (ii) a Stock Appreciation Right, (iii) an Other Stock-Based Award under which the Company will receive monetary consideration equal to the Fair Market Value on the date of grant of the shares subject to such Award, or (iv) an Other Stock-Based Award based solely on appreciation in the Fair Market Value of the Common Stock.

“Gross Misconduct” means the Participant has:

“Incentive Stock Option” or “ISO” means a stock option intended to qualify as an incentive stock option within the meaning of Code Section 422.

“Normal Retirement” means an employee voluntarily ceases to be an Employee at or after reaching age sixty-five (65).

“Option” means a stock option granted pursuant to Section 6 of the Plan that is not an ISO, entitling the Optionee to purchase Shares at a specified price.

“Optionee” means an Employee, Consultant, or Director who has been granted an Option under this Plan or, where appropriate, a person authorized to exercise an Option in place of the intended original Optionee.

“Other Stock-Based Awards” are Awards (other than Options, SARs, RSUs and Restricted Stock Grants) granted under Section 10 of the Plan that are denominated in, valued in whole or in part by reference to, or otherwise based on or related to, Common Stock.

“Participant” means Optionees and Recipients, collectively. The term “Participant” also includes, where appropriate, a person authorized to exercise an Option or hold or receive another Award in place of the intended original Optionee or Recipient.

“Performance Objectives” means one or more objective or subjective performance factors as determined by the Administrator with respect to each Performance Period.

“Performance Period” means a period for which Performance Objectives are set and during which performance is to be measured to determine whether a Participant is entitled to payment in respect of an Award under the Plan. A Performance Period may coincide with one or more complete or partial calendar or fiscal years of the Company. Unless otherwise designated by the Administrator, the Performance Period will be based on the calendar year.

“Plan” means this 2016 Stock Incentive Plan, as amended from time to time.

B-2 FORTIVE CORPORATION 2025 PROXY STATEMENT

“Recipient” means an Employee, Consultant, or Director who has been granted an Award other than an Option under this Plan or, where appropriate, a person authorized to hold or receive such an Award in place of the intended original Recipient.

“Restricted Stock Grant” means a direct grant of Common Stock, as awarded under Section 8 of the Plan.

“Restricted Stock Unit” or “RSU” means a bookkeeping entry representing an unfunded right to receive (if conditions are met) one share of Common Stock, as awarded under Section 9 of the Plan.

“Retirement” means both Early Retirement and Normal Retirement, as defined herein.

“Section 16 Persons” means those officers, directors or other persons who are subject to Section 16 of the Exchange Act.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Stock Appreciation Right” or “SAR” means any right granted under Section 7 of the Plan.

“Subsidiary” means any corporation, limited liability company, partnership or other entity (other than the Company) in an unbroken chain beginning with the Company if, at the time an Award is granted to a Participant under the Plan, each of such entities (other than the last entity in the unbroken chain) owns stock or other equity possessing twenty percent (20%) or more of the total combined voting power of all classes of stock or equity in one of the other entities in such chain.

FORTIVE CORPORATION 2025 PROXY STATEMENT B-3

Notwithstanding anything to the contrary in this Plan, the Administrator may in its sole discretion reduce or eliminate a Participant’s unvested Award or Awards if he or she changes classification from a full-time Employee to a part-time Employee.

B-4 FORTIVE CORPORATION 2025 PROXY STATEMENT

Payment in full of the Exercise Price need not accompany the written notice of exercise provided the notice directs that the shares of Common Stock issued upon the exercise be delivered, either in certificate form or in book entry form, to a licensed broker acceptable to the Company as the agent for the individual exercising the Option and at the time the shares are delivered to the broker, either in certificate form or in book entry form, the broker will tender to the Company cash or cash equivalents acceptable to the Company and equal to the Exercise Price.

FORTIVE CORPORATION 2025 PROXY STATEMENT B-5

The Administrator may agree to payment through the tender to the Company of shares of Common Stock. Shares of Common Stock offered as payment will be valued, for purposes of determining the extent to which the Optionee has paid the Exercise Price, at their Fair Market Value on the date of exercise.

B-6 FORTIVE CORPORATION 2025 PROXY STATEMENT

FORTIVE CORPORATION 2025 PROXY STATEMENT B-7

B-8 FORTIVE CORPORATION 2025 PROXY STATEMENT

FORTIVE CORPORATION 2025 PROXY STATEMENT B-9

In the event of a declaration of an extraordinary dividend on the Common Stock payable in a form other than Common Stock in an amount that has a material effect on the price of the Common Stock, the Administrator shall make a proportionate and appropriate adjustment as the Administrator in its sole discretion deems to be appropriate to the items set forth in any of subsections (a) through (d) in the preceding paragraph in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan.

Any issue by the Company of any class of preferred stock, or securities convertible into shares of common or preferred stock of any class, will not affect, and no adjustment by reason thereof will be made with respect to, the number of shares of Common Stock subject to any Award or the Exercise Price except as this Section 16 specifically provides. The grant of an Award under the Plan will not affect in any way the right or power of the Company to make adjustments, reclassifications, reorganizations or changes of its capital or business structure, or to merge or to consolidate, or to dissolve, liquidate, sell, or transfer all or any part of its business or assets.

B-10 FORTIVE CORPORATION 2025 PROXY STATEMENT

Although in establishing such sub-plans, terms or procedures, the Company may endeavor to (i) qualify an Award for favorable foreign tax treatment or (ii) avoid adverse tax treatment, the Company makes no representation to that effect and expressly disavows any covenant to maintain favorable or avoid unfavorable tax treatment. The Company shall be unconstrained in its corporate activities without regard to the potential negative tax impact on holders of Awards under the Plan.

FORTIVE CORPORATION 2025 PROXY STATEMENT B-11

The Plan is intended to conform to the extent necessary with all provisions of the Securities Act and the Exchange Act and all regulations and rules the U.S. Securities and Exchange Commission issues under those laws. Notwithstanding anything in the Plan to the contrary, the Administrator must administer the Plan, and Awards may be granted, vested and exercised, only in a way that conforms to such laws, rules, and regulations.

Additionally, the Common Stock, when issued under an Award, will be subject to any other transfer restrictions, rights of first refusal, and rights of repurchase set forth in or incorporated by reference into other applicable documents, including the Company’s articles or certificate of incorporation, by-laws, or generally applicable stockholders’ agreements.

The Administrator may, in its sole discretion, take whatever additional actions it deems appropriate to comply with such restrictions and applicable laws, including placing legends on certificates and issuing stop-transfer orders to transfer agents and registrars.

B-12 FORTIVE CORPORATION 2025 PROXY STATEMENT

FORTIVE CORPORATION 2025 PROXY STATEMENT B-13

B-14 FORTIVE CORPORATION 2025 PROXY STATEMENT

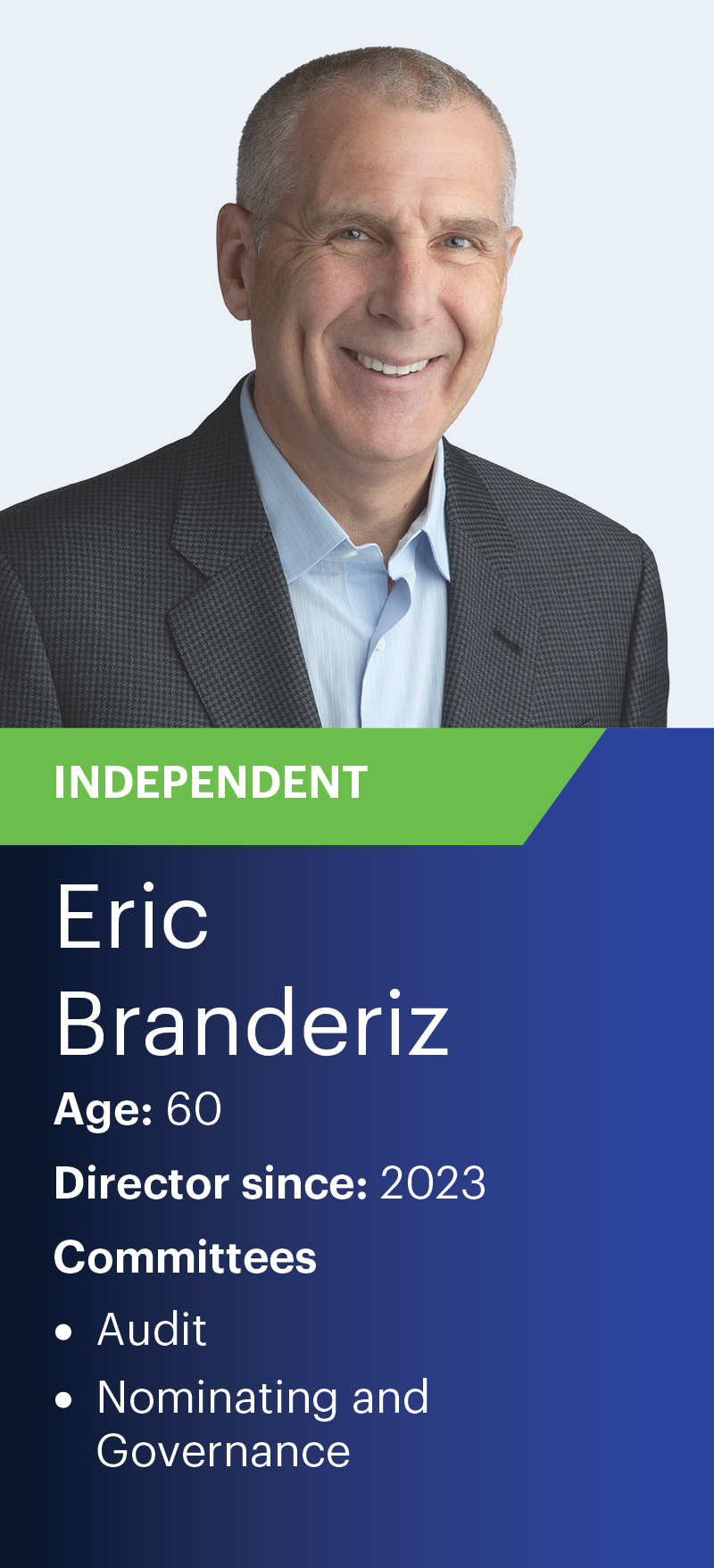

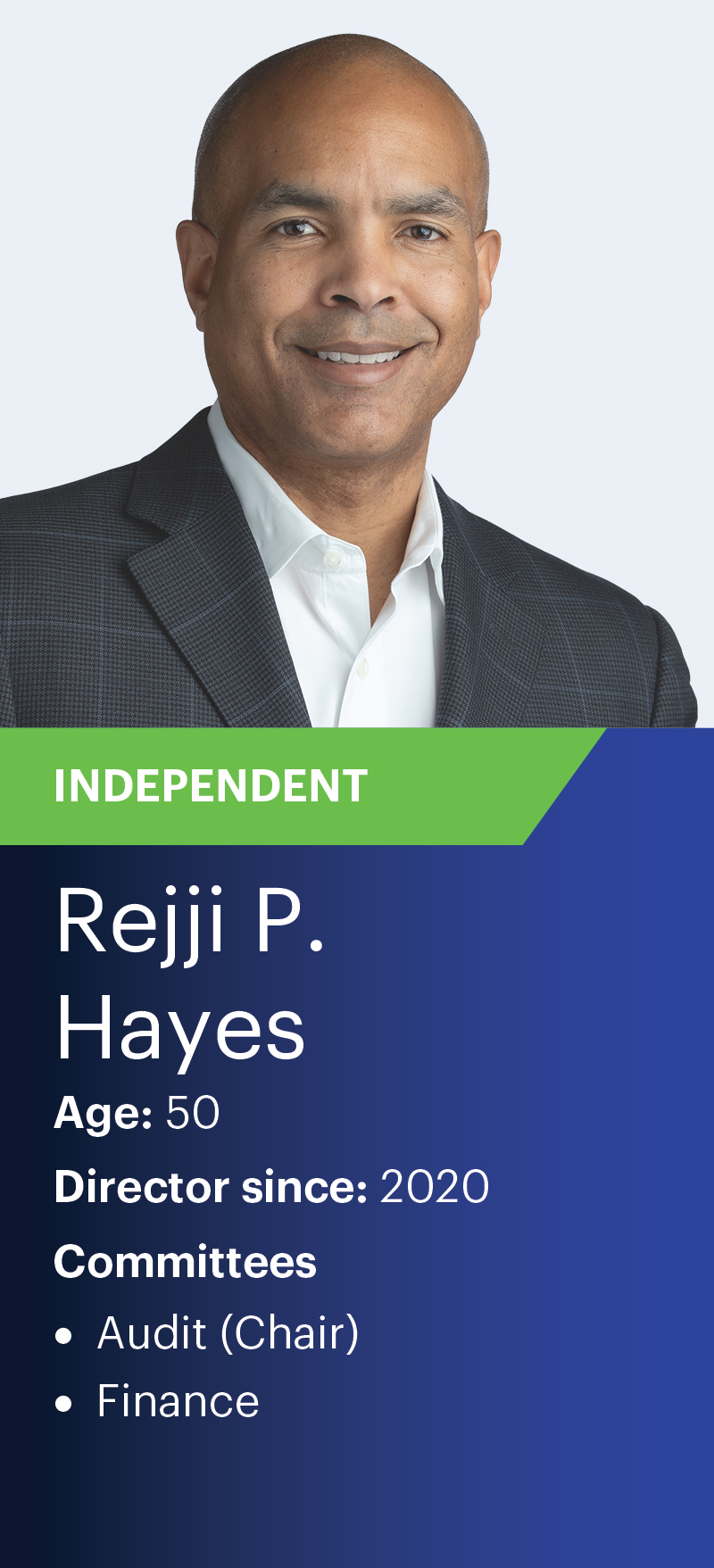

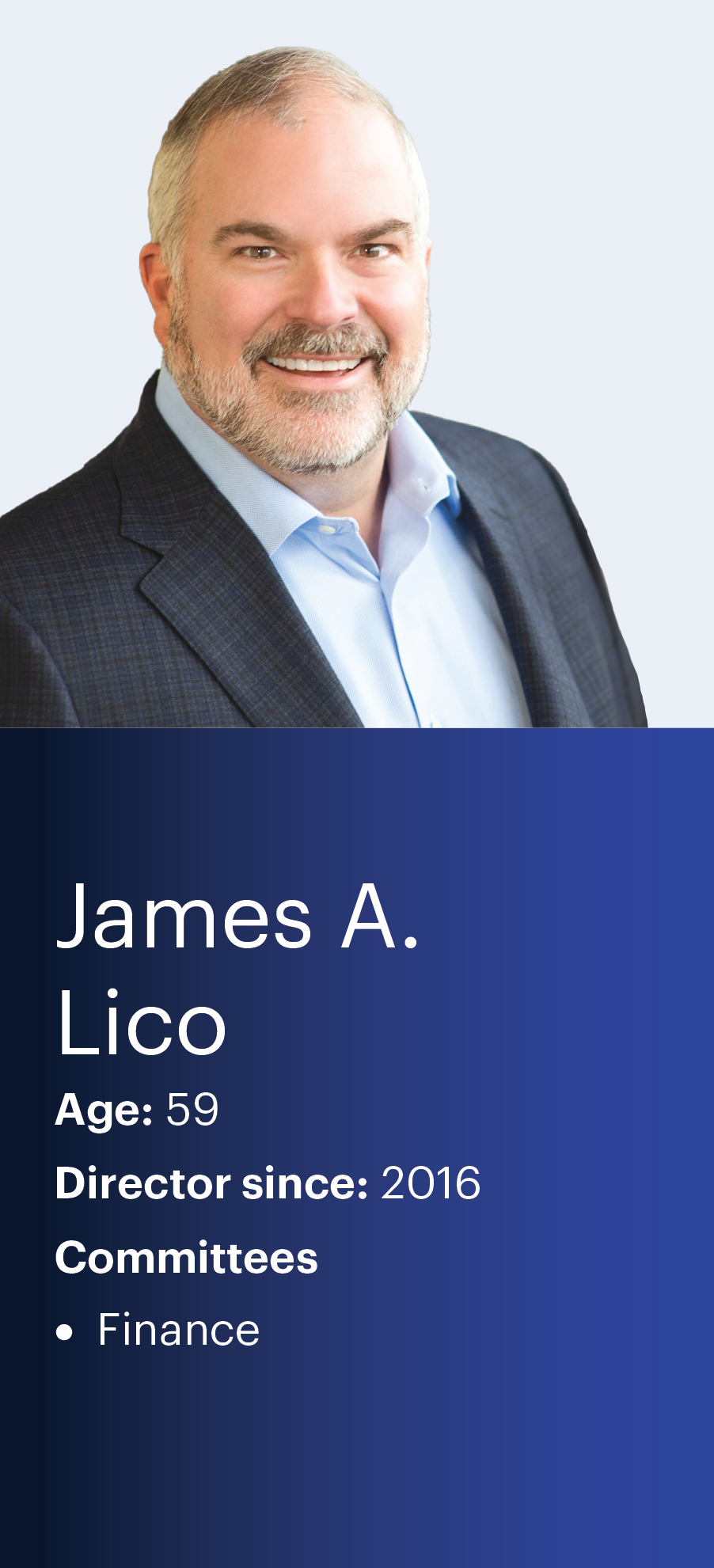

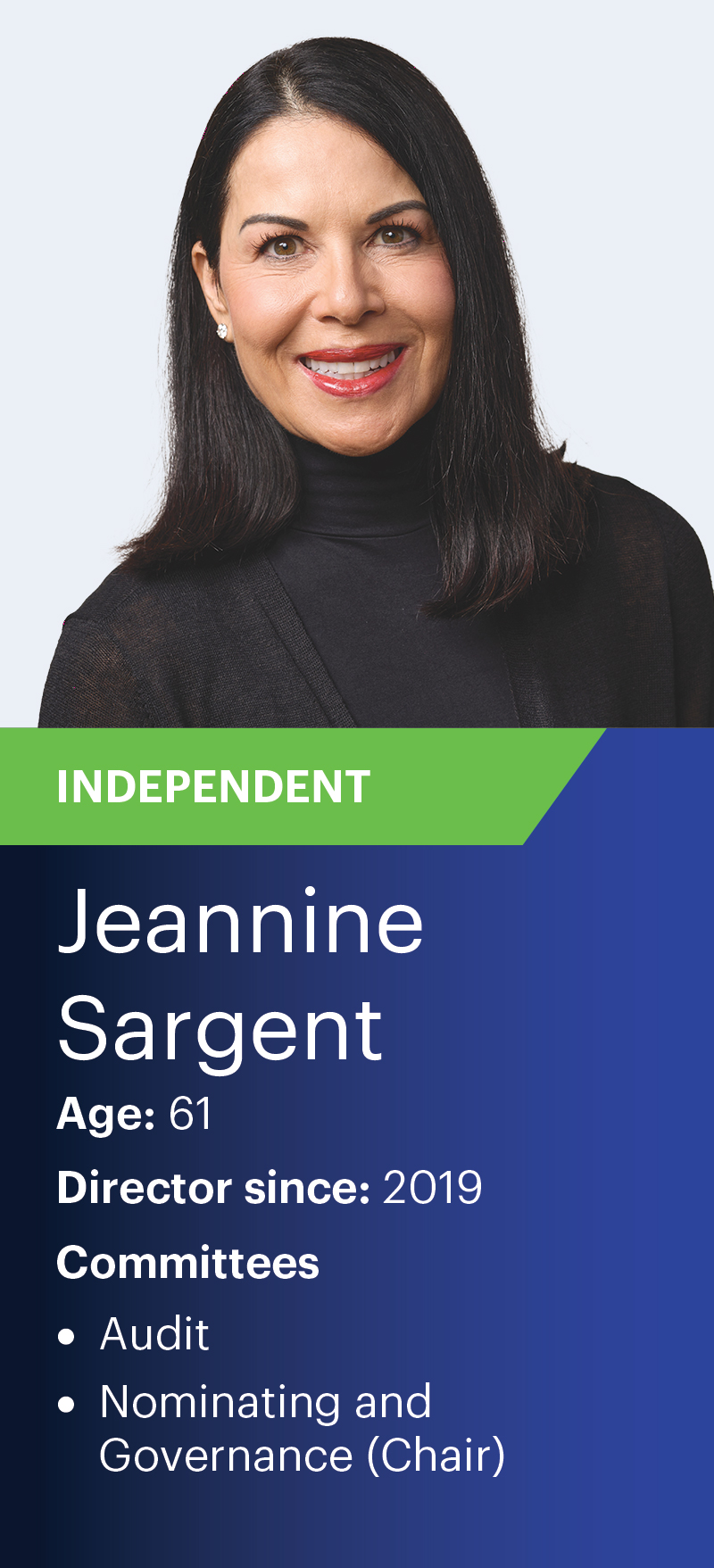

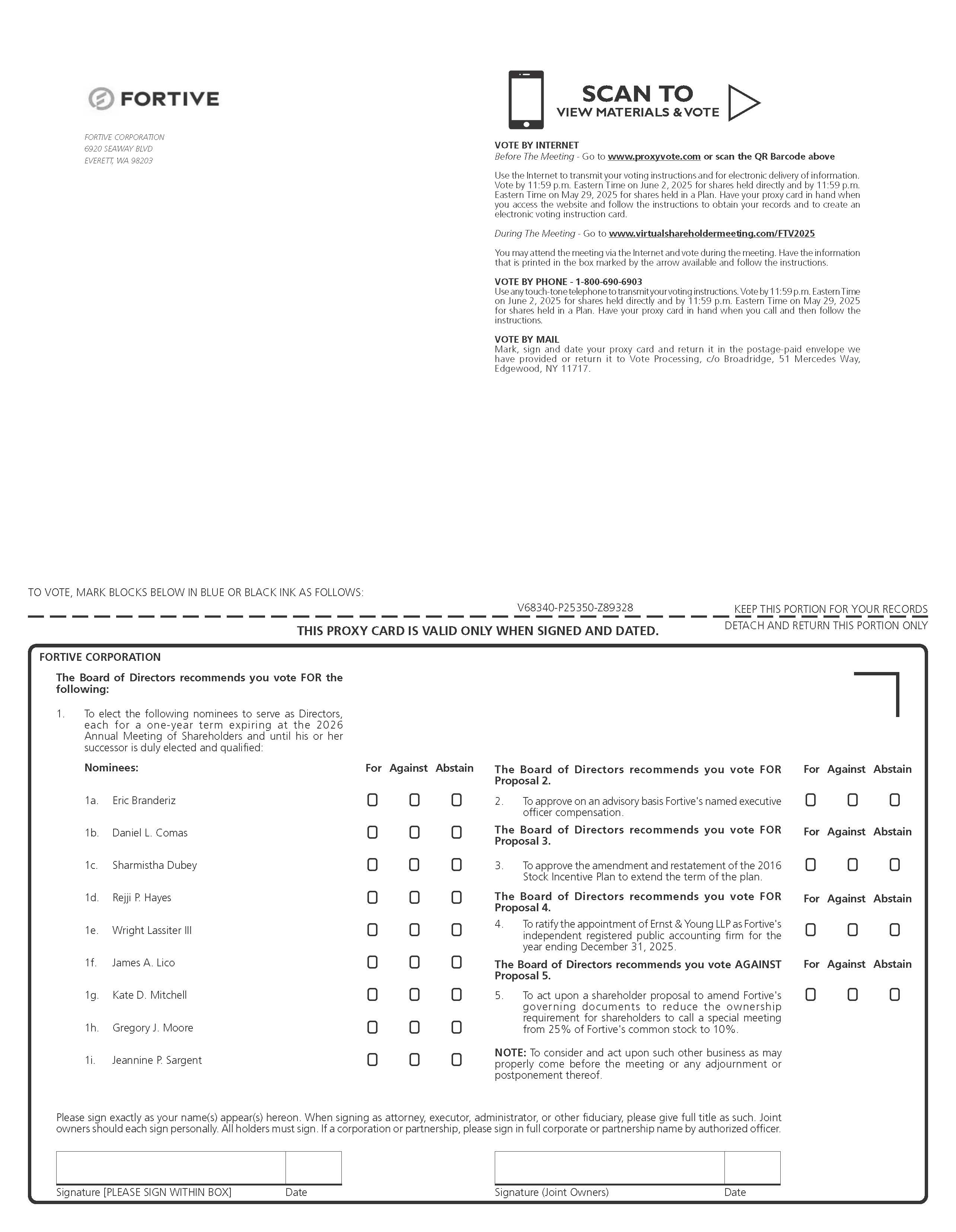

LOGO FORTIVE FORTIVE CORPORATION 6920 SEAWAY BLVD EVERETT, WA 98203 SCAN TO VIEW MATERIALS & VOTE VOTE BY INTERNET Before The Meeting - Go to www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m. Eastern Time on June 2, 2025 for shares held directly and by 11:59 p.m. Eastern Time on May 29, 2025 for shares held in a Plan. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction card. During The Meeting - Go to www.virtualshareholdermeeting.com/FTV2025 You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m. Eastern Time on June 2, 2025 for shares held directly and by 11:59 p.m. Eastern Time on May 29, 2025 for shares held in a Plan. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: V68340-P25350-Z89328 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY FORTIVE CORPORATION The Board of Directors recommends you vote FOR the following: 1. To elect the following nominees to serve as Directors, each for a one-year term expiring at the 2026 Annual Meeting of Shareholders and until his or her successor is duly elected and qualified: Nominees: 1a. Eric Branderiz 1b. Daniel L. Comas 1c. Sharmistha Dubey 1d. Rejji P. Hayes 1e. Wright Lassiter III 1f. James A. Lico 1g. Kate D. Mitchell 1h. Gregory J. Moore 1i. Jeannine P. Sargent For Against Abstain The Board of Directors recommends you vote FOR Proposal 2. 2. To approve on an advisory basis Fortive's named executive officer compensation. The Board of Directors recommends you vote FOR Proposal 3. 3. To approve the amendment and restatement of the 2016 Stock Incentive Plan to extend the term of the plan. The Board of Directors recommends you vote FOR Proposal 4. 4. To ratify the appointment of Ernst & Young LLP as Fortive's independent registered public accounting firm for the year ending December 31, 2025. The Board of Directors recommends you vote AGAINST Proposal 5. 5. To act upon a shareholder proposal to amend Fortive's governing documents to reduce the ownership requirement for shareholders to call a special meeting from 25% of Fortive's common stock to 10%. NOTE: To consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof. For Against Abstain For Against Abstain For Against Abstain For Against Abstain Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice and Proxy Statement and Annual Report are available at www.proxyvote.com V68341-P25350-Z89328 FORTIVE CORPORATION Annual Meeting of Shareholders June 3, 2025 This proxy is solicited by the Board of Directors The shareholder(s) hereby appoint(s) Peter C. Underwood and Daniel B. Kim, and each of them, as proxy holders, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of FORTIVE CORPORATION that the shareholder(s) is/are entitled to vote at the Annual Meeting of Shareholders to be held in virtual only meeting format at 3:00 p.m., PDT on June 3, 2025, via www.virtualshareholdermeeting.com/FTV2025 and any adjournment or postponement thereof. This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted: FOR the election of each of the director nominees listed in Proposal 1, FOR Proposals 2, 3, and 4, and AGAINST Proposal 5. Continued and to be signed on reverse side

17